Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

BRC-20 brings Bitcoin into the "smart era" with both opportunity and risk.Original authors: @Jesse_meta, SUSS NiFT, SUSS NiFT Security Alliance, Global Fintech Academy, Biteye builder, Chartered Fintech Professional; @EatonAshton2, Beosin security researcher, 0xCUHK, 0xCUHKSZ member

Bitcoin’s value will return in 2023, leading the world’s risk assets. Meanwhile, MEME coins in the digital currency asset class have exploded in value by hundreds or thousands of times, triggering FOMO sentiment in the market. The most attention-grabbing and hotly debated MEME coin is the BRC-20 token based on the Bitcoin network. In this article, we will introduce the development process of BRC-20, objectively analyze its value and risks, and provide readers interested in BRC-20 with a comprehensive understanding of this new type of token.

1. BRC-20’s predecessor: Ordinals protocol

Before the Ordinals protocol appeared, experiments with non-fungible tokens (NFTs) on the Bitcoin network had a history. As early as 2012, an asset called “Colored Coins” appeared on the Bitcoin network, representing all types of non-Bitcoin assets on the Bitcoin network. In 2014, the appearance of Bitcoin derivatives CounterBlockingrty provided users with a platform to create and trade digital assets. In 2016, “Rare Pepes” inspired by Pepe memes NFT was born on CounterBlockingrty. Although Bitcoin NFTs were born earlier than Ethereum, those who mention Colored Coins and CounterBlockingrty are now very rare due to market choices. Bitcoin as a store of value and Ethereum’s development of an innovative ecosystem has become a consensus.

However, this trend has changed this year. The Ordinals protocol created by Bitcoin core contributor Casey Rodarmor proposes new concepts of ordinals and inscriptions, injecting new vitality into the Bitcoin NFT ecosystem.

- Reflections on the .sats domain: Current development status and value analysis

- News Weekly | Hong Kong’s “Guideline on Virtual Asset Trading Platform Operators” will take effect on June 1, 2023.

- Glassnode Data Research: A Review of the “Crazy Week” of Bitcoin Scripting Outbreak

1.1 Ordinals

Ordinals refers to a numbering scheme that assigns a number to each Satoshi in the Bitcoin network according to the mining order. A Satoshi is the smallest measurable unit of Bitcoin, abbreviated as sat, named after Satoshi Nakamoto, the founder of Bitcoin, representing one hundred millionth of a cryptocurrency.

In the Ordinals protocol, regardless of how sat is transferred between different wallets, its ordinal identifier remains unchanged. A Bitcoin full node running Rodarmor’s open source software ORD can track these numbered satoshis. This provides us with a mechanism to accurately track and independently verify each satoshi.

1.2 Inscriptions

Another key concept in the Ordinals protocol is Inscriptions. Inscriptions create native digital collectibles on the Bitcoin network by engraving information on a sat. This concept was made possible by two important soft fork upgrades to Bitcoin in recent years: SegWit and Taproot.

SegWit introduced the concept of witness data, which removes a portion of information (the witness data) from transactions, reducing their size in the block. This means that a block can contain more transactions, indirectly increasing the processing capacity of the network. Although in theory, SegWit-upgraded blocks can reach 4MB, this requires all transactions to be SegWit transactions and have a specific form, so actual block sizes are usually around 2MB.

The Taproot upgrade encodes all possible payment conditions (e.g. multi-signature, time locks, etc.) into a single public key, making the data requirements for all transactions the same, improving privacy and efficiency. Taproot improves on the SegWit upgrade by eliminating the size limit of witness data. By using Taproot scripts in witness data, inscriptions up to 4MB in size can be stored.

By combining SegWit and Taproot, the Ordinals protocol can engrave a file, i.e. an inscription, smaller than 4MB on each sat on the Bitcoin block. Inscriptions can contain various forms of information such as text, images, videos, etc.

In short, the ordinal numbering scheme provides each sat with a unique, traceable number, giving sats the characteristics of non-fungible tokens. Inscriptions can add indivisible data information to the ordinal, similar to creating art on a blank piece of paper. Combining the two, Bitcoin has a new NFT standard, opening up the imagination for creating BTC-native NFTs.

