If the Bitcoin spot ETF is approved in the United States, how much capital will it bring to the market?

If US approves Bitcoin spot ETF, how much capital will it bring?Compilation | Wu on Blockchain

Highlights

- For investors, they are eagerly awaiting the launch of a Bitcoin spot ETF. Let’s take a look at the opportunities and impacts of this product.

- There is already nearly $29 billion invested in existing Bitcoin funds globally, but many Bitcoin funds in the United States have flaws that could potentially be resolved through a spot ETF.

- We don’t know the ultimate success rate of such a product, but we hope that our analysis can provide guidance for investors seeking frameworks and more information.

Evaluating the potential size of a spot ETF

Since BlackRock unexpectedly filed an application for a Bitcoin spot ETF on June 15th, the price of Bitcoin has risen by over 20%. Considering the excitement among investors for the potential approval of a spot ETF in the United States, especially since it has been 10 years since such a product first submitted a registration statement, we want to explore what this financial product could mean for the investment community and the price of Bitcoin. Approval is not certain, so we encourage investors to weigh the probabilities based on the potential flow of funds.

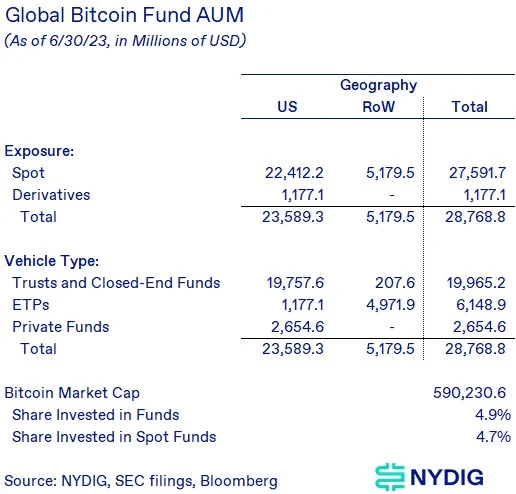

Bitcoin funds already have a significant asset management scale

Firstly, it’s important to understand that although the United States has never had a Bitcoin spot ETF, a significant amount of investment has already been poured into existing structures, including trusts such as the Grayscale Bitcoin Trust (GBTC), US-based futures-based ETFs, spot-based ETFs outside the United States, and private funds. Our analysis shows that the assets under management of these products amount to $28.8 billion, with $27.6 billion invested in spot products. Note: Our measurement does not include private funds that may exist outside the United States, as these funds are more difficult to integrate.

- Will Financialization Destroy NFTs? An Exploration of the Impact of NFTFi on the Market

- How does Ethereum build ‘brick by brick’ for the metaverse?

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors.

Optimistically speaking, existing options have flaws

The optimistic argument for a spot ETF is that despite a large amount of funds being invested in Bitcoin funds, investors have several drawbacks with their existing choices, which a spot ETF could alleviate. In addition to the investor protection provided by exchange-traded products, the familiarity with purchasing and selling through securities brokers associated with the BlackRock and iShares brands, as well as simplified position reporting, risk measurement, and tax reporting, a spot ETF may bring some significant benefits compared to existing alternatives—better liquidity compared to private funds, lower tracking error compared to trusts/closed-end funds (CEFs), and potentially lower costs (definitely lower than GBTC), although the fees have not been disclosed.

Looking for analogies through the gold market

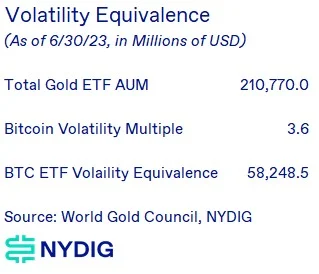

Considering that Bitcoin is often compared to gold (we prefer to view Bitcoin as an upgraded version of gold), we believe it is helpful to observe the existing gold supply and holding methods. As of the end of June, the assets under management of global gold ETFs exceed $210 billion. Nearly half of this, $107.3 billion, is in North America. Surprisingly, global ETFs only hold 1.6% of the total existing gold supply, while central banks (17.1%), bars and coins (20.6%), jewelry (45.8%), and others (14.9%) hold larger portions of gold. Although Bitcoin is not held by central banks (except El Salvador) or used as an input for other products like gold, a larger portion of the Bitcoin supply is held in various fund formats (4.9%) compared to gold (1.6%). If we only look at private holdings of the two assets, almost all Bitcoin, compared to gold ETFs and bars/coins, has a more favorable proportion. Private investments in gold ETFs account for 7.4%, while the share of various Bitcoin funds is 4.9%. Private investments in gold are still predominantly in bars and coins (92.6% of private investments).

