Understanding MEV and opportunities for Oracle extractable value

MEV and Oracles in Blockchain Networks # Introduction Miner Extractable Value (MEV) is the total value that miners or validators can extract by reordering, including, or excluding transactions within a blockchain network. Oracles, which are trusted third-party entities, can provide information about the state of a blockchain network and leverage MEV. # MEV and Oracles Oracles can provide information about the price of cryptocurrencies or the outcome of events, which can be used by miners or validators to maximize their profits by including or excluding transactions from the blockchain. # Opportunities for MEV-Enabled Oracles MEV-enabled oracles can provide opportunities for prediction markets, decentralized exchanges, and insurance protocols. For example, a prediction market can use an oracle to determine the outcome of an event, and miners or validators can use this information to maximize their profits. # Conclusion MEV and oracles enable miners and validators to extract value from transactions, providing significant value to blockchain networks. As blockchain technology evolves, MEV is likely to play an increasingly important role in the ecosystem.Author: Siddhearta, BanklessDAO Editor, Bankless Consulting Assistant Translator: Blocking, Good Europe

Maximum Extractable Value (MEV) has become an increasingly important topic in the DeFi ecosystem due to its negative impact on decentralized applications (dApps) and users. MEV can be understood as a hidden tax on dApps and users, as it increases transaction costs, reduces the profitability of liquidity providers, and may have a negative impact on user experience.

MEV refers to the maximum profit that MEV bots (also known as “searchers”) can capture by identifying and exploiting opportunities in the order, inclusion, or exclusion of transactions in the blockchain. Validators are the roles that process transactions and protect blockchain security. They have the power to determine the order of transactions in the blocks they validate, creating opportunities for searchers to maximize profits. By monitoring opportunities in the memory pool, searchers can execute various strategies such as front-running trades, exploiting arbitrage opportunities, and even prioritizing certain transactions with higher gas fees, which may delay or cancel the execution of lower gas fee transactions.

MEV Based on Oracle Updates

A subset of MEV is related to oracle updates, which involves using oracle data to gain unfair advantages and earn profits. Oracles are an important part of DeFi as they provide real-time data to smart contracts. These data points support various functions, including loan collateral, token exchange, and derivatives trading. Given the critical role of oracles in DeFi applications, they may become targets of MEV attacks.

- Ethereum 2023 Q2 Data Research: Gross Profit of $700 million, ETH Burn Rate Accelerated to 0.8%

- Mint Ventures: Concerns about MakerDao go beyond RWA exposure

- Introduction to Words3, the Full-Chain Game: A Word Chain Game Developed Based on MUD.

Front-Running

In this case, the MEV searcher monitors transactions pending in the memory pool and submits their own transaction with a higher gas fee to “cut in line” ahead of the target transaction. This allows searchers to take advantage of opportunities before the original user executes their intended transaction.

For example, if an oracle is about to update price information for a token, searchers can take advantage of this information asymmetry to execute trades or adjust their collateral ratios on lending platforms to maximize profits or minimize losses. This behavior of taking advantage of temporary price differences often makes the situation worse for other users than if there were no interference.

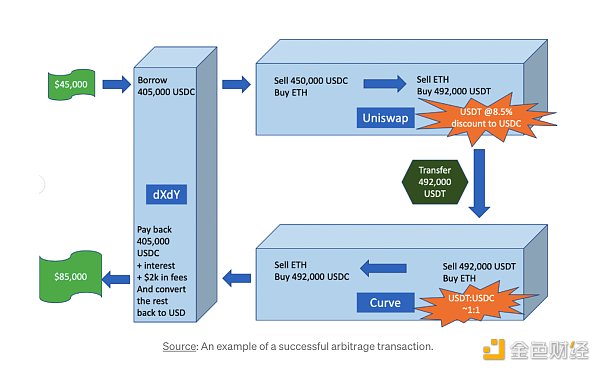

Arbitrage

Oracles also support communication between different blockchains. Given that assets can be traded in the form of derivatives on separate networks, oracles are used to pass price information across multiple liquidity sources, which can lead to slight and significant price differences. These differences provide arbitrage opportunities for different asset pools.

