No one is interested in halving. How can Litecoin, which has been silent for a long time, break out of its ecological development dilemma?

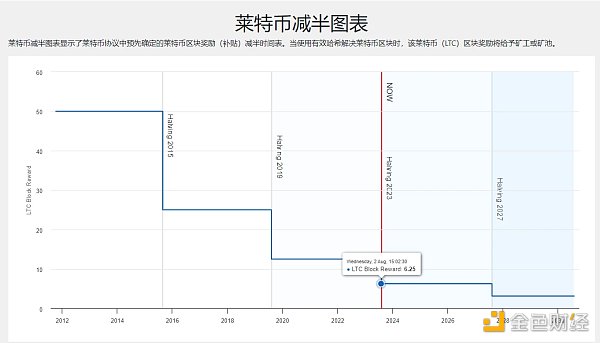

How can Litecoin break out of its ecological development dilemma?On the evening of August 2nd at 23:00, Litecoin (LTC) completed its third block reward halving at block height 2520000, reducing the block reward to 6.25 LTC.

Usually, halving events attract attention and discussion in the market, often accompanied by a narrative of cryptocurrency price increase.

However, the Litecoin halving, which has always been known as “silver to Bitcoin’s gold,” did not receive much attention from cryptocurrency market users. Discussions related to Litecoin are also rarely seen in the crypto community, with only a few countdown news articles related to the halving.

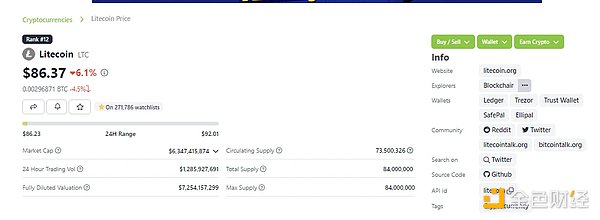

As a representative of ancient era proof-of-work (POW) tokens, the price performance of Litecoin after the halving will determine the level of user interest. Before and after the halving, the token LTC also performed poorly in the secondary market. According to Coingecko, it has seen a 14-day decline of 5%. The price on the halving day also did not fluctuate much, with a 4.4% decrease, currently priced at $86.3.

- Worldcoin has suspended its services in Kenya and plans to cooperate with regulatory agencies.

- Australian ASIC sues eToro over contract for difference products.

- Curve is deeply involved in a security incident, how to establish a defense mechanism to prevent hackers and trace funds?

However, just a few days before the halving, Litecoin founder Charlie Lee and his brother announced the launch of 500 “Litecoin Halving Silver Commemorative Cards,” each card made of 50g of silver and containing 6.25 LTC. They were sold for $1000 each, with an estimated revenue of at least $500,000. This behavior has been mocked by users as: It seems that Litecoin has no use anymore, and the founder and his brother can only make money by selling cards using the hot topic.

While the founder is selling cards during the halving period, as users, we are actually more concerned about whether the halving can bring back attention to Litecoin which has been silent for a long time. Will it have a positive impact on its ecosystem development?

No one cares about Litecoin before the halving, and the secondary market is quiet after the halving

This halving is the third halving in the history of Litecoin since its launch in 2011. However, the cryptocurrency market’s response has been relatively quiet, with LTC tokens experiencing a decline in the secondary market.

The design of Litecoin halving is based on Bitcoin. According to its protocol-defined halving timetable, a halving occurs every 840,000 blocks (approximately every four years), and each halving means that miners will receive only half of the rewards they received before the halving.

As of August 3, 2023, the Litecoin halving event has been completed three times. The first time was in 2015, when the block reward was reduced from 50 LTC per block to 25 LTC; the second time was in 2019, when the block reward was halved from 25 LTC per block to 12.5 LTC; and the third time was on August 3rd this year, when the block reward was reduced from 12.5 LTC per block to 6.5 LTC.

By analogy, the fourth Litecoin halving is expected to occur in 2027, when the block reward will be reduced from 6.5 LTC to 3.125 LTC.

