No longer hesitant, two bills reveal the latest ideas on cryptocurrency regulation in the United States.

New US bills propose cryptocurrency regulation.Are cryptocurrencies really regulated? Bitcoin appeared in 2008, why doesn’t the US have a complete regulatory system in 2023?

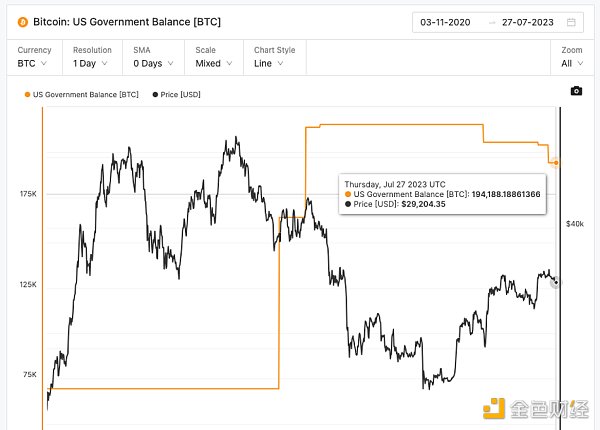

The attitude of the US government towards cryptocurrencies is very ambiguous. On one hand, regulatory agencies are increasing their enforcement efforts and cracking down on cryptocurrencies. In the first half of the year alone, the SEC has filed lawsuits against major institutions such as Genesis, Kraken, Binance, Coinbase, and others. On the other hand, the US government holds the most bitcoin. According to data from Glassnode, as of July 27th, the US government holds a total of approximately 194,188 bitcoins, accounting for about 1% of the bitcoin supply, with a market value of approximately $5.68 billion. Although these bitcoins are seized (free of charge), unlike other governments, the US government is not in a hurry to liquidate the seized bitcoins, but chooses to hold them.

Since the emergence of bitcoin in 2008, the cryptocurrency market has experienced explosive growth, with a market capitalization of $1.1 trillion. During the COVID-19 pandemic, the US government considered the cryptocurrency industry as a means to stimulate economic development and increase employment. However, due to regulatory loopholes, illegal activities related to cryptocurrencies such as fraud, money laundering, and cyber attacks have frequently occurred. In particular, the collapse of major institutions such as Terra and FTX has intensified the call for stronger regulatory policies in the market. Recently, the European Union and the UK have already launched their own cryptocurrency regulatory frameworks. In order to ensure the US’s position in the global cryptocurrency field, attract more industry companies to stay in the US, and prevent capital outflows, the US has to accelerate the promotion of relevant policies.

- Insights from the gambling industry From GGR to NGR – The law of attraction for cryptocurrency games?

- In 2023, AI chip companies are undergoing a deadly three-question challenge.

- In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?

In September 2022, the Biden administration released the first regulatory framework for cryptocurrencies and urged regulatory agencies such as the CFTC and SEC to develop specific rules for digital assets. In just 2022, the US Congress has proposed more than 50 bills related to digital assets. Recently, the cryptocurrency market regulation bill “21st Century Financial Innovation and Technology Act”, passed by the House Committee, is considered to be a milestone in the regulation of cryptocurrencies in the US, while the “Responsible Financial Innovation Act” proposed by the Senate is considered to be its strong competitor. Both bills are expected to help the US establish a viable cryptocurrency regulatory system.

This article will analyze in depth the factors that influence the US’s stance on cryptocurrency regulation, as well as how these two bills will shape the US cryptocurrency regulatory framework and evaluate the potential impact of this change on the market.

The Challenge of Cryptocurrency Regulation in the US: Who is in charge of cryptocurrencies?

Are cryptocurrencies regulated in the US? The answer is yes.

-

In 2013, the US Department of the Treasury defined bitcoin as virtual currency and classified cryptocurrency exchanges and management institutions as Money Services Businesses (MSBs), requiring them to comply with FinCEN’s anti-money laundering policies.

-

In 2014, the Internal Revenue Service (IRS) classified cryptocurrencies as property and required taxation on them.

-

In 2015, the Commodity Futures Trading Commission (CFTC) classified bitcoin and ethereum as commodities and brought their trading under regulation.

-

In 2017, the Securities and Exchange Commission (SEC) stated that ICOs are securities offerings and should be registered with the SEC and comply with anti-fraud regulations.

