Insights from Segregated Witness Bitcoin’s Stagnation and Layered Scalability

Insights on Segregated Witness, Bitcoin Stagnation, and Layered ScalabilityMichael Matulef published an article on Bitcoinmagazine [2], discussing the history of Bitcoin’s scalability and suggesting that Bitcoin needs to adopt a layered approach to scaling without compromising the security and decentralization of the main network.

Translation of the entire content:

The block size war marks a crucial chapter in the history of Bitcoin, highlighting the ability of node operators to resist systemic changes that could undermine the decentralization and censorship-resistant nature of the network. The key controversy revolves around how to scale Bitcoin to accommodate the growing transaction volume. One camp advocates increasing the block size at the expense of some degree of decentralization, but their opponents argue that sacrificing the core spirit of Bitcoin for scalability is not sustainable.

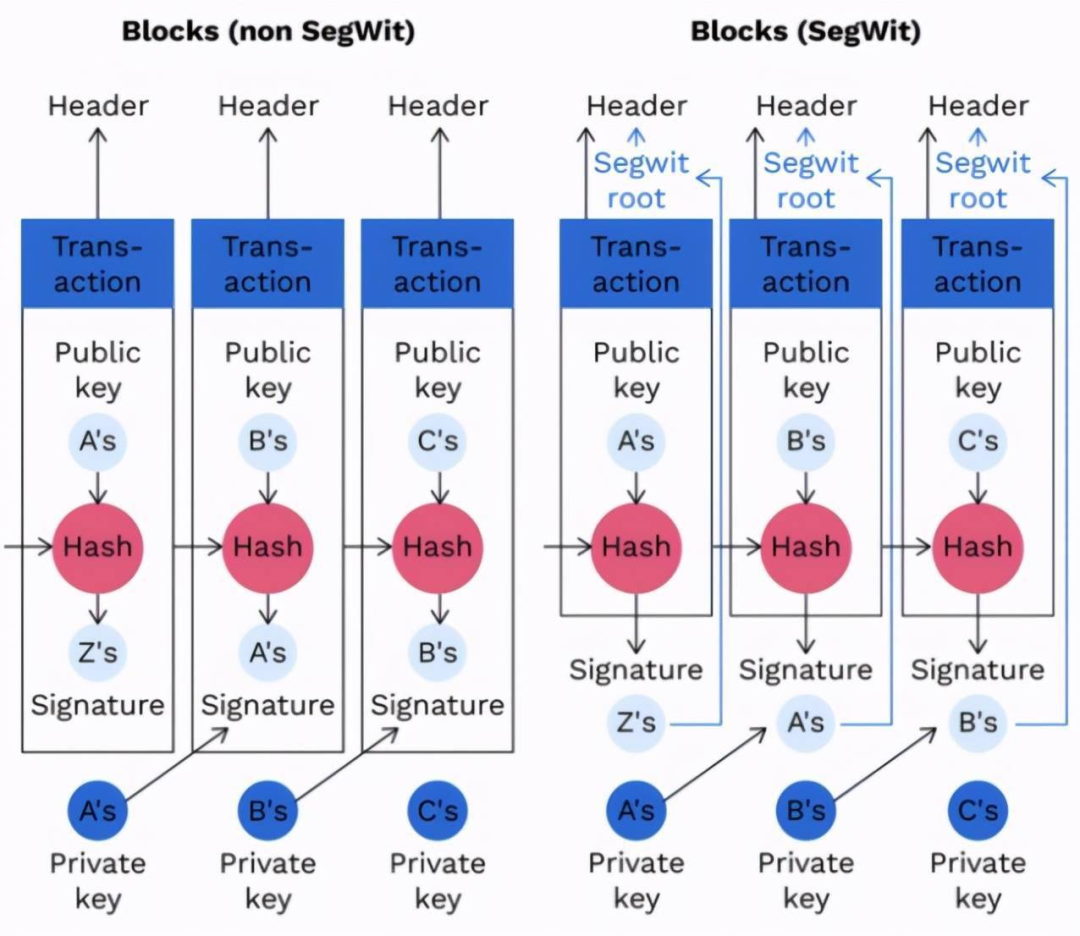

The subsequent stalemate eventually led to a controversial change – Segregated Witness (SegWit). By restructuring the way transactions are stored, SegWit provides moderate capacity increase while also addressing the transaction malleability issue that hindered advanced functionality.

- MARA CEO Bitcoin halving narrative is a fantasy, but Bitcoin is the best Layer 1.

- MARA CEO Halving narrative is a fantasy Bitcoin is the best Layer 1

- Interpreting the Current Situation of Cryptocurrency Markets Outside the United States

SegWit emphasizes the resilience of Bitcoin’s governance model in maintaining its core values amidst internal conflicts. As debates continue regarding how to scale Bitcoin while respecting decentralization and censorship resistance, these deliberations remain highly relevant.

