LianGuai Daily | Coinbase, Block, and Apple release quarterly reports; X Company is seeking data partners to establish a trading platform.

LianGuai Daily reports on quarterly reports by Coinbase, Block, and Apple, while X Company is looking for data partners to build a trading platform.Today’s News Highlights:

The Central Bank of Russia announces the logo and transaction fees for the digital ruble

OpenSea now supports the Base network

Coinbase submits documents to court seeking dismissal of SEC lawsuit

- Ether Futures ETF Applications Pile Up, Is the Gear of Crypto ETF’s Fate Starting to Turn?

- Developer’s Guide How to Build Products on the Base Mainnet?

- World Engine A sharding Rollup framework designed for full-chain games

Curve Finance offers 10% bounty if hacker returns remaining tokens

Web3 social graph protocol CyberConnect opens airdrop query webpage

Semafor: Company X seeks data partners to establish a trading platform within the application

Coinbase’s Q2 revenue of $708 million exceeds analyst expectations

Curve Finance founder sells a total of 111 million CRV tokens for approximately $44 million

Regulatory News

The Central Bank of Russia announces the logo and transaction fees for the digital ruble

According to Cointelegraph, the Central Bank of Russia has unveiled the official logo for its central bank digital currency (CBDC), which is a circular symbol of the international ruble. In addition to the logo, the Central Bank of Russia has also displayed the commission rates for different types of CBDC transactions. All services will be free of charge until the end of 2024, but starting from 2025, B2B transactions will incur a fee of 15 rubles ($0.16) per transaction, while individuals will be charged a fee of 0.3% of the total transaction amount when transferring funds to commercial accounts and a fee of 0.2% when paying for public services.

It is reported that Russian President Putin signed the digital ruble bill into law on July 24. The CBDC is scheduled to come into effect on August 1, 2023, initially in a pilot phase involving 13 local banks.

SEC freezes assets of crypto mining firm Digital Licensing, accusing the company of fraud

According to Decrypt, the U.S. Securities and Exchange Commission (SEC) has frozen the assets of crypto mining company Digital Licensing Inc., which is accused of involvement in fraud. In an emergency action announced on Thursday, the SEC also obtained a restraining order against the Utah-based company operating under the name DEBT Box.

The SEC stated that it has taken action against four individuals associated with Digital Licensing, namely Jason Anderson and his brother Jacob Anderson, Schad Brannon, and Roydon Nelson, as well as 13 other defendants, accusing them of running a “fraudulent scheme” that raised $50 million and an undisclosed amount of Bitcoin and Ethereum. The complaint alleges that the defendants “misappropriated” the funds raised, “purchasing luxury cars and homes, enjoying lavish vacations, and giving themselves and their friends substantial amounts of cash.”

The U.S. Securities and Exchange Commission further claims that DEBT Box used “hundreds of online videos and social media posts” and told investors during events that its cryptocurrency mining activities would bring “huge returns” to investors, but the node licenses were a “scam”.

NFT

OpenSea now supports the Base network.

According to official news, OpenSea now supports the Base network. According to previous news, Coinbase announced that Base will be open to the public on August 9th. Currently, six Base cross-chain bridges have been opened, allowing users to bridge their Ethereum (ETH) to the Base network.

Project Updates

Coinbase has filed documents with the court seeking to dismiss the SEC lawsuit in the United States.

According to CoinDesk, Coinbase has filed documents with the court requesting the dismissal of the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against it. Coinbase argues that its core argument is simple: Coinbase does not offer “investment contracts,” and the SEC ignores this precedent, violates due process, abuses its discretion, and abandons its previous interpretation of securities laws.

“Trading on the Coinbase platform and Prime does not involve or provide contracts that reflect the future value of a company’s revenue, profit, or assets. They are sales of commodities, and the obligations of both parties are completely discharged after the completion of the transaction. The delivery of digital tokens is for the purpose of payment,” the document stated.

Bloomberg analyst: Proshares and Bitwise resubmit three “Bitcoin and Ethereum” related futures ETF applications.

