Is cryptocurrency the biggest scam in history? A decade-long history of love and hate between enthusiasts and critics

Is cryptocurrency a historic scam? The love-hate relationship between enthusiasts and critics over the past decade.Original Author: Ignas, DeFi Research

Translated by: Baze Research Institute

“After in-depth research on cryptocurrencies, anyone with understanding can come to one conclusion – it needs to be completely destroyed because it is a huge scam.”

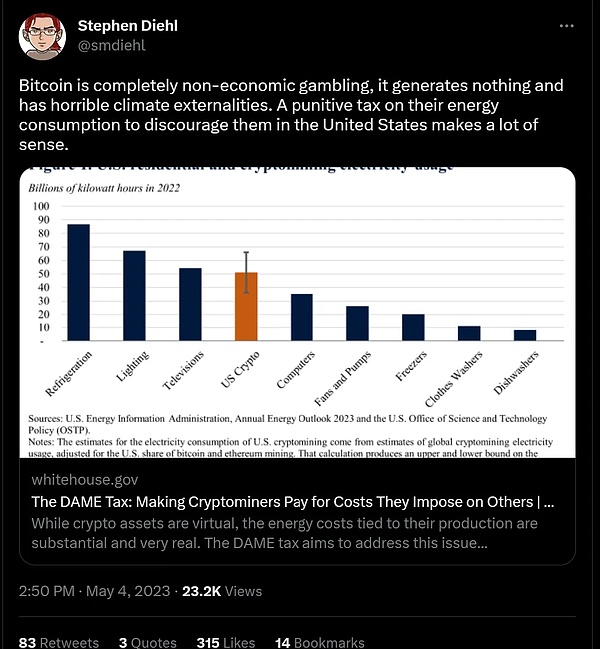

— Stephen Diel, cryptocurrency commentator with 60,000 followers on Twitter

- Evolution of the Web3 Community: The Decline of PFP Community and the New Dawn of NFT

- Web3 Gaming New Infrastructure: Listening to Thunder in Silence

- Who will win in this LSDfi war?

As cryptocurrency enthusiasts, we often only see the positive side of cryptocurrency on Twitter, and to be honest, most cryptocurrencies currently are financial tokens, which also attracts scammers.

Therefore, the sad fact is that many people do not like cryptocurrencies like we do. On the contrary, they believe that “cryptocurrency is a scam.”

There are many reasons for this, in this article, I decided to explore different critical viewpoints and try to understand why some people call cryptocurrencies (and DeFi) the biggest scam ever.

Cryptocurrency: Changing the World Monetary Order<>The Biggest Scam in the World

With the development of cryptocurrencies, criticism has also increased. I believe that we, cryptocurrency enthusiasts, are currently in the minority.

Molly White is a famous cryptocurrency critic who founded a website with an ironic name, “Web3 is going great,” which records catastrophic events in the fields of cryptocurrencies, DeFi, and NFTs.

This proves people’s growing skepticism about cryptocurrencies.

But what really prompted me to write this article was a video made by James Jani called “Cryptocurrency: The Biggest Scam in the World,” which covers all the critical points of cryptocurrency.

The video has been viewed 2.9 million times on Youtube and was even named “Best Video of 2023” by my favorite top tech blogger, Marques Brownlee.

However, it all started with criticism of Bitcoin.

Bitcoin: Revolutionary Digital Currency <> Failed Currency

Bitcoin emerged during the 2008 financial crisis and is a digital currency that is not controlled by governments or institutions. At that time, it attracted a small group of early adopters who did not trust the traditional financial system.

However, Bitcoin’s value quickly attracted well-known investors, transforming its use from a global trading currency to speculation. For example, well-known investors, the Winklevoss twins, have been hoarding Bitcoin since the early days and by 2013 they owned about 1% of the total circulation.

