LianGuaiWeb3.0 Daily | Hong Kong police are investigating whether JPEX is involved in criminal activities

Hong Kong police are investigating JPEX for criminal involvement.DeFi Data

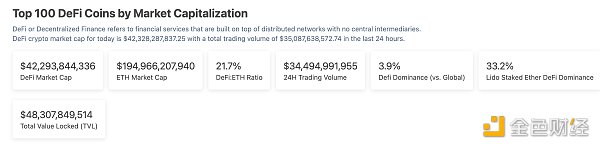

1. Total Market Value of DeFi Tokens: $42.293 billion

- My Perspective on Token2049 in Singapore

- Chain Game Weekly Google to Allow NFT Game Advertising Placement, Linea Launches Web3 Entertainment Festival

- The Future of Derivatives Trading Platforms

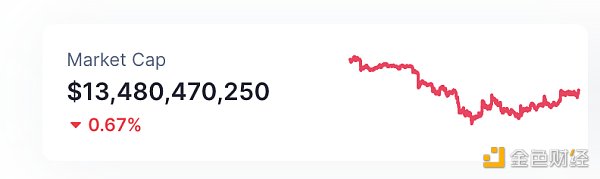

Total market value of DeFi and top ten tokens. Source: coingecko

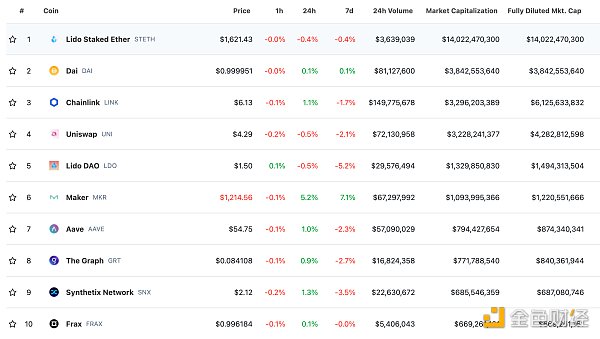

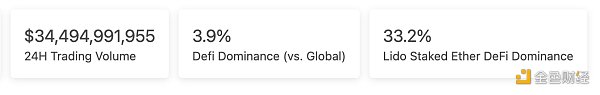

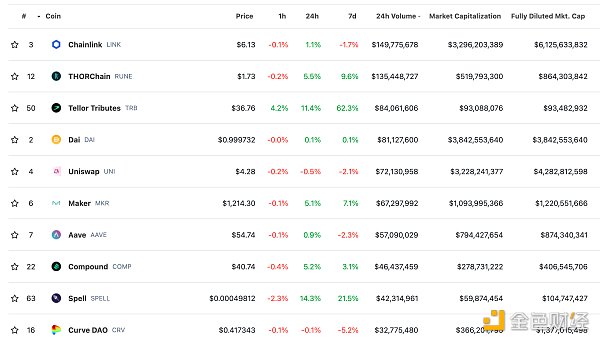

2. Trading Volume of Decentralized Exchanges in the Past 24 Hours: $3.449 billion

Trading volume of decentralized exchanges in the past 24 hours. Source: coingecko