From the absolute quantity of dollars, these numbers are shocking – investments in gold funds exceed $210 billion, while investments in bitcoin funds are only $28.8 billion. Bitcoin’s volatility is about 3.6 times that of gold, which means that on the basis of equivalent volatility, investors need 3.6 times less bitcoin than gold to obtain the same amount of risk exposure. Nevertheless, this will still lead to an increase in demand for bitcoin ETFs of nearly $30 billion.

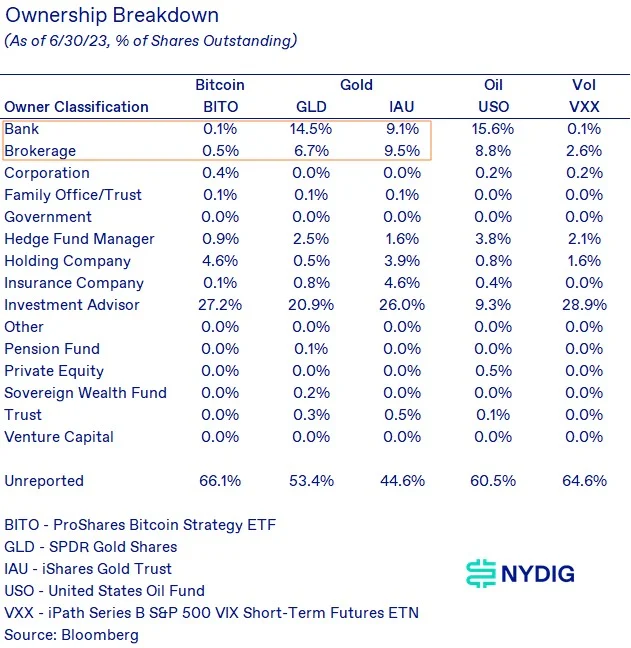

Banks and brokers have smaller exposure to bitcoin futures ETFs

By comparing the types of investors who own gold ETFs and other ETFs (such as oil and volatility), we can better understand where the demand for bitcoin spot ETFs may come from. First, existing major futures ETFs, such as the ProShares Bitcoin Strategy ETF (BITO), have received strong support from investment advisors. If there is anything, investment advisors are more over-indexed on their bitcoin ownership than gold ETFs. However, the big opportunity comes from banks and brokers, whose ownership of BITO ETF is much lower than that of gold ETFs. We believe there are two reasons – fund structure and recommendation. In terms of fund structure, futures-based ETFs are unlikely to be owned by these types of investors because the cost of rolling futures is higher than holding spot (we measured a 6% annualized rate for bitcoin futures before the release of BITO). For investments that actually have no access to the spot market, such as the oil market, banks and brokers have shown a willingness to own futures-based products, such as USO. We believe the bigger issue is that many banks and brokers have not recommended a strategic allocation to bitcoin in their clients’ portfolios. Therefore, their advisors and internal funds have not classified bitcoin as an asset class. While spot ETFs may help institutions overcome the barriers of owning futures-based ETFs, it may not affect the aspect of strategic allocation. To change this situation, banks and brokers may need to recognize the income enhancement and risk reduction (diversification) properties that bitcoin can bring to portfolios.

