Industry Research Report | Blockchain Derivatives Overview: Rapid Development, Risk Symbiosis

Overview Overview

Financial derivatives are an important part of the financial market, and financial derivatives trading has developed into a very mature trading method internationally. The blockchain is considered to be a technological force that has revolutionized the future of finance and its industrial ecology. Although the development time of various types of digital pass trading markets is relatively short, it has matured and the digital pass derivatives trading market has also developed rapidly.

Report report

What is a financial derivative?

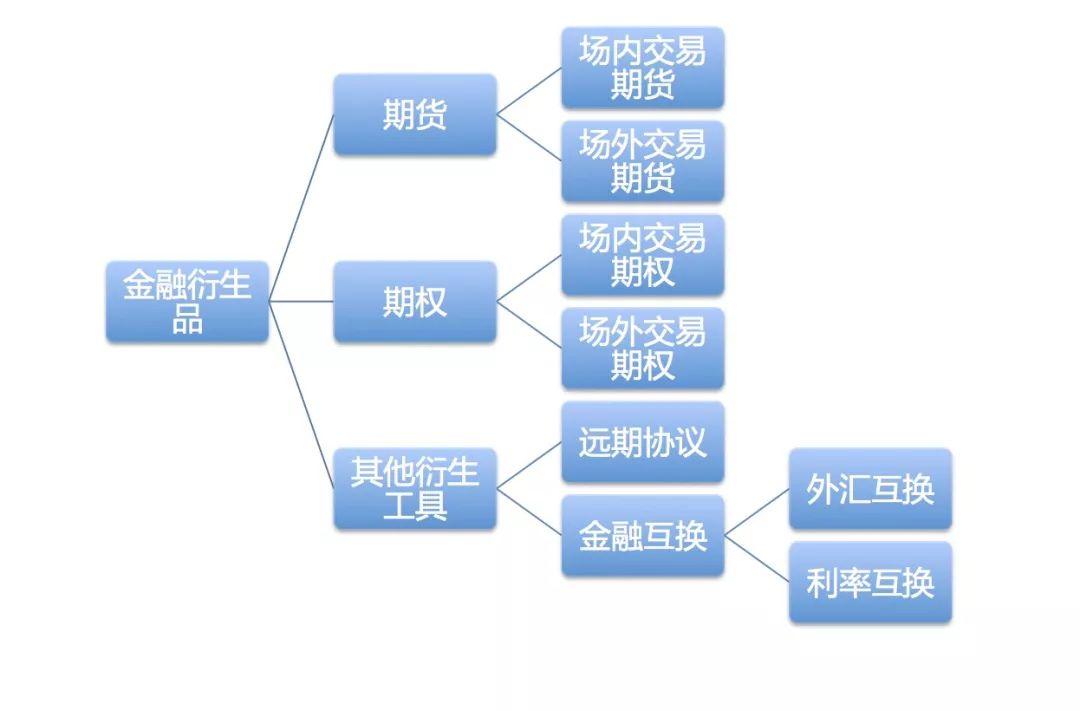

Financial derivatives (derivatives) are financial contracts whose value depends on one or more underlying assets or indices. The basic types of contracts include forwards, futures, swaps (interchanges) and options. Financial derivatives also include hybrid financial instruments with one or more characteristics of forwards, futures, swaps (interchanges), and options.

Such contracts can be standardized or non-standardized. The standardization contract means that the transaction price, trading time, asset characteristics, and trading method of the subject matter (base assets) are all standardized in advance, so most of these contracts are listed and traded on the exchange, such as futures. Non-standardized contracts mean that the above items are agreed by the parties to the transaction, so they have strong flexibility, such as forward agreements.

- Blockchain VS quantum computing, this is probably the true incense law that Ren Zhengfei can't escape.

- Science and Technology Daily: Be wary of changing the blockchain into “blocks”

- A small step for Fidelity, a big step in the cryptocurrency market

The role of financial derivatives is to avoid risks, and prices are found to be a good way to hedge asset risks. However, there is a good side and a bad side in everything. Risk avoidance must be undertaken by some people. The high leverage of derivative products is to transfer huge risks to those who are willing to bear. These three types of traders have jointly maintained the above functions of the financial derivatives market.

Traders can be divided into three categories:

- Hedger hedgers use derivative contracts to reduce the risks they face due to market changes.

- Speculator speculators use these products to place bets on future market variables.

- And the arbitrageur arbitrageurs use two or more offsetting trades to lock in profits.