According to a tweet by Bloomberg ETF analyst James Seyffart, Proshares and Bitwise have resubmitted three “Bitcoin and Ethereum” related futures ETF applications to the U.S. Securities and Exchange Commission (SEC), including Proshares’ “Bitcoin & Ether Strategy ETF” and “Bitcoin & Ether Equal Weight Strategy ETF,” as well as Bitwise’s “Bitwise Bitcoin and Ether Equal Weight Strategy ETF.”

Previously, this week, six companies have applied to launch Ethereum futures ETFs, namely Volatility Shares, Bityise, Roundhill, VanEck, Proshares, and Grayscale. In addition, Direxion has submitted a Bitcoin and Ethereum futures ETF application to the U.S. SEC. Later today, Bitwise also submitted the “Bitwise Bitcoin and Ether Market Cap Weight Strategy ETF.”

Matter Labs responds to “code plagiarism” accusations: Some of Polygon’s claims are untrue, and ownership information is already indicated in the first line of the file.

According to CoinDesk, Ethereum scalability company Polygon claimed in a tweet on Thursday that zkSync development company Matter Labs copied some of Polygon’s open-source code without providing ownership information. Polygon claimed in the blog post, “Matter Labs recently released a proof system called Boojum, which includes a large amount of source code copied and pasted from the performance-critical components of the Plonky2 library. The code does not have original copyrights and is not clearly attributed to the original author. Copying and pasting source code without attribution and making misleading statements about the original work violates the spirit of open source and harms the ecosystem.”

Matter Labs denied these allegations in a statement, stating that the code is “clearly marked” at the top of one of the relevant files. A spokesperson for Matter Labs said, “Polygon’s blog post contains false statements. The new Boojum high-performance proof system utilizes 5% of Plonky2, which is indicated in the first line of our module. Marking the attribution in the first line is to highlight its source.”

Later today, Manta Network stated that the code criticized by Polygon for not being attributed is actually the original work of one of their employees.

Curve Finance: If the hacker returns the remaining tokens, a 10% bounty will be provided.

According to official news, Curve Finance, Metronome, and Alchemix have promised to offer a 10% bounty to the hacker as a reward for returning the remaining tokens. In the on-chain message sent to the hacker’s Ethereum address, they wrote, “If you return the remaining tokens, we will not pursue the matter further, and you will not face enforcement. Otherwise, we will pursue you from various angles within the legal framework.” The deadline for returning the funds is 16:00 Beijing time on August 6th, and the bounty will be awarded to those who provide useful information to assist in capturing the hacker.

Bitfinex theft suspect Ilya Lichtenstein admits to hacking Bitfinex

According to CNBC, New York resident Ilya Lichtenstein admitted in a hearing at the United States District Court for the District of Columbia on Thursday that he was the hacker behind the 2016 attack on Bitfinex and admitted to charges of conspiracy to commit money laundering. US authorities arrested Ilya Lichtenstein and his wife, Heather Morgan, in February last year and charged the couple with laundering billions of dollars from Bitfinex. The US Department of Justice stated at the time that they had seized 94,000 out of the 119,000 stolen bitcoins, worth about $3.6 billion, making it the largest seizure in the history of the US Department of Justice.

LeetSwap: DEX trading has resumed but has not been restarted, users can try selling tokens but should not buy

Base chain DEX LeetSwap stated on Twitter, “Our DEX trading has now resumed. If users still have some tokens, they can try selling them as the remaining liquidity cannot be saved by white hat hackers. We have also attached a URL that can handle more load. If the mainnet cannot load, you can use this URL.”

However, LeetSwap reminded users, “The resumption of trading is to allow users to dispose of tokens that cannot be saved by liquidity. Do not buy any tokens, as the liquidity of the DEX may be exploited by hackers. We have not restarted the DEX. The contract code is immutable and cannot be fixed.”

Earlier on August 1st, it was reported that LeetSwap’s axlUSD/WETH pool was subjected to a price manipulation attack, resulting in a loss of approximately $620,000. Yesterday, it was reported that LeetSwap has recovered about 400 ETH.

