Objective data tells you who is the hardest core public chain in 2019?

Text, Data and Visualization | Edited by Carol | Produced by Bi Tongtong | PANews

From the public chain financing boom that started in 2017, it entered the main net tide in 2018, and then the late star public chain in 2019 handed in transcripts, and middleware became popular. As the industry's infrastructure, the public chain has been launched from the 100 chain, and has unknowingly entered the stage of the stock game.

The financing story of the public chain may end here. The only dozens of public chain projects that have survived have begun to compete. Just in 2019, what happened to the development of these public chains? Who is still working tirelessly to develop it? Who has the most influence on social media? Whose ecology is most prosperous and stable? Who's most active on the chain?

PAData selected 35 public chain projects in the top 100 of the listed market value of CoinMarketCap (note: decentralized accounting, the token is not established on the bottom of another public chain), and the top 20 public chain projects with market capitalization are head asset projects The public chain project with a market value of 21-100 is a waist asset project. By combing and analyzing these projects' Github data, on-chain data, and social media data, inventory of the "best public chain" in 2019.

- Blockchain ushers in a new cycle of industrial landing, the "chain for the chain" or the necessary stage

- Getting on the blockchain? Not much to do

- SheKnows year-end ultimate debate | 2020, the year when the public chain supervision will break?

1. Who is the most active public chain for technology development? Bitcoin is far ahead of multiple waist public chains

Technology is the most important standard for measuring public chain projects. 32 of the 35 public chain projects have open sourced their source code on Github [1]. PAData counts the total number of Stars, total forks, and annual code submissions of these projects. The number of times to comprehensively observe the development activity of public chain projects.

