How does the outflow of stablecoins affect the price of Bitcoin?

Impact of stablecoin outflow on Bitcoin priceAuthor: Michael Rinko

Translation: Biteye Core Contributor Crush

How does the outflow of stablecoins affect cryptocurrency prices? Is the market still purely a game for individual investors? This article will give you the answer today.

- Ecological airdrop season is coming, can DFINITY return to its peak?

- In-depth Explanation of ZeroSync Starkware’s Zero Knowledge Proof System Developed for Bitcoin

- In-depth Analysis of ZeroSync Starkware’s Zero-Knowledge Proof System Developed for Bitcoin

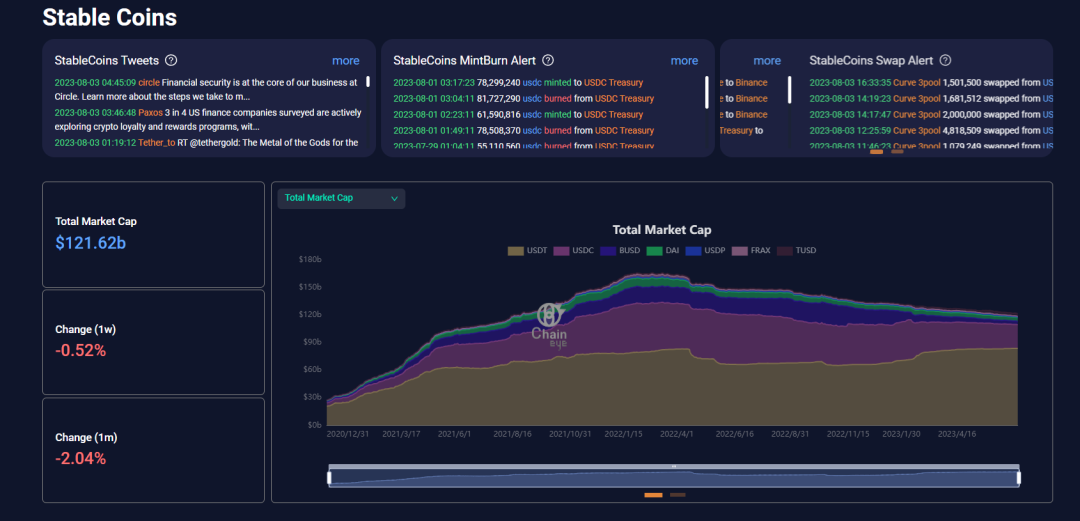

The market value of stablecoins has been declining for the past two years, and the current decline has even returned to the level of the bear market in 2018.

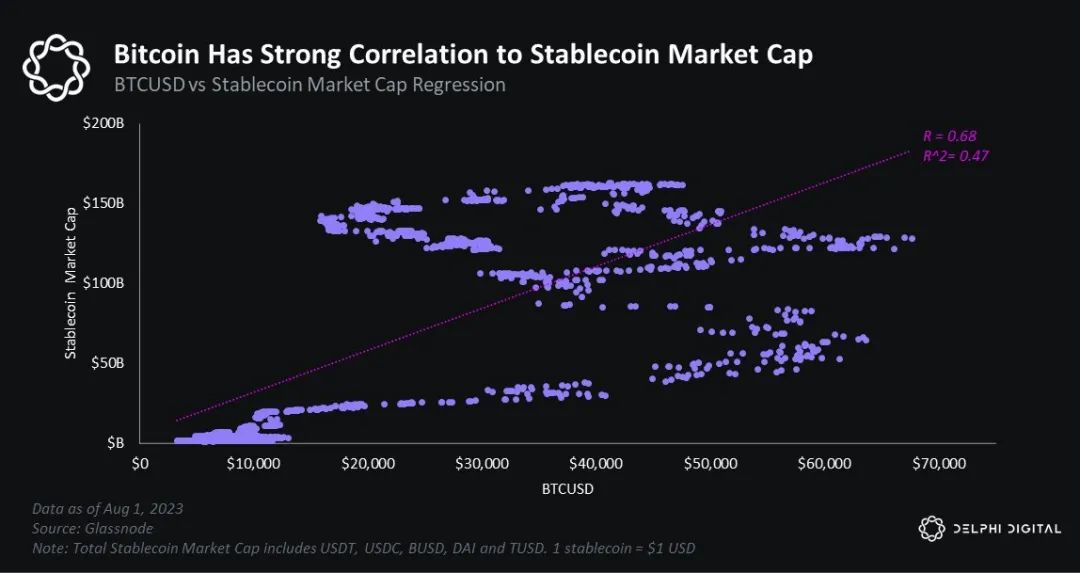

If we conduct regression analysis, we will find that the total market value of stablecoins has a strong correlation with Bitcoin, r=0.68, r^2=0.47.