-

In 2021, the Infrastructure Bill defined digital assets as cash.

It is not difficult to find that in the United States, different regulatory agencies have different definitions of cryptocurrencies/digital assets. This is also one of the important reasons why the US government has been unable to establish a complete regulatory system, that is, regulatory agencies cannot define what cryptocurrencies are and who should be responsible for them.

Cryptocurrencies go beyond the classification framework of traditional assets. If a traditional financial asset is a commodity (such as gold, coffee), it should be regulated by the CFTC; if it is a security (such as stocks, bonds), it should be regulated by the SEC; if it is a currency, the situation becomes more complicated and it is subject to regulation by multiple institutions such as the Treasury Department. However, cryptocurrencies may have one or more attributes of assets. Taking ETH as an example, ETH can be bought and sold on exchanges, so it has the attribute of a commodity; at the same time, it can be used as a medium of exchange for various goods and services in the Ethereum network, so it has the attribute of currency; in addition, Ethereum was similar to traditional securities issuance during early ICO sales, so it has the attribute of security.

Conflict between SEC and CFTC

Due to the difficulty in defining the nature of cryptocurrencies, the division of responsibilities among regulatory agencies is unclear, resulting in many overlaps and gaps in the regulatory system. Among them, the conflict between the CFTC and the SEC is particularly prominent.

First of all, in US law, the boundary between securities and commodities is blurred. The federal securities law defines “investment contracts” as a type of security, that is, one party invests in another and expects to receive returns through the efforts of others. Based on this definition, SEC Chairman Gary Gensler has claimed that most cryptocurrencies should be classified as securities and be regulated by the SEC.

However, in commodity trading law, “commodity” almost covers all goods and services, including Bitcoin and other cryptocurrencies. (In fact, securities can also be considered as a type of commodity.) The overlap between the concepts of “commodity” and “security” has led to ongoing debates between the SEC and the CFTC in recent years.

However, the CFTC primarily regulates derivatives trading of commodities and has relatively limited regulatory authority over spot trading. It can only prosecute when fraudulent and manipulative activities are found in digital assets. This has led to a problem: when a cryptocurrency asset does not belong to securities and does not engage in derivatives trading, neither the SEC nor the CFTC has the authority to regulate it. This situation is not uncommon, for example, in the case of DAO, where token holders are also the managers of the protocol, it is not within the SEC’s regulatory scope (because it does not meet the standard of investors benefiting from the efforts of others). The regulatory gap between the SEC and the CFTC has allowed many cryptocurrency projects to successfully bypass institutional regulation.

Two Bills That Could Change the US Cryptocurrency Regulatory Landscape

Recently, two bills proposed by the US Congress, titled the “21st Century Financial Innovation and Technology Act” and the “Responsible Financial Innovation Act,” may provide solutions to the long-standing issues between the CFTC and the SEC.

TL;DR

-

Both bills aim to establish a viable regulatory framework for digital assets, defining the definition of digital assets and differentiating the regulatory responsibilities of the CFTC and SEC.

-

Both bills grant greater regulatory powers to the CFTC.

-

Both bills aim to protect the rights of consumers/investors, requiring digital asset-related institutions to disclose more information for regulation.

-

Both bills aim to establish the United States’ leadership position in the cryptocurrency field through legislation.

-

Both bills do not involve the regulation of NFTs.

-

Compared to the “Financial Innovation and Technology for the 21st Century Act,” the “Responsible Financial Innovation Act” has a broader scope. The latter also mentions stablecoin issuance, combating financial crimes, digital asset taxation, institutional funding, and other issues.

Financial Innovation and Technology for the 21st Century Act

The “Financial Innovation and Technology for the 21st Century Act” (FIT21) was proposed by Republican members of the House Financial Services Committee and Agricultural Committee on July 20, 2023, and was voted on by the two committees of the House on July 26 and 27. The bill will be transferred to the House and is expected to be voted on after the end of the recess on September 12.

The “Financial Innovation and Technology for the 21st Century Act” aims to establish a regulatory framework for the digital asset market in the United States, provide clear rules for market participants, and protect investors and consumers.