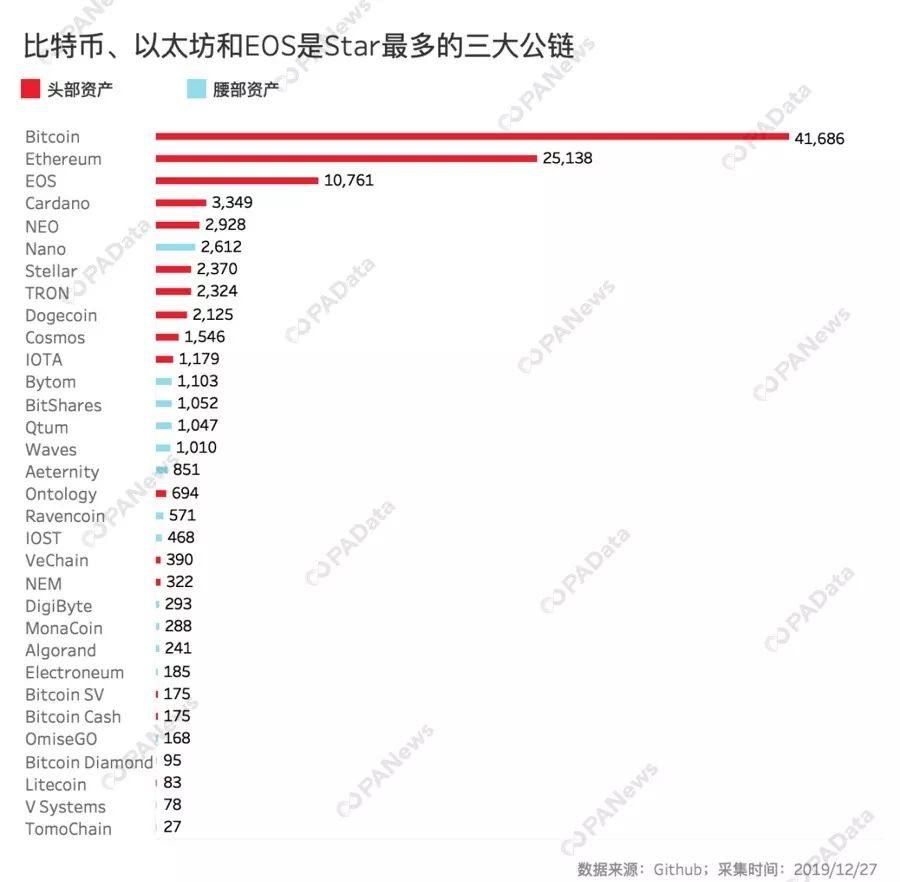

The number of stars refers to the number of developers being followed. The larger the number, the more popular this document is, and the higher the technical gold content. As of December 27, of the 32 public chain projects, Bitcoin has more than 40,000 Stars, far more than other public chain projects. Ethereum and EOS also have more than 10,000 Stars, reaching about 25,000 and 11,000 respectively. Bitcoin, Ethereum, and EOS are the top three public chains most popular with developers.

Although the top 100 projects by market capitalization are already representative of the more fluid blockchain projects, these projects still show a very obvious differentiation pattern. From the number of Stars, except for Bitcoin, Ethereum, and EOS, the number of Stars in other public chain projects is only 5,000, the minimum TomoChain is only 27 Stars, and V Systems, Litecoin, and Bitcoin Diamond are all only 100.

Looking at domestic public chains, NEO is the most popular among developers, with a total of 2928 Stars, followed by TRON, Bytom, and Qtum. Another thing worth paying attention to is the waist asset public chain Nano, which has a total of 2612 Stars, which is the most popular among waist asset public chains.