Ordinals can be used without making changes to the underlying Bitcoin layer, without the need for Bitcoin Layer 2 or side chains. Well-known BTC NFT collections include Bitcoin Frogs, DogePunks, Bitcoin Punks, TwelveFold, BTC DeGods, Taproot Wizards, Ordinal Punks, Bitcoin Rocks, and more. These inscriptions are highly sought after in the market, with individual collectibles trading for tens of thousands of dollars. Currently, trading is mainly concentrated in Magic Eden, and Binance and OKX plan to support Ordinal NFT trading at the end of May or early June.

In addition, Ordinals also gives these sats a degree of rarity, similar to banknotes with integer sequences or special sequence numbers (such as 000001 or 999999). Based on specific events that occur in the Bitcoin network, sats are divided into the following levels:

Ordinary: not the first Satoshi of a block;

Uncommon: the first Satoshi of each block;

Rare: the first Satoshi of each difficulty adjustment period;

Epic: the first Satoshi of each halving period;

Legendary: the first Satoshi of each cycle;

Mythical: the first Satoshi of the genesis block.

2.Opportunities of BRC-20

Since the Ordinals protocol can create Bitcoin NFTs by assigning different “attributes” to each Satoshi, it can also create Bitcoin FTs, that is, homogeneous tokens, by giving a unified “format” and “attributes”. Inspired by the Ordinals protocol, Twitter user @domodata created the experimental and replaceable token standard BRC-20 on March 8, 2023, using the ordinal inscription of JSON data to deploy token contracts, mint and transfer tokens.

Although the name is similar to the ERC-20 token, BRC-20 cannot be programmed to achieve more applications. BRC-20 deploys token contracts, mints and transfers tokens by writing a piece of JavaScript Object Notation (JSON) text into Bitcoin NFTs through the Ordinals protocol. The key to the deployment of BRC-20 is the token name, total supply, and maximum single minting amount. For transfer or buy/sell transactions, additional NFTs are engraved to track off-chain balances.

The BRC20 implements a “first come, first served” mechanism. After deploying a BRC20 token, you cannot deploy a token with the same name again. Even if a token with the same name is deployed, since the off-chain accounting platform has recorded the previously deployed tokens with the same name during the parsing process, it will consider the second deployment illegal and will not record it.

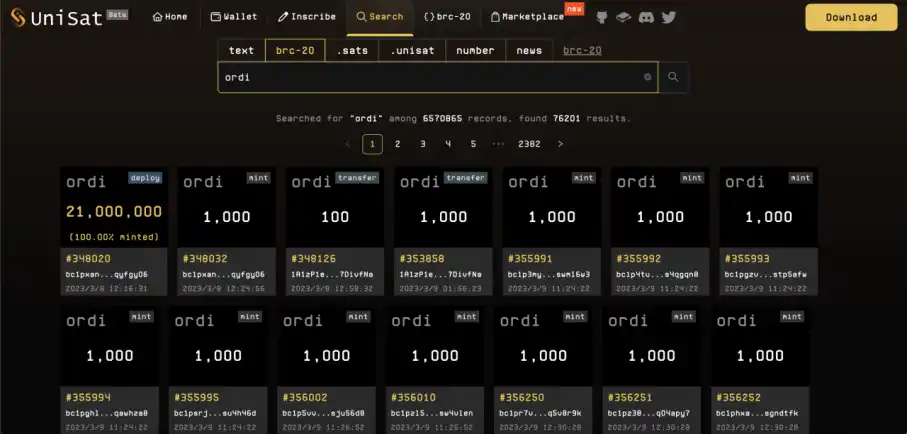

Domodata deployed the first BRC-20 token Ordi, with a total of 21,000,000 tokens and a maximum minting limit of 1,000 tokens per time, which was minted within 18 hours.