Clarifying the jurisdiction of the CFTC and SEC

The bill advocates for digital assets to be jointly regulated by the CFTC and SEC, with the CFTC as the primary regulator and the SEC as the secondary regulator. The bill classifies digital assets into digital commodities, restricted digital assets, and payment stablecoins. Digital commodities are regulated by the CFTC, while restricted digital assets are regulated by the SEC. Payment stablecoins can be traded on platforms regulated by the SEC and CFTC, but neither the SEC nor the CFTC has the authority to regulate stablecoins or stablecoin issuers.

What is a digital commodity? The bill defines a digital asset as a digital commodity when the relevant blockchain network of the digital asset meets both of the following two conditions: 1) functional network 2) decentralization. A functional network refers to a digital asset that can be used for value transfer and storage, participation in services or applications, and participation in governance on that network. Decentralization means that no individual or entity can unilaterally control the blockchain. If a digital asset does not meet the conditions of a digital commodity, it is considered a restricted digital asset.

Similarly, the bill classifies intermediaries into digital commodity intermediaries and digital asset intermediaries. Digital commodity intermediaries are regulated by the CFTC, while digital asset intermediaries are regulated by the SEC.

Information disclosure and consumer protection

For digital assets and blockchain systems related to digital assets, the bill requires disclosure of source code, transaction records, economic models, development plans, related entities and personnel, risk factors, etc.

For intermediary institutions, before providing services, they need to prove to the CFTC that they are not involved in market manipulation and register with specific futures associations. After registration, intermediary institutions should meet various requirements proposed by the bill during operation, including meeting commercial conduct standards, minimum capital requirements, ensuring fair trading, segregating client assets, disclosing operational conditions, ledger records, interest conflicts, etc. If there is any violation, they will be punished by regulatory authorities.

Supporting activities do not need to be registered with regulatory authorities

The bill specifically states that personnel engaged in auxiliary activities related to blockchain operations do not need to be registered with regulatory authorities, such as network verification, node management, providing API/RPC services, development, maintenance, or management of blockchain systems, etc.

Position analysis

The initiators of the “21st Century Financial Innovation and Technology Act” have attracted much attention, including the Chairman of the House Agriculture Committee (Glenn “GT” Thompson) and the Chairman of the House Financial Services Committee (LianGuaitrick McHenry). The bill has received support from the Republican Party and the cryptocurrency community. LianGuaitrick McHenry publicly stated that this is the committee’s first revision of cryptocurrency legislation and emphasized the need to prevent the United States from lagging behind other countries in cryptocurrency regulation. Brian Armstrong, CEO of Coinbase, also publicly supported the bill before the vote. Brian believes that this is a vote to protect cryptocurrencies, American innovation, and security.

However, most Democrats lean more towards Gary Gensler’s view that most cryptocurrencies are securities. They believe that the main regulatory power should not be handed over to the CFTC because important figures in the cryptocurrency industry, such as SBF, have requested this regulatory agency to regulate the industry, which may lead to more fraud in the future. Democratic Representative Stephen Lynch of the House of Representatives expressed his position, stating, “I have been working in this committee for 20 years, and I can clearly say that this is the worst legislation to enter the markup in the last 20 years.”

Responsible Financial Innovation Act

The Responsible Financial Innovation Act was first proposed by senators from both the Republican and Democratic parties on June 7, 2022, and its updated version was launched on July 12, 2023. Its main goal is to create a regulatory framework for digital assets, clarify the jurisdiction of the CFTC and SEC, address issues such as stablecoin issuance and digital asset taxation, protect consumers, and provide certainty and clarity for the industry.

Clarify the jurisdiction of the CFTC and SEC

The bill considers that most cryptocurrencies are commodities rather than securities, including BTC and ETH, and are regulated by the CFTC. However, when digital assets have characteristics similar to debt or equity, they will be considered securities and regulated by the SEC. When digital assets meet any of the following conditions, they are considered securities: 1) debt or equity, 2) liquidation rights, 3) rights to interest or dividends, 4) profits or income derived solely from the management of others, 5) any other economic benefits in the enterprise.

Under this bill, digital assets are considered commodities and do not need to be completely decentralized, and can also be certified as commodities.

Information Disclosure and Consumer Protection

After experiencing the collapse of institutions such as Terra and FTX, responsible financial legislation emphasizes consumer protection and sets many requirements for information disclosure, reserve proof, advertising standards, and loan restrictions.