Web3 social graph protocol CyberConnect has opened an airdrop query webpage

Web3 social graph protocol CyberConnect announced on Twitter that they have now opened an airdrop query webpage, where users can check their eligibility and the amount of airdrop through the official website.

Previously, CyberConnect announced that they will launch the first season of community rewards on August 15th, distributing a total of 2.4 million CYBER tokens. The specific reward policy will be announced on August 4th, 2023.

Sei Network: Mainnet is ready, this version is a fully globalized and physically decentralized network

According to the official Twitter account of Layer1 public chain Sei Network, for a blockchain to truly have resilience and robustness, it must be decentralized. The Atlantic-2 testnet achieved the fastest block finalization time among all blockchains, even with validator nodes in 12 countries across 3 continents, and now its mainnet is ready.

In addition, Sei Network stated in a blog post that the ready version of Sei’s mainnet is a fully globalized and physically decentralized network.

Security company: JPEG’d attacker may have returned all 6106.75 ETH to the project party

According to MistTrack monitoring, the JPEG’d attacker may have returned all 6106.75 ETH to the project party.

Earlier on July 30th, NFT lending platform JPEG’d was attacked by hackers, resulting in a loss of at least approximately $10 million.

Binance, Coinbase, OpenSea, and 5 other cryptocurrency companies are included in the CNBC Global Fintech 200 list.

CNBC has released its Global Fintech 200 list, which includes some of the biggest companies in the industry such as Ant Group, Tencent, LianGuaiyLianGuail, Stripe, Klarna, and Revolut, as well as several emerging startups seeking to shape the future of financial services. Five cryptocurrency companies are also included, including Binance, BitMart, Coinbase, Dapper Labs, and OpenSea.

Latest ACDE meeting for Ethereum: Agreed not to introduce precompiles for EIP-4788, Devnet #8 release postponed

Ethereum core developer Tim Beiko summarized the latest Ethereum core developer execution meeting (ACDE) in Discord, covering topics such as EIP-4788, EIP-6780, Engine API, large validator testnets, and two account abstraction EIP proposals (EIP 5806 and 7377).

Regarding EIP-4788, the developers agreed to continue using regular contracts with system writes instead of precompiles. Before the test call on Monday, developers will attempt to: 1. agree on a deployment plan (as part of a fork or manually deployed before the fork); 2. agree on the first contract implementation to use; 3. submit a PR to the 4788 specification reflecting this situation. Once the developers reach consensus on the contract, the audit/formal verification process will be initiated. This meeting decided to postpone the release of Devnet #8 until the new 4788 specification is implemented.

Offchain Labs launches permissionless verification protocol BOLD

According to the official blog, the Arbitrum development team Offchain Labs announced the launch of the permissionless verification protocol Bounded Liquidity Delay (BOLD) to address Rollup disputes. This verification method provides a fixed upper limit of 7 days for additional confirmation delay without being vulnerable to delay attacks. BOLD allows the Arbitrum technology chain to guarantee the security and vitality of its chain, minimize the delay in resolving states, and prevent dishonest parties from increasing the cost for honest parties.

The code and specification for BOLD are now available on Github. Before BOLD is ready for deployment, several steps need to be completed: 1. Share instructions for running BOLD challenges on Arbitrum Nitro developed in the coming weeks; 2. Release the formal proof code for BOLD written in the Isabelle programming language and the complete academic paper; 3. Provide a new testnet environment for the BOLD community to participate in; 4. If there is positive community feedback, prepare an AIP for the DAO to decide whether to adopt this new protocol in Arbitrum One and Nova.

HashKey Capital will launch a new compliant secondary liquidity fund on September 1st.

LianGuaiNews has learned that HashKey Capital is launching a new compliant secondary liquidity fund called the HashKey Digital Investment Fund. The fund will officially accept investor subscriptions starting from September 1, 2023. It is understood that the fund has obtained a license from the Hong Kong Securities and Futures Commission and is managed by HashKey Capital Limited. The investment portfolio is 100% composed of virtual assets.

