Insights from the gambling industry From GGR to NGR – The law of attraction for cryptocurrency games?

Insights from the gambling industry GGR to NGR - Cryptocurrency games' attraction?Author: Crypto Wei Tuo, AC Capital

Utilizing the gambling model, is GGR suitable for your project? What is your revenue model? How to control the kill?

“Crypto games must be playable.” Crypto game teams that still consider this as their only creed will inevitably die because they fail to understand the gambling nature of Crypto users or, in other words, do not understand “gambling”. Before you start a new crypto game project or plan to invest in a project, please learn Crypto Game 101 – the GGR model of the gambling industry.

GGR, short for Gross Gaming Revenue, is the most common performance indicator in the gambling industry. It refers to the total amount of money players have lost during a certain period of time, which is the gross profit of the casino, calculated as the total amount wagered minus the total amount paid out to players.

- In 2023, AI chip companies are undergoing a deadly three-question challenge.

- In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?

- Exploring the future trends of the NFT space through eths

There is also another algorithm called NGR – Net Gaming Revenue, calculated as: total amount wagered minus total amount paid out minus total amount of bonus paid out (extra chips given in promotions) minus total amount of gambling tax paid out.

Sounds simple, right?

Let me tell you, GGR has another algorithm: total amount wagered X kill rate. The kill rate refers to the percentage of the total amount wagered that will be lost.

It is well known that gambling, even without cheating by the house, is not a fair game. Even in relatively fair games such as blackjack, baccarat, or dice throwing, there is a house edge ranging from 0.5% to 20%.

Putting aside the “infinite money bug,” the house wants players to:

– Keep gambling

– Bet big (higher turnover) Therefore, the casino will control the actual House Edge, especially in online gambling where there is more room for manipulation.

The result is that if the kill rate is too small, it won’t make money, and if it’s too large, no one will play. You can’t let customers keep losing, nor can you let them keep winning, and you need to provide customers with certainty in terms of odds, and customers need to agree on this certainty.

Speaking of this, we can look at Crypto Games and even the crypto trading market. Let’s start with this interesting quote from @Mulan0x:

I agree with what she said, but here the casino should be understood as a general gambling place, not strictly speaking of gambling.

The biggest difference between gambling and crypto gambling is whether players can accept variable odds.

In gambling games, regardless of the final kill rate, there is a framework for odds, while in Uniswap, each Shiba Inu token has different odds, and even each altcoin on @binance has different odds at different times.

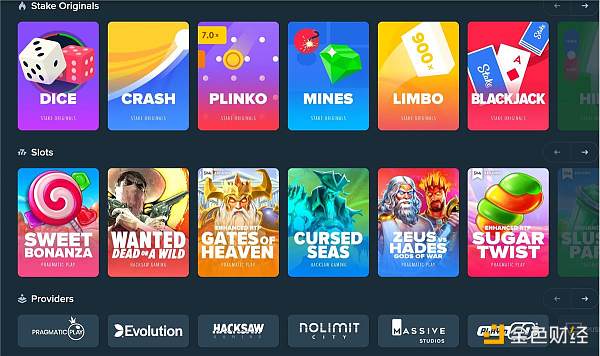

This explains why there is almost no difference between GambleFi products from @rollbitcom to @Stake products. They all have game halls, sports betting, baccarat, fishing, and roulette. Gambling emphasizes mechanism consensus and odds framework. Their audience is focused on how to gain an edge within fixed rules. However, this group of people’s profile does not completely overlap with degens or traders.

Gambling does not need ten thousand games, but rather a mechanism that can be used by ten thousand agents or cash networks.

Most online gambling operates through an agent system, where game providers and cash networks share GGR. Having more games is a significant cost, which is why NGR is mostly around 3%. Secondly, there is the issue of kill rates, or fundamentally, how to make kill rates controllable. Here, three logics are mentioned: gambling, contracts, and the “dog”.

The fundamental difference lies in liquidity:

Gambling: fixed odds, no liquidity, kill rates absolutely controllable;

Contracts: relatively fixed odds (with major cryptocurrencies), some liquidity (settling anytime), water model or relatively controllable kill rates (also known as “customer loss” logic);

Dog CEX/DEX: completely unpredictable odds, absolute liquidity (except for Pixiu), kill rates almost uncontrollable (except for CEX cutting the project party). The more unpredictable the odds, the greater the chip liquidity, and the less controllable the kill rates.

This is also why almost no matter whether it is a gambling game, it will hardly adopt absolute true randomness.

Because kill rates are uncontrollable, once the kill rate is too high, players will be lost.

In online poker games, the “sexy dealer, online dealing” method is often used because pure algorithm pseudo-randomness is easily cracked by stronger algorithms, leading to losses for cash networks. This is a game with the theme of “balance and tug of war”.

Kill rates directly affect the GGR of player unit lifecycle. Going back to the three products mentioned above, from gambling to the “dog”, the user stickiness is decreasing, which directly affects the logic of user growth and conversion.

The most profitable gambling area is the VIP room, which can account for more than 80% of the total casino profits. The VIP room relies on casino intermediaries commonly known as “dice boys” to achieve growth and conversion. How does the casino share profits with the dice boys, and how do they know how much each customer has gambled?

This brings us to how the casino issues chips.