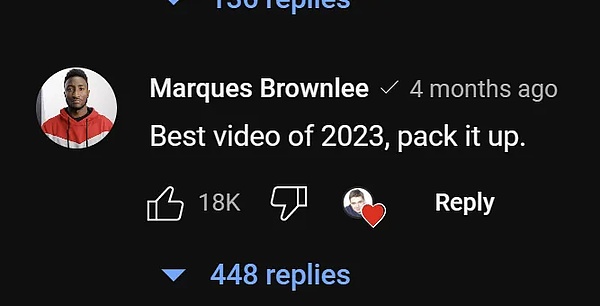

In fact, 34.4% of the BTC supply is held by whales (entities with more than 1000 BTC). However, this concentration has been slowly decreasing and the number of small wallets holding small amounts of BTC is increasing.

Despite this, the purpose of this article is not to refute all criticism, but to listen to and understand the opinions of critics.

Professor Nouriel Roubini, who is known for predicting the 2008 US subprime crisis and the subsequent global financial crisis, criticized the Bitcoin ecosystem as completely corrupt, consisting of seven Cs: Concealed, Corrupt, Crooks, Criminals, Con men, Carnival barkers, and Cult.

Bitcoin critics believe that Bitcoin’s design has serious flaws. Its deflationary nature comes from its fixed total amount of 21 million, which encourages hoarding instead of trading, thereby weakening its function as a global currency.

In addition, Bitcoin’s technical limitations are becoming increasingly clear. It can only process seven transactions per second, which is very slow compared to traditional payment networks such as Visa and Mastercard, which can process thousands of transactions per second.

Bitcoin is also quite expensive to use, especially when the BRC-20 frenzy clogs the blockchain.

Also problematic is Bitcoin’s energy-intensive proof-of-work (PoW) consensus model. Critics argue that this model has sparked a race to build more powerful mining equipment to mine more Bitcoin, resulting in a large amount of energy consumption without an increase in transaction rates.

Ultimately, Bitcoin as a global currency will fail. Critics are very consistent about this argument.

Other prominent critics:

-

Nobel economics laureate Paul Krugman believes that Bitcoin is useless, inefficient, and largely a Ponzi scheme. – “The Bitcoin community attracts investors by combining technology with liberalism, making use of partial cash flow to drive up prices, which brings in more investors.”

-

Warren Buffett believes that Bitcoin is “rat poison squared” and says it won’t produce anything.

-

Gary Gensler, chairman of the US Securities and Exchange Commission, says that all cryptocurrencies are “peddlers, fraudsters, and scammers”.

Despite this, Bitcoin has survived for 14 years and has become the most significant investment asset that can be traded on centralized exchanges.

However, critics believe that this is one of the reasons why Bitcoin’s creator, Satoshi Nakamoto, suddenly disappeared – leaving behind an invention that is far from its original purpose.

Ethereum: the blockchain 2.0 revolution leads to a wave of scams

Debate still rages over Ethereum, a blockchain that allows for programming of smart contracts and led me (and likely you) to believe that it would provide revolutionary use cases in the crypto world.

However, ironically, Ethereum’s first major use case was to create more cryptographic tokens, leading to the era of the first token issuance (1C0) frenzy.

Companies began creating their own tokens, releasing white papers explaining their project goals, and then selling these tokens to the public. Some tokens were imitations, and some were outright scams, but this did not stop people from investing, hoping to sell them at a profit when the token value went up.

For example, “Jesus Coin” aims to advocate for the decentralization of Jesus’ power and hopes to become the currency adopted by all Christians.

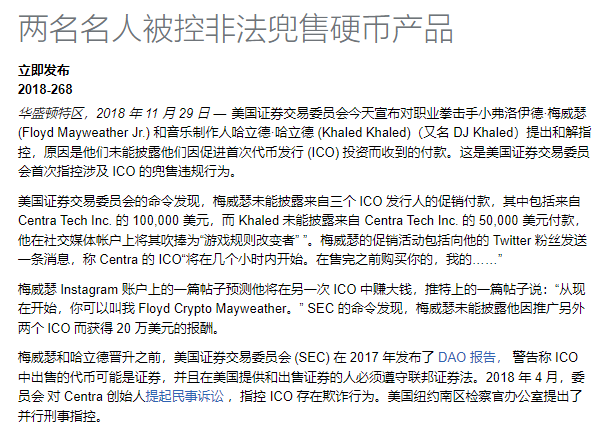

The 1CO frenzy also brought together influential celebrities from the crypto and real worlds. Celebrities such as Floyd Mayweather and DJ Khaled promoted Centra Tech tokens to receive rewards, but the project was later proven to be a scam.