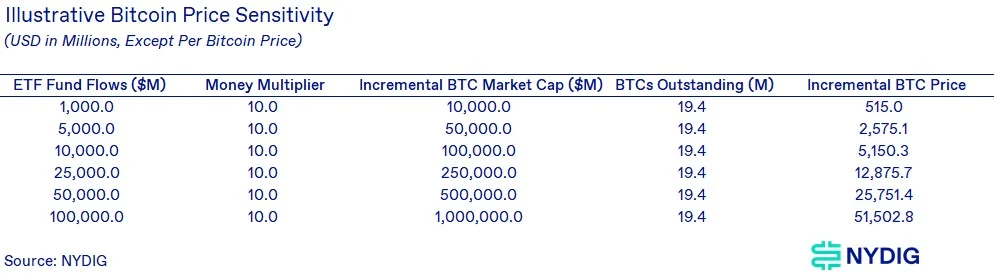

Scenario price sensitivity

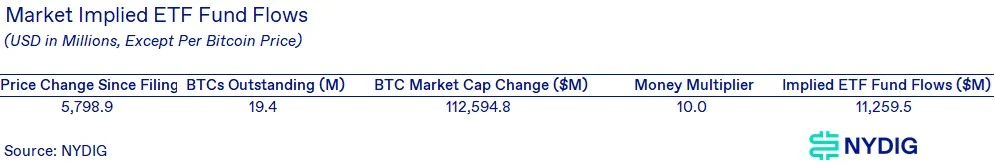

Although only for illustrative purposes, we believe it may be helpful for investors to understand how potential spot ETFs could impact bitcoin prices. These are, of course, scenario analyses and reality may differ from expectations. These scenarios do not embed any discounting and rely on a currency multiplier of 10.0 times (observed in 2018 was 11.36 times), where every $1 AUM flowing into the ETF impacts the value (market cap) of bitcoin by $10.

In the worst case, the $1 billion ETF AUM will be comparable to the existing futures-based BITO ETF. In the best case, $100 billion will exceed the combined AUM of GLD and IAU, which is $85 billion. Although we don’t know the ultimate success of a spot Bitcoin ETF, these seem to be useful ways to define the analysis. We encourage readers to make their own assumptions and remind them that the digital asset market is not always rational.

The price of Bitcoin has risen sharply since BlackRock submitted its application. We can use the same framework in reverse to determine the implied ETF AUM based on price changes. This analysis suggests that all price changes since the application was submitted are due to speculation about the ETF and ignore any other potential price impacts, such as the recent SEC ruling on Ripple Labs.

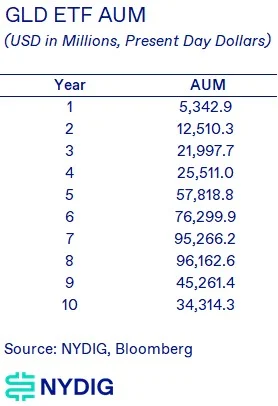

Review of GLD ETF’s Success

The GLD ETF, launched on November 18, 2004, is still the gold standard of ETF success. Its launch, novelty, subsequent growth, and success are still impressive even nearly 20 years later. Therefore, when we think about the success and growth of a spot Bitcoin ETF, we feel it is necessary to emphasize the development path of this product. Its success was not without challenges, as interest in gold waned after the global financial crisis, but this may be helpful for those considering how a spot Bitcoin ETF might develop.

Final Thoughts

It has been 10 years since the first registration application was submitted for a spot Bitcoin ETF, and investors are once again excited about the prospects of existing applications being approved. Although we don’t know the ultimate success of such a product or whether it will eventually enter the market, the analysis we have done hopes to provide help in thinking about the future roadmap. Spot ETFs still have no guarantee, so we encourage participants to weigh their decisions based on the likelihood of final approval. If the process of past Bitcoin ETFs has any guidance, the road ahead may be very winding. There may be many ups and downs and twists and turns, and we are committed to analyzing any new information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Robert F. Kennedy Jr Will Support the US Dollar with Bitcoin if Elected President

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors

- The Battle for the Throne between Bitcoin and Ethereum What are the determining factors for victory?

- Good news for Bitcoin? Understanding the upcoming Nakamoto version of Stacks with one article

- The US instant payment system FedNow is here! But it is not a rival to cryptocurrencies.

- Blockchain Gaming June Monthly Report Market Analysis, Opportunities, and Challenges

- Binance Research An Illustrated Guide to Cryptocurrency Data Tools Track