2.1 BRC-20 Development Status

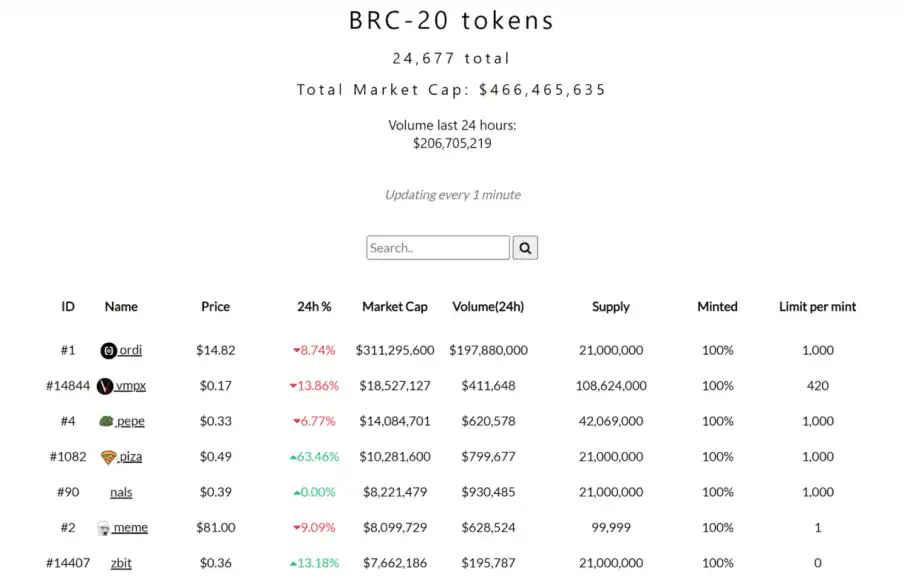

Although demodata classifies BRC-20 as an interesting social experiment and opposes speculators making financial decisions based on its design, cryptocurrency experiments usually have their own life cycle, and BRC-20 is no exception. The funds of the Meme coin craze began to pour into the Bitcoin ecosystem in the past month, and the minting and trading activities of BRC-20 are booming. As of May 18, 2023, there are 24,677 BRC-20 tokens with a total market value of 466 million USD. Ordi has the highest market value, accounting for 66.7% of the total market value of BRC-20.

Source: brc-20.io

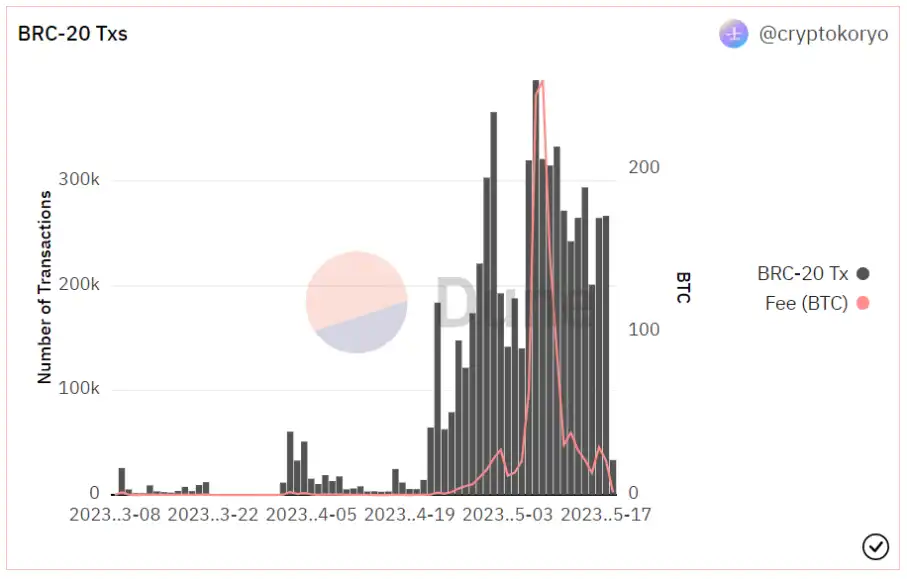

Due to the low minting cost of the Ordi token, it has become a myth of a thousand-fold return, attracting widespread attention from the market. In addition, the relatively imperfect Bitcoin ecological infrastructure has a certain learning curve, and the low liquidity makes BRC-20 tokens easy to rise. The wealth effect has attracted savvy market players to enter the BRC-20 market. As shown in the figure below, when BRC-20 was released on March 9th, there were 25,717 transactions, and then there was a period of silence at the end of March. The activity reached a small peak at the beginning of April, with a maximum of 60,516 transactions. Mid-April experienced a period of underestimation, with less than 10,000 transactions per day. After the end of April, more and more people began to understand and recognize BRC-20, and the activity continued to surge. On May 7th, there were a record-high 396,763 transactions in a single day. Although the number of transactions has fallen recently, there is still significant activity compared to April, and most of the daily transactions in May are above 200,000.

