Reviewing the history of stablecoin crashes: An analysis of the potential risks of USDT

Analyzing the risks of USDT crashes in stablecoins' history.Author: Splin Teron, Crypto KOL Compilation: Felix, BlockingNews

This article will look into the history of stablecoin collapses, discuss the potential risks of USDT, and examine what a USDT collapse could mean for the crypto market.

TerraUSD (UST) Collapse

On May 9, 2022, a whale sold a large amount of UST, causing its price to drop below $1. Concerned about the stability of UST, large amounts of funds were withdrawn and UST was sold off from Anchor (a UST staking service in the Terra ecosystem that had previously maintained a stable APY of 20%), exacerbating the downward trend.

- How to identify “smart money” and track them?

- Another strong contender has arrived in the Ethereum L2 game: produced by the parent company of the Fox Wallet, zkSync is one of the strongest competitors.

- zkSync’s Road to Mass Adoption: The Ecosystem is Still in its Early Stages with Many Variables in the Future

In response, LFG (LUNA Foundation Guard) deployed $1.5 billion in stable funds to support the price. Terraform Lab’s $1.5 billion stable fund was also used to bail out the market.

Despite this, even with $2 billion in attempted and potential additional investment, the price continued to decline (there were rumors that companies such as Jump and Alameda had provided an additional $2 billion to save UST). Due to congestion on the Terra (LUNA) network causing a large backlog of unprocessed transactions, Binance suspended withdrawals of UST and LUNA, and then Terraform Labs went after investors for an additional $1 billion.

Later reports suggested that Do Kwon had withdrawn $2.7 billion prior to the bankruptcy. In the latest news, the Supreme Court of Montenegro revoked bail and extended Do Kwon’s detention until June 16. The court will then review the termination reason proposed by the higher court and make a decision on whether to grant bail to the defendant based on the defense lawyer’s advice. In addition, both the United States and South Korea have requested the extradition of Do Kwon.

What conclusions can be drawn from this?

-

Avoid chasing high interest rates, as they may be part of a scam.

-

Diversify assets to avoid the total loss of capital.

USDC Depegging Event

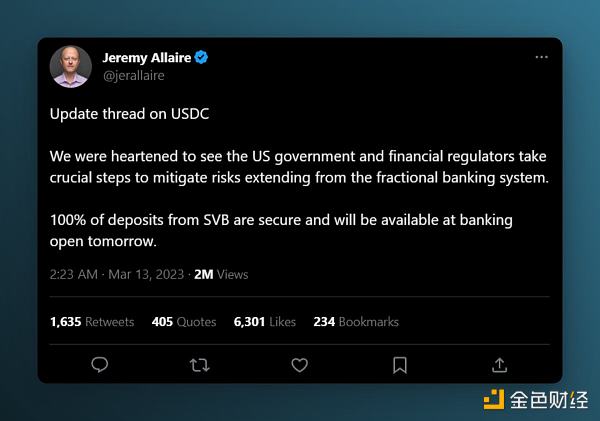

Now let’s analyze the USDC depegging event that occurred in March 2023. During the peak of the panic, some exchanges saw Depeg reach -25%. These situations are worth studying because they may be of reference value in the future – history often repeats itself.

The first news to catch people’s attention was the sudden collapse of Silicon Valley Bank, which had long been an important part of the Silicon Valley financial landscape.

When news broke that Circle’s funds were stored with SVB, the de-anchoring process for USDC began. This situation also had a negative impact on other stablecoins, as traders worried about their financial situation, leading to a large-scale run on the market. However, USDT was not included in this.

The algorithmic stablecoin DAI was most affected by this. This is because 48% of DAI is backed by USDC, so there is a direct correlation between its value and that of USDC.

Later, the CEO of Circle brought some good news. He said that, due to the joint bailout plan of the Federal Reserve, the Treasury Department, and the FDIC, 100% of Silicon Valley Bank’s deposits were safe and withdrawals would be allowed the next day after the bank reopened. Subsequently, market panic gradually subsided, and the price of USDC returned to near-normal levels.

What conclusions can be drawn from this?

-

News background is worth paying attention to and analyzing, and a collapse will not happen overnight.