MEV searchers can detect price differences across different markets prior to an update. They take advantage of this by purchasing assets in the cheaper market and then selling them on the more expensive market.

API3 OEV LiteBlockingper focuses on Synthetix and GMX as examples, explaining how the lack of granularity due to threshold-based rules (determining when to update the feed) creates arbitrage opportunities that negatively impact protocol performance and user experience. If the data source shows an outdated price compared to another market, searchers will rush to trade at that price because they know they can immediately sell that asset in another market for a profit. This situation forces liquidity providers to accept a continuous stream of unprofitable trades, resulting in losses and decreased protocol performance. These issues forced Synthetix to implement a Uniswap time-weighted average price (TWAP) oracle along with Chainlink to determine asset pricing. However, this solution is not perfect, as TWAP oracles essentially provide outdated prices and bring additional obstacles to listing additional assets.

Liquidation

Oracle updates also offer opportunities for profitable liquidations. MEV searchers can identify under-collateralized loans in lending platforms and quickly submit transactions to liquidate those loans ahead of other users or bots. By being the first to liquidate, searchers can earn liquidation bonuses and other rewards.

These are just a few examples of the different types of MEV attacks that Oracle updates can trigger in the blockchain and DeFi ecosystem. This is a relatively ongoing battle, with developers continuously designing solutions to enhance the security, fairness, and resilience of networks. Currently, two main approaches have been proposed to mitigate MEV problems: MEV-Boost and proposer-builder separation (PBS).

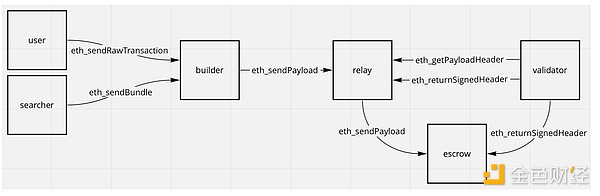

MEV-Boost is an iterative version of the original Flashbots mechanism, introducing a set of measures and roles aimed at reducing the negative impact of MEV, including Builder API, block builders, custody mechanisms, validators, searchers, and relays. The Builder API is a tool that allows validators and block builders to interact effectively and prevents validators from tampering with block contents for the sake of MEV profits. Block builders leverage profitable transaction strategies found by searchers to construct profitable blocks. These transactions are validated by relays before reaching validators, with custody mechanisms ensuring all necessary data is available. Once validators add the block to the Ethereum network, they receive transaction fees and MEV rewards.

Source: https://ethresear.ch/t/mev-boost-merge-ready-flashbots-architecture/11177

MEV-Boost benefits the Ethereum network by preventing centralization, reducing gas fees, and enhancing user privacy. The mechanism democratizes the opportunity to obtain MEV profits, reduces the risk of centralization, and allows individual stakers to earn MEV profits without joining large staking pools.

The proposer-builder separation (PBS) is part of the planned Danksharding upgrade, which will have different entities managing block proposals and block production. MEV-Boost, as a precursor to PBS within the protocol, provides a glimpse into what PBS could look like once implemented. PBS aims to reduce the negative impact of MEV on the decentralization and security of the Ethereum consensus layer, and inspire the development of consensus-layer logic necessary for implementing external block construction in Ethereum.

However, neither PBS nor MEV-Boost directly addresses the MEV opportunity brought about by oracle updates. Instead, these approaches primarily focus on reducing the negative impact of MEV on the decentralization and security of the Ethereum consensus layer. To address the MEV opportunity brought about by oracle updates, a different approach is needed.

