Inventory of Potential Early LSDFi Projects

LSDFi Projects InventoryPreface:

The LSD track has been repeatedly hyped and the market has a high degree of understanding and corresponding attention to the track. The certainty of the future development of the LSD track is beyond doubt, but the mainstream targets face weak marginal changes, and high certainty makes the market almost no effective expectation difference to provide high odds trading opportunities. At this time, due to the continuous expansion of the underlying LST’s asset size, the new LSDFi protocol constructed on this asset will become the alpha of the entire LSD track.

Main text:

The LSDFi protocol introduced in this article is mainly concentrated in two categories. The first category is a protocol that uses LST as collateral to mint USD stablecoins through CDP, and the second category is a protocol that uses LST as collateral to mint WrapETH through CDP. The reason for focusing on these two types of products is that: as the ETH collateralization rate continues to increase and the scale of ETH continues to decrease, the scale of LST continues to expand; based on the point of improving the efficiency of fund utilization, the market demand for lending protocols with LST as collateral will inevitably continue to expand, especially when the market rebounds and the risk appetite for funds increases.

- Beginner’s Guide to Sudoswap: Tutorial and Related Skills

- World Engine: Introducing game sharding, a high-performance end-to-end game platform

- Synthetix launches alpha version of V3 spot market, here’s a quick overview of its main features and functionalities

Lending protocols are usually divided into two types. One is the model of deposit and loan (such as AAVE and Compound), but this model requires users to deposit funds on the funding side. The network effects and brand effects that are built on the first-mover advantage have obvious moats, making it difficult for backward protocols to compete with them. At the same time, this model also faces the problem of high lending rates. The other is the model of CDP minting (such as DAI). There is no user fund custody on the funding side of this model. Due to the coin-minting right of the protocol itself, users can enjoy extremely low borrowing rates. The cost of the protocol is transformed from the bilateral interest rate subsidy to the liquidity expenditure of the collateral certificate. This model is more suitable for lending protocols based on LST, a yield-bearing asset, especially for leverage based on interest rate exposure.

Source: LD Capital

The following LSDFi are early-stage projects, and most of the product planning, function implementation, and economic models of the targets need to be continuously tracked.

Category 1: CDP USD stablecoin protocol with LST as collateral

1. Prisma Finance: Curve ecological support, Liquity Fork

Product introduction:

Prisma Finance’s main function is to mint the US dollar stablecoin acUSD with LST assets as collateral, and the first batch of listings support wstETH, cbETH, rETH, sfrxETH and WBETH as collateral. It has received support from a group of Defi OGs including Curve founder, Convex founder, FRAX Finance, Coingecko, OKX Ventures, etc. According to the FRAX [FIP-227] proposal, FRAX Finance has invested $100,000 in Prisma Finance with a valuation of $30 million, and the token distribution will be linearly unlocked within 12 months.

Features:

Like most over-collateralized stablecoin protocols, Prisma Finance’s core need is to improve capital efficiency. Users can mint stablecoins through the CDP method while retaining LST price fluctuations and yield exposure to achieve leverage. In this link, acUSD liquidity is crucial, which is the main protocol cost of the CDP protocol and also the biggest advantage of Prisma Finance.

Economic model:

In terms of token economic model, Prisma Finance introduces the ve model. The veToken will have the governance right to decide the distribution of tokens in different lending pools, protocol fees, pool parameters and LP mining yield, aiming to attract LSD protocol (asset issuer) and LP locking protocol tokens to form interest binding while reducing secondary market selling pressure.

2. Raft: User-friendly, anti-censorship, real-name team, backed by Balancer ecological construction liquidity

Product introduction:

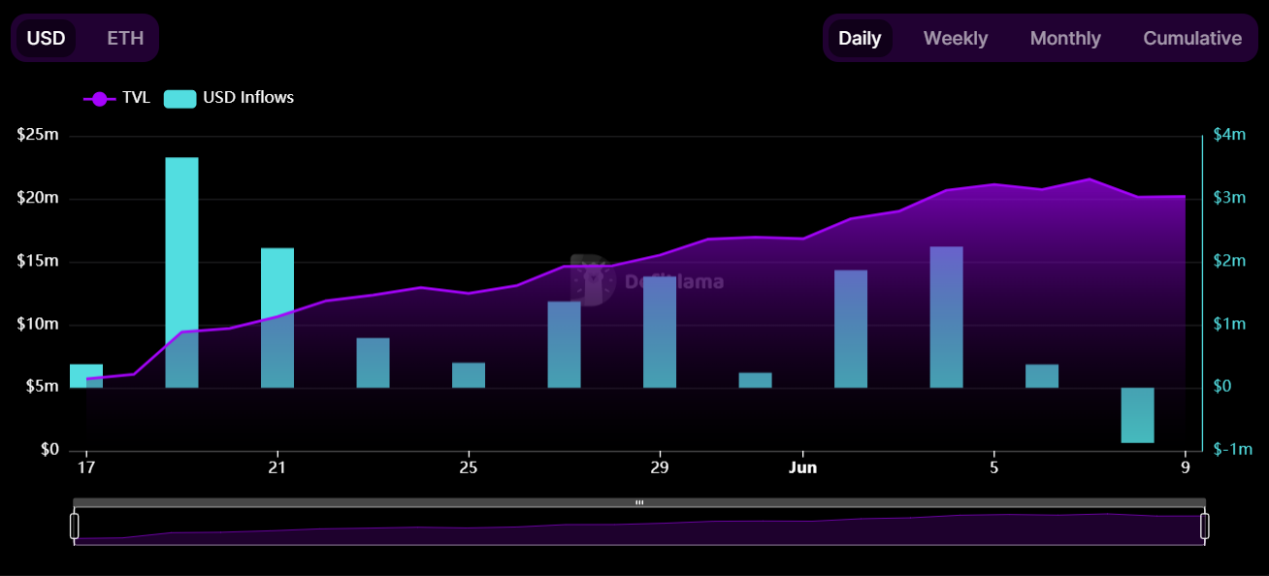

Raft is an immutable, decentralized lending protocol that allows users to borrow US dollar stablecoins R with LST (currently supporting stETH) as collateral; it maintains the protocol’s anti-censorship through immutable smart contracts and decentralized front-end. Raft is incubated by TempusFinance, and the co-founder once worked for the ETH Foundation. The team members have also developed Nostrafinance (the first lending product on StarkNet). Raft has received support from institutions such as Lemniscap, Wintermute, GSR, etc., and the main product functions have been implemented, with a TVL of $30 million (without token incentives) within 3 days of going live.

Source: https://www.raft.fi/, LD Capital

Features:

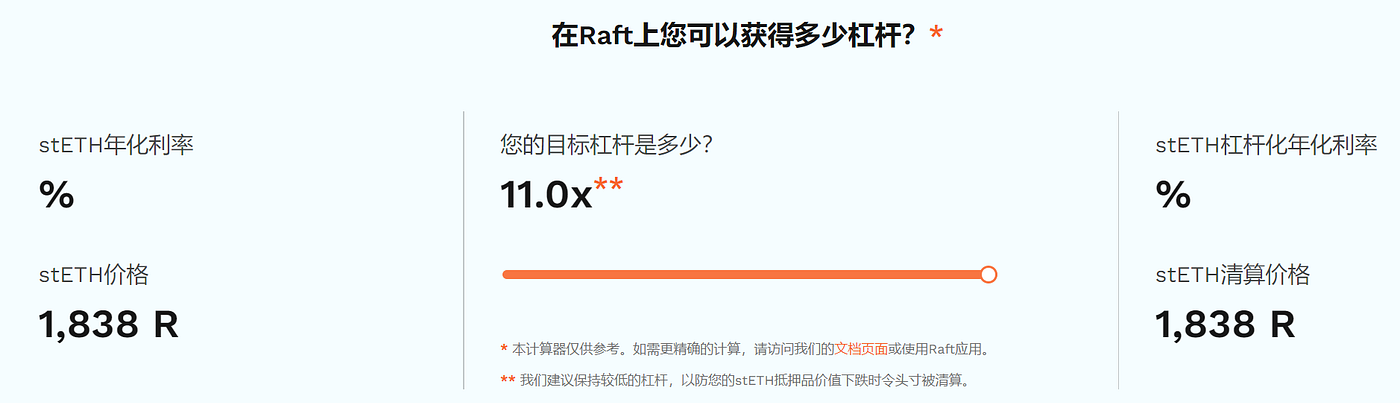

The product features flash exchange and one-step leverage functions: the principle of flash exchange is similar to AAVE’s lightning loan, the difference is that R comes from the protocol minting, and on the basis of flash exchange function, one-step leverage function can be developed, that is, deposit stETH into the protocol, flash exchange R, exchange R for additional stETH, generate R, and repay R flash exchange debt in a few steps completed in a single transaction, which greatly improves user experience and saves transaction gas; users can get up to 11 times leverage.