(Translator’s note: Here, r represents the correlation between the market value of stablecoins and the price of Bitcoin, ranging from -1 to 1. -1 indicates 100% negative correlation, and 1 indicates 100% positive correlation; r squared represents explanatory power, for example, here it means that 47% of the current price of Bitcoin can be explained by the market value of stablecoins, and the remaining part may be caused by other reasons.)

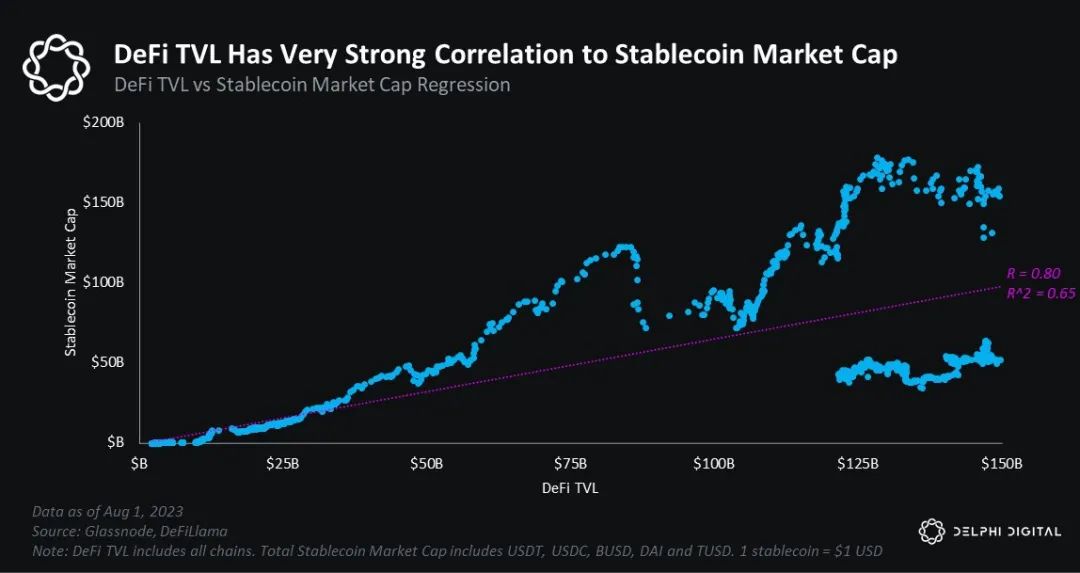

Its correlation with Ethereum is even stronger, r=0.80, r^2=0.64. This is likely due to Ethereum’s significant decentralized financial ecosystem.

The market value of stablecoins has the strongest correlation with the total locked value in DeFi, r=0.80, r^2=0.65.

This is reasonable because most people enter DeFi through stablecoins, and more stablecoins mean more locked value in DeFi.