Source: https://dune.com/cryptokoryo/brc202.2 The impact of BRC-20 on the BTC ecosystem

- 2.2.1 Active on-chain activities increase the income of miners

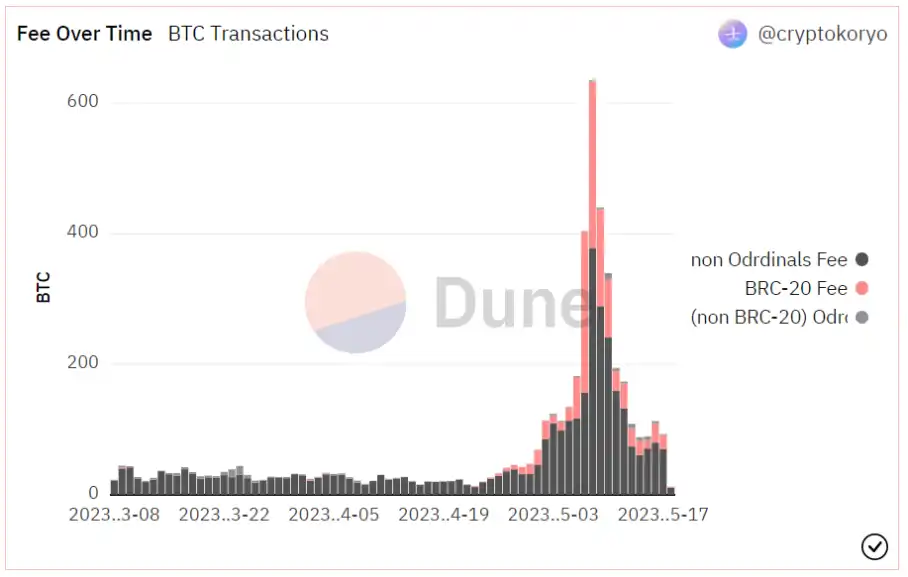

The halving event of Bitcoin that occurs once every four years reduces the return on Bitcoin mining by half. After 21 million bitcoins are mined, miners can only obtain income from transaction fees. If this part of the income cannot cover the mining cost, miners will shut down and exit the market, and the security of Bitcoin will be greatly reduced. The activity of BRC-20 brings more income from transaction fees to Bitcoin miners, incentivizing them to continue mining and guarding the Bitcoin network. As shown in the figure below, the transaction demand from Ordinals (including BRC-20 and non-BRC-20) has brought considerable income to miners. On May 7th, it even exceeded the normal Bitcoin transfer fees. On May 8th, miners earned $17.4 million in transaction fees, making it the third-highest fee-generating day in Bitcoin’s history. In addition to the extra income from Ordinals, normal transfer transactions from non-Ordinals also paid more fees to miners because they had to compete for block space. It is worth noting that whether the BRC-20 promoted surge in Bitcoin transaction fees is sustained remains to be seen, which also raises concerns about the accessibility of the Bitcoin blockchain.

Source: https://dune.com/cryptokoryo/brc20

- 2.2.2 Higher transaction fees reduce Bitcoin accessibility

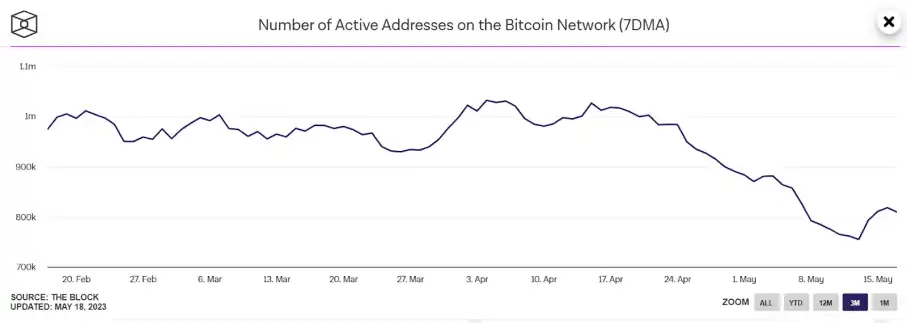

The original intention of Bitcoin was to provide a decentralized peer-to-peer transfer solution, which is currently its main use case. Bitcoin is a popular financial solution in areas without banks or with insecure or inefficient banks. However, if transaction costs rise, existing and potential users may choose to abandon or temporarily suspend the use of Bitcoin. According to data from Block, the average number of active addresses on the Bitcoin network has actually decreased after the BRC-20 token became active in late April.

