Comprehensive Explanation of Radiant: Can it Beat Aave and Compound to Become the New King?

Radiant: The New King of DeFi? A Comparison with Aave and Compound.Original author: Andrew Kang Compiled by: Deep Tide TechFlow

Andrew Kang, co-founder of Mechanism Capital, believes that Radiant Capital may become the best competitor of Aave and Compound, and outlines in this article why he thinks so.

Aave and Compound are currently the largest currency markets in cryptocurrency, with TVLs of $5 billion and $2 billion, respectively. Through innovation, Radiant Capital is a top competitor to challenge the throne and has the potential to become the new currency market king in the cryptocurrency market.

- Viewpoint: How do Web3 game players become losers?

- Resolution to the US debt crisis and inflation

- Summary of evidence related to the SEC’s lawsuit against Binance

Brief introduction to Radiant:

-

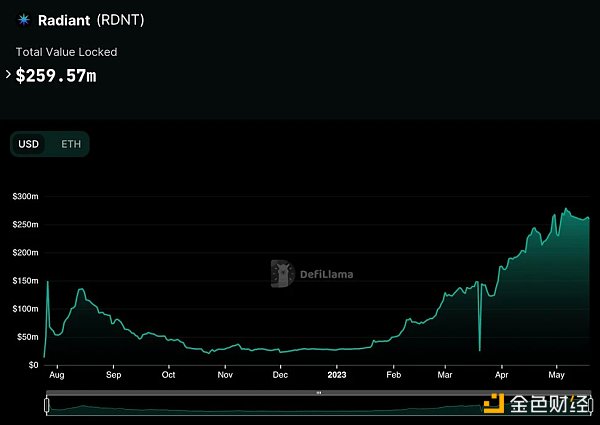

TVL on Arbitrum and BSC is $260 million;

-

The first functional cross-chain MM (lending on X chain, borrowing on Y chain);

-

Will be launched on ETH and zkSync soon;

-

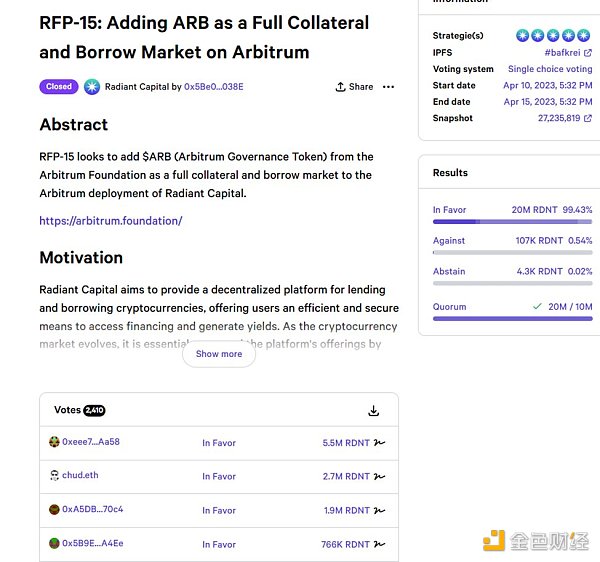

Add more secure collateral, such as $ARB (other currency markets act slowly);

-

Token design optimizes demand and protocol growth.

Aave and Compound only offer 1-2% yield on stablecoins, lower than the treasury. With stablecoin market capitalization exceeding $100 billion, more than $10 billion stablecoins that were once in market makers are now idle, and this untapped liquidity is a huge opportunity. The 10-40% stablecoin yield provided by this audited one-year protocol will be known to more people, and TVL is expected to grow.

The second biggest opportunity is ETH + LSDs. Currently, the total value of Compound and Aave is $4 billion, but Radiant’s sustainable and incentivized yield can capture market share. In addition, many non-stETH LSDs worth billions of dollars lack currency markets, and Radiant can become their first choice.

Flywheel

Radiant is one of the biggest beneficiaries of ARB, and no other currency market has listed ARB except for Radiant, so we expect continuous capital inflows to allow $2 billion ARB to find a place in unilateral returns.

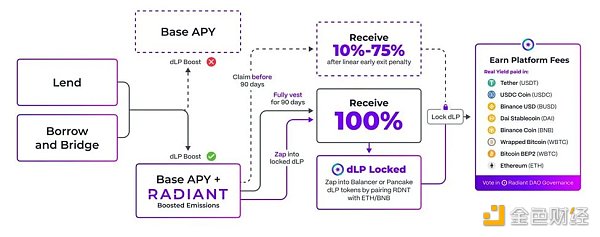

An important driver of RDNT growth is the V2 Tokenomics flywheel upgrade, which increases the value of its incentive reserves and guides more sustainable issuance to long-term protocol-related users.