“Scalability is a problem for developers and users who want to reference a previous transaction before it is confirmed on the blockchain and use it as an input in a new spending transaction. The reason for this problem is that in order to spend the bitcoins created by a previous transaction, the spending transaction must reference the txid of the previous transaction. If the txid can be changed, the reference will fail and the spending transaction will be invalid. Specifically, transaction malleability is an issue that hinders the adoption of the Lightning Network, as the Lightning Network relies on the exchange of unconfirmed Bitcoin transactions.”

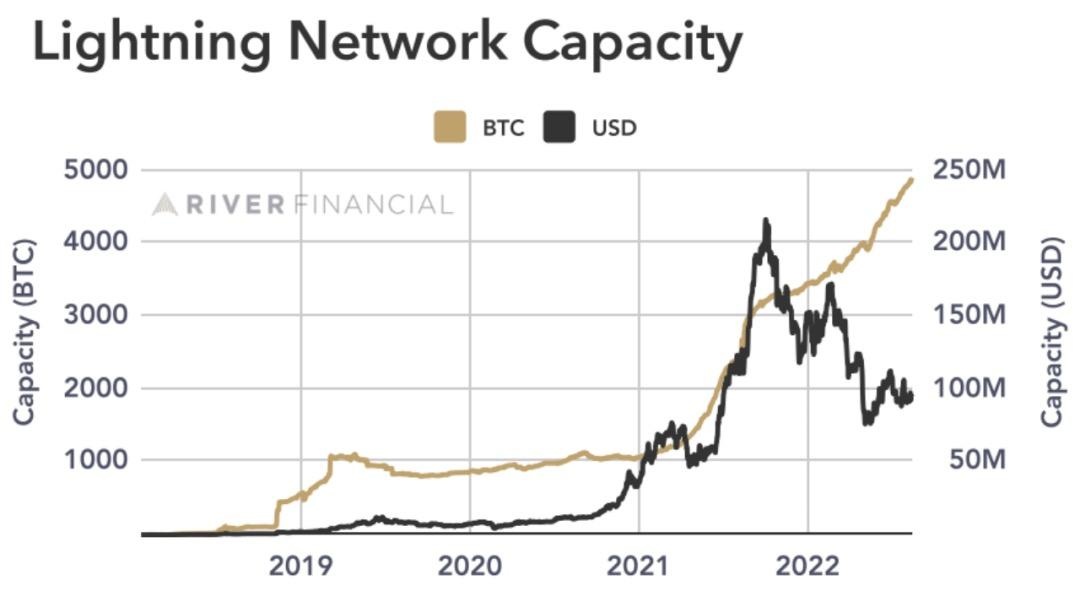

The activation of SegWit has been a key precursor to the development of the Lightning Network. The Lightning Network is a layered scaling solution that enables fast Bitcoin payments. By settling transactions off-chain and only broadcasting the settlement balances to the Bitcoin mainnet, the Lightning Network aims to enhance Bitcoin’s scalability and transaction capabilities without compromising its core security model. Since its inception, the Lightning Network has experienced significant growth as a payment mechanism, enabling instant microtransactions and highlighting the feasibility of Bitcoin as an efficient medium of exchange.

As the Lightning Network continues to mature, it provides real-world test cases for layered scaling solutions that may shape Bitcoin’s technical roadmap to align its goals of censorship resistance, decentralized security, and mainstream payment usability.

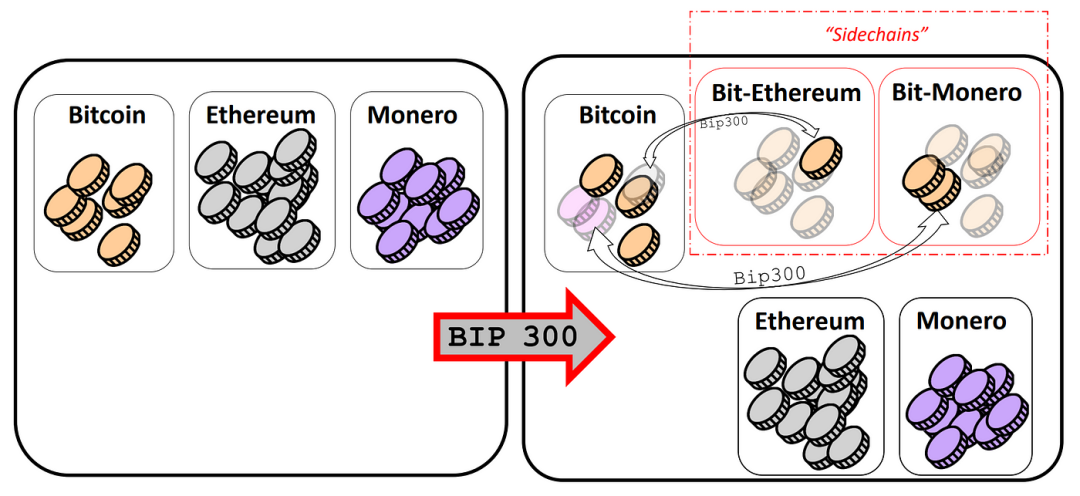

One important lesson learned from the early scalability debate of Bitcoin is that “Bitcoin can scale in layers”.

