Cregis Research: The Value of Ethereum Account Construction Archaeology and Account Abstraction

Cregis Research: Ethereum Account Construction and Abstraction's ValueBefore discussing the value of account abstraction (AA), it is necessary to review the Byzantine problem and the pain points of Ethereum.

In traditional internet transactions, when A pays B for online shopping, two things happen: 1) A transfers the value of the money to B, which is value transfer; 2) A notifies B of the payment of one dollar. From the perspective of information, A loses one dollar and B gains one dollar. Only when the above three pieces of information are confirmed at the same time, an online shopping order is considered complete. How to synchronize the confirmation of the above three processes can be understood as the Byzantine problem.

Bitcoin or the Byzantine problem aims to achieve atomic operations in the real world in the Internet or computer environment, that is, information transfer occurs at the same time as value transfer. However, based on its decentralized concept, Bitcoin cannot construct a complex Internet environment.

In 2012, Vitalik Buterin, who had not yet become famous, proposed to add Turing completeness to Bitcoin Core based on Bitcoin to achieve more functions, but was mercilessly rejected. He then established the Ethereum ecosystem. Although the birth of Ethereum and smart contracts has taken the blockchain world to a new height, Ethereum running in a decentralized environment still faces the biggest pain point: linear environment cannot execute high concurrency and complex code compilation. This is why V God has been encouraging users to enter the layer 2 network, advocating contract wallets and account abstraction, and even encouraging users to give part of their privacy to the project party in exchange for social login, social recovery and other user experiences close to Web 2.0. The reason is that if Ethereum does not make these changes, it will never be able to realize its vision and can only be a subsidiary of Bitcoin.

- Understanding MEV and opportunities for Oracle extractable value

- Ethereum 2023 Q2 Data Research: Gross Profit of $700 million, ETH Burn Rate Accelerated to 0.8%

- Mint Ventures: Concerns about MakerDao go beyond RWA exposure

Core topic 1: What is account abstraction?

There are two types of accounts on the Ethereum public chain. One is called an external address account (EOA), which is characterized by free creation and can initiate transactions directly through signatures. The other is a contract account (CA), which has its own code area and data area and is essentially a smart contract, so it cannot initiate transactions directly. Since creating a contract account = creating a smart contract = executing on-chain interaction, it needs to be paid (this is the causal relationship mentioned by V God in the debate about MPC wallets and CA wallets, that the creation cost of a CA wallet is xx dollars). When EOA sends an asset to CA, theoretically, this CA can become an Account Abstraction (AA) wallet.

Account abstraction (AA) wallet can be understood as a decentralized “bank”. EOA can place assets in this “bank”, and when a transfer is needed, it only needs to notify the “bank” to complete the transfer operation. In this way, value transfer and information transfer no longer occur simultaneously on EOA, but occur on an abstract account. Of course, these transactions still need EOA to issue transaction instructions and sign for execution.

Core Topic 2: How is the function of account abstraction realized?

With the content update of the EIP-4337 protocol, the capital market’s hype (or deification) of the account abstraction concept has reached its peak, among which the most famous are the concepts of [social login], [social recovery], [stranger device recovery], [feeless transfer], etc. However, the contract account (CA) itself is a decentralized product, and the operation of asset chain transactions still needs to be signed and executed by EOA, so social login/recovery through web 2.0 information, biological information, and identity verifiers. The necessary centralized service cooperation (this is also the reason why V God even encourages users to surrender some privacy in exchange for a user experience close to Web 2.0).

However, the [stranger device recovery] function, which is highly controversial in the EOA wallet (for example, the private key recovery service previously launched by the Ledger wallet), can be achieved in the CA wallet by writing backup EOA into the smart contract, without any sensitive information being handed over to the wallet operator. No need to surrender any privacy information, so it is safer than the recovery function introduced by EOA wallet.

Finally, how is the [feeless transfer] realized? First of all, everyone pays attention to a key point: CA wallets and account abstraction (AA) wallets can only run on public chains that support EVM, and the main battlefield must be Ethereum. As we all know, before the EIP-1559 proposal was implemented, Ethereum’s POW miners could freely choose a chain transaction for free packaging, but after the EIP-1559 proposal was passed, due to the necessary payment of the deflationary burning base fee, the Ethereum network did not exist. There are truly free transactions. Next, Cregis Research will analyze in detail how the [feeless transfer] of the AA wallet is realized:

First of all, taking the USDT smart contract as an example: it contains a code area and a data area. The data part can be understood as a table, which records how much USDT each EOA has, that is, the balance of each EOA. When transferring, a balance of an account will be deducted and the balance of another account will be increased.

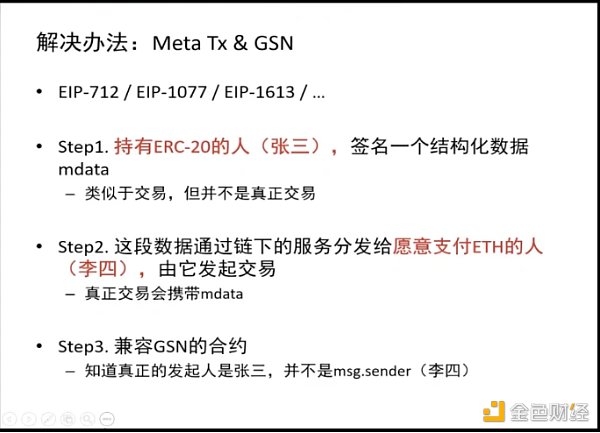

At this point, we can think of it in terms of game-fi or social-fi: the project side hopes to lower the participation threshold so that users can participate without holding gas fee. Although the current Ethereum EOA cannot achieve this, smart scientists have still thought of an indirect solution: Meta Tx & Gas station network (GSN). The principle is that the token trader (Zhang San) signs and executes structured data similar to the transaction (mdata) and sends it to someone (Li Si) who is willing to pay the gas fee. Li Si sends the transaction containing the mdata to the smart contract compatible with GSN and pays the on-chain gas fee to complete the transfer, and the consensus node of the Ethereum network confirms that Zhang San is the initiator of the transfer.

