Layer1 Transformation, Layer2 Discussion – The Business Secrets Behind ‘Ethereum Layer2

Layer1 Transformation, Layer2 Discussion - Secrets of 'Ethereum Layer2' BusinessBuilding L2 solutions seems to have become a trend recently.

From emerging projects to established public chains, everyone is actively exploring and implementing L2 solutions.

On July 17th, Mantle Network, a modular L2 solution using Optimistic Rollup and incubated by BitDAO, went live on the mainnet;

On July 18th, Linea, an L2 solution developed by Consensys, the parent company of Metamask, also released its mainnet Alpha version;

- Why is the discount on GBTC narrowing and what are the reasons and impacts?

- Opepen’s Rekindling A Community of Co-creation and Win-win

- zkEVM Performance Comparison Testing the Deployment of Ethereum L2 Contracts

Earlier, Coinbase also announced the test network for its L2 solution BASE.

Recently, even the established public chain Celo released a proposal on its internal forum, calling for a shift in its development direction from an independent Layer1 public chain to an Ethereum-compatible L2 solution.

I vaguely remember the battle of new public chains two years ago, where various contenders emerged with the intention of “killing” Ethereum and becoming an “Ethereum killer”; but now, the focus is on building L2 solutions, more like “Ethereum Builders,” aiming to “share” Ethereum’s performance issues through technical optimizations.

These are two completely different approaches: the former is direct competition, while the latter is elegant parasitism.

Now, why are people enthusiastically embracing L2 instead of creating new public chains? Is it because new public chains are no longer desirable, or because L2 can indeed bring new narratives and benefits?

L2, a faster way to see results

We won’t go into detail about solutions like Mantle and Linea that were designed for L2 from the beginning. Their external narrative is nothing more than improving the scalability of ETH and reducing fees, creating a better interactive experience for applications and users.

As for Celo, a public chain that is originally L1, choosing to become an L2, the initial intuitive reaction is “compromise and backtrack” — competing public chains with Ethereum solve Ethereum’s shortcomings through a “make myself better” approach; but then they choose to become Ethereum’s L2, which seems like surrendering and joining.

To understand the reasoning behind this, let’s take a look at what Celo has to say:

The benefits of compatibility, security, and liquidity are undeniable, but the author feels that it doesn’t touch upon the core interests: what determines whether a project chooses to build a standalone L1 or opportunistically parasitize Ethereum by running on L2?

The answer lies in costs and benefits.

An article by Lightning HSL titled “Building Rollup is Good Business” provides a very good business perspective: whether developing L1 or L2, the goal is to solve existing problems and create value. However, from a business standpoint, L2 seems to be more profitable.

Business Model: L2–> Equivalent to ETH main chain functionality–> Lower gas fees, faster speed–> Attract dapps and users–> Increase on-chain transaction volume;

L2 Revenue: Gas fees paid by users for transactions on L2;

L2 Expenses: L2 operators periodically batch and upload Rollup transactions to Ethereum L1, incurring gas fees;

The difference between revenue and expenses is the approximate gross profit of operating L2 rollup mode; therefore, as long as there are more applications and TVL on L2, it is possible to generate more user transactions, allowing the L2 operator to generate larger revenue while incurring relatively fixed expenses and thereby increasing profit.

In terms of cost, Rollup does not require the development of complex consensus mechanisms and theoretically does not require tokens (even though current projects have them). It only requires a minimum of one server to start running, and the core technical components can be built using Optimistic or Arbitrum, essentially having a complete open-source solution, with difficulty certainly lower than building a standalone L1.

In comparison, developing a new public chain (L1) is much more costly and difficult:

-

First, you need to develop a consensus mechanism that the market can accept, which requires a significant amount of research and development resources, time, and accumulation;

-

Second, you need to attract enough nodes to participate in your network to ensure network security and decentralization;

-

Finally, you need to build some differentiated narratives, such as focusing on privacy or security, etc…

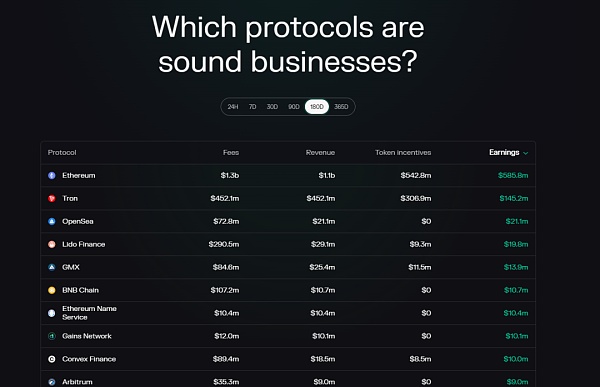

At the same time, the data also confirms the analysis of cost and benefit.