There are two types of chips, cash chips and mud chips. Cash chips can be cashed in both directions, while mud chips are only used for betting.

Winning bets will result in cash chips. Each bet is considered chip cleaning, and the dice boys can receive commissions, and even gamblers can receive rebates.

Deja vu? The commission rebate system used by contract exchanges adopts a similar form. The contract experience bonus is equivalent to mud code, the advantage being that it incentivizes without spending real money.

The takeaway here is:

– Mud code locks in liquidity, directly driving bets (transactions);

– Rebates essentially form a key growth node with aligned interests, the larger the turnover, the greater the profit (even for gamblers, it’s about generating turnover to earn). In reality, this further ensures controllable kill rate and improves unit lifecycle GGR. So, we have discussed the three cores of gambling:

– Fixed odds framework;

– Controllable kill rate;

– Growth conversion;

Let’s take a case study: @0xMJM, which recently announced financing. It is a classic real-money mahjong game on the blockchain and is worth studying.

Since the functionality is not fully open and the experience time is limited, the analysis below is not complete (let’s be a bit lenient). Mud code: MJU – a stablecoin equivalent to 10 cents, obtained by depositing U.

Equivalent to cash code, can be exchanged. The GGR, kill rate, and growth conversion logic of the game are all very interesting and worth careful consideration.

First, let’s look at GGR and kill rate. The game currently has three pay-to-play modes: Ladder, Spirit Battle, and Private Room. Ladder is a PVP mode, and the game only charges a maximum of 6% table fee.

Spirit Battle is similar to automated gameplay, where users need to place bets when they join. As the mahjong rules are fixed, the odds are also fixed. In theory, the project can directly act as the user’s opponent and control the kill rate by arranging “operations” and directly adjusting the game.

In this process, GGR = 6% table fee (no operational intervention) + losses from Ladder/Spirit Battle users (operational intervention) – winnings from users (operational intervention). Here comes something interesting, the mahjong parlor mode, which is the casino logic of this game:

– Users can rent mahjong parlor NFTs to host private games, and the higher the level of the parlor, the greater the cost (rent or purchase);

– The rules for betting in private games are customizable;

– The parlor charges a commission of 30-70% from the table fee, based on the parlor’s level;

Unlike the discussed rebate earlier:

– The parlor is owned by the host, who has upfront sunk costs;

– The host acts as the opponent;

– The host’s interests are aligned with the official, i.e., generating high turnover and maximizing the unit lifecycle GGR. The host needs to calculate NGR, which is the total amount of bets + total turnover;

– Total allocation – total parlor costs, there is an obvious bug here;

– The hall master is not the dealer in the mahjong game, there is no clear edge, and cannot control the kill rate;

Purely in terms of drainage, compared with the traditional Macau rebate points, the hall master’s drainage is quite considerable. However, first, there is a pre-sinking cost (the hall master needs to pay a fee to open the hall); second, it is impossible to control the kill rate, which may result in a loss of capital; third, there is no mud code, which means that players can leave at any time. If I understand the game mechanism correctly, there are doubts about the cost-effectiveness of renting and buying Mahjong hall NFTs, but of course, if the NFT secondary market prices can rise, it’s another matter.

Let’s take a look at the classic rebate model of @rollbitcom:

– Regular level: For each registered and code-generating account, 10% of the banker’s advantage (banker wins) is rebated to the inviter;

– Advanced level: For 100 registered and code-generating accounts, the total amount of code generated is over $100,000, and the rebate is 20% house edge;

– Red stick level: For 500 registered and code-generating accounts, the total amount of code generated is over $1,00,000, and the rebate is negotiable.

From this, we can see that Rollbit actually adopts the classic horizontal row direct push stacking model, and promoters have no risk, no upfront costs, and no need to be opponents. Its competitors, such as http://Stake.com, basically adopt the same strategy (the highest rebate is 45% of the banker’s advantage). Therefore, as agents, the competitiveness of @0xMJM’s hall master mechanism is worth discussing.

Of course, there is also an unpopular opinion here: all blockchain-based gambling or chess games are essentially using growing data as a meme to quickly capitalize the casino, rather than making revenue like their Web2 predecessors. After all, AG or iGaming may not have the same demands.

Inspiration for crypto game teams:

– First, understand that crypto players are not traditional game consumers, they will not consume without seeking returns to support your “ROI participants” with yield: the first priority is “gambling” rather than just having fun;

– Make use of the gambling model, whether GGR is suitable for your project, what is your revenue model, and how to control the kill rate?

– Learn from stacking followers how to do CX. Macau has already blazed the trail, so don’t grope in the dark.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Even older than Ethereum itself? A Brief History and Current Situation of MEV

- Function hidden in the LianGuaiyLianGuail stablecoin code can freeze assets and clear addresses.

- LD Capital Understanding the Current Situation of CyberConnect in One Article

- Web3 advertising startup HypeLab has completed a $4 million financing round, led by Shima Capital and Makers Fund.

- Onchain Summer has started. How to play with the Base chain?

- LianGuaiWeb3.0 Daily | Hong Kong-listed companies have approved a budget of $5 million to purchase cryptocurrencies.

- Grasp the opportunity of MEKE public beta and seize the core of Binance Chain Odyssey.