The total issuance of LTC tokens is 84 million, with a current circulation of approximately 73.5 million, accounting for about 87% of Litecoin in circulation. Its current market value is approximately $6.34 billion, ranking twelfth among cryptocurrencies.

The halving, which occurs every four years, is often seen as positive news in the cryptocurrency market, especially for Bitcoin, as the halving is usually accompanied by a bull market. This is because halving or reducing production is usually designed to avoid token inflation issues and control supply to favor price increases. Therefore, every halving event attracts attention and discussion in the cryptocurrency market.

The halving affects the networks and related parties of POW mechanism Tokens, such as mining pools and mining equipment manufacturers, the most. The halving means a reduction in mining rewards, an increase in difficulty, and a significant increase in mining costs. This will have a direct negative impact on the network, and after the decrease in profits, some miners will leave or switch to mining other mainstream Tokens, putting the security of the network to the test.

It is commonly believed that halving will lead to price increases for two main reasons. Firstly, the reduction in miner rewards after halving is equivalent to an increase in costs, which theoretically drives up the token price. Secondly, from the perspective of supply, halving breaks the dynamic balance of production and leads to a decrease in the speed of token supply. If demand remains unchanged or increases, the decrease in supply will cause demand to exceed supply, potentially triggering a price increase.

However, it is not necessarily the case that token prices will rise after halving. The price of cryptocurrencies is the result of various factors, including macro-environment and overall market sentiment. For example, the price of DASH tokens, which completed halving on June 23 this year, fluctuated around $30 for more than a month after the halving.

In contrast, there has been very little discussion and news related to Litecoin’s halving this time. Some users even asked in the community, “Is LTC halving tomorrow?” and multiple users replied, “No one cares anymore. People no longer care about these ancient POW coins.”

In addition, most users have a “short” view on Litecoin’s halving. In response, crypto player Lin mentioned, “During the bull market in 2021, the Litecoin Foundation retweeted a false news that Walmart supported LTC payments, but then deleted it. However, this caused a huge fluctuation in the market, so I realized at that time that the mainstream coins now can only manipulate the market through news, and there is no longer a consensus to dominate the market. In the long run, Litecoin’s halving is not worth paying attention to.”

On the day of the halving, LTC experienced a short-term decline in the secondary market, with an intraday decline of 4.4%, and is currently priced at $86.3. This seems to further validate users’ bearish predictions for its halving.

Founder Launches “Halving Commemorative Silver Card”

While Litecoin community users are paying attention to the halving market, Litecoin founder Charlie Lee and his brother Bobby Lee jointly launched a physical collectible card made of 99.9% pure silver called the “Halving Commemorative Silver Card” to commemorate Litecoin’s halving event that occurs once every four years. It is expected to be priced at $1000 per card.

On July 27th, Charlie Lee and his brother announced in a live broadcast about Litecoin halving that they have partnered with Ballet to produce 500 physical collectible cards made of 99.9% pure silver to commemorate Litecoin’s third halving, which is known as the “silver” of cryptocurrency.

Ballet is a manufacturer of special cryptocurrency cards (similar to gift cards) for cold storage, and Bobby Lee is its CEO and co-founder.

According to the introduction, each silver card is made entirely of 50 grams of 99.9% pure silver (also known as “999 pure silver”), with a coin value of $40 per card. In addition, this card will come pre-loaded with 6.25 LTC, with a token value of approximately $555, which means the estimated value of the card itself is about $595. It is expected to be priced at approximately $1000, with the premium part being a potential expectation for buyers. In addition, Charlie Lee stated that all proceeds from the sales will be donated to the Litecoin Foundation to promote the adoption and development of blockchain.

Bobby Lee mentioned that these collectibles are about the size of a credit card and have a double-layer QR code sticker. The top layer displays the Litecoin deposit address, while the hidden bottom layer displays the encrypted private key (EPK). The password for decrypting the private key can be accessed by scratching off the second part below the QR code.