Source: Standard Consensus

Source: Standard Consensus

Traditional financial derivatives produce background

In the 1970s, Western countries began to abandon Keynesian policies, allowing market prices such as interest rates and exchange rates to have more floating space, which eventually led to the complete collapse of the Bretton Woods system, in which the dollar was linked to gold and the currency of the agreement was linked to the dollar. The neo-liberal economic policy not only made the Western capitalist countries gradually out of the dilemma of stagflation, but also opened a new wave of contemporary economic globalization. Under this new international economic system, the rapid growth of international trade, cross-border investment and financing has made international investors have more choices in various fields, but they also face more and more complex risks than before. The risk is reflected not only in the uncertainty of the price of different factors of production in different times and in different places in the future, but also in the needs and judgments of different investors on these uncertainties. Financial derivatives meet the needs of investors in the face of these risks. Due to the constant changes in investor risk appetite and exposure, financial derivatives have also shown continuous development characteristics, and the scale of transactions has grown rapidly.

Compared with the production of traditional financial derivatives, digital pass derivatives are mainly generated to meet the speculative needs of market investors. Although with the continuous development of the digital pass derivatives trading market, more and more investors have entered this market, and gradually found other effects such as hedging, arbitrage and asset-liability management of derivatives.

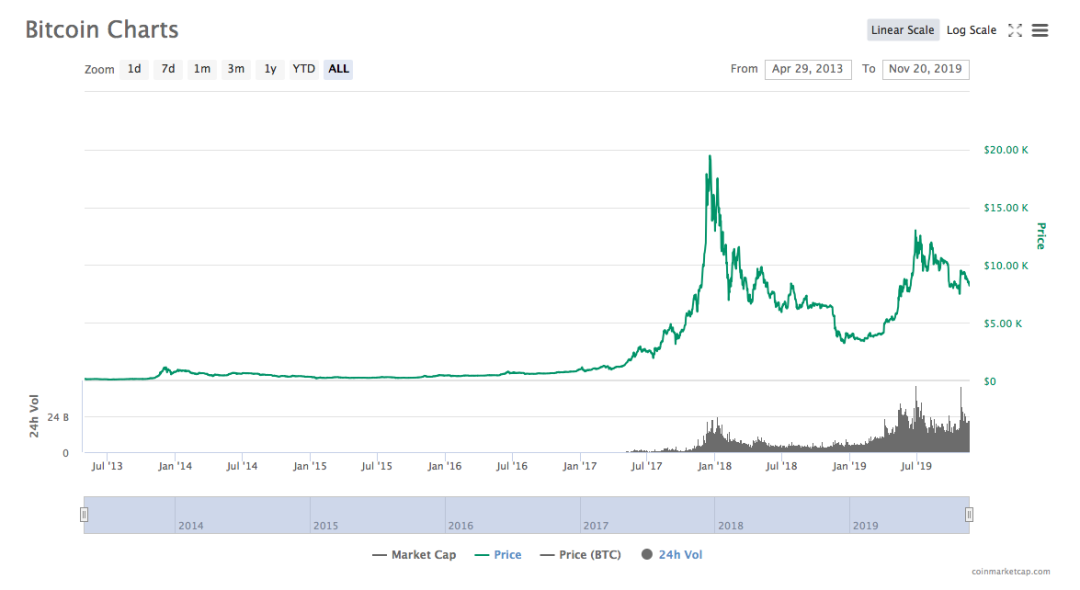

Bitcoin spot market

From January 3, 2009, Nakamoto bought the first block, and on May 22, 2010, a programmer named Laszio Hanyecz purchased two pizzas with 10,000 bitcoins. The price of bitcoin has reached a maximum of 20,000 US dollars. Throughout the process, Bitcoin experienced a roller coaster development and also led to the development of the entire digital pass market. According to CoinMarketCap's data, Bitcoin has grown from an average of tens of millions of dollars per day in 2013 to an average daily tens of billions of transactions, which has increased by a thousand times in terms of turnover and has been recognized by more investors.

Source: CoinMarketCap

Source: CoinMarketCap

Bitcoin derivatives market

According to the product form, the current Bitcoin derivatives market can be divided into two categories: futures and options.

A futures contract is a standardized contract established by a futures exchange, which stipulates the contract expiration date and the type, quantity and quality of the assets it buys and sells.

An option transaction is a transaction in which the right to buy or sell. An option contract specifies the right to buy or sell a particular type, quantity, or quality of a native asset at a particular price at a particular time.

At present, bitcoin futures contracts are more popular, and many trading platforms have this type of investment. Such as the blockchain field of fire coins, OKEx, BitMEX, etc., as well as traditional areas and hold relevant licenses Bakkt, Chicago Mercantile Exchange CME and Chicago Board Options Exchange CBOE.