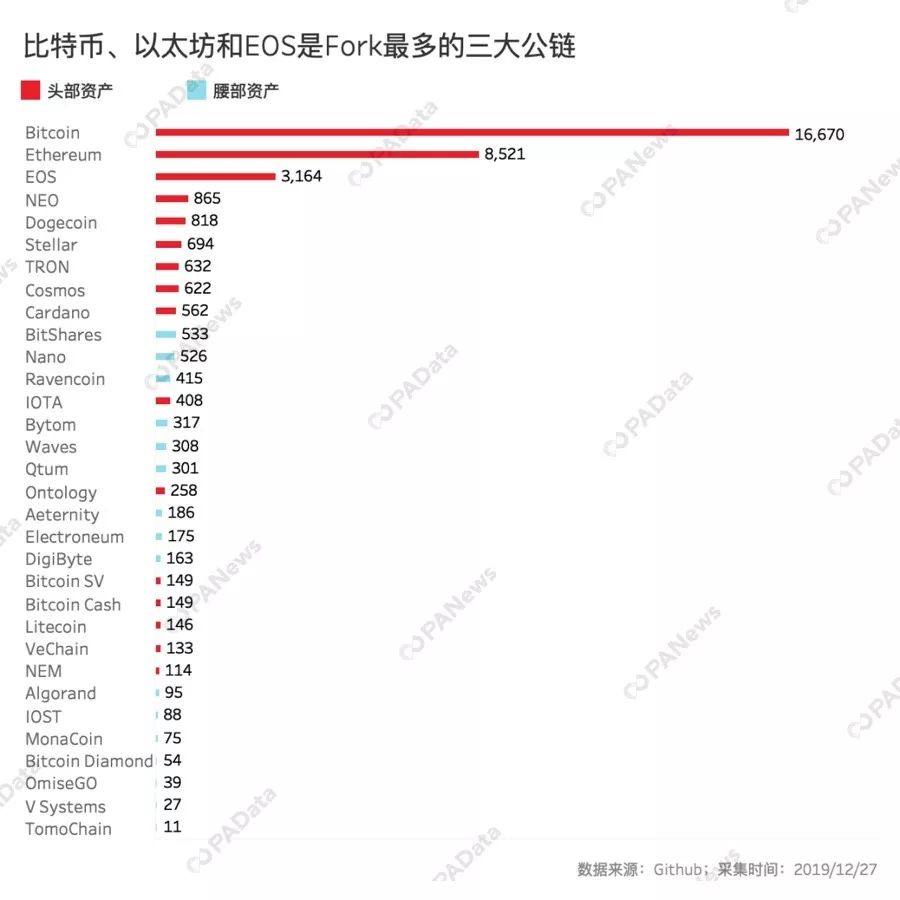

The number of forks is another indicator to measure the technical gold content of open source documents. The larger the number, the more the code is referenced and the more popular it is for developers. From the statistical results, the distribution of the number of forks of public chain projects is basically the same as that of Star. Bitcoin, Ethereum, and EOS are the three public chains that have been Fork's most. They have been cited by 16,700, 8,500, and 32,200 times, respectively. Other project codes have been cited less than 1,000 times. NEO is the public chain that has been forked the most times among domestic public chains, with a total of 865 times. Among the top 10 public chain projects of Fork times, BitShares is ranked 10th and has been cited 533 times in total.

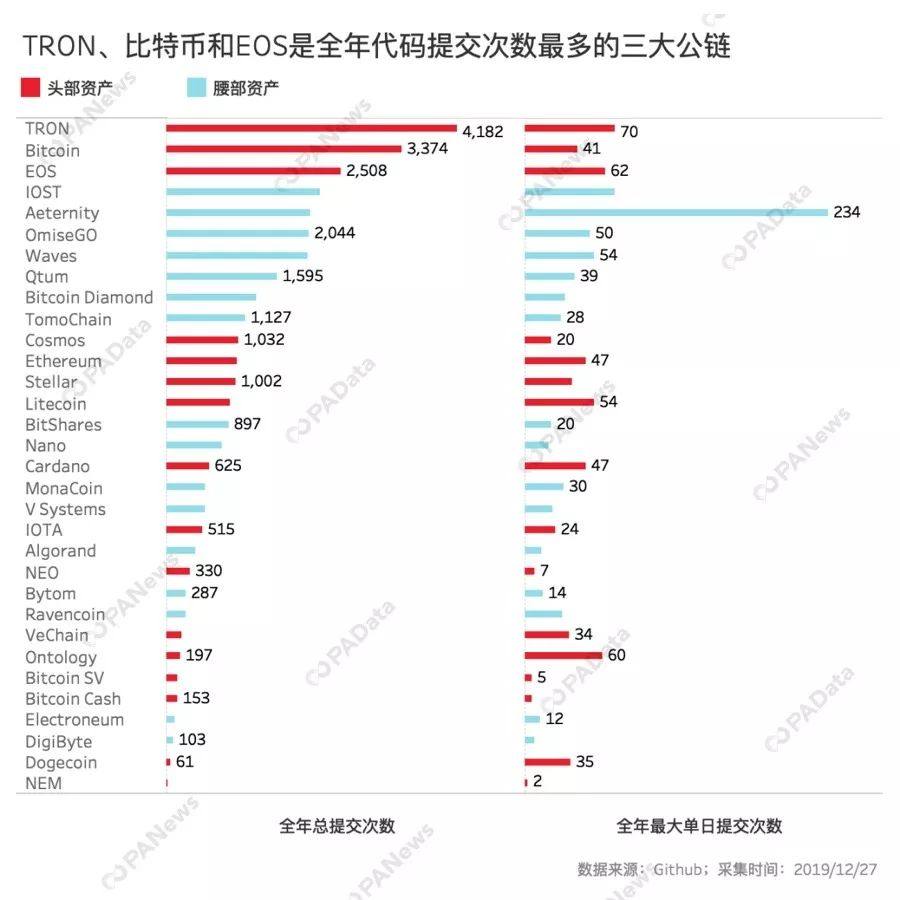

In terms of the number of code submissions this year, TRON submitted 4182 times throughout the year, with an average of 11.45 times per day, which is the highest number of public chain submissions among all public chain projects. It was followed by Bitcoin and EOS, which submitted 3374 and 2508 submissions, respectively.

Judging from the group of head asset project and waist asset project, this year, the code submission of waist asset project is very active. IOST, Aeternity, OmiseGO, Waves, Qtum, Bitcoin Diamond, and Tomochain rank 4th to 10th, and have submitted codes more than 1100 times throughout the year. Among them, Aeternity also set a record of 234 submissions per day.