This design concept recognizes that the base layer of Bitcoin is a secure and decentralized foundation, while the higher layers, such as Layer 2 protocols, are used to support scalability and transaction capacity. By leveraging the base layer as a trust anchor, innovative solutions can be developed to enhance the scalability and usability of Bitcoin without compromising its decentralized and censorship-resistant core values. As Bitcoin matures, the layered scaling model aims to achieve mainstream utility and payment efficiency while respecting the consensus-driven governance and security guarantees provided by its permissionless architecture. With advancements in technology, innovations in Layer 2 may provide a pathway for Bitcoin to achieve global scale while adhering to its fundamental principles.

Although the “Bitcoin layered scaling” paradigm is a constructive conceptual step, some people interpret it dogmatically as an excuse for complete rigidity of the Bitcoin base layer. Due to an excessive focus on minimizing risks and maintaining Bitcoin as a primary store of value (SoV), they believe that no further changes should be made to the underlying protocol. However, this extreme stance overlooks subtle differences and unforeseen consequences. Strict limitations on expanding functionality to higher layers may ultimately undermine Bitcoin’s self-sovereignty and censorship resistance, qualities that are highly valued by today’s users. As transaction fees and congestion on the base layer increase over time, only wealthier entities have the ability to directly interact with the base layer, concentrating everyday users onto custodial solutions. While cautious and conservative progress is prudent, blindly rejecting any enhancements to the base layer out of paranoia can inadvertently lead to long-term centralization of Bitcoin and strip ordinary users of their power. There is a trade-off between scalability ambitions and technical stability, but reflexive rigidity fails to conduct a nuanced cost-benefit analysis of proposals that could improve user experience without sacrificing decentralization.

The core value proposition of Bitcoin lies in its ability to provide true self-sovereignty and censorship resistance to users. By design, Bitcoin enables users to independently control their funds, eliminating the need for transaction validation or custody by external third parties such as banks or governments. Users can truly own their Bitcoin, hold the private keys, and make payments that are irreversible and tamper-proof. This makes Bitcoin the first permissionless and politically neutral monetary system that upholds financial autonomy regardless of nationality or institutional status. Unlike traditional finance, there is no central authority that can easily freeze, seize, or block payments on the Bitcoin network. These interconnected properties promote decentralization and mitigate systemic risks, as Bitcoin has no single point of failure and exhibits resilience even in adversarial environments. Users no longer need to place absolute trust in external institutions to participate in finance – Bitcoin enables direct peer-to-peer electronic cash on a global scale. The phrase often quoted, “Not your key, not your money,” cleverly encapsulates the ability provided by Bitcoin for self-sovereignty, resistance to censorship, and escape from permissioned systems.

With the wider adoption of Bitcoin, there are economic constraints on expanding capacity to meet the growing transaction demand. The block space of Bitcoin is essentially limited, and increased usage will bring more competition for this scarce resource. The basic supply and demand dynamics indicate that as global utilization increases, fees will rise unpredictably, excluding smaller transactions. While initially absorbable, the continued growth in fees will have external effects on the accessibility and ethos of Bitcoin. The high fees make it difficult for ordinary users to conduct on-chain transactions, forcing them to turn to custodial services, which contradicts the premise of Bitcoin’s self-sovereignty.

Quoting [Anthony Towns’ article: Putting the B in BTC](https://www.erisian.com.au/wordpress/2023/06/21/putting-the-b-in-btc)

“The space there is not infinite – it is expected to manifest as fee pressure and backlog as well as a decrease in the ability to rapidly resolve transaction storms. This in turn will make it difficult and expensive for those with small amounts of funds to continue to self-custody on the main chain. At that point, acquiring new high-value users will mean pricing off existing low-value users.”

Quoting James O’Beirne’s thoughts on scaling and consensus changes [3]

“It needs to be said loudly: when a billion people want to use Bitcoin, transaction costs on the main chain will be exorbitant. Note that I said ‘exorbitant’ rather than ‘impossible’ because if users lose the ability to take custody in some form at Layer 1, then Bitcoin is just frictionless gold: paper markets will develop, and all the good properties of paper markets will develop. Bitcoin will shrink.”