Source: Fire Coin

Source: Fire Coin

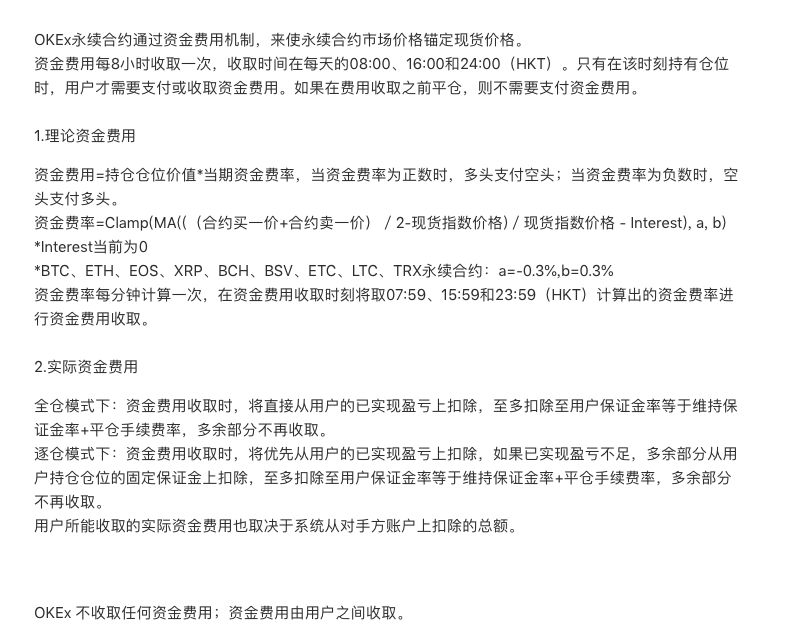

OKEx and BitMEX have opened a perpetual contract based on the delivery contract. The perpetual contract is a new type of contract that evolved from the traditional futures contract. Compared to futures contracts, the perpetual contract has no expiration or settlement date, more like a margin spot market. Because there is no expiration date, lack of time constraints, and the loss of hedging or hedging, it is easy to turn a perpetual contract into a gambling tool. The mechanism of anchoring the spot price through perpetual contract prices minimizes the malicious manipulation of contract prices.

Perpetual contract related regulations:

- At a certain moment, when the futures price is greater than and significantly deviates from the spot price, more parties need to pay to the empty party;

- At a certain moment, when the futures price is less than and significantly deviates from the spot price, the empty party needs to pay to multiple parties;

- The greater the degree of deviation, the higher the rate of payment.

Source: OKEx

Source: OKEx

Except for Bakkt's futures contracts, which are settled in kind, other futures contracts are settled in cash. Currently, futures contracts are settled in cash. This means that, at the expiration of the contract for purchase, market participants pay or charge the difference in the maturity of the futures (such as US dollars). Cash-settled futures contracts have little impact on the demand for bitcoin, as market participants simply buy the exposure of such digital passes rather than buying actual bitcoins. Bitcoin futures settled in cash are more inclined to a gambling game, and will not have too much impact on the actual demand of Bitcoin, but when it comes to the delivery of things, the exchange must retain enough bitcoin before the expiration date. Meeting the needs of customers will affect the circulation and demand of Bitcoin, thus actually affecting the actual price of Bitcoin.

Bitcoin options have not yet formed a mainstream, and only some small trading platforms have appeared in the bitcoin options trading, but there is no exercise attribute. However, on September 20, 2019, the Derivatives Exchange CME Group announced that it will launch Bitcoin options on January 13, 2020, which is awaiting regulatory evaluation and approval.

Source: Straight Flush

Source: Straight Flush

Conclusion

Digital Pass has entered the field of traditional financial investors, so the market continues to expand, and the digital pass derivatives market will once again enter the stage of rapid development. Even derivative products such as digital pass forwards and swaps (interchanges) will continue to emerge. These new products will help institutional and professional traders manage the digital exposure of the spot market and hedge the risks of the digital pass market in a regulated environment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | The market rebound is weak, beware of the risk of breaking the position (1120)

- In the past week, the total amount of Bitcoin’s large transactions plummeted by 97%. What does this mean?

- Ethereum Istanbul Upgrade Announcement (Full Text)

- At least 1.6 million BTC stones sink into the sea! Why is Bitcoin scarier than you think?

- Bitcoin is digital gold and a payment tool

- MakerDAO founder: ETH is the most stable choice for the Dai ecosystem in terms of value drivers

- Fidelity Digital Asset Services is licensed by NYDFS to operate a cryptocurrency custodial platform