NYDIG What impact will the forecasted market size of Bitcoin spot ETF have?

NYDIG What impact will the Bitcoin spot ETF's forecasted market size have?Compilation: Wu Talks Blockchain

Highlights Overview

● For investors, they are eagerly anticipating the Bitcoin spot ETF, let’s take a look at the opportunities and impacts of this product.

● There is already nearly $29 billion invested in existing Bitcoin funds globally, but many Bitcoin funds in the United States have flaws that could be addressed through a spot ETF.

- If the Bitcoin spot ETF is approved in the United States, how much capital will it bring to the market?

- Will Financialization Destroy NFTs? An Exploration of the Impact of NFTFi on the Market

- How does Ethereum build ‘brick by brick’ for the metaverse?

● We don’t know the ultimate success rate of such a product, but we hope that our analysis can provide guidance for investors seeking frameworks and more information.

Evaluating the Potential Size of the Spot ETF

Since BlackRock unexpectedly submitted an application for a Bitcoin spot ETF on June 15th, the price of Bitcoin has risen by over 20%. Considering the excitement among investors in the United States about the possible approval of a spot ETF, especially since it has been 10 years since such a product first submitted a registration statement, we want to explore what this financial product could mean for the investment community and the price of Bitcoin. Approval is not certain, so we encourage investors to make probability-weighted decisions based on the potential for fund flows.

Bitcoin funds already have a considerable asset management size

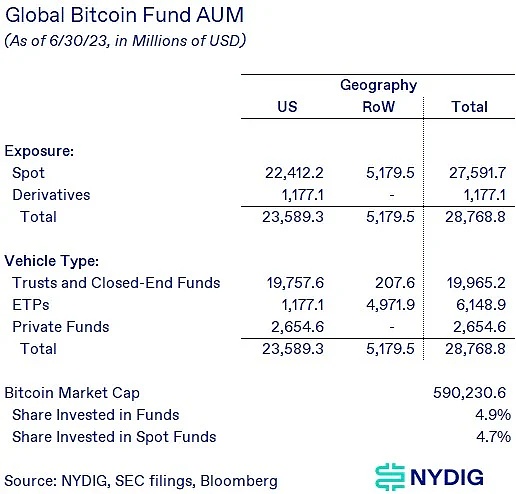

First and foremost, it is important to understand that although the United States has never had a Bitcoin spot ETF, a significant amount of investment has already been made in existing structures, including trusts such as the Grayscale Bitcoin Trust (GBTC), U.S.-based futures-based ETFs, spot-based ETFs outside the United States, and private funds. Our analysis shows that the assets under management of these products amount to $28.8 billion, with $27.6 billion invested in spot products. Note: Our measurement does not include private funds that may exist outside the United States, which are more difficult to integrate.

Optimistically, existing options have flaws

The optimistic argument for spot ETFs is that although a significant amount of funds have been invested in Bitcoin funds, investors’ existing choices have several drawbacks that could be alleviated by spot ETFs. In addition to the investor protections provided by exchange-traded products, the familiarity of purchasing and selling through securities brokers, simplified position reporting, risk measurement, and tax reporting associated with the BlackRock and iShares brands, spot ETFs may bring significant benefits compared to existing alternatives – better liquidity compared to private funds, lower tracking error compared to trusts/closed-end funds (CEFs), and possibly lower costs (definitely lower than GBTC), although fees have not been disclosed yet.

Looking for analogies in the gold market

Considering that Bitcoin is often compared to gold (we prefer to view Bitcoin as an upgraded version of gold), we believe it is helpful to observe the existing gold supply and holding methods. As of the end of June, global gold ETFs had assets under management exceeding $210 billion. Of this, nearly half, $107.3 billion, is in North America. Surprisingly, global ETFs hold only 1.6% of the total existing gold supply, while central banks (17.1%), bars and coins (20.6%), jewelry (45.8%), and other (14.9%) account for larger shares of gold holdings. Although Bitcoin is not held by central banks (except El Salvador) or used as inputs for other products like gold, a larger portion of the Bitcoin supply is already held in various fund formats (4.9%) compared to gold (1.6%). If we only look at private holdings of the two assets, essentially all Bitcoin, compared to gold ETFs and bars/coins, has a more favorable proportion. Private investments in gold ETFs account for 7.4%, whereas the share of various Bitcoin funds is 4.9%. Private investments in gold still primarily consist of coins and bars (92.6% of private investments).

In terms of the absolute quantity of US dollars, these numbers are staggering – investments in gold funds exceed 210 billion US dollars, while investments in Bitcoin funds are only 28.8 billion US dollars. Bitcoin’s volatility is about 3.6 times that of gold, which means that on an equivalent volatility basis, investors would need 3.6 times less Bitcoin than gold to obtain the same level of risk exposure. Nevertheless, this would still lead to an increase in demand for Bitcoin ETFs by nearly 30 billion US dollars.