In contrast, some of the earliest head-asset projects that submitted the code this year did not have a high number of code submissions. For example, the smallest NEM submitted only 4 times this year, Dogecoin only submitted 61 times, and DigiByte only 103 times. Vechain, whose currency price rose 122% at the end of October, also submitted only 219 times this year, with an average of 0.58 times per day. Of the ten countdown projects submitted for code submissions throughout the year, well-known domestic public chain projects accounted for three seats. In addition to Vechain, there were Ontology and Bytom.

However, it should be pointed out that the number of code submissions does not reflect the quality of the code. If projects with lower quality code are submitted throughout the year, their technical capabilities may not be as good as submitting high-quality code projects at one time.

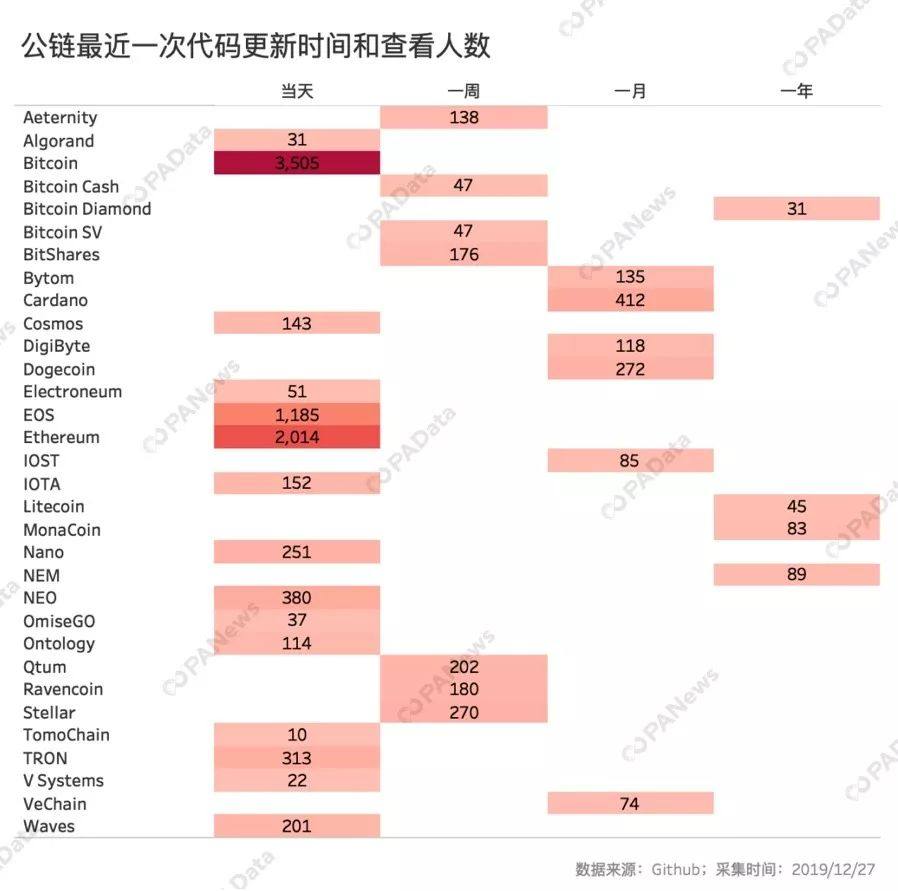

From the time of the latest code update of 32 public chain projects, nearly 50% of the public chains have submitted codes on the day of statistics (December 27), of which Bitcoin was viewed 3505 times after the last update, followed by Ethereum and EOS were viewed 2014 and 1185 times, respectively. In addition, only four public chain projects were last updated nearly a year ago, namely Bitcoin Diamond, Litecoin, MonaCoin, and NEM, and the number of views after the update did not exceed 100 times.

