The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?

Integrating Environment and Finance: Can ReFi Shape Web3 Sustainably?01, From DeFi to ReFi

The mainstream narrative of Web3 seems to have never touched on the planet we live on. Compared to the shrinking Amazon rainforest, native inhabitants of the crypto world are more concerned with the bloated and expensive Ethereum network. What is the latest crypto theme? “Pepe achieved a market value of $1 billion in 23 days,” and various beneficial myths are spreading, with investors rushing into meme projects with an average lifespan of less than a week. However, behind these noises, the development of the Web3 industry is facing a crisis of narrative corruption. To achieve the recognition and migration of Web3 by billions of mainstream people, it is obviously necessary to create narratives that are more blockchain-native, combining the characteristics of low-cost trust and free flow of encrypted verification, to solve the most urgent challenges faced by humanity in this era. The most precious exploration in this direction is the attempt to combine web3 with environmental issues: regenerative finance – ReFi (Regenerative Finance).

Unlike the many controversies facing the development of the crypto industry, the mainstream society has always been committed to using financial means to improve the environmental problems facing humanity. Concept such as impact investment and green finance have also received the support of mainstream institutions, and they have successively established their own ESG investment departments. Among them, the carbon emission trading market recorded in 2021 was $909 billion, which increased by 12% compared to 2021. In contrast, the current market value of Bitcoin is $521 billion. Like RWA, the potential market for ReFi has greater imagination space than native crypto assets.

Although the vision of ReFi is to create a sustainable future for humanity and includes grand visions such as regenerative agriculture, environmental protection, and eliminating inequality. However, in the practice of ReFi, most mainstream ReFi protocols focus on the rapidly growing voluntary carbon trading market (different from mandatory carbon trading required by regulations). This is because, in the traditional voluntary carbon trading market, the unique attributes of carbon projects mean that carbon offsets can only be traded in the form of differentiated products (carbon contracts), which strongly rely on verification services provided by third-party central organizations (such as VCS provided by Verra) and do not have the attributes of bulk commodities (such as corn or rice). Therefore, most carbon trading occurs in the OTC market, lacking transparency for the entire market. This makes it difficult for end customers to know whether they are paying a fair price and how much funding is flowing to the initial project developers.

Ideally, ReFi hopes to use blockchain technology to transfer ecological assets to the chain in a real and tamper-proof manner, and to tokenize ecological assets through smart contracts after they are on the chain, so that individual investors around the world can use decentralized finance means to freely trade and borrow, thus improving the value of the ecological assets behind the tokens.

- What is the purpose of the world coin that features iris authentication, global airdrops, and the creator of ChatGPT?

- Can the combination of decentralized derivative exchanges and account abstraction open up the next incremental entry point?

- US House Stablecoin Hearing: State and Federal Regulatory Authority Dispute Focus of Both Parties

02, Current mainstream ReFi practices

The main attempts to combine blockchain technology to achieve ReFi goals are: ReFi platform, ReFi protocol, ReFi Dao and ReFi Game, etc.

Green public chain – Celo

Celo is one of the main promoters of ReFi development. Since its inception, Celo has been committed to providing decentralized financial services to billions of unbanked populations worldwide through mobile devices. As a platform, Celo itself does not provide ReFi services, but it supports major carbon credit tokenization projects such as Toucan, Moss, and Flowcarbon. Celo is also the first negative carbon emission public chain-automatic carbon offset credit purchases from Project Wren through block rewards, thus overcompensating for its carbon emissions. They also plan to transition 40% of the stablecoin (cUSD) reserve assets on Celo to tokenized rainforest and carbon sequestration assets over the next four years.

ReFi protocol – Toucan Protocol , Regen Network

Toucan Protocol is an open-source carbon trading protocol based on Polygon, which has now expanded to the Celo network. Its product architecture consists of two parts: carbon bridge and carbon token pool , and users can transfer their real-world carbon assets to the chain through the carbon bridge and then trade them in the carbon pool. As a ReFi pioneer, Toucan currently occupies a major share (US$4 billion in transaction volume) in this field and has facilitated the reduction of 50,000 tons of carbon emissions.