USDT

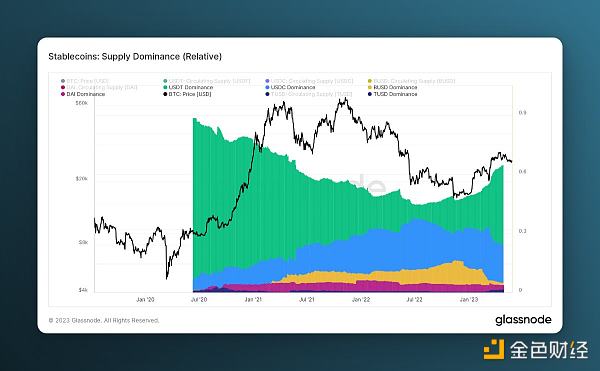

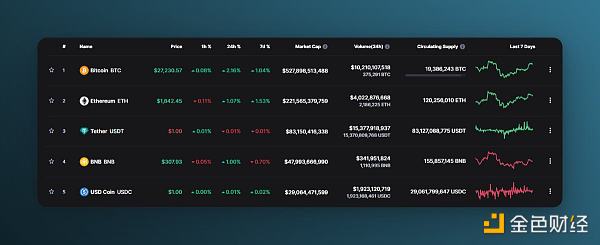

Now let’s discuss USDT. According to the latest data, USDT dominates the stablecoin market with a market share of 64.978%.

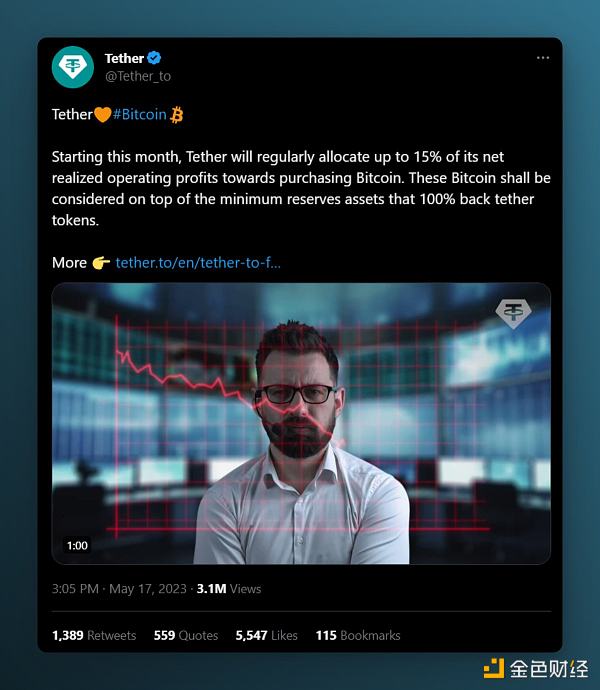

Tether, the issuer of USDT, reported a net income of $1.5 billion for the first quarter of 2023, with the company’s excess reserves totaling $2.44 billion. In their latest announcement, Tether said they will invest 15% of their monthly profits in BTC.

For a long time, the potential collapse of USDT has been a topic of discussion in the cryptocurrency community. Although stablecoins have withstood the harsh bear market, traditional hedge funds insist that the collapse of USDT is only a matter of time.

Opponents of USDT argue that Tether artificially inflates the cryptocurrency market, leading to increased speculation and giving users a false sense of value.

Supporters have refuted these claims, but this has made investors more cautious when dealing with Tether.

For years, hedge funds have been shorting Tether, and now more institutional investors are considering similar actions. This trend is due to concerns about Tether’s financial condition and transparency. Regulatory agencies fining Tether for unclear financial reporting has further fueled these suspicions.

Many have been eagerly waiting for news of an audit. However, Tether has been unable to provide this information because, once disclosed, the US government would immediately freeze bank funds that hold Tether assets. Tether insists that it is operating well, and executives have referred to many speculations about its financial condition as stress tests.

USDT decoupling occurred in 2017 and several other instances, with a decoupling rate of 5-10%, but the time was short.

In terms of market capitalization and being one of the most widely used assets, a USDT collapse would have disastrous consequences for the entire cryptocurrency industry. However, for traders, the best approach is to be prepared for any situation, stay up to date with the latest news, and react accordingly.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: Exploring the Development Potential of the Ordinals Ecosystem from ORDI to OXBT

- Explaining dYdX Indexer in detail

- Hong Kong’s new anti-money laundering regulations have taken effect. Here are the key compliance points:

- Origin and Development of ZKP: From the 1980s to Present

- 【Exclusive from ChainDD】Analysis of 525-page EU Regulatory Regulations: Step-by-Step Guide to Writing White Papers, Only 3 Types of Cryptocurrencies Approved

- Comprehensive analysis of the .sats domain

- There have been rumors for 2 years that “Grand Theft Auto 6” will introduce cryptocurrency, why won’t it integrate with Web3?