Even though the CEO wasn’t even a real person, they managed to raise $32 million.

Despite the increase in fraudulent activities, cryptocurrency enthusiasts continue to look for potential new use cases to prove that the value of cryptocurrency will continue to increase.

This is where NFTs come in.

NFT: A new era of digital art <> A new era of fraud

NFTs are generally seen as a new way for digital artists to monetize their work on the blockchain. In theory, ownership of art can be verified through the blockchain.

The most famous example is digital artist Michael Winkelmann (aka Beeple), who sold collages of his first 5,000 daily works of art as NFTs, titled “Everydays: The First 5000 Days,” for $69.3 million. This auction was one of the largest in the history of digital art.

However, you may not have heard of this part:

The buyer of the art NFT was Vignesh Sundaresan, a cryptocurrency entrepreneur who previously co-founded a cryptocurrency investment company called Metapurse with Beeple.

Before spending $69.3 million on the NFT, Metapurse had already spent over $2.2 million buying more of Beeple’s NFTs. Then, Metapurse bundled Beeple’s NFTs together, put them in a virtual museum, and issued a token called B20, holding which represents owning a part of the virtual museum.

Critics argue that the $69.3 million sky-high transaction was primarily a marketing gimmick to boost the value of B20 tokens and manipulate the market.

Indeed, the price of B20 has now dropped by 99.66%, and Metapurse’s Twitter account is silent.

The NFT market has also been criticized for being highly speculative, with most NFTs essentially just a set of data on the blockchain containing image links that anyone else can access.

Critics argue that this is not true ownership, and that NFTs are primarily used for speculation, driving more funds into the cryptocurrency market.

David Gerard summarized the fraud of NFTs in his book “Why Cryptocurrencies Are No Good”:

-

Tell artists they can make a lot of money

-

Tell artists they need to hold cryptocurrency as a fee to make money

-

There are indeed some artists who have made money through NFTs

-

But you may not be the one who makes money

DeFi: Revolutionizing Traditional Finance <> Decentralized “Mirage”

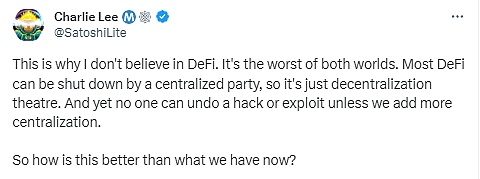

In 2020, DeFi Summer arrived, and the DeFi field achieved significant growth, but it has been criticized by many for its lack of true decentralization and vulnerability. Critics include Charlie Lee, the founder of Litecoin LTC, and the Bank for International Settlements (BIS), among others.

DeFi Paradox

I remember in 2020, Lee tweeted that he didn’t believe in DeFi. Lee pointed out that DeFi lacks true decentralization, which is the basic principle of blockchain, and that more centralization is needed to solve the frequent hacker attacks in the DeFi field.

In fact, DeFi did face some technical limitations in 2020-2021, which made the gap between vision and reality more and more apparent:

-

DeFi faces the problem of high gas fees, which reduces its attractiveness to low-capital users

-

The level of De (decentralization) of DeFi is increasingly questionable, as in all protocols, the team is in centralized control of development and updates

-

More importantly, DeFi protocols and their governance are dominated by a few wealthy “whales,” most of whom are protocol founders

-

Everything is over-margined, increasing the cost of funding opportunities

-

In trading, leverage, and synthetic assets, DeFi lags far behind the centralized platforms it seeks to replace

-

The immutability of the blockchain means that errors in user interaction with DeFi protocols are irreversible and costly.

