If Buffett wanted to buy Bitcoin, what would he buy?

Author: 0x22

Source: BlockBeats

Editor's note: This article has been deleted without changing the original intention of the author.

Buffett will buy Bitcoin? Doesn't Buffett call Bitcoin the square of rat pills?

- Opinion | Synthetic tools will become the ladder to the future of DeFi and achieve the popularity of DeFi

- 36 transactions cleared the HEX investment address, 48,000 ETH were scattered and transferred. It is suspected that the scam project is finally hammered?

- DeFi weekly selection 丨 DeFi lockup value is approaching US $ 1 billion. Will the "ruler" Maker be overthrown in 2020?

I believe many readers are full of doubts after seeing the title. In fact, what BlockBeats wants to discuss in this article is not Buffett's view of Bitcoin, but rather a brief introduction to the current hot option concepts and options strategies in the crypto industry based on Buffett's early use of the option "bottom" Coca-Cola stock. Combing. This article is only a discussion of Buffett's business technology and does not constitute any investment and purchase advice. Please note that the higher risks of options exist.

This article will circumvent all the mathematical language of options, and try to explain the basic logic of options with the most straightforward words and the simplest examples.

First, we need to briefly introduce options.

According to Baidu Encyclopedia, options originated in the US and European markets in the late eighteenth century, and option contracts give holders the right to buy or sell an asset at a fixed price on or before a certain date. . In other words, an option is a contract related to rights and obligations, and both parties to the transaction can bet on the purchase and sale of the underlying asset.

To give a simple example to explain, if you want to receive a bitcoin at US $ 8,500, but the entry funds are only available after 3 months, then you can buy a call option with an exercise price of US $ 8,500 after 3 months. If after 3 months the price of Bitcoin exceeds $ 8,500, you can exercise your rights and still buy it for $ 8,500. If it does not exceed US $ 8,500, for example, it has fallen to US $ 6,000, then of course you will not exercise. Although you lost the right to purchase call options at the time, you can make a dip in the spot market for US $ 6,000.

Conversely, if you are a miner and you want to lock the mining bitcoin income in advance, then you can buy a put option with a strike price of $ 8,500 after 4 months, and if the bitcoin falls to $ 6,000 after 4 months After you exercise, you can still sell at the unit price of US $ 8,500. Similarly, if the bitcoin has surged, you can sell it in the spot market instead of exercising it. Maybe you are already confused about the ups and downs, there will be an explanation of options call / put / buy / sell below.

Some people may ask, the same is hedging, what is the difference between miners when using futures and options?

There are two main differences. The first is that the amount of funds used is different. Generally, the option premium used for hedging is less than the futures margin, which means that the efficiency of funds is improved. The second is the difference in risk. Regardless of price changes after futures hedging, under the premise that the hedging policy does not burst out, the income is completely locked, and neither will suffer losses due to market declines, nor will it profit from rising market prices. . The advantage of option hedging is that if the currency price rises sharply, miners can give up exercise and sell in the spot market, so they will not go short of a skyrocket, and can still exercise and lock mining profits when the market declines. However, the disadvantage of option hedging is that if the price does not change in the future, it is approximately equivalent to the miner losing the premium in vain.

Similarly, some cryptocurrency trading platforms, such as Tiger Fu, have launched a variety of "refund rights" to help users avoid the risk of a plummeting currency price. Such "refund rights" are essentially a put option.

We can conclude from these three examples that options are divided into Call (Call) and Put (Put) options, and each option corresponds to two operations of buying (or buying, issuing). Then, a combination of two, the basic operating strategies of all options can be divided into four types: buy call, buy buy, sell call, sell sell.

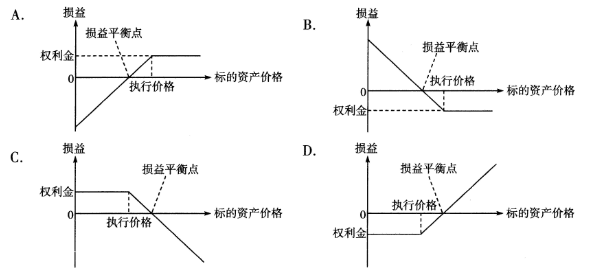

BlockBeats Let's take a call option (Figure D below) as an example to analyze its profit and loss structure. Take the exercise price of 8000 USD as an example. If the price of Bitcoin is lower than 8000 USD, the person who buys the call option will lose the premium; otherwise, he will earn the difference between the current price and 8000 USD on the basis of expending the premium.

