Radpie: Upcoming launch of RDNT’s “Convex”

RDNT's "Convex" to launch soon.Since its opening, Penpie$PNPIDO has risen fivefold. Magpie took advantage of this momentum and announced that it will continue to launch Radiant$RDNT’s “Convex” in subDAO mode. Can Radpie replicate or even surpass PNP’s returns under the blessing of multiple narratives?

This article will introduce you to the Radpie mechanism, product advantages and disadvantages, narrative tags, and participants in the Magpie IDO.

A. Radpie Mechanism

Simply put, Radpie is to RNDT what Convex is to Curve. In terms of liquidity incentives, the Radiant adopts restrictive measures. In other words, you need to indirectly lock a certain amount of RNDT to obtain mining rewards. Specifically, you need dLP equivalent to 5% of the deposit amount. dLP is an LP of an 80% RDNT/20% ETH Balancer pool. Once the proportion is less than 5%, you will not receive RDNT emission rewards.

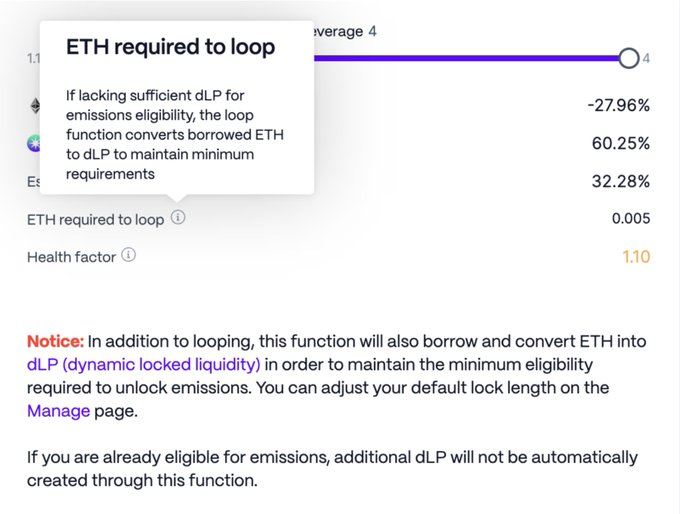

If you use RDNT’s one-click loop function, the system will automatically help you borrow money to buy dLP once your dLP proportion is less than 5%.

- How to Trust AI: What Ideas Does Zero-Knowledge Machine Learning (ZKML) Offer?

- Founder of Aave: “DeFi frontend applications” such as payments will drive widespread adoption of Web3

- Will Perp DEX lead the next bull market? Comparative analysis of the fee structure, indicators, and growth potential of six protocols.

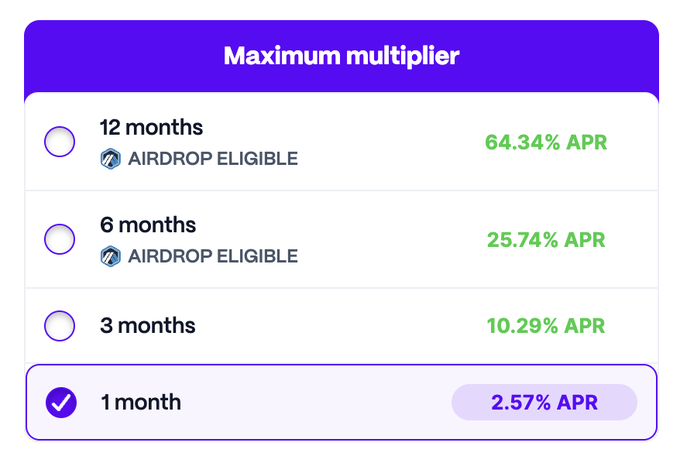

This also brings RDNT good sustainability, because when you are mining RDNT, you are actually providing long-term liquidity for RDNT. After all, dLP has a lock-up time requirement, and the longer the lock-up period, the higher the APR.

