Market analysis on May 23: Bitcoin volume fell, callback mode opened, when can I bargain?

After two days of shocks, Bitcoin couldn't help the huge pressure above and began to retrace. From the point of view of volume, it began to fall in volume and the slump was very serious. Mainly due to the excessive increase in the previous period, the profit margin is more, and once the decline sells, the sentiment is more serious.

As for the risk of falling, it has long been reminded. If you look at the article two days ago, you can see that the indicators are seriously deviated and begin to weaken. Once there is a drop, the extent of the fall will not be small.

As for the chip that has been trapped, this time it is trapped, and liberation may take a little time. After all, the double top constitutes, and in the short term, it is believed that many parties will not rashly attack.

In fact, the process of this pull-up has begun to be weak, coupled with the continuous narrow range of shocks, giving the time of shipment, no funds to enter the market, the market is a matter of time. But most of the leek has been brainwashed by the crazy rise ahead, and the subconscious mind thinks it will rise again and choose to take over.

- Following Tencent and Alibaba, the Crypto.com chain received a commercial license for Intel® SGX

- Getting started with blockchain: Why do bitcoin transfers have to wait for 6 confirmations before they arrive?

- CoinEx goes online for a sustainable contract, perfecting the digital currency service ecosystem

I know that I have been very cautious, and I would rather be tempted to attack. Recently, many of my friends asked me what currency I invested in. I chose to silence or reject it. It is really not a good time to buy. The risks and benefits are not proportional to each other. There is no need to take risks.

If you don't return the currency, if you don't know how to invest, you can pay attention to the public number: the big devil in the currency circle, and speculate with me to learn the investment logic.

Look at this wave of killing volume and trend, and further decline trend, may be able to stabilize near $6,800, temporarily can not be bargain-hunting. If you want to rebound, you can focus on heavy volume, but the profit is small, the risk is big, and the best is still waiting.

From the indicators point of view, bitcoin volume fell, fell below the 5 day line, and MA5 and MA10 dead fork form, the trend is very weak in the short term, Bollinger line continues to go up, then may start to close, Bollinger middle track is a support point .

The short-term KDJ has begun to move down, the RSI has also fallen back to around 50, the buyer's strength is decreasing, the MACD is high, the green column disappears, and the red column begins to appear.

In the short term, it is still bearish, and the rebound is the time to lighten up the position. For the time being, don't cut the bottom, there is still room for it, and the support is $7,300 and $6,800.

ETH once fell below the 5th and 10th lines, and it is more likely to continue to explore. At 210 US dollars, there is support for the Bollinger Middle Track. The DIF of the MACD moves down, the Death Fork is about to form, the Green Column is short, and the RSI returns. The normal level of 50; KDJ continues to go down and continues to fall in the short term. The Yin line in the K line can be enlarged and the throwing pressure is large.

In the short term, there is no need to go to the bottom, there is still room for decline, and it is possible to choose whether to dip the bottom according to the trend in the vicinity of 200-210 USD.

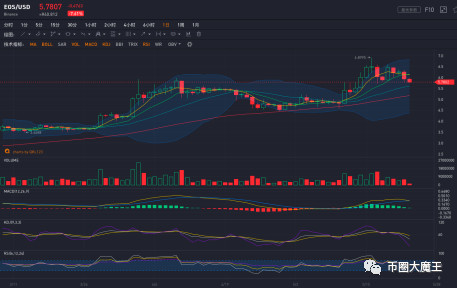

EOS fell below $6 and once again announced that the upside failed. The last article emphasized that EOS is weak, and that $6 is not an effective breakthrough. Today it falls and supports $5.5, which can focus on support.

From the point of view of indicators, it is still a heavy volume decline, barefoot Yinyin line, there is a tendency to continue to fall. The short-term indicator KDJ has fallen below 50, the RSI is also below 50, the buyer is watching, the short-term kinetic energy is very strong; the MACD dead fork is formed, the Bollinger line closes, begins to weaken, and does not want to bottom out in the short term.

Judging from the megatrend, the decline will continue, and it will fall below the bottom of the last plunge. It is unlikely to be lifted at the bottom of the second round. Therefore, it is not wise to bargain-hunt in the short term, and it can wait for the decline to stabilize. Buy. If you don't return the currency, if you don't know how to invest, you can pay attention to the public number: the big devil in the currency circle, and speculate with me to learn the investment logic.

This article data source: QKL123

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: Bitcoin faces the test of the 15th moving average of the sky, and the key points are coming!

- Comparison of the advantages and disadvantages of the Staking revenue generation tool

- Why did the Sino-US trade war have a stock market crash and bitcoin strengthened?

- The Ministry of Public Security named the fake project "BRIC Digital Currency" and carefully covered the pyramidal chain MLM project!

- Twitter Featured: Coin An Zhao Changpeng sued Sequoia for damage to his reputation

- Unique BBFT consensus algorithm, Bystack creates a hundred times EOS level TPS high performance blockchain

- DeFi Outlook: The future of the "code world" dominates?