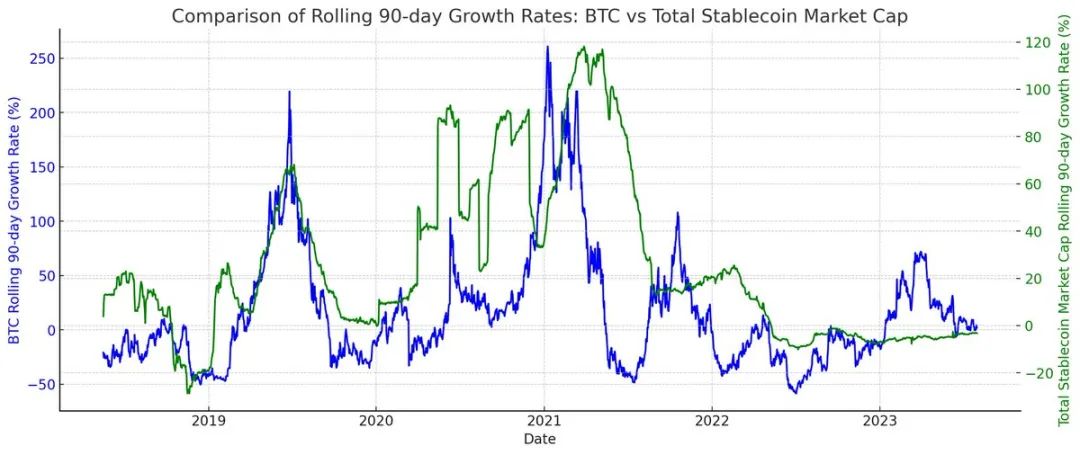

Overall, there doesn’t seem to be a clear cause-and-effect relationship between Bitcoin and the market value of stablecoins. We can verify this by conducting correlation analysis with different lag periods from -10 to 10 days. We found that the highest correlation between Bitcoin and the total market value of stablecoins occurs at 0-day lag.

(Translator’s note: Here, the lag period refers to shifting the market value of stablecoins forward by 10 days, 9 days, 8 days, and so on, until shifting the data backward by 10 days, and then conducting correlation analysis between the value of each day and the price of Bitcoin on that day to check whether there is some degree of temporal causality or relationship between the two.)

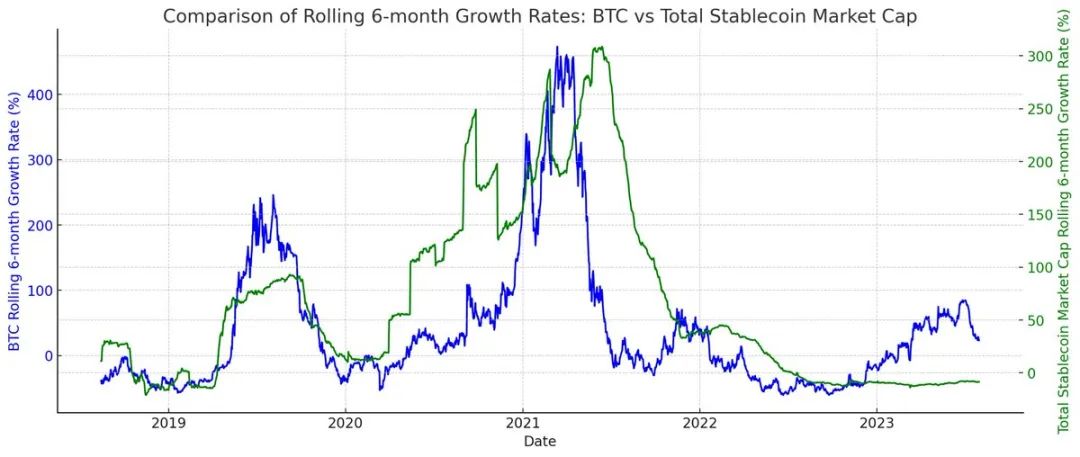

If we expand it to a 180-day growth rate, we can see that in the previous cycle, the market value of stablecoins led the rise in Bitcoin, but in the decline, Bitcoin led the way ahead of stablecoins.

However, we should not rely too much on this observed relationship, as it is based on only one market cycle.

Here is a chart of the 1-year growth rate:

In conclusion, @Pentosh1’s statement is correct. Currently, the entire market is still in a PVP game state, and once we see a large influx of stablecoins, this may indicate the return of more retail investors and risk-takers.

For those interested in stablecoins, you can use Chaineye’s stablecoin dashboard to learn more detailed data.

https://chaineye.tools/stablecoins

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpretation and Comparison of the EU’s Cryptocurrency Market Regulation Act (MiCA)

- Halving Narrative and Reflexivity LTC falls instead of rises, can BTC halving still bring a bull market?

- Hashed Partner The next bull market will be mainly driven by the Asian market, and bottom-up innovation may emerge in Asia.

- Fortune Magazine From ambitious to defensive, what twists and turns has the crypto queen Katie Haun experienced?

- From hard forks to the Lightning Network, who is supporting the Bitcoin ecosystem?

- Semafor The US Department of Justice is considering fraud charges against Binance, but is concerned about a FTX-style run in the market.

- MicroStrategy plans to sell stocks to raise $750 million to purchase Bitcoin.