-

Digital asset exchanges must be registered with the CFTC and comply with disclosure requirements.

-

The issuer of digital assets needs to regularly disclose information to the SEC to prove the commodity nature of digital assets.

-

Intermediaries need to disclose significant changes and operating methods to users, including asset custody, bankruptcy handling, fee structure, dispute resolution, etc.

Establishment of Stablecoin Issuance Policy

This bill imposes strict requirements on stablecoin issuance, which can only be issued by federal/state depository institutions and regulated by federal/state regulatory authorities. In addition, issuers need to maintain 100% reserve of high-quality assets and publicly disclose the reserve assets supporting stablecoins and their values. At the same time, the bill proposes that algorithmic stablecoins should be regulated by the CFTC.

Adjustment of Cryptocurrency Taxation

This bill clarifies the taxation policy of digital assets and provides small-scale tax incentives for cryptocurrency holders. In addition, the bill proposes convenient measures for providing cryptocurrency services to non-U.S. persons in terms of taxation.

Position Analysis

The responsible financial innovation bill was first proposed after the collapse of Terra, so it emphasizes the issue of stablecoin regulation. However, the bill did not receive much support at that time. But after the FTX collapse, the initiators Cynthia Lummis and Kirsten Gillibrand made substantial modifications to the bill. The modified bill emphasizes consumer protection more and clarifies the regulatory status of the CFTC over the SEC.

It is worth noting that unlike the “21st Century Financial Innovation and Technology Act,” this bill was jointly proposed by bipartisan members of Congress. However, the bill is also likely to face questioning from some SEC supporters. Furthermore, the bill is under the jurisdiction of the Banking Committee and the Agriculture Committee in the Senate, but Sherrod Brown, the chairman of the Banking Committee (Democratic Party), has explicitly stated that he will not support the bill.

However, some opinions believe that the bill has broad coverage and does not necessarily need to be passed as legislation. Each part of it has a profound impact on other more specific proposals.

How will the new bill affect the market?

The introduction of the above two bills has attracted a lot of attention, but these bills still have a long process to go through before implementation, including stages such as proposal, review by the House of Representatives and the Senate, final approval by the President, and becoming law. Currently, the “21st Century Financial Innovation and Technology Act” has just passed the review of the House of Representatives committee, while the “Responsible Financial Innovation Act” has just been proposed. It is worth noting that the “21st Century Financial Innovation and Technology Act” is expected to be voted on by the House of Representatives after the September recess. If passed, the market is expected to experience a short-term correction.

Overall, the intention of the new cryptocurrency regulatory framework is to clarify the responsibilities of regulatory agencies and protect consumer rights through enhanced information disclosure. Both bills were formulated taking into account the characteristics of the digital asset industry, such as decentralization, and did not attempt to suppress the development of the industry. Clear regulatory frameworks will help eliminate market uncertainty and provide participants with a clearer operating environment, which will attract more institutional and individual investors to enter the market and further promote market maturity and stability.

However, any kind of change will inevitably bring some fluctuations in its initial stages. The implementation of regulatory policies will undoubtedly affect some gray areas in the current cryptocurrency market and may cause market turbulence in the short term. The requirement for information disclosure may also contradict the vision of decentralization and unregulated pursuit by some market participants. However, both bills support the CFTC as the regulator of the cryptocurrency industry. The CFTC has always had a more friendly attitude towards the industry compared to the SEC and has received support from leading figures in the crypto industry. Therefore, the CFTC becoming the ultimate regulator of the industry is in line with the expectations of the crypto community and is a positive development.

In the long run, the introduction of these new regulatory policies will help protect consumer interests and bring greater transparency and trust to the cryptocurrency market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring the future trends of the NFT space through eths

- Even older than Ethereum itself? A Brief History and Current Situation of MEV

- Function hidden in the LianGuaiyLianGuail stablecoin code can freeze assets and clear addresses.

- LD Capital Understanding the Current Situation of CyberConnect in One Article

- Web3 advertising startup HypeLab has completed a $4 million financing round, led by Shima Capital and Makers Fund.

- Onchain Summer has started. How to play with the Base chain?

- LianGuaiWeb3.0 Daily | Hong Kong-listed companies have approved a budget of $5 million to purchase cryptocurrencies.