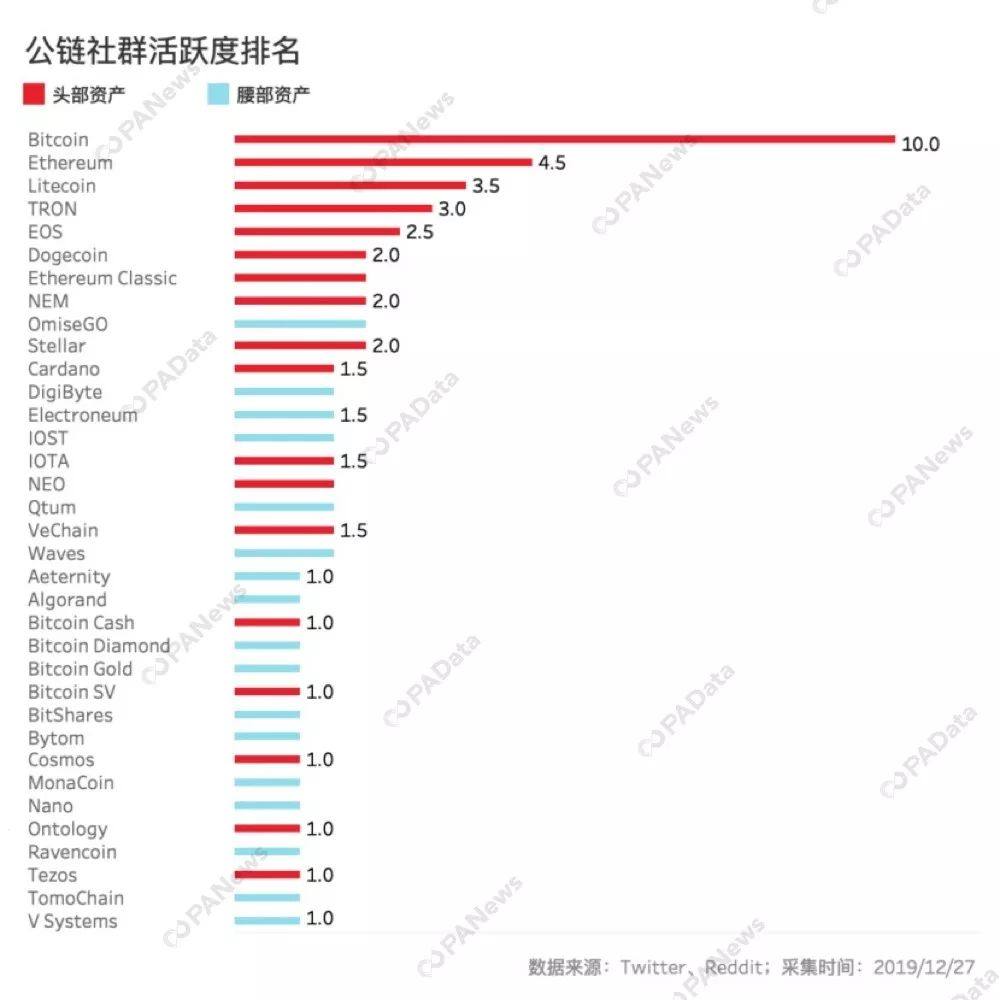

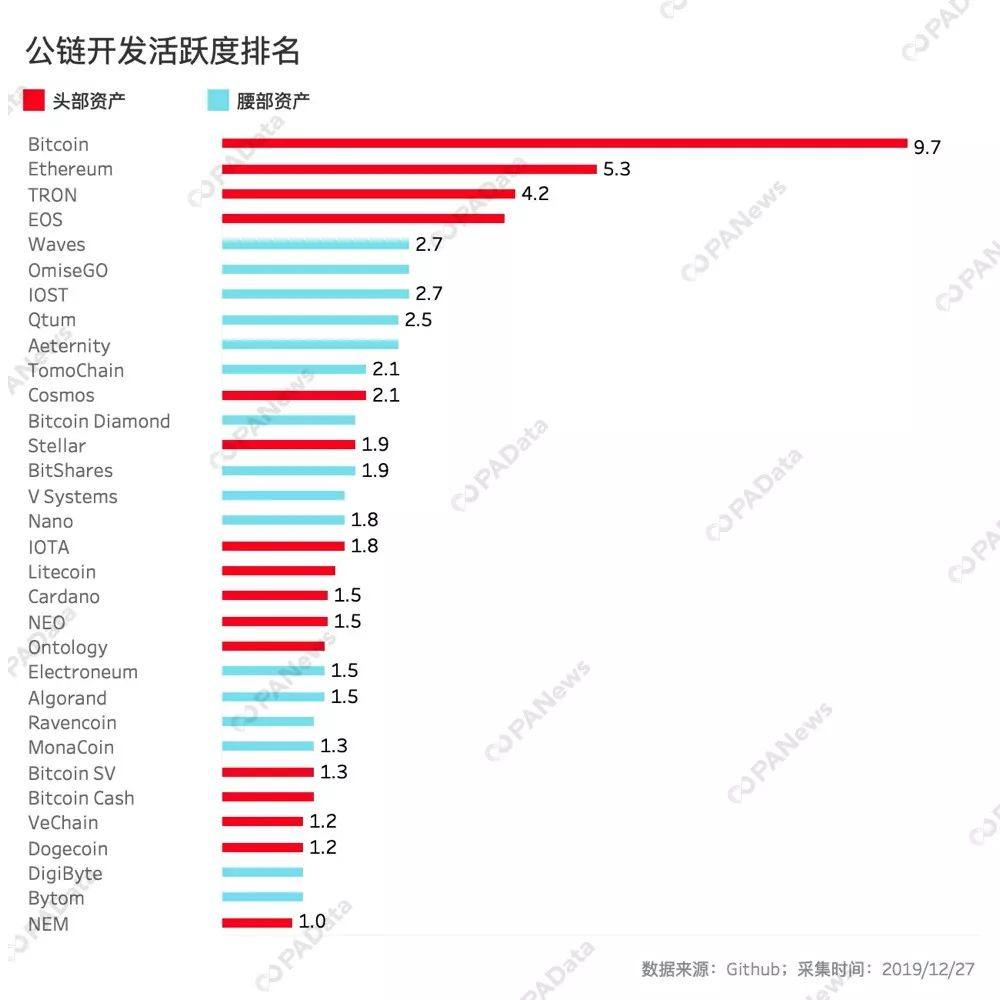

In order to observe the technical development activity of each public chain project from a more uniform cross-section, PAData quantified the performance of data in different dimensions, including Star, Fork, the number of code submissions throughout the year, the latest code submission time, and The number of viewers is assigned 10-0 points after sorting from high to low, and the total score is calculated according to the weights of 30%, 30%, 30%, and 10%. The higher the total score, the more the technology of the public chain project is explained. The more active the development.

According to statistics, Bitcoin has become the most active public chain technology development project with 9.7 points, followed by Ethereum and TRON, with weighted total scores of 5.3 and 4.2 respectively. Waves, OmiseGo, and IOST are the three most active waist asset projects for technology development, but the weighted total score is only 2.7 points. In terms of weighted value, Bitcoin is arrogant and far ahead. Ethereum, TRON and EOS constitute the second echelon, while other public chains are much less active in technology development.

2. Which public chain has the most social influence? The head public chain community has a good foundation, and the wave field is "partial".

In addition to technology and market value, the influence of the public chain is also reflected in the attention of fans in various social channels. In particular, the public chain advocates community autonomy, which determines that they must pay special attention to the promotion of various social channels and the operation of fans from the day of its creation.