Charlie Lee explained that this is a silver card, so even if Litecoin falls to zero, it is still worth the price of 50 grams of silver. Additionally, he also mentioned that some of these silver cards may also be auctioned off, such as the first 20, 21, etc., while the rest will be sold at a fixed price, which has not yet been determined.

Currently, the Litecoin halving commemorative silver card has not yet been launched and is expected to be available for sale at some point after the halving in August.

The launch of this “Halving Commemorative Silver Card” by the two brothers who are the founders of Litecoin can be said to be a win-win situation. With the help of the Litecoin halving event, the Ballet cryptocurrency gift card website has not only gained user attention but also easily earned at least $500,000. This move has been jokingly referred to by users as the two Litecoin founder brothers being the most skillful in the cryptocurrency circle, leveraging the promotion of hot projects while effortlessly pocketing $500,000.

Halving May Not Solve Litecoin’s Ecological Development Dilemma

In fact, in addition to the short-term price impact brought by the halving narrative, users are more concerned about the long-term ecological development of Litecoin.

Today, as the leader of the POW, Bitcoin has seen rapid ecological development since the birth of the Ordinal protocol in 2023, which has also shown people the possibility of Bitcoin having other applications besides holding value. It has also allowed miners facing the next halving to see the possibility of on-chain fee income in addition to block rewards.

Naturally, as the representative of Bitcoin’s fork, Litecoin is also expected to have a promising ecological development.

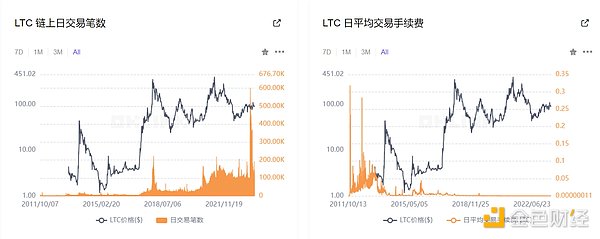

In May of this year, during the BRC 20 hype, the Litecoin community launched the BRC 20 standard fork version LTC 20, which supports users to engrave NFTs, text content, and more on Litecoin.

Driven by the wealth effect of BRC 20, LTC 20 attracted a large number of users to enter the Litecoin ecosystem in a short period of time. Data has shown that on May 9th, the number of daily transactions on the Litecoin chain exceeded 570,000, and the number of active wallet addresses exceeded 810,000.

However, as the popularity of BRC 20 waned, LTC 20 had already fizzled out before entering the mainstream market.

According to Litescribe, the Litecoin inscription trading market, on August 3rd, the total market value of LTC 20-related assets was $27.91 million, with a trading volume of only 12.65 LTC.

Originally, many users had hoped that with the narrative boost of Litecoin’s halving in August, market funds and traffic would converge on Litecoin and promote its ecological development.

However, from the current situation, most of the LTC 20 projects in the Litecoin ecosystem are imitations of the Bitcoin ecosystem, and speculation outweighs other factors. The expectation of Litecoin’s halving narrative empowering ecological development has not been seen in the current development. This is not good news for a veteran mining coin that has already faded from people’s view.

If Litecoin continues to rely solely on speculative price increases to solve its ecological dilemma, it is destined to be eliminated by the market and gradually disappear in the river of crypto history.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data Interpretation Holders reluctant to sell, Starbucks NFT series profitable across the board.

- Governance Methods and Solutions of Four Platforms under Curve Liquidation Crisis

- Opinion Could Swell become a strong competitor to Lido?

- Coinbase’s estimated revenue for the second quarter of 2023 non-transactional revenue surpasses its transactional revenue for the first time.

- Why is Starknet friendly to blockchain games it reduces redundant calculations, thereby reducing gas fees and increasing TPS (transactions per second).

- Bloomberg Analyst Probability of Spot BTC ETF Approval Soars from 1% to 65%

- Podcast Notes | Conversation with Polygon Co-founder From Matic to POL, the endgame of Polygon 2.0