In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?

MakerDAO attracted $700 million in deposits in less than a week. Is the 8% interest rate really that appealing?Author: LianGuaiBitpushNews Mary Liu

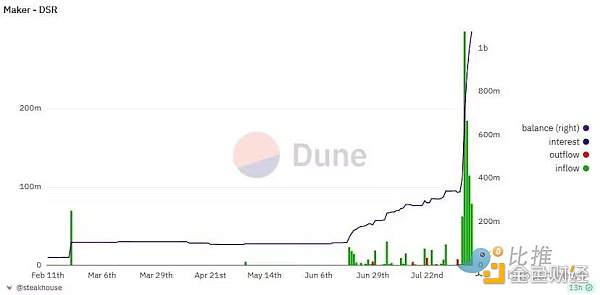

Dune data shows that after MakerDAO raised the Dai Savings Rate (DSR) from 3.3% to 8%, MakerDAO has attracted nearly $700 million in funds deposited. The purpose of this move is to promote the adoption of the stablecoin DAI, the LianGuairk Protocol, and DSR.

Since the interest rate increase, the amount of DAI deposited in DSR has doubled to over $1 billion.

- Exploring the future trends of the NFT space through eths

- Even older than Ethereum itself? A Brief History and Current Situation of MEV

- Function hidden in the LianGuaiyLianGuail stablecoin code can freeze assets and clear addresses.

DAI now offers the highest yield among stablecoins, surpassing various money market yields and DEX LP returns. Many crypto celebrities are also participating. On-chain data shows that Tron founder Justin Sun’s wallet exchanged over 90,000 stETH for 77.8 million DAI and deposited it into Maker. With an annual yield of 8%, he can easily earn over $10,000 daily.

Maker previously raised the savings rate in May from 1% to 3.3%. With the introduction of Curve and Aave’s new stablecoins, this move aims to solidify DAI’s market share in the stablecoin market.

Curve’s crvUSD and Aave’s GHO allow users to mint stablecoins based on the protocols that generate revenue. This means that users can continue to earn passive returns while gaining stablecoin liquidity based on their assets.

Therefore, the increase in DSR allows DAI to compete with its new rivals for market share. The LianGuairk Protocol is a branch of Aave v3 lending protocol launched with the support of MakerDAO in May. The DAI-centric money market has also created new use cases and revenue opportunities for DAI holders, allowing depositors to access DSR and obtain loans by collateralizing DAI.

Volatility in the Aave DAI Market

The interest rate on DAI on the top money market protocol Aave v3 has experienced significant volatility in recent months.

From February to mid-June, the borrowing cost of DAI remained stable between 2% and 4%, with a peak increase of up to 10%. On July 13th, the rate skyrocketed to 31% and touched 26% twice before the end of the month.

In the first week of August, the rate is still fluctuating and appears to be rising again.

The rise of LianGuairk may provide alternative sources of income for stablecoin holders, thereby exacerbating the volatility in Aave’s DAI market.

Is the Strategy Sustainable?

A report published by Delphi Digital shows that this strategy has significant financial implications. With the DSR currently set at 8%, Maker’s annual cost is estimated to be $54 million. Therefore, this will reduce Maker’s projected annual profit from $84 million/year to $41 million/year. Nevertheless, it can be seen as the customer acquisition cost that reignites the demand for DAI.

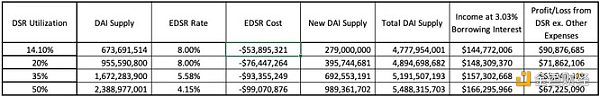

Analysts say that EDSR is calculated based on a multiplier of 3.19% of the DSR base rate. As the utilization rate of DSR increases, this ratio will shrink, with a cap of 8%:

0-20% = 3x DSR = 8%

20-35% = 1.75x DSR = 5.58%

35-50% = 1.3x DSR = 4.15%

As more and more DAI is minted, Maker’s interest generated by newly minted DAI will exceed the interest it pays for DSR. However, as DSR deposits increase, this dynamic will put pressure on Maker’s profits, causing profitability to decline unless it reaches the level of 4.15% EDSR.

Delphi Digital believes that the enhanced version of DAI DSR provides an attractive on-chain alternative compared to US Treasury bonds. Given its higher yield, the DSR utilization rate may stabilize below 35%, consistent with the current Treasury bond benchmark rate of 5.5%. This strategic move aims to promote the development of Maker and lay the foundation for the introduction of the Maker SubDAO, with the goal of increasing demand and utility for DAI and MKR tokens.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LD Capital Understanding the Current Situation of CyberConnect in One Article

- Web3 advertising startup HypeLab has completed a $4 million financing round, led by Shima Capital and Makers Fund.

- Onchain Summer has started. How to play with the Base chain?

- LianGuaiWeb3.0 Daily | Hong Kong-listed companies have approved a budget of $5 million to purchase cryptocurrencies.

- Grasp the opportunity of MEKE public beta and seize the core of Binance Chain Odyssey.

- Analyzing the Landscape of Investment DAOs Definitions, Categories, Structures, and Design Space

- Exploring the Potential of SocialFi Decentralized Social Media