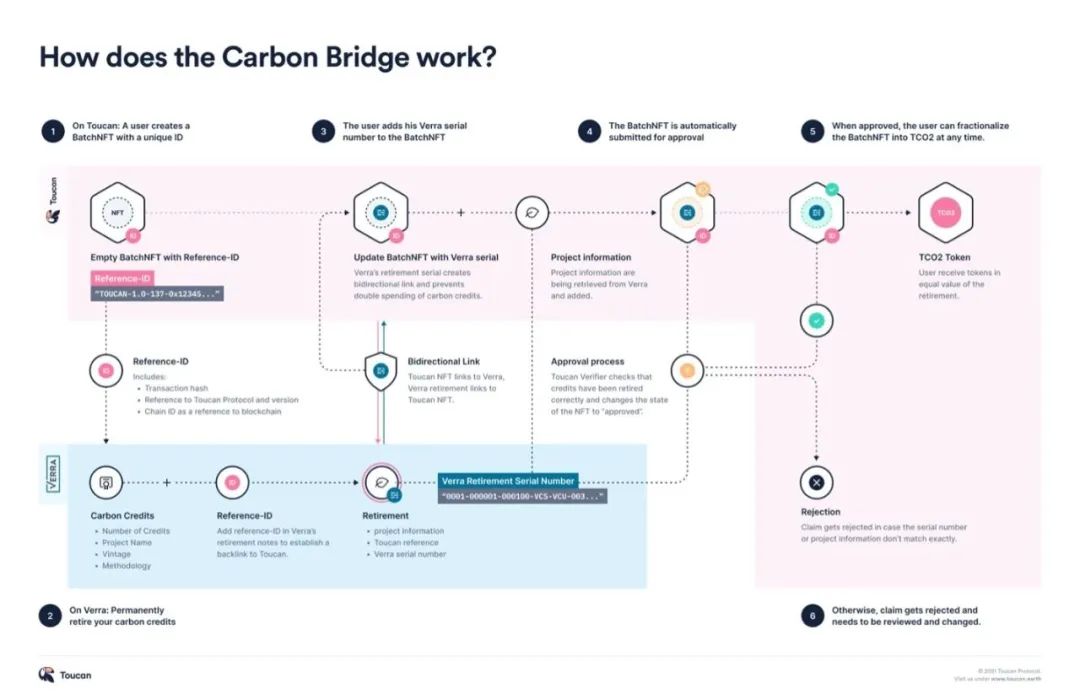

Carbon bridge:

Toucan’s carbon bridge is a concise process based on VCS verification: Users first generate a blank BatchNFT and get a corresponding reference number (including transaction hash, on-chain ID, Toucan protocol number), and then destroy their carbon credit assets in Verra and fill in their NFT reference number. Then add your own Verra destruction number to your BatchNFT and wait for validation. After approval by Toucan, the blank BatchNFT will automatically fill in all information about the project (carbon emission reduction type, quantity, time, etc.). Then the nft can be extracted into corresponding Toucan carbon tokens (TCO2) with corresponding attributes.

Carbon Pool:

·The product logic of the carbon pool is to bundle the carbon emissions tons (TCO2 tokens) of multiple specific projects together to form a more liquid carbon index token, providing price discovery for different categories of carbon assets.

·Not every TCO2 is of equal value

·Carbon project categories include carbon removal, emission reduction, and avoidance, each with different values.

·The pricing of carbon projects is influenced by multiple differentiated standards, such as project type, country, strictness of standards, and additional benefits (such as biodiversity increase or sustainable development goals).

·Toucan’s carbon pool has achieved some level of commoditization by aggregating similar carbon tokens. This is necessary to provide transparent price signals for different categories of carbon offsetting. These standardized carbon tokens can be traded on decentralized exchanges and have deeper liquidity than individual project offset tokens.