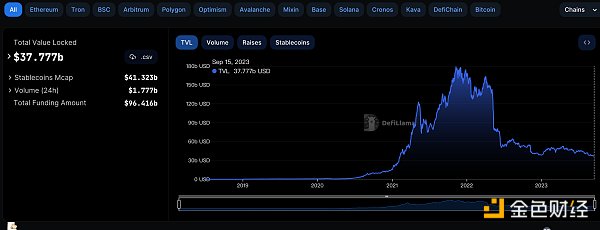

3. Locked Assets in DeFi: $37.777 billion

Source: defillama

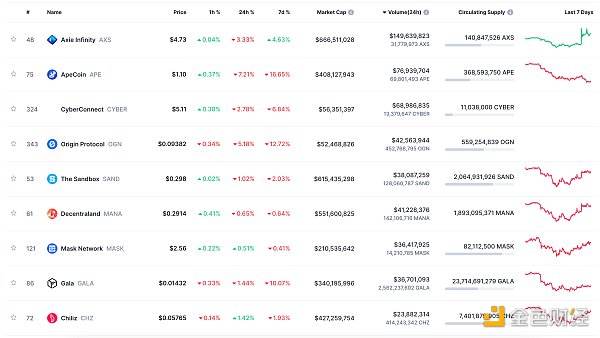

NFT Data

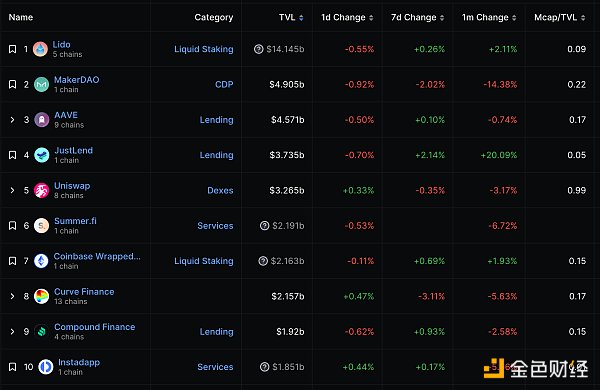

1. Total Market Value of NFTs: $13.48 billion

Total market value and top ten projects by market value of NFTs. Source: Coinmarketcap

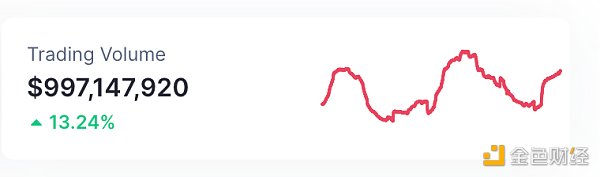

2. NFT Trading Volume in the Past 24 Hours: $997 million

Trading volume in the past 24 hours and top ten projects by trading volume of NFTs. Source: Coinmarketcap

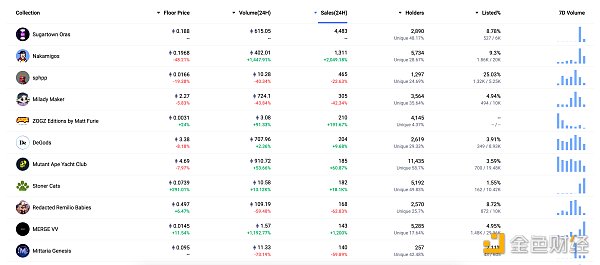

3. Top NFTs in the Past 24 Hours

Top ten NFTs sold in the past 24 hours. Source: NFTGO

Headline

Hong Kong Police Investigating Whether JPEX is Involved in Criminal Activities

LianGuai reported that the Hong Kong police have confirmed that they have received notification from the Securities and Futures Commission (SFC) and are currently investigating whether the JPEX case involves criminal elements. Online writer “Qian Song C” pointed out that at a certain cryptocurrency summit in Singapore, JPEX, as one of the platinum sponsors, did not have any staff present today.

NFT/Digital Collectibles Highlights

1. SEC Crackdown on Stoner Cats NFT Boosts Secondary Market Sales

LianGuai reported that after the U.S. Securities and Exchange Commission (SEC) took action against the Stoner Cats NFT project, both the floor price and trading volume of the NFT project have significantly increased. According to data from opensea and nftpricefloor, the floor price reached a high of 0.084 ETH, equivalent to approximately $136. Prior to the SEC crackdown, the floor price of Stoner Cats was around 0.0189 ETH, equivalent to approximately $30.73 based on the current ETH exchange rate.

2. ApeCoin Releases AIP-304 Proposal Vote, Currently Over 76.44% Opposed

LianGuai reported that ApeCoin initiated the AIP-304 proposal in the ApeCoin community, proposing to use 11 million APE tokens to purchase blue-chip projects such as BAYC and MAYC under Yuga Labs for exhibition and donation to art institutions. The proposal vote officially started at 9:00 this morning and is expected to end at 9:00 on September 21. Currently, there are over 76.44% of votes against the proposal, with only 23.56% in favor. It is worth noting that the proposer, ApeCoin, has not yet voted. According to DeBank data, the ApeCoin address of the proposer has a stake balance of over 4.24 million ApeCoins, accounting for approximately 1.15% of the total circulating supply of APE. However, the total number of votes for the proposal is currently only about 1.11 million ApeCoins. Therefore, it can be expected that if the proposer participates in the vote, it may reverse the voting result.

3.Magic Eden adds support for compressed NFT cNFT

On September 15th, NFT marketplace Magic Eden added support for compressed NFTc NFT (compressed NFT), providing a low-cost and large-scale NFT production opportunity for innovative NFTs on Solana.