Previously, HashKey Capital’s dedicated funds have raised over $560 million, with accumulated assets under management of nearly $1 billion, and have invested in over 500 blockchain projects worldwide.

UK digital bank Revolut announced the suspension of its cryptocurrency services in the United States starting from September 2nd.

According to Decrypt, UK digital bank Revolut announced the suspension of its cryptocurrency services in the United States. This decision is due to the constantly changing regulatory environment and uncertainty of the US cryptocurrency market and will take effect on September 2, 2023. At that time, US customers will no longer be able to place cryptocurrency purchase orders on the Revolut platform. Revolut plans to complete the delisting process on September 18th. More comprehensive restrictions will be implemented starting from October 3, 2023. At that time, US customers will be completely prohibited from accessing cryptocurrencies through Revolut. However, this decision does not affect Revolut’s business outside the United States. A spokesperson for Revolut stated that US customers account for less than 1% of the company’s global cryptocurrency customers.

Korean cryptocurrency exchange Upbit’s trading volume in July exceeded Coinbase and OKX, ranking second only to Binance.

According to a report from cryptocurrency analysis platform CCData, the spot trading volume of Korean cryptocurrency exchange Upbit surpassed Coinbase and OKX for the first time in July. Upbit’s spot trading volume in July increased by 42.3% to reach $29.8 billion. On the other hand, Coinbase and OKX saw a decrease in trading volume by 11.6% and 5.75% respectively, with $28.6 billion and $29 billion. This shift makes Upbit the second-largest exchange in terms of trading volume after Binance.

The report also shows that in July, the total trading volume of spot and derivatives on centralized exchanges decreased by 12.0% to $2.36 trillion, the lowest monthly trading volume so far this year. Binance remains the largest cryptocurrency spot trading venue with a trading volume of $208 billion.

Semafor: X Company is seeking a data partner to establish a trading platform within its application.

According to Semafor, citing documents and sources familiar with the matter, X Company (formerly known as Twitter) under Elon Musk is looking for a financial data giant to establish a trading platform within its application. The documents show that X has requested financial data providers to submit proposals regarding financial content and real-time stock data in recent weeks. X has promised to provide the potential partners with “hundreds of millions of high-quality users” but will not provide compensation. These companies are asked to write down the amount they are willing to invest in this project. However, Musk later tweeted, “As far as I know, there is currently no work being done in this regard.”

Ripio, a Latin American cryptocurrency company, has launched a stablecoin called UXD that is pegged to the US dollar and hosted on the LaChain blockchain.

According to CoinDesk, Ripio, a Latin American crypto service provider, has launched a stablecoin pegged to the US dollar, partly to provide a method for Argentinians to protect their assets from inflation. Ripio users in Argentina are already able to purchase the UXD stablecoin (also known as Criptodólar), which can also be used in Brazil and is hosted on LaChain, a Layer 1 blockchain focused on Latin America that Ripio launched in June in collaboration with SenseiNode, Num Finance, Cedalio, and Buenbit. The company also plans to integrate UXD into its Ripio Card.

Ripio, founded in Argentina, currently operates in Brazil, Uruguay, Colombia, Chile, Mexico, the United States, and Spain, and recently obtained approval to operate as a cryptocurrency exchange in these countries. The company has 8 million users and a monthly trading volume of $200 million.

Key Data

Coinbase’s Q2 revenue of $708 million surpasses analyst expectations

Coinbase’s latest Q2 financial report reveals that the company generated $708 million in revenue in Q2, with adjusted earnings of a loss of $0.42 per share, surpassing analyst expectations of $628 million in revenue and a loss of $0.76 per share. Transaction revenue accounted for $327 million, lower than the $375 million in Q1. Total trading volume decreased from $145 billion in Q1 to $92 billion, and interest income decreased from $241 million in Q1 to $201 million. Of the interest income in Q2, $151 million came from USDC held by the exchange. After-hours trading on Thursday saw Coinbase’s stock price increase by 1.38% to $92. Year-to-date, Coinbase’s stock price has risen by approximately 160%, while the price of Bitcoin has increased by over 75% during the same period.