·TCO2 tokens are locked in carbon pools with similar attributes through logical filters and a carbon pool token (such as BCT token) is created and sent to the depositor’s wallet. Carbon pool tokens are interchangeable ERC20 tokens.

·Currently, Toucan has two carbon pools, BCT (basic carbon ton) and NCT (natural carbon ton).

Although the Toucan protocol is currently in a leading position, its on-chain natural asset process is heavily dependent on third-party professional organizations (Verra). On May 25, 2022, Verra suspended related registration services due to concerns about the ReFi project, which also shook market confidence in related ReFi protocols.

Regen Network differs from ReFi protocols such as Toucan and Moss that use the Verra-carbon bridge solution, and is more inclined to build an open platform they define as the global ecological accounting system (Regen Ledger), using the Tendermint consensus engine and based on Cosmos SDK to support a wide range of third-party ecological projects that can deploy their created ecological value and status changes verified on the chain, and provide a complete incentive framework for tracking ecological changes.

Regen Network’s product is mainly composed of three parts: Regin Registry digitizes real-world ecological asset data, Regen Ledger manages and captures the value of ecological assets, and Regen Marketplace provides a trading market and liquidity for tokenized ecological value.

Compared to Toucan, which relies on centralized institution verification services, the implementation logic of Regen Registry is more blockchain-native and easier to gain industry recognition. Regen will directly sign agreements with creators of ecological value and collect ecological data through four channels:

- Original remote sensing data (optical, infrared, lidar)

- Geographic information system datasets (terrain, soil type, water distribution)

- Sensor networks (climate, moisture, vegetation)

- User collection

After the ecological data is uploaded to the chain, Regen will generate the credit analogy and credit batch to which the ecological asset belongs based on metadata and Regen verification logic.

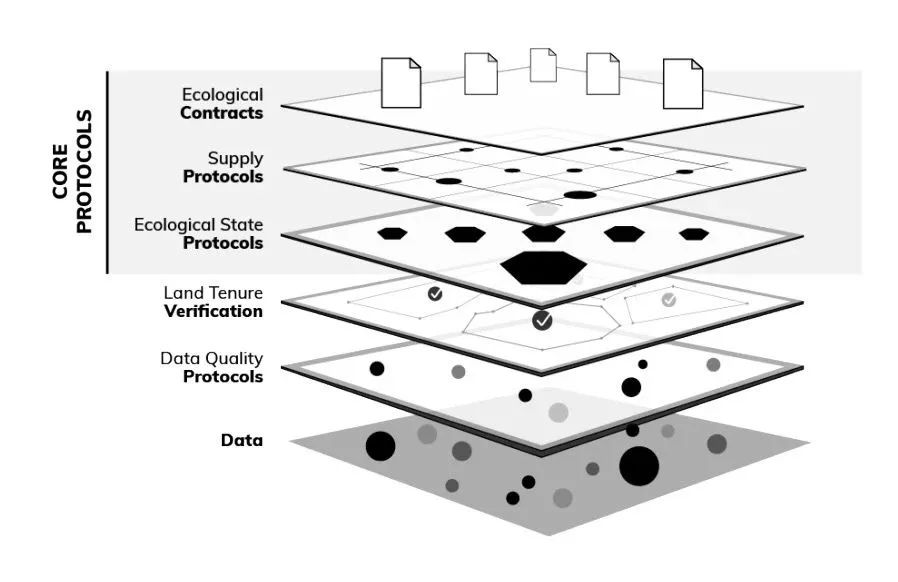

Regen Ledger provides three core ecological protocol frameworks: Ecological State Protocols (ESPs), Ecological Contracts (ECs), and Supply Protocols (SPs).

ESPs are the most core component of Regen Network’s unique value and the main reason why it differs from Toucan and realizes web3-native value. ESPs are algorithms and standards used to verify specific ecological states. Each ESPs will be individually labeled and managed by the Regen Foundation, such as the number of tons absorbed at a specific time on corresponding land, the Boolean value of corresponding land underground water reserves, etc. Like open source code libraries in traditional web3, different ESPs can reference each other and make version derivatives based on specific versions.