Data from Token Terminal shows that in the past six months, among the top ten projects in terms of revenue, if only looking at the public chain layer, only Ethereum, Tron, and BNB Chain made the list, with Arbitrum in L2 also included in this ranking. Considering the difference in construction time between these L1 chains and Arbitrum, it is clear that Arbitrum has a better cost-effectiveness in terms of pure revenue.

Furthermore, in a bear market environment, it is more difficult for VCs to buy into the story, and retail investors are less likely to accept it. Building a new L1 inevitably encounters setbacks from the primary market to the secondary market, and it becomes more difficult for project teams to monetize tokens through the capital market, making it far less practical and cost-effective than building an L2.

Rather than starting from scratch to create a unique public chain, which requires a large investment and has slow results, it is more practical and relatively fast to parasitize within Ethereum’s L2.

More importantly, the “traffic business,” that is, where users come from.

As mentioned earlier, TVL and transaction volume are key to whether L2s can generate revenue, which in turn relies on the entry of more users.

Coinbase, Metamask, or Binance can be used as Layer 2 (L2) solutions, which naturally allows the integration of existing users from their centralized exchange (CEX) or wallet services into L2. This gives startup teams an unmatched advantage in terms of customer acquisition cost.

For L1 solutions like Celo transitioning into L2, existing users on L1 can be migrated, although it may require more incentives and guidance.

Regardless, most projects and capital choose to start with their own product ecosystems or the existing user base in the Ethereum ecosystem when building L2, and then expand into more collaborative scenarios (such as Polygon’s actions in the Web2 field).

Is L1 a dead sea while L2 is already a saturated market?

The analysis above only focuses on the internal characteristics of L1 and L2. However, if we look at the external competitive environment, the choice to build L2 becomes easier to understand.

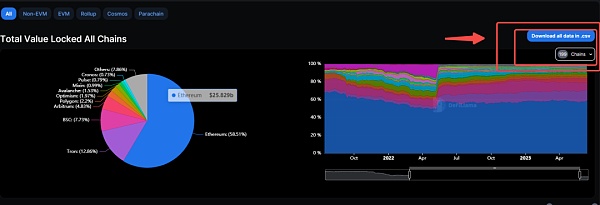

According to data from DeFiLlama, there are currently nearly 200 public chains in the market. Excluding dozens of L2 chains, this means we are facing nearly 190 L1 public chains.

Therefore, the current L1 track is more like a dead sea: overcrowded with intense competition.

Only a few public chains occupy users’ minds, especially considering the black swan events in recent years and the withdrawal of capital. Many once popular public chains have disappeared from various user activity, revenue composition, and transaction volume indicators.

Most L1 chains still exist in concept, but lack vitality. Choosing to enter a dead sea from a business perspective is not a wise choice.

In comparison, the situation for L2 is slightly better.

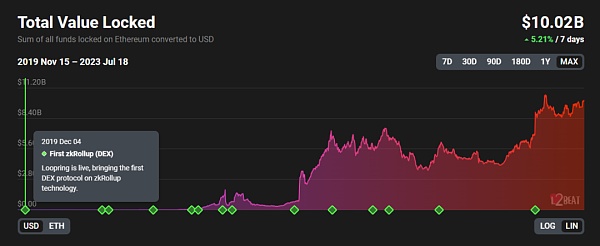

L2’s total value locked (TVL) is still in an upward trend over time.