Source: https://www.raft.fi/, LD Capital

Economic model: undisclosed

3, Gravita Protocol: Liquity Fork, CDP stablecoin protocol with LST as collateral

Product introduction:

Gravita Protocol is the first stablecoin protocol to adopt Liquity fork to support LST assets. It achieved a TVL of $20 million within a month without token incentives. It supports WETH, stETH, rETH and bLUSD as collateral, and its stablecoin GRAI has good liquidity depth in Curve, Bunni and UniV3.

Features:

Compared with Liquity, Gravita not only supports LST assets, but also has lower borrowing interest rates; users need to pay a one-time borrowing fee of 0.5% to borrow in Gravita. If they repay the loan within 6 months, Gravita will refund the borrowing fee according to the loan term. Users will be charged at least 1 week’s borrowing fee.

Source: Defillama, LD Capital

Economic model: undisclosed

4, PSY: 0 borrowing fee, Arbitrum ecology, ve(3,3), Liquity Fork

Product introduction:

PSY supports a variety of LST and its LP tokens as collateral to mint USD stablecoins (SLSD), and its product structure is the same as Liquity, and it will be launched on the Arbitrum chain in the future.

Features:

PSY will provide 0 interest rate borrowing and introduce ve(3,3) token model, specific details need to be continuously tracked.

The second type: CDP WrapETH protocol with LST as collateral

5. ZeroLiquid: 0 borrowing rate, no liquidation, interest automatically repays debt.

Product introduction:

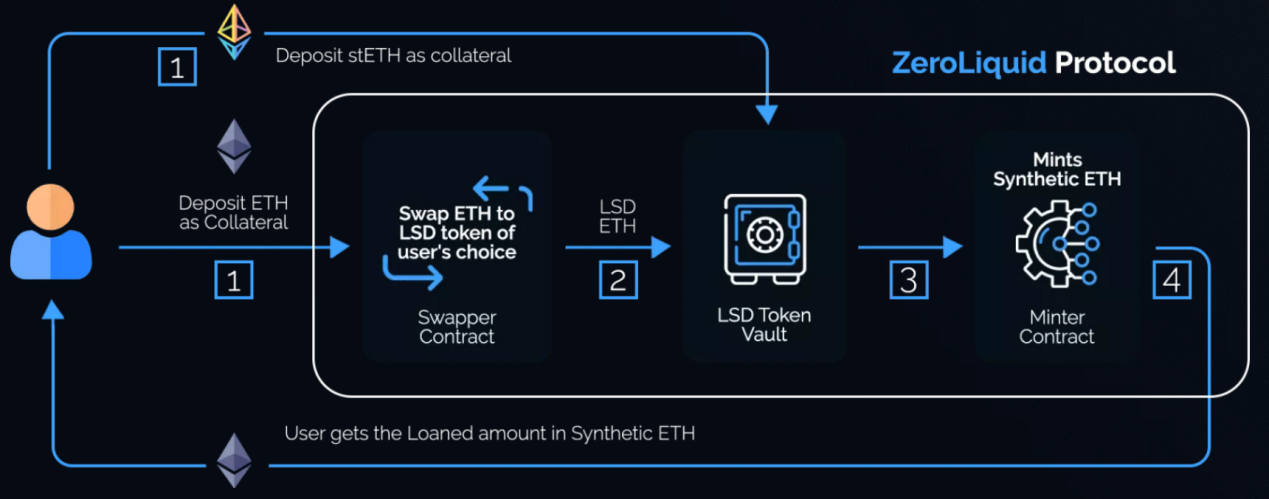

ZeroLiquid is currently in the testnet stage, allowing users to mortgage LST to cast ZETH (when users deposit ETH, ZeroLiquid will convert it to LST, with an initial LTV of 50%). ZETH is a borrowing certificate anchored to the price of ETH, and because it has price fluctuations in the same direction as ETH, ZeroLiquid can achieve no liquidation, hedge price fluctuation risks, and have long ETH collateral rate exposure without considering the risk of underlying LST assets coming from LSD protocol (hacker attacks, massive fund seizures, etc.). ZeroLiquid initially intends to charge a protocol income of 8% of the LST yield, and the subsequent proportion can be adjusted through governance.

