Hong Kong opens first virtual bank trial operation, expected to open in first half of next year

Virtual banking is really coming!

Yesterday, Ruan Guoheng, vice president of the Hong Kong Monetary Authority (hereinafter referred to as the "Hong Kong Monetary Authority") stated that after the efforts of all parties, the first virtual bank will conduct a trial operation in the Hong Kong Monetary Authority's financial technology supervision sandbox from that day. This means that Hong Kong bank customers are about to experience more innovative banking services, and it marks a new milestone for Hong Kong's banking industry.

It is understood that Zhongan Bank will become the first trial virtual bank. It will use the financial technology supervision of the Hong Kong Monetary Authority to supervise the sandbox trial operation. It initially provided services to approximately 2,000 Hong Kong retail customers. By collecting feedback from selected users, Further improve the banking service platform and prepare for formal opening.

- 2019 China Blockchain Underlying Technology Platform Development Report: 78% of the originality of the architecture, landing applications focus on three major areas

- Libra Association releases second edition of Libra Core roadmap goal to attract 100 members to join

- Exploring the Value of Bitcoin: Energy Is Value?

The Hong Kong Monetary Authority said that it will observe the operation of virtual banks after opening, user reactions, market acceptance and impact on the banking system, and carefully consider the way forward. If the trial results are satisfactory and it is confirmed that all regulatory requirements are met, the virtual bank can be officially opened.

A total of 8 virtual banking licenses were issued, and all of them are expected to open in the first half of next year

In September 2017, the Hong Kong Monetary Authority announced a series of measures to promote Hong Kong into a "new era of smart banking", one of which is the introduction of virtual banks in Hong Kong.

On February 6, 2018, after inspecting the "Virtual Banking Recognition" guidelines issued for the first time in 2000, the Hong Kong Monetary Authority issued a revised version of the "Virtual Banking Recognition" guidelines. The new revised guidelines affirm the basic principles of the original guidelines, but have updated and revised specific content. Notable ones include: banks, financial institutions and technology companies can apply to hold and operate virtual banks in Hong Kong; virtual banks Mainly engaged in retail business, it should be operated as a locally registered bank; virtual banks must comply with the same set of regulatory principles and main regulations applicable to traditional banks.

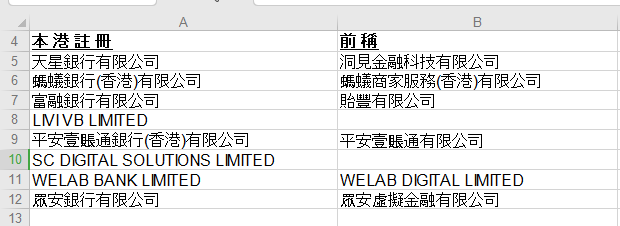

According to the reporter, up to now, the Hong Kong Monetary Authority has issued eight virtual banking licenses in three batches, including giants such as Ping An Group, Ant Financial, Tencent, and JD.com.

On March 27 this year, the Hong Kong Monetary Authority announced on the official website the list of the first batch of virtual banking licenses (three). According to the official website, the Monetary Authority has granted bank licenses to Livi VB Limited, SC Digital Solutions Limited and Zhongan Virtual Finance Co., Ltd. to operate virtual banks in accordance with the Banking Ordinance. The licenses became effective on the same day.

Among them, LiviVBLimited is a joint venture between BOC Hong Kong, JD.com and Jardine, with BOC Hong Kong as the controlling party; SC DIGITAL SOLUTIONS LIMITED is a combination of Standard Chartered Hong Kong, PCCW, Hong Kong Telecom and Ctrip Financial, and Standard Chartered Hong Kong is the controlling party; ZhongAn International Founded by Zhongan Technology and Beststar Group, the two companies hold 51% and 49% of the shares respectively. ZhongAn Technology is a wholly-owned technology subsidiary of ZhongAn Online Property Insurance Co., Ltd., which was launched by Ant Financial, Tencent, and Ping An of China.

Subsequently, on April 10 this year, the Hong Kong Monetary Authority announced the issuance of the fourth virtual banking license, and all companies in this license are WeLab Bank Limited. It is understood that WELAB Virtual Bank is a Hong Kong-based fintech company.