(Block Beats Note: ABCD is the sell-and-sell, buy-sell, sell-sell, and buy-sell charts respectively)

Therefore, for the option buyer (purchaser), the worst case is the loss of the premium of the option, and the best case is that the underlying asset exceeds the exercise price threshold to obtain profit. Therefore, in the option transaction, the buyer's maximum loss is limited The maximum return is unlimited; for the seller of the option (issuer), the worst case is the loss of the underlying asset when the buyer becomes a counterparty. The best case is the premium received by the buyer for exercising the right. Therefore, the seller's maximum Unlimited losses and limited maximum gains.

Since the buyer's profit and loss structure is more advantageous, should the option be the buyer?

No. In fact, most options do not exercise, that is to say, in most cases, the seller of the option has a high probability of collecting the premium to make money, so it cannot be said that the buyer of the option has unlimited returns and limited risks, which is suitable for buying the option.

A more difficult question is how are the prices of options determined? What factors affect the price of options? The mathematical pricing model of options is more complicated, which is not the direction of this article. Interested readers can consult relevant information by themselves. The option price is affected by the underlying asset price, time, implied volatility, exercise price, and interest rate. For example, the price of the underlying asset is the Bitcoin price, and the time is the length of the expiration date of the exercise. The implied volatility is the future market volatility expectation (and in general, the volatility that everyone mentions is often historical volatility. The rate is a depiction of the magnitude of past price changes).

"Never sell out" is a word of praise from many people, but in the view of BlockBeats, this is more like a marketing concept. Because if you buy a full position naked option, or a part of the naked option, you may lose your money. The advantage of "no liquidation" of options over futures is that the effect of "pins" can be avoided in extreme market conditions.

Returning to the example mentioned at the beginning of “The Buffett Option Operational Strategy is Reintroduced to Bitcoin”, this is actually a view recently expressed by AKG Venture warehouseman on Weibo. Let us use the above knowledge to think about it. Makes no sense.

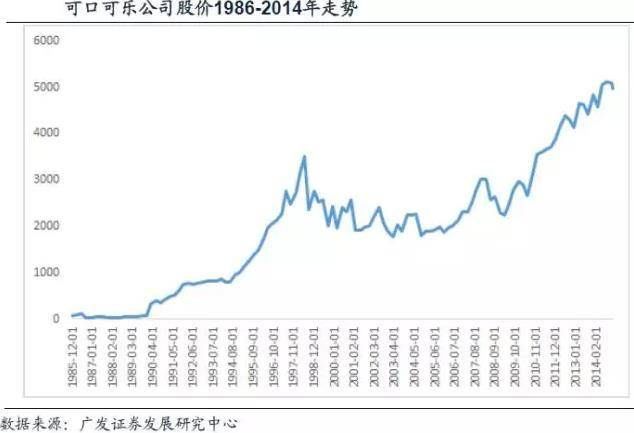

BlockBeats looked up the data and found that Buffett did use an option strategy to invest in Coca-Cola stocks in 1993.

Coca-Cola's stock price was hovering around $ 40 at the time. Buffett sold 5 million put options that expired in December of that year with an exercise price of 35 yuan for $ 1.5 each.

If Coca-Cola's stock price is above $ 35 when it expires in December, Buffett will earn $ 7.5 million in premiums; if it falls below $ 35, Buffett will be the equivalent of a successful $ 35 dip in cash. It can also be seen from this that selling down puts to reduce entry costs requires strong fundamental pricing power and an analysis of price fluctuations, otherwise it will evolve from a "successful dip" to a "high takeover" with heavy losses .

In fact, Coca-Cola never fell below $ 35 in 1993-1994, so Buffett eventually earned $ 7.5 million in royalties. Going back to the original question, can such ideas be reused in the current Bitcoin operation?

For example, you are optimistic about the halving of the market, and you are also optimistic about the long-term value of Bitcoin, or you appreciate the appreciation of the currency standard, but you think that Bitcoin may still have a pullback in the short term. Want to get in the car but not dare to get in the car at the current price.

At this time, you can choose to sell Bitcoin's future put options, such as the $ 6,000 put option that was exercised in March 2020. If Bitcoin does not fall below $ 6,000, the option buyer will not exercise, so you can earn a premium income. If bitcoin falls below $ 6,000, taking $ 5,500 as an example, although the option buyer will cause you a certain loss, you can also buy $ 6,000 in chips, without having to worry about giving up the bottom due to market sentiment.