Source: zeroliquid.gitbook.io, LD Capital

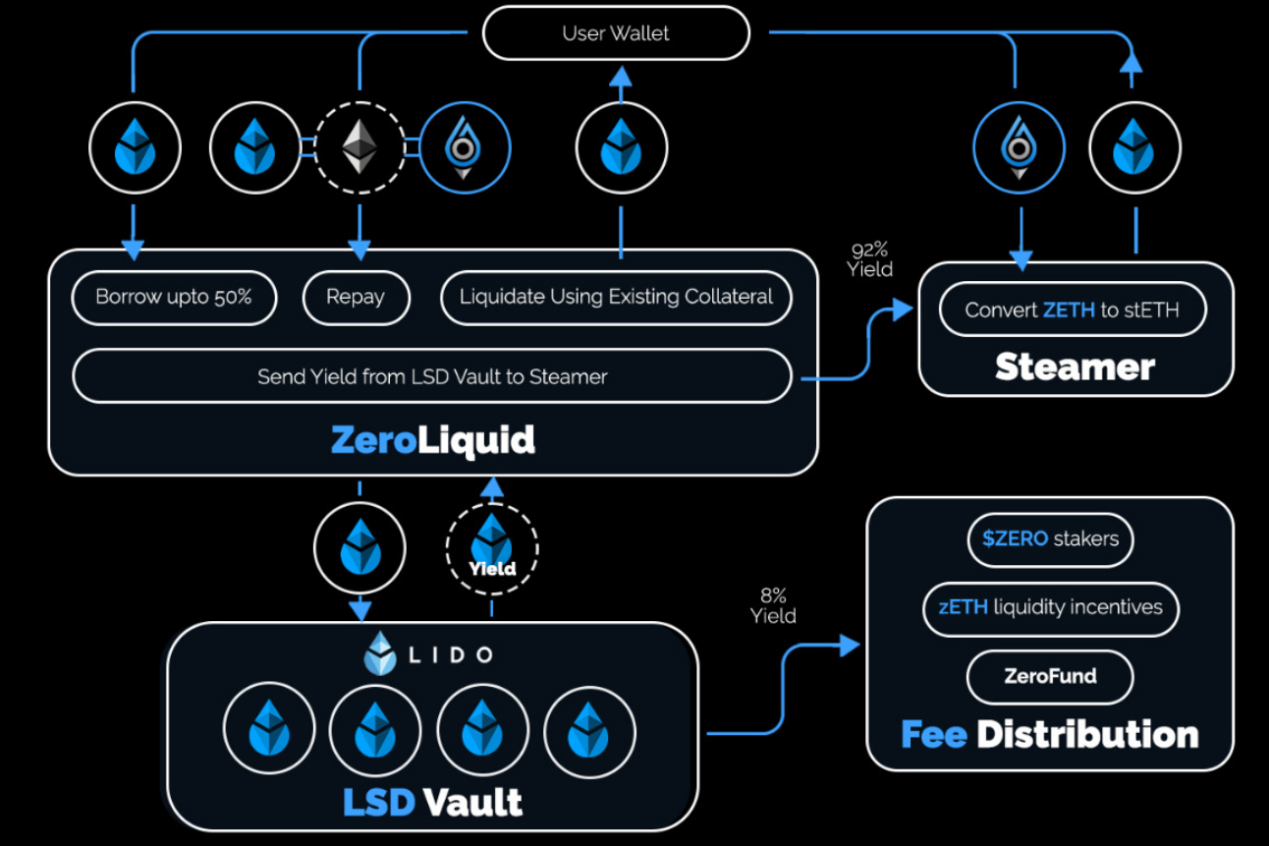

ZeroLiquid’s current problems are its low LTV, relatively high protocol drawdown, and how to anchor ZETH; among them, LTV and protocol drawdown can be adjusted through governance, and the main problem is how to achieve anchoring with ZETH. In ZeroLiquid’s economic model, the cost of liquidity incentives accounts for 20% of the total token amount (relatively low), which requires a good redemption mechanism to maintain the stability of the ZETH/ETH exchange rate.

Currently, ZeroLiquid provides liquidity for secondary market discount arbitrage through the Steamer module. The liquidity of the Steamer module comes from the excess collateral part of user mortgage and the income generated by collateral. This design largely affects the protocol’s LTV, and it remains to be seen if it will be improved in the future.