4.Bitcoin NFT protocol Ordinals cumulative minting cost exceeds 2000 BTC, doubling in four months

According to the latest data from Dune Analytics, the cumulative minting cost of the Bitcoin NFT protocol Ordinals has exceeded 2000 BTC, reaching 2,015.3428 BTC at the time of writing, which is equivalent to $52,084,834. Historical data shows that the cost of the Bitcoin NFT protocol Ordinals reached 1000 BTC on May 20th, which means that this metric has doubled in the past four months.

DeFi Highlights

1.LSD stablecoin protocol Prisma Finance has increased the debt ceiling for wstETH, rETH, sfrxETH, and cbETH collateral

On September 15th, the LSD stablecoin protocol Prisma Finance announced that the new debt ceiling has been activated, raising the debt ceiling for wstETH, rETH, and sfrxETH from 6 million mkUSD to 9 million mkUSD, and raising the debt ceiling for cbETH from 2 million mkUSD to 3 million mkUSD. Currently, the debt ceiling for wstETH has been reached.

2.Total locked value on Ethereum Layer2 is $9.56 billion

L2BEAT data shows that the total locked value on Ethereum Layer2 is $9.56 billion, with a 0.68% decrease in the past 7 days. The highest locked value is in the scaling solution Arbitrum One, which is approximately $5.201 billion, accounting for 54.41%, followed by Optimism with a locked value of $2.438 billion, accounting for 25.50%.

3.After Ethereum transitions to PoS, ETH net supply decreases by nearly 300,000

On September 15th, 2021, Ethereum implemented a crucial upgrade called the Merge, which switched the largest smart contract blockchain from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism. According to data from the Ethereum analytics dashboard ultrason.money, since then, Ethereum has minted 680,455.31 Ether (ETH) and burned 980,377.87 Ether (ETH), resulting in a net supply decrease of 299,922.50 Ether (ETH). Calculated on an annualized percentage basis, the supply has decreased by 0.249%.

4.Polygon co-founder: Recursive ZK proof technology will be key to achieving aggregator layer

Polygon co-founder Sandeep Nailwal stated that Polygon plans to invest $1 billion in developing zero-knowledge (ZK) proof-based scaling solutions to further enhance the Ethereum ecosystem. Nailwal introduced the latest progress in the “Polygon 2.0” expansion work and the potential of recursive ZK proof technology in creating a seamless interoperable blockchain ecosystem. Recursive ZK proof technology will be key to achieving the aggregator layer, and it is expected to be deployed within the next few months. This technology will allow different blockchains to submit ZK proofs of their network state to the aggregator, which will then submit these aggregated proofs to the Ethereum network. Nailwal emphasized the potential benefits of sharing value among high liquidity chains (such as zkEVM and PoS chains) and noted that larger Layer1 blockchain platforms have expressed interest in utilizing interoperable layers. The test version of Polygon zkEVM was launched in March 2023, allowing developers to deploy smart contracts and decentralized applications with faster throughput and lower costs than Ethereum Layer1.

5. MakerDAO Founder: Decentralized Stablecoins May Dominate the Cryptocurrency Market

In an interview at the Token 2049 conference in Singapore, Rune Christensen, co-founder of MakerDAO, expressed his thoughts on the future of decentralized stablecoins like Dai and their role in the broader cryptocurrency economy. Christensen believes that interest-bearing stablecoins could capture 30% of the market within two years, as long as cryptocurrencies fulfill their potential. Ultimately, decentralized stablecoins may come to dominate the stablecoin market. However, this will depend on whether cryptocurrencies are “cashable” and subject to regulation. If so, centralized stablecoins will become mainstream. The true potential, however, lies in decentralized stablecoins.

Disclaimer: As a blockchain news platform, LianGuai’s published articles are for informational purposes only and should not be considered as investment advice. Please establish a correct investment concept and be sure to increase risk awareness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ANZ Bank uses Chainlink CCIP to test the purchase of tokenized assets

- Is the encryption industry ready to welcome the influx of funds from Wall Street?

- US SEC Targets NFTs What Does It Mean for NFTs?

- Messari Farcaster’s usage rate has reached a historical high recently. What are the key factors driving Farcaster’s growth?

- Introduction to Aztec.nr Aztec’s privacy smart contract framework allows smart contract developers to intuitively manage privacy states.

- Reshaping the future of Ethereum staking SSV enters the launch phase

- Must-Read for Entrepreneurs – China’s NFT Digital Collectibles Compliance Operation Guide V2.0