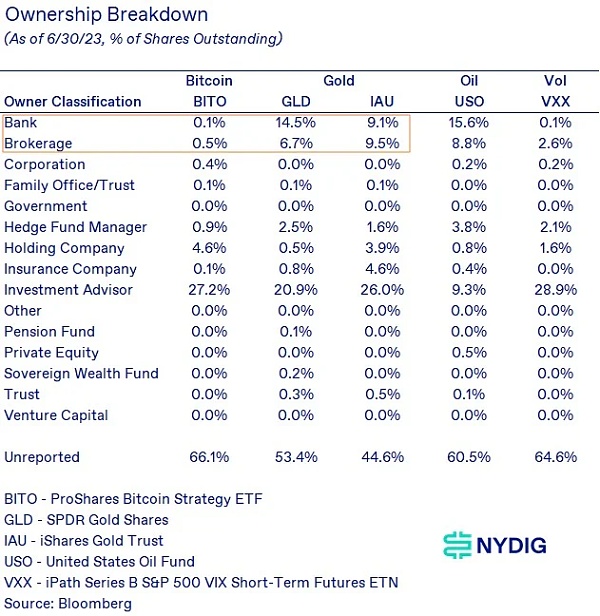

Banks and brokers have smaller exposures to Bitcoin futures ETFs

By comparing the types of investors who own gold ETFs and other ETFs (such as oil and volatility), we can better understand where the demand for Bitcoin spot ETFs may come from. First, the existing major futures ETF, ProShares Bitcoin Strategy ETF (BITO), has received strong support from investment advisors. If anything, investment advisors are over-indexed on their Bitcoin ownership compared to gold ETFs. However, the big opportunity comes from banks and brokers, whose ownership of BITO ETF is much lower than that of gold ETFs. We believe there are two reasons for this – fund structure and recommendation. In terms of fund structure, futures-based ETFs are less likely to be owned by these types of investors because the cost of rolling futures is higher than holding spot (we measured a 6% annualized cost of rolling Bitcoin futures before BITO was launched). For investors who actually have no way to access spot markets, such as the oil market, banks and brokers have shown a willingness to own futures-based products like USO. We believe a bigger issue is that many banks and brokers have not recommended a strategic allocation to Bitcoin in their clients’ portfolios. Therefore, their advisors and internal funds have not considered Bitcoin as an asset class. While a spot ETF may help institutions overcome the barriers of owning a futures-based ETF, it may not affect the aspect of strategic allocation. To change this situation, banks and brokers may need to recognize the potential for Bitcoin to enhance returns and reduce risk (diversification) in investment portfolios.

Scenario price sensitivity

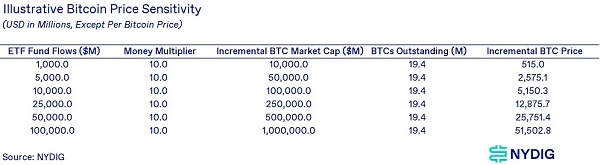

Although only for illustrative purposes, we think it may be helpful for investors to understand how a potential spot ETF could impact Bitcoin prices. These are, of course, scenario analyses, and reality may differ from expectations. These scenarios do not incorporate any discounting and rely on a 10.0x currency multiplier (compared to the observed 11.36x in 2018), where each 1 US dollar AUM flow into the ETF would impact the value (market cap) of Bitcoin by 10 US dollars.

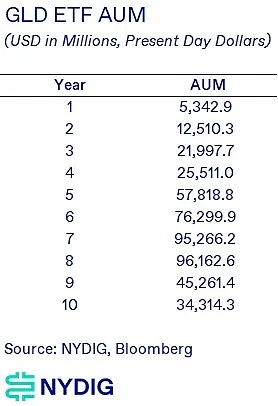

In the worst case, a 1 billion US dollar ETF AUM would be on par with the existing futures-based BITO ETF. In the best case, 100 billion US dollars would exceed the combined AUM of GLD and IAU of 85 billion US dollars. While we do not know the ultimate success of a spot Bitcoin ETF, these seem to be useful ways to frame the analysis. We encourage readers to make their own assumptions and remind them that the digital asset market is not always rational.

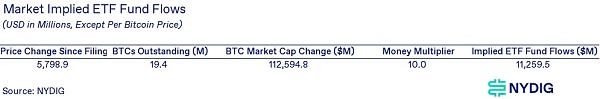

The price of Bitcoin has risen sharply since BlackRock submitted its application. We can use the same framework in reverse to infer the market’s implied ETF AUM based on price changes. This analysis suggests that all price changes since the application was submitted have been driven by speculation on the ETF, ignoring any other potential price impacts, such as the recent SEC ruling on Ripple Labs.

Review of GLD ETF’s Success

The GLD ETF, launched on November 18, 2004, remains a benchmark for ETF success. Its launch, novelty, subsequent growth, and success are still impressive nearly 20 years later. Therefore, when we consider the success and growth of a spot Bitcoin ETF, we feel it is necessary to emphasize the development path of this product. Its success was not without challenges, as interest in gold waned after the global financial crisis, but this may be helpful for those contemplating how a spot Bitcoin ETF could evolve.

Final Thoughts

It has been 10 years since the first registration application for a spot Bitcoin ETF was submitted, and investors are once again excited about the prospects of existing applications being approved. While we do not know the ultimate success of such a product or if it will eventually enter the market, the analysis we have done hopes to provide help in thinking about the roadmap ahead. Spot ETFs still have no guarantees, so we encourage participants to weigh their decisions based on the likelihood of final approval. If the process of past Bitcoin ETFs is any indication, the road ahead may be very winding. There may be many ups and downs and twists, and we are committed to analyzing any new information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors.

- Robert F. Kennedy Jr Will Support the US Dollar with Bitcoin if Elected President

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors

- The Battle for the Throne between Bitcoin and Ethereum What are the determining factors for victory?

- Good news for Bitcoin? Understanding the upcoming Nakamoto version of Stacks with one article

- The US instant payment system FedNow is here! But it is not a rival to cryptocurrencies.

- Blockchain Gaming June Monthly Report Market Analysis, Opportunities, and Challenges