Source: zeroliquid.gitbook.io, LD Capital

Economic model:

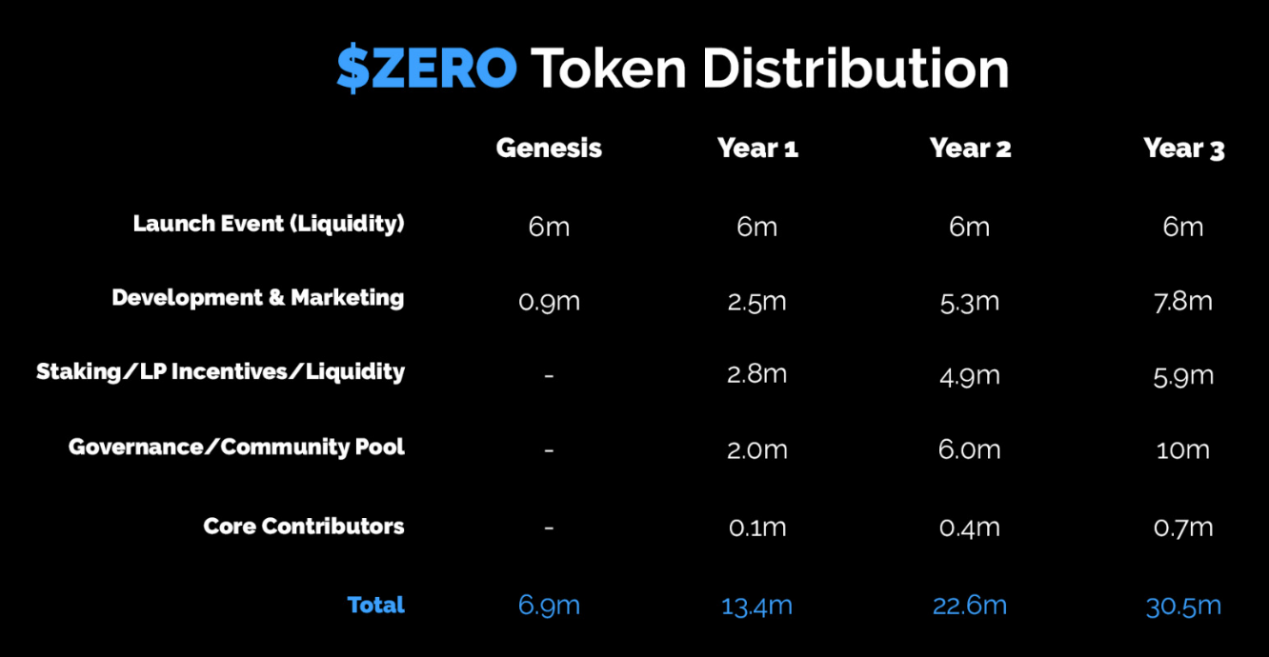

The $ZERO token was launched on Uniswap platform on March 19th in the form of self-raised funds, with a total of 30.5 million tokens (initial total of 100 million tokens, 69.42% of which were destroyed by community proposals), of which 6 million were used to provide initial liquidity, 13.7 million belonged to the community, 1 million belonged to the national treasury, and 700,000 belonged to core contributors. Currently, 6.9 million tokens are in circulation in the secondary market, and the rest will gradually belong in 3 months to 3 years. $ZERO has dividend rights while enjoying governance rights, and single-token staking can capture protocol income.

Source: zeroliquid.gitbook.io, LD Capital

6. Ion Protocol: 0% borrowing interest rate, supports EigenLayer re-staking certificates

Product introduction:

Ion Protocol supports multiple collateral types, including LSTs, LST LP Positions, Staked LST LP Positions, EigenLayer Validator/LST/LST LP Restaking Positions, and LST Index Products. At the same time, Ion Protocol plans to customize the risk models of this agreement for the inherent risk-reward structures of different collateral types, and guide users to deposit by adjusting the LTV or borrowing interest rate of different collateral types, while ensuring that allETH is over-collateralized and anchored to the greatest extent possible to improve fund efficiency.

Source: ionprotocol.medium, LD Capital

Economic model: Not published

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the Value of StarkNet Ecosystem: Representative Projects, Development Prospects, and Limitations

- AI+Web3 Race Research Report: Following the Trend and Narrative Dominance

- Inventory of Polychain Capital investment projects: Quasar, nil, SBlockingCE ID…

- Optimism has completed the Bedrock mainnet upgrade, and its native token OP has increased by over 10%.

- With no pre-mining and a fair launch, how did the FairERC20 protocol become so popular overnight?

- Deep Analysis of the Past, Present, and Future of Full On-chain Games

- New Project Preview | Interpreting Convergence: A Governance Aggregation and Profit Redistribution Layer Similar to Convex.