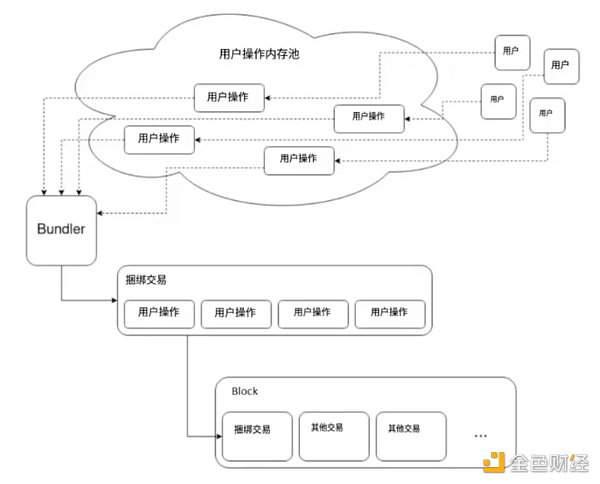

The above solution is an important part of the EIP-4337 proposal. The EIP-4337 proposal is a transaction optimization scheme that does not change the Ethereum consensus layer: when a user wants to initiate a transaction, they only need to pass a msg, but this msg is not sent to the Ethereum mainnet, so the user does not need to pay gas fee. The msg will be sent to a memory pool, and authentication will be performed according to the EIP-4337 standard in the memory pool. If it is confirmed to be correct, it will be published to the Ethereum chain by the operator’s EOA and finally recorded by the POS node. In addition, the EIP-4337 proposal also includes a series of standards for the benefits that packagers can get, and how to refund if the packaging fails; PS. If a method of hiding the association between the operator’s EOA and msg is added to the EIP-4337 proposal, privacy transactions can also be realized.

EIP-4337 proposal: a plan that does not change the Ethereum consensus layer

The mystery is solved: Account Abstraction (AA) Wallet=Contract Account (CA)+Off-chain Communication Standard

Analyzing to this point, I believe everyone understands that although the content of the EIP-4337 proposal may take 11 to 13 months to complete, the Account Abstraction (AA) wallet can not only be implemented through the EIP-4337 protocol, so there are indeed real AA wallet products on the market, but the EIP-4337 protocol is likely to be the operation standard and scheme with the highest recognition.

As an old-fashioned enterprise-level wallet, Cregis can certainly provide CA and GSN services: CA is optional in private deployment, and GSN was deployed on the Tron network in April this year, saving customers 1.93 million TRX so far. However, Cregis has not been eager to launch AA wallet services, and the reason is that the industry standards mentioned above have not yet been implemented, and hasty launch may lead to future products not being compatible with mainstream standards.

The well-known multi-signature wallet operator Gnosis·Safe also implements multi-signature function through contract accounts (CA), and is also not eager to launch AA wallets, which may also have concerns in this regard.

Core Topic 3: Is the AA wallet really perfect? What are the shortcomings?

There are many advantages to the AA wallet, but it is not perfect. A week ago, V God commented on CA and MPC based EOA in his own Twitter AMA. Various bigwigs also discussed it very deeply under this tweet. Here are a few objective defects:

-

The cost of creating CA is very high. The more prosperous (congested) the Ethereum network is, the more expensive it will be;

-

The security of CA depends on the builder of the smart contract. If the smart contract has vulnerabilities or the builder leaves a malicious backdoor, the security of user assets is in danger. The staking contract of the cross-chain bridge is also a CA, and the frequent theft cases and large-scale stolen assets of the cross-chain bridge are all risk warnings for CA wallets;

-

CA can currently only run on EVM chains, and does not support token payments of BTC and non-EVM public chains. This is also why Cregis can provide CA, but also needs to provide other wallet solutions to take into account the diversity of payment methods for enterprise-level users.

-

Calling a CA wallet depends on the EOA signature. The EOA generated by the seed phrase needs to be signed by the private key, and if the private key is not properly kept, it may still be stolen, and the security logic has not been upgraded.

As one of the onlookers of this hot AMA, the view of Cregis Research is: there is no absolute security path in the world of blockchain, and it is the responsibility of each user to make trade-offs between convenience and security. Providing users who choose Cregis with tools that are both safe and convenient is Cregis’s responsibility: providing a fully self-managed MPC (multi-party computing) wallet + optional private deployment plan (including CA) + rich financial SaaS functions to provide Web 3.0 entrepreneurs with a new asset collaboration management platform.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introduction to Words3, the Full-Chain Game: A Word Chain Game Developed Based on MUD.

- Arbitrum and the Dawn of a New Era: Exploring Ethereum’s Cancun Upgrade and the Future of $ARB

- Founder of Folius Ventures: 8 Insights on the Development of the Cryptocurrency Field

- LD Capital: Summary of NFT Lending Platform Updates

- Decoding Ambient Finance: An Efficient Two-Way AMM Protocol Combining CEX and DEX Advantages

- Interpreting Entangle Protocol: Convert any asset into LSD to solve the liquidity problem across the chain

- Viewpoint: Why is it not a good idea to bet 100% on Ethereum, using Lens and dYdX as examples?