In the three years since DeFi’s inception, many new protocols have attempted to address these issues.

Interestingly, DeFi, which was initially founded with the mission of “banking the unbanked,” now seems to prioritize pursuing higher yields rather than its original purpose.

The fantasy of decentralization

The international financial institution BIS, which serves central banks around the world, also questioned the level of decentralization in DeFi in its quarterly report for 2021.

The organization believes that complete decentralization in DeFi is a fantasy:

-

Due to the inevitable need for centralized governance and the trend of blockchain consensus mechanism centralization, DeFi has a “fantasy of decentralization”

-

DeFi’s inherent governance structure is a natural entry point for public policy (as evidenced by the fact that multiple DAOs have been sued)

-

Due to high leverage, liquidity mismatches, inherent interconnectedness, and lack of resilience, DeFi is extremely fragile.

BIS believes that these three aspects make the DeFi ecosystem particularly vulnerable to the impact of financial instability.

Leverage in DeFi: A Double-Edged Sword

Although most DeFi advocates excess collateralization, the use of leverage by DeFi users has raised concerns. (Funds borrowed in a DeFi transaction can be reused as collateral in other transactions)

This allows investors to build increasingly large exposures on a certain amount of collateral, which can lead to significant losses during bear markets or periods of market weakness, even though it may be advantageous during bull markets.

“Cryptocurrency is a cult”

In addition, the cryptocurrency community culture is often compared to a “cult,” with different factions such as Bitcoin maximalists and Ethereum enthusiasts promoting their different visions.

Bloomberg’s article “The Story of the Cryptocurrency Winter” describes how the cryptocurrency community maintained its enthusiasm during bear markets.

Cryptocurrency researcher Molly White describes the cryptocurrency community as “predatory,” and the Fame Lady Squad NFT, which is hailed as a “female-led project,” is actually created by three white men.

Jemima Kelly, a columnist for the Financial Times, has repeatedly referred to cryptocurrencies as a “cult”:

Everything in the cryptocurrency community is full of optimism, keeping you in a frenzy.

You are certainly familiar with popular phrases such as “Hodl” and “Wagmi” (encouraging cryptocurrency holders to continue holding tokens no matter what storms they face), which sound a bit strange to outsiders.

Some holders reassure other holders that they have not missed the opportunity to get rich by saying “we are still early.”

Those who still hold tokens even though they have reason to sell them are praised for having “diamond hands.”

In the cryptocurrency community, criticism is often regarded as “FUD” (fear, uncertainty, doubt), or rejected by comments such as “you don’t understand at all.”

Critics are often outright rejected, and they are responded with “enjoying the fun of poverty.”

Scam or not? It depends on the future

Overall, the “anti-crypto movement” has a large number of followers, and cryptocurrency critics are increasing. For example, the Reddit sub-forum Buttcoin has 159,000 members who come together just to celebrate the ultimate failure of cryptocurrencies. Their motto: “Buttcoin-This is a scam, and we are honest about it!”

Interestingly, both cryptocurrency enthusiasts and critics have reached a consensus on issues such as scams, centralization, and pumping and dumping.

Scam or not? The difference lies in the future.

As a supporter of cryptocurrencies, I believe that we can shape a healthier ecosystem and make critics believe that blockchain can indeed bring unique benefits to improving society.

Risk Warning:

According to the “Notice on Further Preventing and Dealing with the Risk of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Please strictly abide by local laws and regulations and do not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the first digital asset “Ponzi scheme” case prosecuted by CFTC

- Amidst the warlord chaos of LSDfi, who will become the “King of Hanzhong”?

- In-depth analysis of the innovation and disruption of Uniswap V4

- Comparing Perp DEX protocol: GMX, Gains, dYdX…

- SatScribe: Game rule changer for rare sat hunting

- Messari: Uniswap V4, the moment for the platform of crypto applications

- Circle restarts buying US treasury bonds as USDC reserve assets