As of May this year, the Hong Kong Monetary Authority issued four virtual banking licenses in one go. These include Ant Bank (Hong Kong) Limited (formerly known as Ant Merchant Services (Hong Kong) Limited); Ping An One Account Co., Ltd. (a subsidiary of Ping An Group); Furong Bank Limited (formerly known as Yifeng Limited, It is a joint venture between Tencent, Industrial and Commercial Bank of China (Asia) Limited, Hong Kong Exchanges and Clearing Limited, High Capital and Hong Kong's famous business person Zheng Zhigang through its investment entity Perfect Ridge Limited; Star Bank (formerly known as Insight Financial Technology Co., Ltd.) ), A joint venture by Xiaomi Monk Group.

As Zhongan Virtual Bank, as the first pilot bank, the bank's chief executive, Xu Luosheng, said that since the issuance of the virtual bank license, he has focused on back-office development and testing, and is now ready for trial. During the period, he will review customer opinions and operations and technology. Preparations will be evaluated, and close communication will be made with the regulators to further discuss and determine the exact opening time.

It is worth noting that Zhongan launched its business through a "sandbox" approach, which is to use the flexible testing ground provided by the Hong Kong Monetary Authority to test new services. The source pointed out that according to past experience, the general time to stay in the sandbox test is about three months. At present, there are 3 virtual banks that are 'one step in place', that is, no sandbox test is required. After ensuring that all processes are smooth, they will directly Officially opened, the regulator does not have a mandatory requirement that it must be tested in a sandbox first.

According to sources, in the first quarter of next year , three more virtual banks will debut, and it is expected that all eight virtual banks will open in the first half of the year.

Mainly for retail users, new advantages of virtual banking

In the official website of the Hong Kong Monetary Authority, its purpose for launching a virtual bank is: “Promote inclusive finance”.

Chen Delin, President of the Hong Kong Monetary Authority, once stated, "The introduction of virtual banking is a key move for Hong Kong towards a new era of smart banking. It is also a milestone in enhancing Hong Kong's advantages as an international financial center. In addition to promoting Hong Kong's financial technology development and innovation, It can provide customers with a better experience and promote the popularization of finance. However, virtual banks do not have physical branches and can only open remote accounts and provide various banking services for customers through the Internet. "

So, what exactly is a virtual bank, and what are the advantages of a virtual bank compared to a traditional bank?

According to public information, virtual banks generally refer to banks that provide retail banking services through the Internet or other forms of electronic channels rather than physical branches, and are generally targeted at individuals and SME customers. The virtual bank proposed by Hong Kong is similar to the “Internet Banks” such as Weizhong, Internet merchants, and Xinwang in the Mainland, but the mainland still lacks a strict official definition of “Internet Banking” and “legal direct banking” of independent legal entities, and the relevant concepts are not clear. Define.

In the regulations on virtual banking introduced by the Hong Kong Monetary Authority, although the main customers of virtual banking in Hong Kong are retail customers, there is no intention to organize virtual banks to provide services to other types of customers.

Recently, a relevant HKMA spokesman also stated that there are no restrictions on virtual banking business, and the products and services provided by individual virtual banks and product pricing are their commercial decisions. Banks set their own product pricing based on their own circumstances, taking into account business strategies and costs, but emphasize that virtual banks should not adopt a predatory strategy to expand market share.

So what can you do after getting a virtual banking license?

According to Hong Kong's "Virtual Bank Recognition" guidelines, what a virtual bank license can still provide is retail banking services, namely "deposit, loan, remittance, and management". In other words, although the word "virtual" is added to the virtual bank, its essence is still a bank, and its main business is still mainly deposits, loans and remittances, and it also adds a part of consignment wealth management products.

However, unlike traditional banks, virtual banks move some offline businesses of traditional banks to online, and can provide existing and new customers with secure, convenient and comprehensive online financial services. In theory, because virtual banks can save the resources and manpower of operating entity branches, they have more room to set higher fixed interest rates and lower loan interest rates in order to attract users.