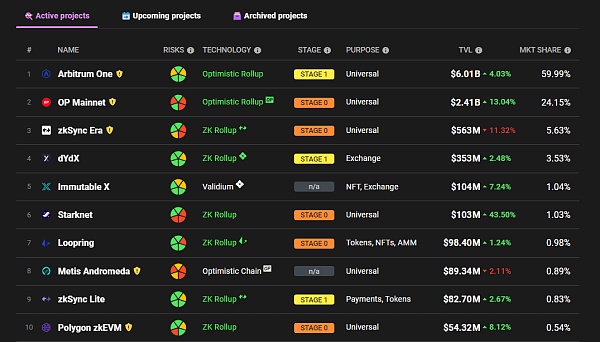

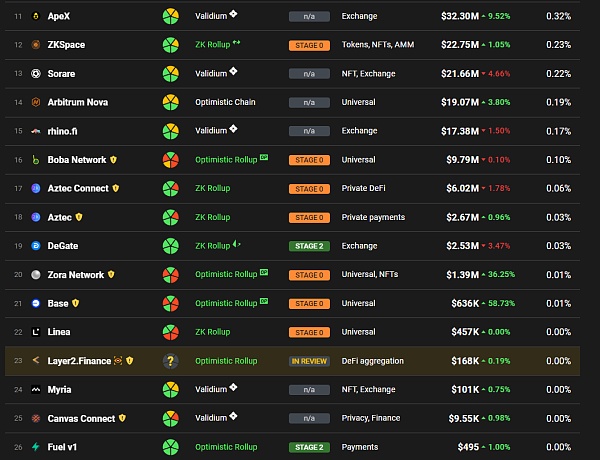

In terms of competition, L2Beat currently tracks 26 L2 solutions, which is about one-seventh of the competition compared to L1. Although Arb and OP have taken the lead in market share, the market share of other projects is relatively scattered and average, which presents an opportunity for another leader to emerge.

However, considering the technical architecture, there are already typical representatives of different technology stacks in the existing L2 market:

-

Optimistic rollup-based solutions like Optimism and Arbitrum;

-

Zk-Proof-based solutions like Zksync and Starknet;

-

Base, which is built on the OP Stack;

-

Linea, an EVM-compatible chain launched by Consensys;

-

Zk-EVM and more, introduced by Polygon….

Although it can’t be called a blue ocean, there are still opportunities compared to L1.

With the completion of Ethereum’s technical upgrades this year and several subsequent upgrades, the narrative around performance will continue for a long time, and L2s still have a considerable development window. At the same time, there are not many narratives and tracks that can sustain attention in a bear market. In the environment of attention and funding scarcity, L2s also have the advantage of continued attention.

Therefore, from the perspective of competition and external environment, it seems that doing L2 is currently a profitable business.

Who does the L2 business serve?

Outside of business, the author feels a sense of “redundancy” within the circle.

We often see a project migrating from one L1 to another, from supporting one L2 to supporting more L2s. Projects run across chains, and the number of chains itself is increasing.

By switching to a different ecosystem, one can stake a claim again, gather another wave of resources, and capture another wave of users. L1 and L2 are to some extent like undeveloped colonies. Ignoring the differences in technical details, the same business can be done again in a different place.

Do we need so many “places”? Who do these many places serve?

Capital needs, token airdrops, scams, narratives… but normal demand may not be necessary.

If all L2s talk about lower fees and faster speeds indiscriminately, what is their essential difference?

After all, as end users, the technical process is not important. If the results are consistent, the increasingly crowded L2s can be interchangeable.

History has shown that after a round of new public chain movements, Ethereum is still Ethereum, and it has become stronger in competition.

Will it be the same for the current state of L2s? From a blue ocean to a red ocean to a dead sea, after a round of money throwing, the project density becomes larger and in the end, only one or two will remain on the surface, and there may not be many users in the pool.

The business of L2 can quickly yield results, but hopefully, it will not exhaust the resources.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing the Reasons Behind SOL’s Recovery from Solana Q2 Report

- Opinion The launch of UniswapX is both expected and unoriginal.

- Analyzing Arkham Airdrop Data 95% of Token Recipients Choose to Sell

- Analysis of two wallet solutions MPC and smart contracts. Why do we choose the latter?

- Brevis Alpha goes live What are its available features and use cases?

- What is the social protocol XMTP, which is collaborating with Coinbase and Lens, all about?

- Stick to the Right Path and Surprise Everyone A Rational Choice for ETH Staking’s Security and Returns