How does Ethereum adapt to and influence traditional finance?

How does Ethereum affect traditional finance?Ethereum is often described as the opposite of traditional financial power. In reality, there is no conflict between the two. Ethereum’s goal is not to overthrow the traditional financial sector, but to supplement and improve it. In the future, these two systems will have more intersections. The core values of Ethereum are self-custody, transparency, and decentralization, which can be achieved within the existing traditional financial regulatory framework. Ethereum has taken the first step in institutional adoption and is likely to become one of the main settlement layers for global financial transactions in the future due to its high degree of decentralization.

Neutrality in a multipolar world

Ethereum is not about providing an intangible alternative currency or a shadow economy of anonymity, but about providing neutrality to users and serving as a fair arbiter of the global financial system. The geopolitical stability of “US first” is being eroded, and the domestic political volatility of major economies is rising. In a multipolar world, the financial system urgently needs to maintain reliable rules.

- Looking for Alpha on-chain: which are the fastest-growing protocols? What are the current trends and narratives?

- Ethereum’s “semantic layer”, Relation and EIP-6239

- Speech by Huang Renxun at the National Taiwan University graduation ceremony: How did NVIDIA, after experiencing multiple failures, grow into a trillion-dollar AI giant?

The system that Ethereum uses for transactions and data storage is incorruptible. This is largely due to the highly decentralized consensus layer, which consists of more than 500,000 validators distributed among more than 10,000 physical nodes in various countries or regions. Although some people worry that Ethereum’s transition to PoS will become more centralized, over time, new nodes are becoming more and more dispersed. Ethereum will never replace traditional contracts or legal authorities that mediate disputes, but it can use code to prevent countless disputes from arising at the source.

Solving the delegation problem

Centralized platforms such as Celsius, FTX, and Silvergate have exposed the shortcomings of traditional finance more than the failure of cryptocurrencies in the Black Swan events of the “crypto winter”. In these cases, the classic delegation problem was exacerbated by loose supervision and centralization of power.

Historically, the default solution to this problem has been stricter regulation, but Ethereum provides other foundational solutions. Trustless smart contracts and distributed ledgers can completely eliminate the risk of delegation problems. In the future, Ethereum and its extended blockchains may penetrate into traditional banks and asset management. From savings accounts to retirement investment portfolios, almost every investor will be able to self-custody their assets with trustless smart contracts and complete the tokenization of fiat currency with almost no friction in compliance with regulations.

Investors and regulators will continue to rely on trustless on-chain oracles to report fund performance by asset managers. In these areas, Ethereum will not conflict with regulations, but rather strengthen them. Ultimately, major jurisdictions around the world will become highly focused on the technical specifications of smart contracts, much like they are for reserve liquidity. Ethereum’s future is not entirely permissionless. Identity-based permissioning may become a standard, but a seamless experience will make users hardly feel regulated. As central bank digital currencies spread across countries, scrutiny regimes will be a major focus, and laws limiting arbitrary freezing of digital assets will gain enormous political support globally.

In short, Ethereum has the potential to greatly reduce financial malfeasance, but its impact on national scrutiny regimes will be more limited.

New Institutions Adopt

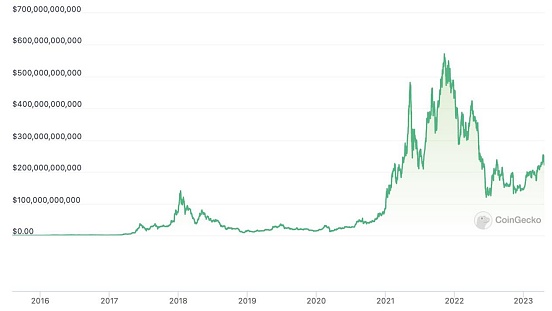

The future of Ethereum may still be distant, but its components have been formed. DeFi was overhyped and speculative in 2021, but this frenzy also sparked tremendous innovation. The technology now exists to create a wide variety of decentralized markets and tokenized financial instruments.

What is currently lacking is connectivity to the broader financial system. This is where a series of regulated fiat-to-crypto exchanges and custodians (such as Circle) are focused, with the US-based company laying the foundation for a digital dollar economy. Circle is now building other key infrastructure, such as fiat-to-crypto hybrid accounts, which will extend directly onto Ethereum and its scaling chains.

Over the next few years, the world may witness the proliferation of tokenized securities, starting from stable and robust fixed income assets. After the Shanghai upgrade, ETH staking will continue to attract significant investments and gradually become a key strategic asset for institutional crypto markets. Other key areas will include on-chain financial reporting, simplified user flows for regulatory compliance, and institutional-grade tokenized derivatives, among others. Recent US enforcement actions have cooled crypto development activities, but it will still be the primary market for the upcoming wave of regulatory protocols.

Summary

The surge in regulatory pressure on cryptocurrencies, especially DeFi, marks the beginning of a new era of interaction between cryptocurrency and traditional finance. In the Ethereum ecosystem, protocols that cannot or do not adapt to the constantly changing landscape will eventually be eliminated. However, protocols that can still integrate well with the existing financial system will be widely adopted, and Ethereum’s revolutionary impact on traditional finance is just beginning.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Three major product matrices, exploring X2E in multiple scenarios, Salad Ventures builds Web3 economic flywheel effect.

- BKEX: Suspends withdrawals due to cooperating with the police to investigate funds suspected of money laundering.

- Analysis of a whale who spent $385,000 buying new tokens within 72 hours

- Quick overview of the advantages and potential issues of stateless Rollup

- Following the Crypto Narrative: Understanding 5 Protocols Set to Receive Major Updates

- Analysis of Contango, the expiring contract platform: What are its advantages compared to perpetual contract platforms?

- Study on Dilation Effect: Contract Authorization Risks of Major Wallets such as Binance. Are Big Institutions Really Safe?