- 2.2.3 Congestion and bloated block space lead to intense community discussions

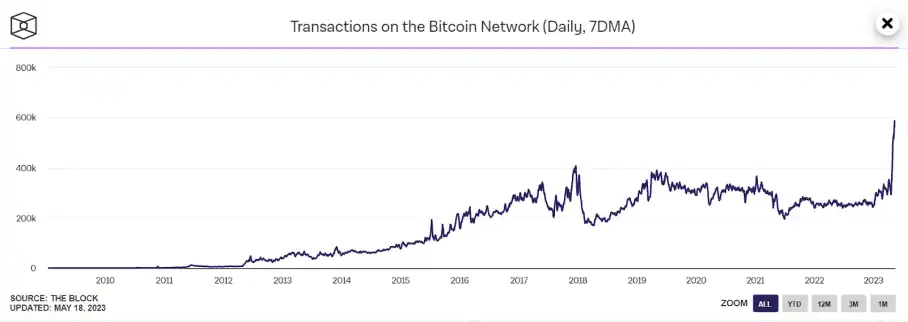

According to Kunal Goel’s report, Bitcoin’s blocks became congested during the peak periods of the bull market in 2017, the revival in 2019, and the first bull market in 2021 due to an increase in BTC transactions, and Bitcoin’s price would soon collapse. Some investors judged it to be a speculative bubble. The following graph shows that the daily transaction volume on the Bitcoin chain has surged recently, according to the 7-day moving average of on-chain transactions. On May 12, it reached a historical high of 587,100 transactions. Although Bitcoin has been congested again, it is due to the activity of BRC-20 tokens, and the market story has changed.

Source: https://www.theblock.co/data/on-chain-metrics/bitcoin/transactions-on-the-bitcoin-network-daily

Since BRC-20 activity occurs on the Bitcoin network, it means that it also occupies block space, causing delays in normal Bitcoin transfers. In addition, according to data from Glassnode, in the weeks following the launch of Ordinals, the upper limit of the average block size of Bitcoin increased from 1.5-2.0 MB to 3.0-3.5 MB. Congestion and bloated block space have led to intense discussions in the Bitcoin community.

On May 8th, Ali Sherief, a Bitcoin core developer, initiated an email discussion, stating that BRC-20 is almost worthless, and the harmony of Bitcoin transactions has been disrupted, and developers should consider taking action.

Aleksandr proposed two solutions, one is to limit non-standard transactions to a maximum of 10% of block capacity, and the other is to change the structure to make Ordinals transaction fees more expensive and promote it to the Lightning Network.

Li Qingfei, Chief Marketing Officer of F2Pool, believes that “Ordinals is a beneficial exploration of Bitcoin applications and helps release greater value in the Bitcoin network.”

In my opinion, the reason why Bitcoin is popular today is because of its inclusive, free, permissionless, and anti-censorship characteristics. We should not try to censor transactions, and it is not acceptable for centralized referees to define the validity of transactions.

2.3 The Potential Opportunities and Application Value of BRC-20

- 2.3.1 Will ORDI be the first MEME coin in the MEME BTC ecosystem to explode?

MEME coins are an important part of the cryptocurrency ecosystem, and BTC is a social experiment that started with free distribution. As banks repeatedly prove that they cannot help people manage their money and constantly shrink personal wealth through currency creating credit bubbles, more and more people recognize the value of Bitcoin and use it to store assets. According to the network effect, as the number of participants in the system increases, the value and utilization of the underlying network and its services increase. This supports the value of Bitcoin, which is now the world’s 12th largest asset after Tesla.

Bitcoin is not the only successful MEME. The birth of DOGE came from a joke, and it quickly developed into a large and passionate cryptocurrency community, supporting some great causes and charities. After multiple rounds of bull and bear markets, today’s DOGE is the third largest payment token in terms of market capitalization except BTC and XRP, ranking among the top ten.

