Why is LSDFi considered a transparent narrative?

Why is LSDFi transparent?Original author: Yugi AI

Original translation: Kxp, BlockBeats

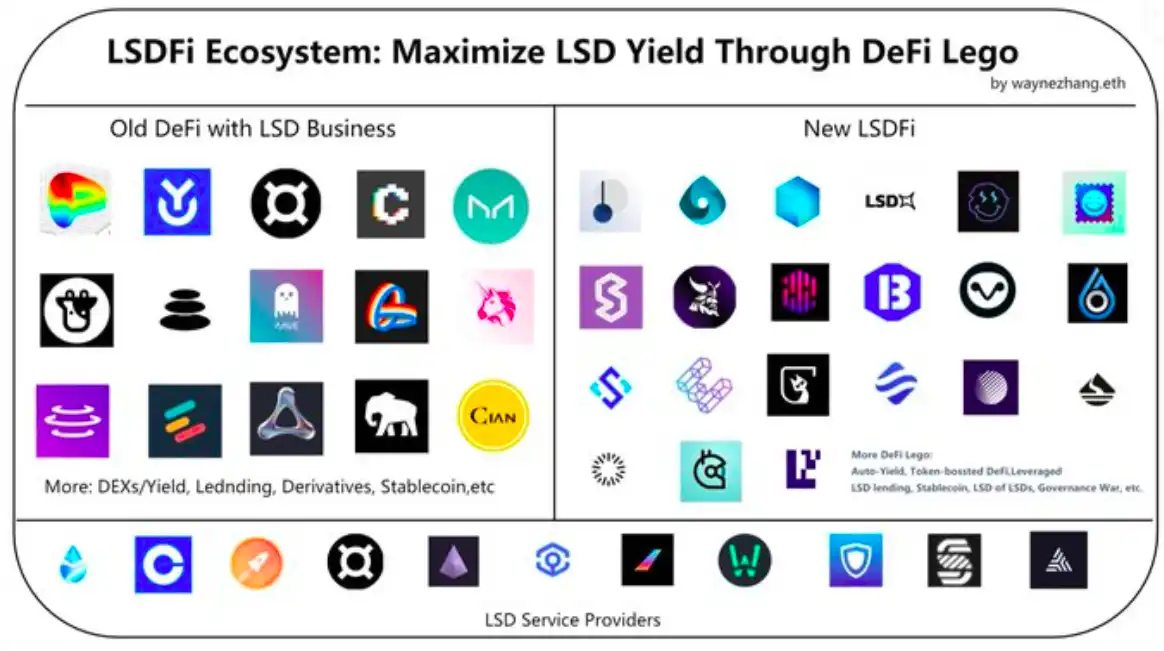

LSDfi is one of the most exciting storylines in LSD and the entire DeFi space. If you want to know what it is and what projects it encompasses, don’t miss this thread and let’s uncover its mysterious veil together.

1. LSDfi

LSDfi refers to a group of protocols based on LSD. It includes a series of projects that may cover classic DEX and lending protocols, as well as more complex protocols built using unique LST properties.

- How does Ethereum adapt to and influence traditional finance?

- Looking for Alpha on-chain: which are the fastest-growing protocols? What are the current trends and narratives?

- Ethereum’s “semantic layer”, Relation and EIP-6239

As these protocols are widely adopted with LST, they will play an important role in the DeFi ecosystem, laying the foundation for the DeFi ecosystem; and projects that build more complex products on top of LSD will be at the next level.

LSD has become a major category in total locked-in value TVL, with Lido being one of the largest projects. Therefore, LSD plays a key role in driving the growth of the entire DeFi ecosystem.

The integration of DeFi and LSD industries is an important trend, and LSDfi is the result of this evolution. As this trend continues, LSD is becoming one of the main forces in DeFi. Currently, LSDfi has developed into an independent field within DeFi and is making positive progress. It includes not only classic DeFi protocols, but also more complex protocols such as Baskets protocol, stablecoins, yield strategies, and more.

2. DeFi Classic

LSD has long been an important part of classic DeFi. Many LSTs can serve as collateral and be traded on decentralized exchanges.

Classic LST DeFi examples include:

- $stETH as collateral in Aave

- Liquidity pool in Curve Finance

- Treasury in yearn

As LSD becomes increasingly popular, we can anticipate the emergence of decentralized exchanges or aggregators tailored to LSD. For example, protocols focused on LSD include LSDx Finance (similar to Curve) and Cat-in-a-Box Finance as a lending protocol.

3. LSD Basket

There are currently many liquidity pledging solutions for ETH, so theoretically there should be a protocol that can integrate them into a basket and create a corresponding index. This approach can achieve risk diversification and make LSD-related investments more convenient.

LSE Basket Protocol:

- Index Coop has launched two index-like LSDs, dsETH and icETH. dsETH includes top Ethereum LSTs, while icETH utilizes leverage.

- unshETH has launched a basket containing top Ethereum LSTs.

- Asymmetry Finance supports depositing ETH and receiving safETH, supported by the top three LSTs.

4. Revenue Strategies

LSD is a token that can generate continuous revenue. Naturally, you can develop a strategy around it. For example, allocate it to different pools, use it as collateral, utilize leverage, and manage staking rewards.

Revenue strategy protocols:

- 0xAcid allows you to invest ETH in a diversified investment basket consisting of original LSTs and various strategies.

- Blockingrallax Finance is a leverage LSD revenue strategy platform that aims to merge multiple LSTs.

Another method is Pendle, which provides a unique approach: since this is a platform for purchasing futures, you can buy ETH at a discount and receive it later while it is invested in specified LSTs.

Asymmetric revenue:

- asymetrix.eth is a protocol that generates asymmetric revenue distribution through staking, inspired by Premium Bonds with similar mechanisms. It is similar to a lottery, where a few winners will share all the staking rewards for a period of time.

5. Stablecoins

Using LSD for excess collateralized stablecoins is a very logical choice. LSD will continue to generate revenue from staking, making stablecoins revenue-generating. In this case, everything is still backed by ETH.

Stablecoins supported by LSD:

- eUSD launched by Lybra Finance

- aUSD launched by Agility

- R launched by Raft

6. Summary

LSD has become the standard for PoS ecosystems and has become one of the main trends in DeFi. LSD can generate stable, low-risk passive income, helping to maintain the stability of blockchain. LSDfi is a reasonable extension of LSD, creating a complete economic system that can generate significant income while simplifying interaction with LSD projects.

LSDfi will continue to develop and gradually witness an increase in the complexity and uniqueness of the project. Let’s look forward to its future development together.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Speech by Huang Renxun at the National Taiwan University graduation ceremony: How did NVIDIA, after experiencing multiple failures, grow into a trillion-dollar AI giant?

- Three major product matrices, exploring X2E in multiple scenarios, Salad Ventures builds Web3 economic flywheel effect.

- BKEX: Suspends withdrawals due to cooperating with the police to investigate funds suspected of money laundering.

- Analysis of a whale who spent $385,000 buying new tokens within 72 hours

- Quick overview of the advantages and potential issues of stateless Rollup

- Following the Crypto Narrative: Understanding 5 Protocols Set to Receive Major Updates

- Analysis of Contango, the expiring contract platform: What are its advantages compared to perpetual contract platforms?