-

User deposits 1 million US dollars and meets the 5% threshold for “locked LP” emissions.

-

If the RDNT price drops, the user is now below the 5% threshold.

-

The user will be incentivized to buy RDNT and re-lock more LP to stay above 5%.

With the rise of LayerZero and zkSync narratives, Radiant is expected to become a huge beneficiary as people use the platform to mine for possible airdrops.

The total TVL in USD and ETH has been growing throughout the year.

Earnings

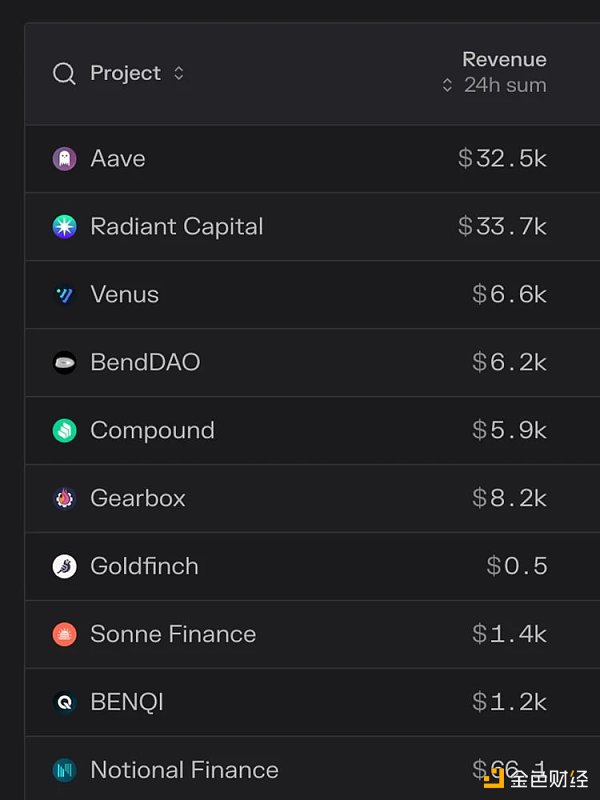

In the 90-day earnings, Radiant has surpassed Aave, Compound, and even Solana. From the 90-day trend, they are one of the fastest growing protocols in the field.

Valuation

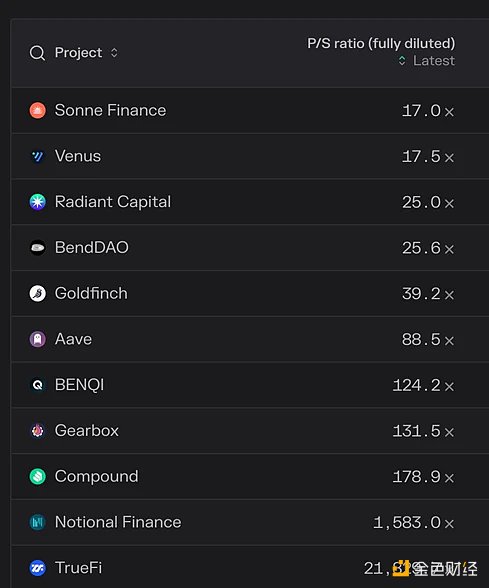

Radiant’s trading valuation is not high, but its P/E ratio is consistent with other blue-chip projects.

Community Involvement

The community is very active. DAO governance proposals average over 2,000 votes, with a third of token holders registered on Snapshot.

In the past few weeks, over 10 million USD worth of dLP has been unlocked. When comparing the total dLP tokens (locked and unlocked) on May 31 with the total tokens on May 10, the USD total value of dLP has increased by about 5.2 million USD. This means that Radiant is still attracting new locking users even when unlocked.

In the two weeks following the implementation of RFP-17 and RFP-18, 71% of locking users chose to lock for 6 months or 1 year. In contrast, only 40% of users chose this term last month.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Application of Traditional Corporate Finance Theory in the DAO Field

- Latest developments in SEC’s “Operation Thunder”: Coinbase refuses to take down tokens and services, while Binance retaliates by actively seeking Gensler’s advice as a consultant.

- Four narrative shifts in the Ethereum ecosystem’s cycles

- Understanding Binance’s Decentralized Global Operating Model from SEC Lawsuit Documents

- 5 Misconceptions About the Metaverse

- Attacker’s liquidation price for BNB bridged to Venus Protocol is around $220. Venus governance proposal: Frozen, cannot be liquidated.

- Exchange sued by SEC: Future regulation in the US will be more transparent