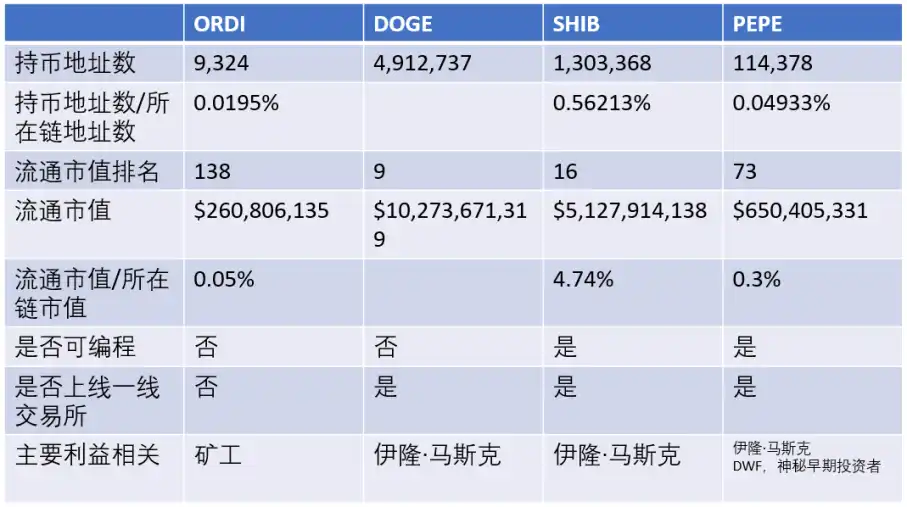

Data source: Chaineye, Coingecko, Ethscan, Blockchair, produced on May 18, 2023: SUSS NiFT, Beosin

Although there has been a significant increase in a short period of time, the entire BRC-20 market currently has a market value of only $589,003,867, lower than the market value of a MEME coin PEPE in the ETH ecosystem. As shown in the figure above, the number of holding addresses for the BRC-20 leader ORDI is much lower than that of other MEME coins, indicating that the number of participants is still small and it is still in the early stage. According to the number of holding addresses/chain addresses, it can be seen that ORDI is more evenly distributed in the MEME coin market, with less risk of being impacted by whale selling, but it also lacks a strong manipulator. According to the circulating market value/chain market value, SHIB is 4.74%, PEPE is 0.3%, and ORDI is only 0.05%. There are multiple MEME coins in the ETH ecosystem, and they are in full bloom. However, as the only MEME coin based on the largest MEME coin BTC, ORDI may enjoy a higher premium, although its current market value ranking is still outside the top 100.

The current low market value of BRC-20 is partly due to its short existence. DOGE and SHIB both had amazing price performance after a period of community construction. Another reason is that the infrastructure of BRC-20 is less developed. Bitcoin currently has 47,606,484 addresses, while Ethereum has 231,862,278 addresses. Bitcoin has long been only used for storage and transfer functions, while the Ethereum ecosystem is more prosperous and diversified, and it is more convenient for users to purchase MEME coins. If the price of BRC-20 can maintain benign and healthy development, it will attract more Ethereum ecosystem players to enter the Bitcoin ecosystem, improve the utilization rate of the Bitcoin network, and be beneficial to the long-term development of Bitcoin.

In addition, BRC-20 is a new technology, and there are currently few centralized exchanges that have launched BRC-20 tokens. Currently, the largest funds in the cryptocurrency market are still in centralized exchanges. If the BRC-20 ecosystem continues to develop steadily, the on-line of centralized exchanges at the appropriate time may bring about a situation of oversupply, establishing BRC-20’s place in the cryptocurrency world. However, on the other hand, early participants in BRC-20 have already obtained considerable benefits in the short term, and caution is needed to avoid profit-taking due to the liquidity brought by centralized exchanges.

- 2.3.2 Does BRC-20 Have Application Value?

BRC-20 is an alternative token engraved on the Cong network. Some investors consider it a digital gold accessory, to be held as a collectible. Therefore, the current price of BRC-20 tokens is mainly supported by the consensus culture and MEME culture of the crypto circle. Intrinsic value refers to the discounted cash generated during the product or company’s life cycle, so BRC-20 has no intrinsic value. However, the psychological value of BRC-20 is determined subjectively by the holder’s emotions, which is similar to the emotional value brought by other collectibles or pet raising. Moreover, based on the fact that BRC-20 is a replaceable token standard, its circulation is better than that of non-replaceable collectibles in other categories.

