Jianan listed plans to raise 100 million US dollars, the source: or due to the poor performance of the road show, the amount of funds raised

Author: Xi breeze

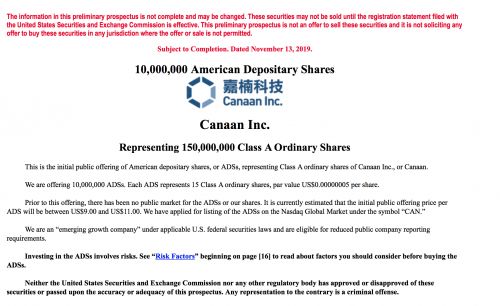

At 17:00 pm local time on November 3, according to the US Securities and Exchange Commission (SEC) official website, mining machine manufacturer Jia Nan Zhizhi re-updated the preliminary prospectus. According to the content of this update, Jianan Technology Plan With 10 million ADSs issued, the price of ADS per share is between $9 and $11, so the total amount of funds raised is between $90 million and $110 million. There is a certain gap compared to its maximum fundraising total of 400 million US dollars.

Some investment bankers told Caijing.com that the company has completed the roadshow yesterday and is expected to officially list on the US Nasdaq on November 20. He said: "Road is the announcement of the upcoming company to investors, because not everyone likes to read the prospectus. The road show means that Jia Nan has obtained the SEC approval."

- The hacker group Anonymous announced the establishment of a $75 million Bitcoin fund to boost privacy technology and cryptocurrency development

- Viewing the Governance and Game Theory under the Chain from the Merchant Law in the Middle Ages

- The Swiss Stock Exchange is based on the XTZ-based ETP, and investors can get XTZ staking income.

In addition, the Scallion has also announced a roadshow PPT in Jianan.

Although the latest prospectus is still a version of the informal prospectus, the maximum amount of funds raised in the home page is still $400 million, but this prospectus further clarifies the specific fundraising scale.

For the purpose of this prospectus, each ADS represents 15 shares of Class A common stock, a total of 150 million shares of Class A common stock, including 2,015,597,778 Class A common shares and 356,624,444 Class B common shares (if the underwriters fully exercise) Over-allotment option can reach 2,038,097,778 Class A common shares and 356,624,444 Class B common shares).

In addition to the fact that the amount of funds raised is lower than the market expectation, the list of underwriters is more obvious. Except for Citigroup, Huaxing Capital, CMB International, Galaxy Digital, Huatai Securities and Tiger Securities, they have been underwriting. Credit Suisse, the top seller, did not appear in the list of underwriters for this new prospectus, and added Haitong International.

As for the reason that the amount of funds raised is lower than the market expectation, according to people close to Jianan Zhizhi, the financial network and chain finance said that only $100 million has been raised. The main reason may be that yesterday’s roadshow may not be as good as theirs. Expectations, the scene response is not very good.

The financial network reporter on this news on the Jianan Yuzhi joint chairman Kong Jianping to verify, as of press release, the other party has no reply.

Some insiders also said that there may be another reason: the IPOs are generally diluted by the original shareholder shares, and Jianan may feel that there is no need to raise so much funds and sell so many shares.

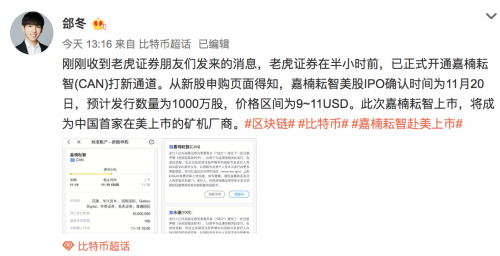

At noon today, Snowball Blockchain analyst Yan Dongfa said: "We just received a message from Tiger Securities friends that Tiger Securities has officially opened a new channel for Jianan Zhizhi (CAN) half an hour ago. According to the new share subscription page, the IPO confirmation time of Jianan Zhizhi US stocks is November 20, and the expected number of shares is 10 million shares, and the price range is 9~11 USD. The listing of Jianan Zhizhi will become the first in China. A mining machine manufacturer listed in the US."

According to Tiger Securities subscription information, Jianan Zhizhi is expected to be listed on December 21st. It is expected that the subscription date of new shares will be from November 14th to November 19th. The minimum subscription amount is 100 shares and the minimum subscription amount is US$1,320.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Morgan Creek CEO: Every asset in the world will be tokenized, selling Amazon stock to buy bitcoin

- Getting started with blockchain | 10 common misconceptions about blockchain and cryptocurrency

- Do not blow black, a quick overview of the 2019 cryptocurrency 10 development trend

- Last year’s battle, this year’s cold and clear, BCH upgraded this year?

- QKL123 Quote Analysis | Libra will replace Ethereum? Unable to help themselves! (1114)

- Speed | Cryptographic Currency Derivatives Exchange: Clearing Mechanism; Bitcoin and "Great Wealth Transfer"

- Ten facts that Bitcoin does not know most people