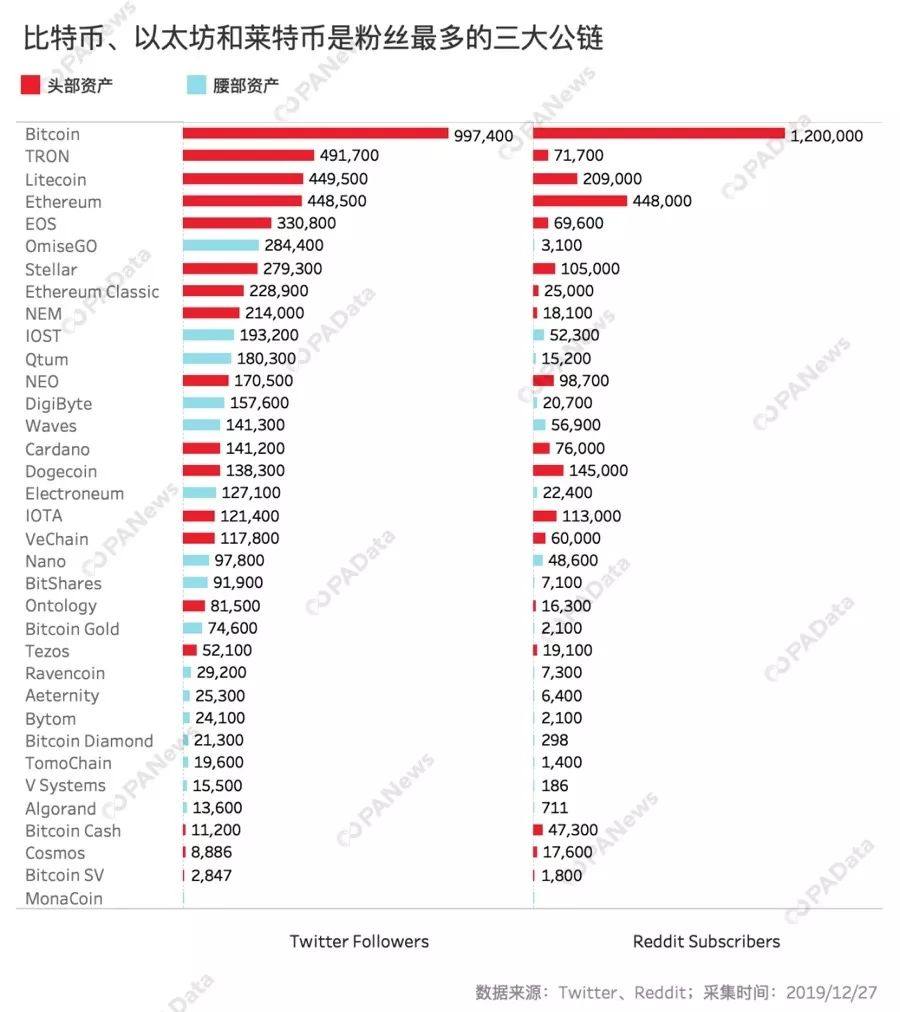

PAData counts the number of followers of 35 public chain projects on Twitter and Reddit. The account selection criteria is based on the official social account. If there is no official social account for an individual project, the official foundation social account or the main social group social account is selected in turn .

According to statistics, Twitter is an important community for public chain projects. Bitcoin account has the most followers on Twitter, with 978,400 followers, which is about to break through the million followers mark. Compared with the statistics of PAData at the end of last year, Bitcoin rose about 67,400 in 2019, an increase of about 7.25%. Bitcoin has more Reddit subscribers than Twitter, reaching 1.2 million people. However, it is worth mentioning that the holder of Bitcoin Twitter is still an anonymous person. Roger Ver, an early Bitcoin investor and Bitcoin Cash supporter, was once considered to be the operator of this account. After the account was temporarily closed in January, it was clarified that the owner of the account was a Bitcoin Cash investor who participated in Bitcoin investment in 2009.

More Twitter account followers include TRON, Litecoin and Ethereum, with 497,700, 449,500 and 449,500 followers, respectively. Among them, Ethereum and Litecoin also have a large number of Reddit followers, with 209,000 and 448,000 followers, respectively. Litecoin is the second largest public chain on Reddit after Bitcoin. And TRON is consistent with the statistics of the previous year, it is still "partial", and the number of Reddit fans is only 71,700.