Finally, the immortal Hal Finney said in 2010 [4]:

“In fact, there’s a good reason for Bitcoin-supporting banks to exist, issuing their own digital cash currency that’s redeemable for Bitcoin. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the blockchain. There needs to be a second-layer payment system, lighter weight and more efficient. Banks can be thought of as a kind of decentralization of that second layer.”

“Different banks could have different policies, some more aggressive, some more conservative. Some might be partial reserve, and others might be 100% Bitcoin-backed. Interest rates may vary. Cash transactions could be discounted in some banks.”

George Selgin elaborated on the theory of competitive free banking, arguing that such a system would be stable, resistant to inflation, and self-adjusting.

I believe this will be the ultimate destiny of Bitcoin, to become a “high-performance currency” as the reserve currency of banks issuing their own digital cash. Most Bitcoin transactions will take place between banks to settle net transfers. Private Bitcoin transactions will be as rare as Bitcoin-based purchases are today.”

The solution to this urgent economic predicament remains shrouded in uncertainty. While we may discover innovative technological engineering solutions, it is also possible that the predicament stems from a fundamental, inevitable economic constraint—a true constant that requires recognition and adaptation from all strata.

We must be prepared to face such a prospect: certain economic trade-offs and limitations are inherently integrated into the structure of our existing system. If we are to consider custody as inevitable, our primary responsibility is to strive to impose strict constraints on custodians, effectively curb risks, and cultivate a mature ecosystem with positive incentives for a free market economy. In addition, they must strengthen their resistance to encroachment by state authorities, retain sovereignty, and ensure unrestricted participation in an unconstrained free market. Regardless of one’s stance on the scalability of self-custody or the inevitability of custody, it is crucial to strongly oppose rigid phenomena for as long as possible.

The most important lesson learned from the block size war is that the expansion of Bitcoin needs to be enhanced at its fundamental level. Without a significant upgrade to Segregated Witness (SegWit), the emergence of revolutionary developments such as the Lightning Network would still be a daydream. This underscores a crucial correlation: the effectiveness of secondary layers is inseparable from the effectiveness of the main network protocol. If we desire to achieve the scalability of self-custody and impose restrictions on custodians, we must firmly commit to free market incentives and resist state coercion through a robust scrutiny system, and therefore, Bitcoin’s development must continue.

Allow me to clarify that my position does not advocate reckless behavior or indiscriminately implementing every proposed change. On the contrary, we should approach with extreme caution and carefully examine each proposal. Our overall mindset should revolve around how to modify elements that we may hesitate but consider necessary. The key to this approach lies in fostering an open and constructive dialogue within our community. Unfortunately, the existence of malicious actors and their deceptive marketing strategies pose significant obstacles to our development efforts. They not only consume our valuable time but also divert the attention of those genuinely seeking knowledge. We have a responsibility to actively contribute to creating genuine spaces where meaningful discussions can take place, and individuals can engage in continuous learning.

Maybe my arguments about the necessity of the Bitcoin revolution haven’t convinced you. You may think that the current situation is satisfactory and that the potential risks associated with unknown uncertainties outweigh any challenges encountered during the expansion process. Your viewpoint is correct because if enough people agree with you, we may indeed have reached a point of protocol ossification, and we must adapt accordingly to this reality.

The ongoing narrative of Bitcoin is still an unfolding story. As this groundbreaking economic innovation continues to mature, its precise trajectory remains a mystery, influenced by numerous unpredictable and diverse factors. While Bitcoin’s decentralized structure prevents any single entity from exercising absolute control, individuals operating nodes have significant influence over its processes. Their values, philosophies, and visions of Bitcoin’s future will inevitably leave their mark on the protocols and systems they choose to adopt.

The future of Bitcoin is yet to be written, and only time will reveal its ultimate direction.

References

[1] Michael Matulef: https://twitter.com/MichaelMatulef

[2] Article by Michael Matulef on Bitcoinmagazine: https://bitcoinmagazine.com/technical/coming-to-terms-with-the-economic-reality-of-scaling

[3] Thoughts on Scaling and Consensus Changes: https://delvingbitcoin.org/t/thoughts-on-scaling-and-consensus-changes-2023/32/1

[4] Hal Finney’s quote from 2010: https://bitcointalk.org/index.php?topic=2500.msg34211#msg34211

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Block space is a scarce commodity, how to objectively evaluate it?

- How do the interest rates and future prospects of the Federal Reserve affect the cryptocurrency market?

- Data What is the crypto market like outside of the United States?

- Dialogue with Circle CEO How can USDC recover the market lost due to SVB’s bankruptcy?

- Common situations and criminal defense strategies for embezzlement of executive positions in the cryptocurrency industry

- 3 NFT markets restrict ‘Stoner Cats’ transactions after SEC takes action

- The Flow of Traffic behind Tip Coin User Profit Expectations and Internal Market Game