Block’s Q2 Bitcoin sales revenue reaches $2.4 billion, a 34% YoY increase

The latest financial report released by payment company Block, Inc. shows that the Bitcoin sales revenue of its Cash App division reached $2.4 billion in Q2, representing a 34% year-on-year increase. The gross profit from Bitcoin sales was $44 million, a 7% increase compared to the previous year. The company stated that customers continue to purchase more digital assets even when prices are falling. Block purchased $50 million worth of Bitcoin in Q4 2020 and an additional $170 million worth in Q1 2021. As of June 30, 2023, Block’s fair value of Bitcoin investments was $245 million, which is $142 million higher than the book value after deducting accumulated impairment charges. Overall, the company’s Q2 revenue was $5.53 billion, higher than the $4.4 billion in the same period last year. Gross profit also increased from $1.47 million to $1.87 million.

Data: Numerous traders selling USDT in Curve Finance and Uniswap stablecoin pools

According to CoinDesk, on Thursday, cryptocurrency traders concentrated their abandonment of Tether’s stablecoin USDT in the main stablecoin pools of Curve Finance and Uniswap, causing these pools to be severely unbalanced. Data shows that in Curve 3 Pool, composed of USDT, USDC, and DAI stablecoins, the USDT balance soared to 62%, while USDC and DAI accounted for about 19% each. In Uniswap’s USDT-USDC trading pool, the USDT balance is $105.4 million, while USDC is only $6.5 million. The current imbalance indicates that investors are increasingly inclined to hold DAI or USDC instead of USDT, as there are more USDT sellers in the pool. The current price of USDT is reported as $99.88, slightly below $1.

Curve and Uniswap pools are popular places for traders to quickly exchange stablecoins. In most cases, tokens are in a balanced state in the pools. The imbalance indicates that investors are seeking to collectively sell a certain asset, and the market is in a predicament. Similar imbalances occurred during the Terra crash in May 2022 and the Silicon Valley Bank crisis impacting USDC issuer Circle in March of this year.

Apple’s third-quarter revenue in the third quarter decreased by 1% to $81.8 billion

According to Interface News, on August 3rd local time, Apple released its performance report for the third quarter of the 2023 fiscal year ending on July 1, 2023. The report shows that the company’s third-quarter revenue reached $81.8 billion, a year-on-year decrease of 1%, marking the third consecutive quarter of decline; diluted earnings per share were $1.26, a year-on-year increase of 5%. Among them, iPhone revenue in the third quarter reached $39.67 billion, a year-on-year decrease of 2.4%; Mac revenue reached $6.84 billion, a year-on-year decrease of 7.3%; iLianGuaiD revenue was $5.79 billion, a year-on-year decrease of 19.8%.

Curve Finance founder sold a total of 111 million CRV tokens for approximately $44 million

According to Nansen analyst Sandra Leow’s summary, combined with the evening on-chain data, as of now, Curve Finance founder Michael Egorov has sold a total of 111 million CRV tokens for a price of $44 million. Leow said that recent sales include transactions with Wintermute (12.5 million CRV), a trader named Llanero (270,000 CRV), 237.eth (3.75 million tokens), and wallet addresses related to the former xDAI deployer (6.25 million CRV).

LianGuaiNews APP Points – PT (Grape) officially launched, join Read to Earn!

PT (short for Grape in Chinese) is the points reward that LianGuaiNews users can earn by participating in interactive activities such as reading news, sharing content, liking, and collecting on the LianGuaiNews website and APP. PT Grape cannot be traded or transferred, but can only be used for redeeming various prizes in the “Points Mall” of LianGuaiNews and participating in various daily activities. Experience it now!