Learn about OEV-Share and create opportunities for sustainable and efficient dApps

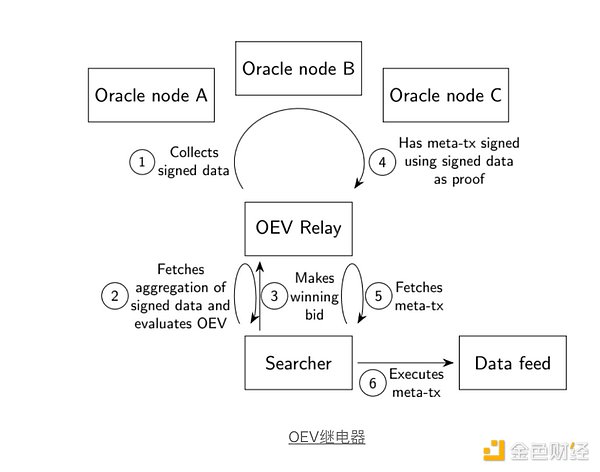

MEV presents significant challenges to users and dApps, but also provides an opportunity to design new solutions that make the ecosystem more efficient. One opportunity to improve the efficiency of DeFi protocols is to address the MEV issues related to oracle updates, which creates an opportunity to extract oracle-extractable value (OEV).

In API3’s OEV LiteBlockingper, API3 introduces an off-chain market that allows dApps to auction off meta-transactions signed by first-party oracles to update data sources. In this model, bidders compete for the right to update the oracle and collect the MEV associated with the transaction. The winning bidder is allocated to the dApp and external oracle provider. This creates a more efficient system where the price feed is updated when the dApp needs it, rather than being affected by a bias threshold. Overall, the system design can be compared to the Flashbots relay, but bidders bid on oracle updates rather than block space.

API3 is working to redesign the oracle update process to minimize the impact of MEV. By implementing novel mechanisms to protect oracle data from exploitation, their goal is to ensure that oracle updates are safer and more transparent. This can lead to a more powerful and efficient DeFi ecosystem, ultimately benefiting users and applications.

The benefit of OEV is that the value captured by searchers is shared with the protocol from which it originates. This approach minimizes the negative externalities from extracting MEV from dApps and helps create accurate and low-latency oracles. When MEV extraction does not incentivize oracle updates, the price feed will be updated based on normal deviation thresholds and heartbeat time.

OEV-Share does not counter MEV opportunities and attempt to eliminate value loss in the network, but instead uses shared incentives to recapture and repurpose the value of MEV opportunities to create a more efficient and sustainable DeFi ecosystem.

OEV benefits the entire DeFi ecosystem

One of the core challenges faced by oracles is how to bring real-world data onto the chain. As cost limitations hinder data feed updates for every block, oracles must strategically decide when to update, making oracle architecture crucial in addressing this challenge. This challenge has a negative impact on the DeFi ecosystem, leading to reduced profits and potential loss. OEV-Share provides an opportunity to turn these challenges into advantages for users, dApps, and the entire DeFi ecosystem.

By capturing OEV through the use of API3’s order flow auctions, dApps can minimize the negative externalities caused by MEV extraction. This model allows MEV searchers to bid on the right to update oracles, turning the problem into an opportunity. Winning benefits users and dApps, while successful MEV searchers update oracles and gain relevant value.

The long tail advantage of OEV is that it can create accurate and low-latency oracles. More accurate data and value captured from order flow auctions can be used to increase the profitability and sustainability of liquidity provision, providing more optimized market-making protocols for applications that rely on oracles. Improvements in dApp liquidity provider market-making will create a flywheel effect, attracting more liquidity to applications, while lowering fees and listing more assets, attracting more users and trading volume.

Oracle Extractable Value solves a key challenge in the DeFi space by improving oracle efficiency and creating value for all parties involved. By minimizing the negative impact of MEV and increasing data accuracy, API3 is paving the way for a more sustainable and profitable DeFi ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Arbitrum and the Dawn of a New Era: Exploring Ethereum’s Cancun Upgrade and the Future of $ARB

- Founder of Folius Ventures: 8 Insights on the Development of the Cryptocurrency Field

- LD Capital: Summary of NFT Lending Platform Updates

- Decoding Ambient Finance: An Efficient Two-Way AMM Protocol Combining CEX and DEX Advantages

- Interpreting Entangle Protocol: Convert any asset into LSD to solve the liquidity problem across the chain

- Viewpoint: Why is it not a good idea to bet 100% on Ethereum, using Lens and dYdX as examples?

- Some thoughts about NFTFi: NFTs, as a more easily understandable trading asset and a carrier for more attributes in SocialFi and GameFi, will continue to exist.