What Radpie does is to raise dLP and share it with DeFi miners, allowing DeFi miners to mine without holding RDNT, which is similar to sharing veCRV in Convex. The raised dLP will also be given mDLP tokens, which is similar to CRV being converted into cvxCRV through Convex.

For RNDT holders, they can form dLP and convert it into mDLP through Radpie, while holding RNDT positions to enjoy high returns. The logic is similar to cvxCRV, after all, dLP contains 80% RNDT and the price changes are very close to RDNT. For the Radiant project, this is also a good thing, after all, after converting into mDLP, it is perpetually locked, and part of RNDT is directly sent to the black hole to support the long-term liquidity of RDNT. In addition, it also helps to attract more lightweight users.

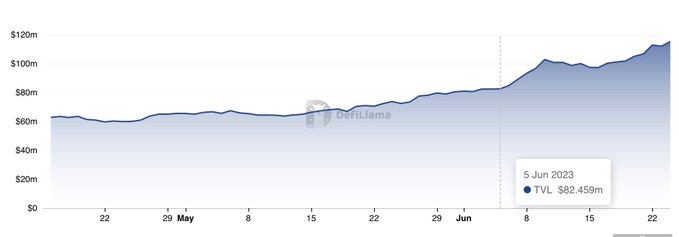

For example, in the figure below, Pendle started to accelerate growth after the launch of the Pendle series “Convex” product, and Radiant is also expected to benefit from this.

The downside is that Radiant lacks the incentive distribution decided by voting, like Pendle/Curve, so it lacks the bribery income.

However, Radiant has made it clear that it will continue to build DAO, so governance rights are expected to gain more value in the future, and Radpie, which holds a large amount of governance rights (dlp), is also expected to benefit from this.

B. Product Advantages and Disadvantages

Similar to Penpie, Radpie is also a project standing on the shoulders of giants, with clear upper and lower limits. Compared horizontally, Aura FDV is 35% for Balancer and Convex is 14% for Curve. As an FDV project with a market cap of $300 million and listed on Binance, RDNT’s valuation is also comparable. In accordance with Magpie subDAO’s consistent style, the FDV of Radpie’s IDO should be below 10M, which provides some profit space for IDO participants.

The disadvantage is that Radpie does not have the same horizontal expansion capability as the mother DAO Magpie, but it will also benefit from Magpie’s inner and outer circulation system of subDAOs, as described in the next section.

C. Narrative Tags

LayerZero/ARB Airdrop/Super Sovereign Leveraged Governance/Inner and Outer Circulation/SubDAO will be Radpie’s narrative tags

LayerZero, RNDT is a well-known LayerZero concept coin, and Radpie will naturally use LayerZero to achieve cross-chain interoperability.

ARB airdrop, RNDT DAO has decided to airdrop 40% of the ARB obtained to new locked dLPs for a period of time, and 30% to existing dLPs surviving for the next year. Radpie happens to catch up with this time point and is expected to participate in the feast of sharing these 2M+ ARBs, which is helpful for the project’s launch.

Super Sovereign Leveraged Governance, according to convention, a large amount of RDP will be allocated to the Magpie treasury. On the one hand, the income brought by these tokens will be distributed to MGP holders, and on the other hand, when Radiant DAO makes decisions, MGP holders can also participate through the RDP they control.

Considering that MGP participates as a whole in RDP and RDP in RDNT, this actually comes with a kind of leverage. If MGP votes for a certain option, since it holds the majority of RDP shares, it can basically be passed as long as others do not collectively oppose it. In the voting of RDNT, dLP, which is 100% controlled by Radpie, will also be voted for this option. This is the essence of super-sovereign leverage governance.

There is an inner and outer loop, which is a unique system generated by Magpie’s use of the subDAO model to expand in the governance race track.

For a simple example, the mdLP/dLP trading pair is highly likely to be deployed on Wombat, and more wom incentives will be obtained by bribing vlMGP holders. If mDLP is added to Pendle in the future, then Radpie will bribe Penpie.