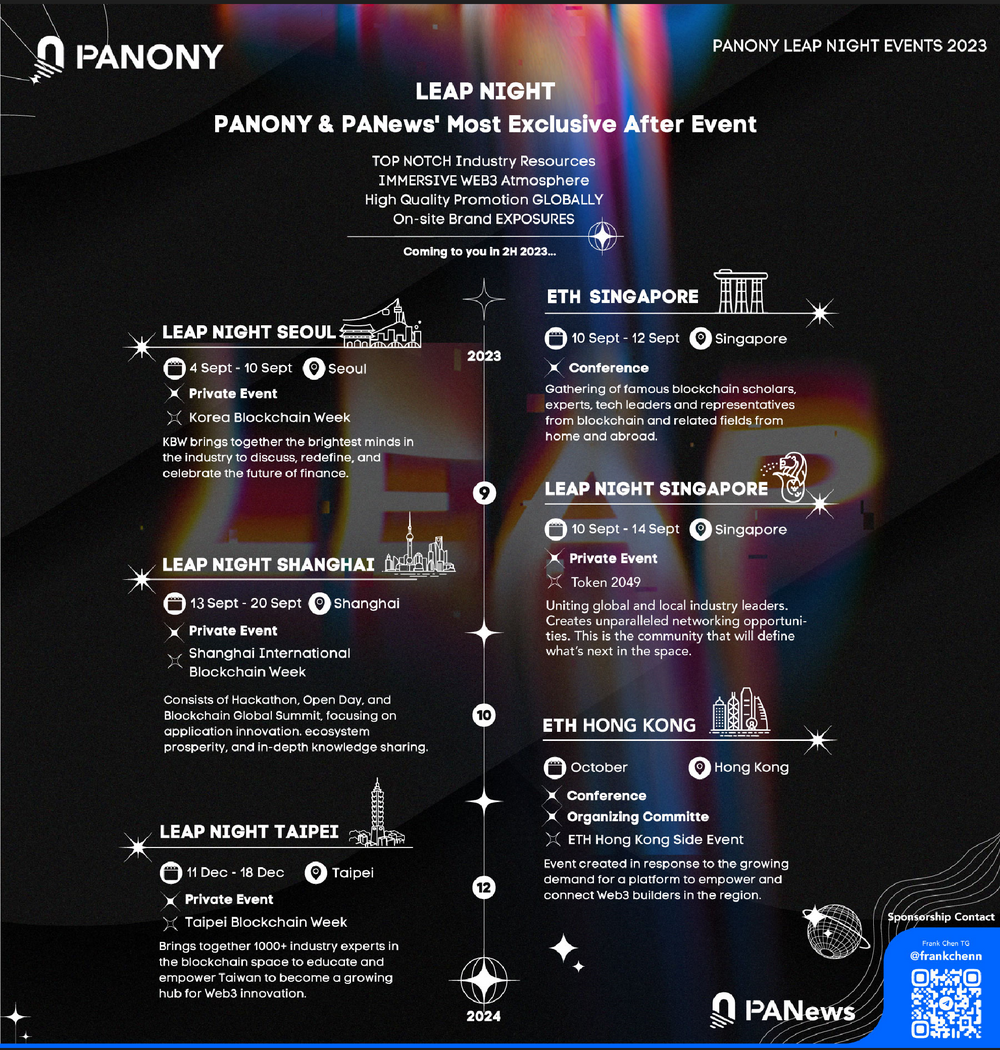

LianGuaiNews launches the global LEAP tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple locations gather to witness a new chapter in globalization!

📥 Activities are being jointly organized in multiple locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The inevitable outcome of Non-EVM public chains? Analyzing the reasons for the decline of ICP from multiple perspectives

- Latest developments in the Curve incident Has the crisis been resolved? Does the founder have to sell coins and pay off debts?

- OP Research Sociology Experiment of Currency and Global Citizens

- Exclusive Interview with 1inch Co-founder How does 1inch gradually innovate to grab food from the horse’s mouth in the liquidity battle?

- Extensive Article The Iron Curtain of Regulatory Control in the United States Has Fallen, What Tomorrow Will Crypto Face?

- Here is a list of cryptocurrency observations for the next week $LTC halving event, Evmos 2.0 launch…

- Outlier Ventures Data-Driven Token Design and Optimization