What are the risks of doing this? If the position to sell put options is not controlled, or the price analysis is wrong, such as when Bitcoin drops to $ 1,000 and there is no stop loss during the period, then investors will suffer huge losses. It can also be seen from this that selling down puts to reduce entry costs requires strong fundamental pricing power and an analysis of price fluctuations, otherwise it will evolve from a "successful dip" to a "high takeover" with heavy losses .

A question that cannot be ignored is how much margin is required to sell put options? For this reason, BlockBeats interviewed a person in charge of an option derivatives trading platform. The other party stated: "Currency-based overlay selling of put options is a very common type of income enhancement strategy. Under the platform's combined margin rules, Short and long positions can reduce the use of margin. A 1 BTC position generally requires only 0.1 BTC + the current option price margin. "

How else can options be applied? Trading volatility. Generally speaking, the spot and futures can either buy up or buy down, but can not buy volatility, and options with non-linear changes in the underlying assets can complete complex volatility strategies.

When the consolidation pattern enters the convergent end, the change will be imminent and the direction will not be determined. In this case, the purpose of long volatility can be achieved by buying both call and put options with expiration dates (in specific operations, the selection of the exercise price and Greek value parameters should be based on demand).

As long as the underlying asset fluctuates violently, whether it is rising or falling, it will be profitable. Of course, if the underlying asset unfortunately continues sideways, investors will lose all their premiums.

To give a simple example, in September 2019, Bitcoin has been in a wide range of US $ 9500-12000 for a long time. When the triangle sorts into the end of the pattern, the transaction gradually shrinks and the volatility gradually decreases, Bitcoin will soon choose the direction At this time, whether it is holding the spot or using long or short leverage, it may not be as good as long volatility.

Others are keen on the operation of doomsday options. The so-called doomsday options are options that are very close to the expiration date and are about to face exercise. Especially for an imaginary doomsday wheel that does not have exercise value, it is very prone to violent market fluctuations in the later period, and the leverage ratio can even reach hundreds or thousands of times. Therefore, it has attracted a group of people to specifically place bets, that is, Low probability high odds bet. Take a simple example to understand the doomsday round. In a football match, the time of a goal in the last 3 minutes and a goal after the first half is obviously different. The former has a smaller possibility, so if If the bet is successful, the former will have an excess return.

However, what BlockBeats needs to remind investors is that there are only two stories of doomsday riches. One is a daydream and the other is a professional who has made a living and studied for many years. Traders, therefore, retail investors through the fantasy to buy a doomsday overnight riches is basically impossible, but may lose money because of this.

Of course, there are many strategies in the complicated options market. For example, professional traders will trade according to whether the Greek value parameter deviates. For the sake of space, this article has omitted some of the more complex concepts such as implied volatility when introducing options. Such as real value par value imaginary value, the difference between European American options and so on.

Since the bear market in 2018, the scarcity of spot market opportunities has prompted investors to use futures contracts and leverage to trade, which has spawned a huge derivatives market. Cryptocurrency trading platform OKEx has just launched bitcoin's options contracts. BlockBeats also mentioned many times that as the cryptocurrency market becomes more mature, the trading volume of derivatives in the future will far exceed the spot market and eventually lead by orders of magnitude.

Today, futures contracts have gradually become the "standard configuration" of cryptocurrency trading platforms, and everyone's competition in the derivative field has spread to options. However, the complexity and non-linearity of options make ordinary retail investors unsuitable for blindly investing in options, and the current liquidity of options in the cryptocurrency market is also limited. Therefore, even if the trading option is a buyer who can control the loss of the premium, there are still Very big risk.

When entering the market, everyone often thinks that if the spot goes up to make money, the futures go down to make money, and the options can make money sideways; but the fact is often that without a thorough understanding of the rules and strategies, blind trading Eventually lead to losses, losses, and sideways losses.

"If Buffett wants to buy Bitcoin", do you think that is possible? Welcome to leave a message in the message area below.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin's eternal battle: fighting entropy, rising on the borders of order and chaos

- Perfecting Blockchain Cognition with Bitcoin's Middle Tier Knowledge

- Dry goods | Three technical analysis methods to play the Bitcoin market cycle

- Babbitt Column | Regulatory Sandbox Confirms Difficulties in Implementation, China Should Actively Deploy Industrial Sandbox

- Will the date of CME's launch of Bitcoin options be the end of altcoins?

- Analysis of Singapore's Payment Services Act: What is the difference between the regulatory policies imposed on different types of digital currencies

- EOSIO 2.0 is officially released, solving the biggest bottleneck of blockchain development, making EOS "faster, easier and more secure"