BRC-20 is currently only deployed on the Bitcoin network and can be cross-chain to other chains with smart contracts for use in DeFi. The cross-chain protocol Map Protocol proposed the BRC-201 cross-chain standard on May 19th, aiming to achieve this vision. However, this depends on the subsequent development of BRC-20, and only a few first-mover BRC-20 tokens with strong consensus can play a role in DeFi.

In addition to making BRC-20 tokens work in other ecosystems, some projects plan to develop based on the Ordinal protocol, trying to introduce the BTC network into the LP mode to provide liquidity for the BRC-20 ecosystem. However, the feasibility and market recognition of this idea remain to be seen.

One application of the BRC-20 protocol is to provide a fairer coin issuance mechanism. Anyone can participate in token minting, which is a rebellion against the existing token sales method for VC to obtain chips at a low price. Anyone can easily deploy tokens, which is an option for issuing community consensus tokens.

Web3 culture is more open, inclusive and vibrant than traditional industries. When Bitcoin was born, no one thought of adding smart contracts, and ETH encountered the prosperity of DeFi and NFT in ICO. The final success of new things is a step-by-step process. Although BRC-20 currently does not have actual application value, it is still worth keeping an eye on.

3 Risks of BRC-20

3.1 Security Risks of BRC-20

- 3.1.1 Centralization Risk

For the BRC-20 protocol, it treats the inscription as a ledger for recording the deployment, minting, and transfer of BRC-20 tokens. Since smart contracts cannot run on Bitcoin, BRC-20 tokens cannot query the relevant information of the current token by running smart contracts. Therefore, BRC-20 retrieves all deployment, minting, and transfer operations of all BRC-20 tokens through off-chain queries, that is, using centralized servers to retrieve Bitcoin blocks, in order to query the final balance of each user’s BRC-20 tokens.

Simply put, the ledger of BRC-20 is decentralized and recorded on the Bitcoin chain, but the settlement process is centralized. Currently, there are two websites, brc-20.io and unisat.io, that support BRC-20 token-related queries.

However, the centralization of the settlement process may result in different platforms having different results when querying the balance of a particular account. Although all operations are recorded on the chain, the verification of these operations is carried out by a certain client. If these centralized service providers do not disclose their verification rules, then there is actually no guarantee for the entire BRC-20 ecosystem.

- 3.1.2 False Deposit/Double Spending Attack Risk

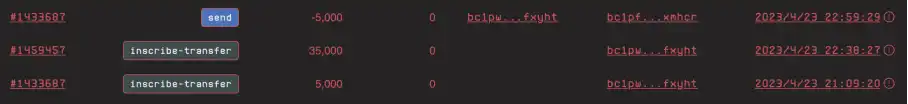

On the evening of April 23rd, UniSat launched the BRC-20 trading platform, but it suffered a large number of double spending attacks due to vulnerabilities in the codebase. The address bc1pwturekq4w455l64ttze8j7mnhgsuaupsn99ggd0ds23js924e6ms9fxyht initially used to transfer Ordinals NFTs attempted to transfer 5000 ORDI and 35000 ORDI to its own address out of thin air, and tried to sell the forged ordi to other users. Unisat subsequently suspended website access and conducted an investigation, ultimately finding that 70 transactions were affected.

https://unisat.io/brc20?q=bc1pwturekq4w455l64ttze8j7mnhgsuaupsn99ggd0ds23js924e6ms9fxyht&tick=ordi

In other BTC browsers, we can see that this user forged Ordinals NFTs in the transaction at 9 pm on April 23rd and falsely transferred 5000 ORDI according to the BRC-20 protocol.

If Unisat had not retrieved the error that night, the expected loss caused by this double spending attack would exceed $1 million. Ensuring that centralized servers retrieve and verify without errors is the most important issue to be solved in the development process of BRC-20.

3.2 Policy risks of BRC-20

Due to the popularity of BRC-20, many exchanges have joined in attempting to capture this wave of traffic. However, centralized exchanges are susceptible to attacks and have opaque internal operations. When ORDI was listed on an exchange, it fell all the way to 7.5U. Some users accused the exchange of manipulating data to drive down the price and absorb chips.