However, some people also believe that at present, some of the traditional banks' businesses are gradually becoming Internet-based. For Mainland or Hong Kong companies, the virtual banking licenses they now receive in Hong Kong are more strategic layouts for future development in Hong Kong, especially Some non-bank financial institutions.

How each company will lay out competition

ZhongAn's first trial means that the planning of the Hong Kong Virtual Bank is about to go from behind the scenes to the front of the stage, and for the long-established member companies, they are about to usher in a magical moment.

For this trial, Xu Luosheng, CEO of ZA Bank of Zhongan Bank said, "Since the virtual bank license was granted, the team of ZA Bank has been focusing on providing excellent customer experience, and has been focusing on back-office development and testing. Progress. Now we are ready to start trials for selected users and take our products and services to a new stage of development. "

Unlike the physical model of traditional banks, through virtual banking, ZA Bank users will be able to experience true all-day banking services, and complete services such as account opening, deposit, and transfer through a one-stop mobile application, eliminating the hassle of going to branches . In addition, users can complete their account opening within 5 minutes as long as they have a Hong Kong identity card. In addition, ZA Bank will support fast cross-platform transfers, and will launch features such as "5-second transfer buffer" and "face recognition authentication".

It is understood that due to the introduction of virtual banking in Hong Kong, ZhongAn's initial services will not be too fancy, mainly for remote account opening, currency savings accounts, time deposits, local transfers, electronic statements and other services. It will initially absorb the main efforts deposit. ZhongAn disclosed that the initial investment scale was about 1.6 billion yuan.

In addition, ZA Bank will also use some core technologies such as artificial intelligence, big data and blockchain.

WeLab, which also has a virtual banking license, has its own plans. Recently, in an interview, Chen Jiaqiang, Chairman of the Board of WeLab Virtual Bank, stated that WeLab will focus on providing pure online personal retail financial services, mainly providing account opening and deposit services in the initial stage. It is believed that there will be more and more in the quarters after opening. The more products there are, the more room for optimization.

Chen Jiaqiang said that virtual banks in Hong Kong, like traditional banks, are fully licensed. We will rely on advanced financial technology to create a new banking service experience, so that individuals who have not previously received traditional banking services will have more convenient and diversified retail. Banking services and products to practice the concept of inclusive finance. "

At the same time, Chen Jiaqiang said that virtual banks not only provide services to individuals, but also provide better financial management services for SMEs in the Guangdong, Hong Kong and Macau Greater Bay Area, making it easier and more efficient for SMEs to raise funds.

Feng Yulong, CEO of Ping An Yitong Bank, previously stated that in addition to remote account opening, online business and other basic advantages, virtual banks must also put forward higher requirements in terms of information security, system stability and continuous management.

For Tianxing Bank, with the addition of Xiaomi, it can create a more comprehensive ecology. Earlier, Cai Zhijian, Chairman and CEO of AMTD Group, stated that because Xiaomi has strong SMEs, upstream and downstream ecosystems, and incubates many companies to list globally, Hong Kong is the core location of Xiaomi ’s foreign investment funds, and AMTD Help companies raise funds for listing, bond issuance, etc., and gather a lot of funds. And this is where Star Bank can obtain a virtual banking license.

Due to the restrictions on the application of virtual banks, all the companies with strong backgrounds participated in the competition. Who can stand out? What problems will the virtual banks face during the launch and what are the impacts after launch? Wait and see.

Original: Share Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Researcher of Chinese Academy of Social Sciences: Implementing the rule of law network into blockchain management

- Baidu Blockchain Xiao Wei: Focus on Exploring "Trusted Computing + Blockchain" Next Year

- Crypto Derivatives: Blessing is not a curse, a curse cannot be avoided

- Hedge fund Fortress raises the price several times to buy MtGox claims. Will you sell 30% of Bitcoin?

- Ethereum's DETH: 2020 may be a particularly crazy year

- Asset on-chain practice: how the emerging public chain Algorand 2.0 promotes real-world transactions with ASA

- Big coffee perspective: 20 investment tips from the founders of Messari and the crypto market outlook