SPs are supplementary protocols built on ESPs to measure the output of corresponding ecological values and assist in verifying the full supply chain circulation process of the output based on algorithms on the chain.

ECs are the core value assertion protocol and smart contract framework of the system. Different ecological projects can make their own funding requests or initiate crowdfunding based on ECs to achieve specific ecological goals, such as carbon sequestration. By setting phased tasks and conditions, the collected funds can be used transparently based on smart contracts to ensure that they are used to achieve the corresponding goals.

The main trading pair of Regen Market Place is REGEN/EcoCredit. In order to cope with the non-homogeneity of ecological assets, the ecological asset value captured on the chain through the above ESPs process is abstracted as a separate logical container, that is, Credit Class. They will then be assigned Credit Type attributes (such as carbon credits, ecological protection credits, etc.) and collected into different Credit Batches. Each Credit Batch is non-homogeneous but contains a fixed set of interchangeable Credits, which can be freely exchanged and cancelled. Through this logic, Regen Network can take into account the value differences of different ecological credits and maximize the EcoCredit liquidity.

After sorting out the product components and logic of Regen Network, we can say that although Toucan Protocol is the pioneer of the Refi protocol and has a huge lead in TCL and transaction volume, Regen Network has taken a more open source and blockchain-spirited path. It is worth mentioning that Regen Network and Toucan Protocol announced the launch of a two-way bridge between the two networks last month, and NCT will be used as a standardized carbon currency for mutual recognition.

ReFi Game

The main mode of current mainstream web3 games is X to Earn, which provides different game forms and focuses on developing corresponding economic incentive mechanisms and token economic models. ReFi Game is no exception, generally referred to as ImBlockingct to Earn, that is, to incentivize players to create ecological value and positive externalities through economic rewards. However, on this basis, Refi has also expanded another quadrant, namely Play to ImBlockingct, which is the opposite of the former and incentivizes players to play through positive externalities, similar to Ant Forest on Alipay.

Play to ImBlockingct Game:

Guardians of Earth: The game realizes the twin mapping of the real world through the oracle, and players can create their own “Nature Realm” on the chain by paying and monitor the ecology of that area. Other gameplay of the game is still under development.

Climate Guardians: The gameplay is designed for players to generate their own villages and form their own tribes to combat the threat of rainforest disappearance, and the project party will donate the income to the Amazon rainforest protection fund.

ImBlockingct to Earn Game:

Wheel Coin: Rewards players for low-carbon travel with WheelCoin, which can be used to exchange for train miles.

Litter Coin: Encourages users to clean up garbage to get LitterCoin, which can be exchanged for the cryptocurrency ADA.

03, the future of ReFi

In the definition of the ReFi Foundation, ReFi is described as a “re-designed monetary system to better coordinate with the earth.” Traditional finance has a problem of one-way value flow: natural resources and ecological value flow unidirectionally into the human monetary system, but this system does not reward behaviors that fill and restore the ecosystem itself. It is obvious that such a system needs to be thoroughly changed.

Although the current mainstream ReFi practices are mainly focused on carbon offset trading, we can optimistically predict that the development of ReFi will supplement more diverse natural capital-backed currencies into our economic system and transmit transactions verifiably through blockchain, whether it is based on green agriculture, water purification, or even the richness of species in a protected area. As writer Charles Eisenstein said, “if you back the money with more things you want to see in the world, you will get more of those things.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Conversation with Sui Developer Relations Manager: How to start developing on Sui from scratch?

- Analysis of Dune: A powerful and practical free on-chain analysis tool

- Will modularization become the ultimate solution for cross-chain?

- Themis Protocol: An all-in-one DeFi platform, powering the full growth of Filecoin

- What kind of Midjourney does Web 3 need? Exploring practical AIGC with Orbofi as an example

- Revolution of AI in Chain Games (Part 3): Electronic Games, the Hidden Driver of Technological Development

- Why do I always receive “Exchange Withdrawal” messages? Learn about the classification and protection measures of Web3.0 data leakage events in this article.