With the participation of exchanges, users face even more complex risks, but blockchain technology cannot restrict these risks related to BRC-20. If more and more users participate in BRC-20 in the future, the importance attached to supervision and compliance is likely to increase. At that time, how will the BRC-20 community and developers respond to regulatory policies?

3.3 Hype risks related to BRC-20

Currently, BRC-20 tokens are in a very early stage, and their speculative value far exceeds their actual value. According to data from the chaineye tool, there are currently about 10,000 users participating in BRC-20. The actual number of users is much lower than the apparent heat. Many BRC-20 tokens have poor liquidity and no market value. Therefore, users need to control their FOMO emotions and pay attention to the hype bubble surrounding BRC-20.

ChainEye - Free and open source omni-chain analytical tools

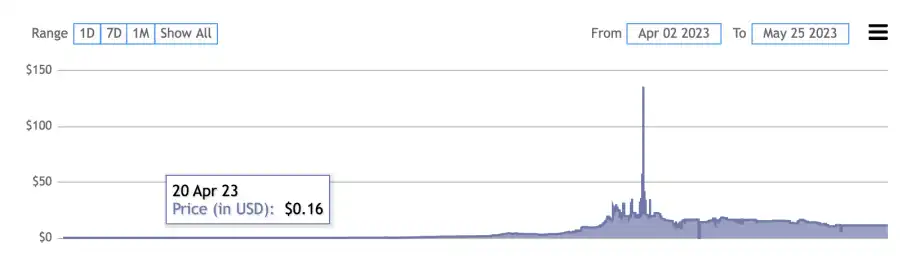

From the chart of ORDI’s trend below, it can be seen that after domodata launched the BRC-20 protocol and deployed the ORDI token on March 9th, the ORDI token remained silent for a month. It wasn’t until the explosion of a series of meme coins such as $PEPE and $Aidoge in late April that some players began to pay attention to and buy ORDI, causing its price to rise. It can be said that the popularity of BRC-20 was actually due to the funds in the meme season starting to speculate on tokens on BTC.

BRC-20.io | ordi price today, market cap and chart

With regard to hype, we can see a similar process from the Ordinals NFT in February. On February 9th, some users participated in the minting of BTC PUNK NFTs. Then on February 15th, Blur airdropped, causing the NFT market to heat up, and speculation on NFTs related to Bitcoin began. On February 28th, Yuga Labs entered and minted NFTs using the Ordinals protocol.

BRC-20 rose to its current highest point of $123 and a market value of over 2.5 billion on May 10th, due to the accumulation of hype and users from meme season and the previous Ordinals protocol, as well as the release of the BRC-20 research report by Grayscale on May 8th. However, its price quickly fell thereafter, dropping to $6.7 on May 25th.

BRC-20.io | ordi price today, market cap and chart

4. Conclusion

BRC-20 is currently controversial. Some Bitcoin supporters believe that BRC-20 only exacerbates congestion on the Bitcoin network and stores worthless data. Some investors believe that BRC-20 is similar to meme coins, as these tokens have no value since Bitcoin cannot run smart contracts and most BRC-20 tokens return to zero after the hype dies down. BRC-20 supporters believe that BRC-20 has created a fairer token distribution mechanism on the Bitcoin network, adding new use cases and demand for Bitcoin, and that the Bitcoin ecosystem may become a long-term hotspot and narrative in the future. It is difficult to foresee and judge the development of new things, and the determination and execution of the community has played a key role. We will continue to pay attention to the development of BRC-20.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why is DigiFinex Coin considered as the “backbone” and pillar between fiat currency and virtual assets, even though it is not a stablecoin pegged to the Hong Kong dollar?

- Ark Introduction: A Layer 2 Protocol for Anonymous Bitcoin Payments Off-Chain

- BXB Capital: Made fortune from kimchi premium, once co-founded Korean market with Binance

- Multiple macroeconomic negative factors have hit the market, causing Bitcoin to drop below 26,000 US dollars in the short term.

- Macro negative factors continue to ferment, and Bitcoin may weaken in the short term and test $26,000.

- New Order: Money Meme – When Game Theory Meets Memes

- Web3 Marketing Handbook: How to Disruptive Products to Mainstream Market