These emitted tokens are still kept within the Magpie system, which is called internal circulation, reducing external net outflows.

External circulation refers to resource sharing between multiple projects to reduce costs and increase efficiency. For example, Ankr obtains Pendle incentives through Penpie Bribe, and if Radiant opens Bribe in the future, it will naturally be easy to negotiate.

SubDAO, it is not difficult to see that the super-sovereign leverage governance and the inner and outer loop system are based on the expansion of Magpie through the subDAO model. In addition to the above two, subDAO actually has other advantages. Firstly, in the current world of Rug, the most important thing for doing projects is reputation. The subDAO model can inherit the reputation of the parent DAO. Secondly, providing independent tokens can fully leverage the advantages of Tokenomics for growth. Thirdly, it provides more gambling tools to the market to ensure that the parent project can keep up with most narratives.

D. Participation in Magpie IDO

In Penpie, the IDO shares are distributed as follows:

- 35% – xGRAIL holders

- 30% – mPENDLE holders

- 25% – vlMGP holders

- 10% – Penpie LP providers

And so on, in the future, the participation in Magpie’s IDO can be divided into:

The long-term participation method is to buy and hold vlMGP, which is expected to participate in all Magpie subDAO IDOs in the future. However, this model is greatly affected by the fluctuation of MGP price, so please do your own research thoroughly.

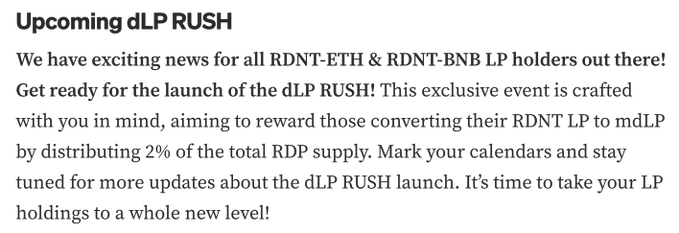

The participation method for short line arbitrage is to borrow RDNT through Binance collateral or short contract hedging, participate in the mDLP Rush activity to convert DLP into mDLP, and get RDP airdrop on one side and IDO share on the other. If you have a desire to hold the underlying token (RDNT), you can also buy and participate in mDLP Rush directly.

It should be noted that mDLP/DLP, like cvxCRV/CRV, is a soft link rather than a mandatory link, and may not be maintained at 1:1 when you exit, so dyor dyor!

In addition, LaunchBlockingd platform can also share a portion of the benefits, but to be honest, it makes little sense for such undervalued projects to raise funds through LaunchBlockingd platform.

PNP is expected to consider attracting traffic and contacting the ARB community through Camelot to help Magpie make a name for itself on Arbitrum, so it seems that Radpie no longer has this necessity?

Blockingncake/Camelot is a feasible candidate (Camelot is not that qualified🤣), but if there are no suitable terms, there is no reason to share the benefits, so the uncertainty in this area is still relatively high. And Cake & Grail has a large plate, and the arbitrage profit may be relatively small, but there are many uncertain factors.

summary

Radpie is the Convex of RDNT, and the biggest advantage is its low valuation + good to ride on the big tree. Rapie has five narrative tags: LayerZero/ARB airdrop/super-sovereign leverage governance/internal and external circulation/subDAO. IDO participation methods are diverse, suitable for both long and short positions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Gemini: Customers affected by Voyager’s bankruptcy can file claims through opening an account on Gemini

- OKX BTC browser officially supports Lightning Network now.

- Warning of new scam: tricking you into thinking big players are buying memecoins by transferring “fake WETH”

- Bankless: The Prosperity and Challenges of Optimistic Rollup

- Inventory of DAO trends that have received ARB airdrops: Balancer, Radiant, Stargate DAO……

- Is cryptocurrency the biggest scam in history? A decade-long history of love and hate between enthusiasts and critics

- Evolution of the Web3 Community: The Decline of PFP Community and the New Dawn of NFT