In domestic public chains, in addition to TRON, IOST, Qtum, and NEO also have more Twitter followers, all exceeding 170,000. These public chains generally have fewer fans on Reddit, which may be related to the radiation of Reddit itself. For domestic public chains, in order to cover domestic users, they often pay more attention to operating local communities such as Weibo. For example, TRON founder Sun Yuchen Before the Weibo title was itself the big V on Weibo.

PAData ranks the number of followers on the two websites from high to low and assigns 10-0 points, and calculates the total score according to each 50% weight. The higher the total score, the more traffic this public chain project has and the community The more active. According to statistics, as of December 217, Bitcoin is the public chain with the most fans. Secondly, Ethereum, Litecoin, and TRON constitute the second camp with a weighted total score of 4.5, 3.5, and 3.0.

It is worth noting that Litecoin's technology development activity is low, but the fan base is large. In addition, the fan base of public chain projects that were established earlier is often better, while the fan base of newly developed projects is weaker. For example, the star public chain projects Cardano and Cosmos in the past two years have weighted scores of only 1.5 and 1.0, which shows that One possibility, the blockchain industry has formed a certain circle after years of development, but the efforts in "out of the circle" in the past two years have had little effect.

3. Who is the most active public chain for on-chain transactions? Ethereum has more transactions per day than Bitcoin

The launch of the main chain on the public chain is just the beginning. The key is whether anyone will use it after the launch. The current blockchain technology has not been applied to commercial scenarios on a large scale. The circulation of public chain tokens in exchanges may be the most important form of on-chain transactions. In other words, this is also the minimum application threshold. If a public chain's native tokens do not have secondary market liquidity, how can we expect it to have other application scenarios in the current environment?

PAData uses the number of daily active addresses on the chain throughout the year, the number of daily transactions per year, and the number of transactions per year throughout the year as indicators to observe the on-chain transaction status of the public chain. Includes on-chain data of 8 public chains within the scope of this statistics. Statistics show that Bitcoin has the most daily active addresses throughout the year, exceeding 620,000. If the daily average active address is regarded as the average daily active user, it is equivalent to the daily activity of the Bitcoin network has reached 620,000. However, it should be pointed out that under the Bitcoin UTXO model, the change balance will automatically generate a new address, so the daily average active address here is likely to include these automatically generated addresses, resulting in the actual daily activity may be lower than this statistics digital.

However, Bitcoin's daily live address is much higher than the second place of Ethereum, which is about 339,300 daily averages, so even if the new address generated by the change balance is removed, Bitcoin is also the public chain with the most daily live users.

Although the daily live address of Ethereum is not as good as Bitcoin, the average daily transactions is much higher than that of the Bitcoin network. According to statistics, the average daily transaction times of Ethereum throughout the year reached about 670,700, while Bitcoin was only 328,400, Bitcoin SV was only 142,900, and the average daily transaction times of the rest of the public chain were only 100,000.

Looking at the average daily transaction volume throughout the year, Bitcoin has reached $ 32,700, followed by Bitcoin Cash and Litecoin, which are about $ 24,800 and $ 10,900 respectively.

PAData assigns 10-0 points after ranking the number of daily active addresses throughout the year, the average number of daily transactions per year, and the average daily transaction amount throughout the year, and calculates them according to each 1/3 weight The total score, the higher the total score, the more active the transactions on this public chain project chain, and the more popular the users are.

According to statistics, Bitcoin is the most active public chain on the chain, with a weighted total score of 8.7, followed by Ethereum and Bitcoin Cash, with a weighted total score of 57 and 3.3. From the perspective of the distribution of weighted total scores, Bitcoin is much higher than the second Ethereum, and Ethereum is much higher than other public chains. The level difference is more active than technology development and community activity.

4. Who is the most prosperous public chain? Ethereum and EOS type rich TRON transactions are high

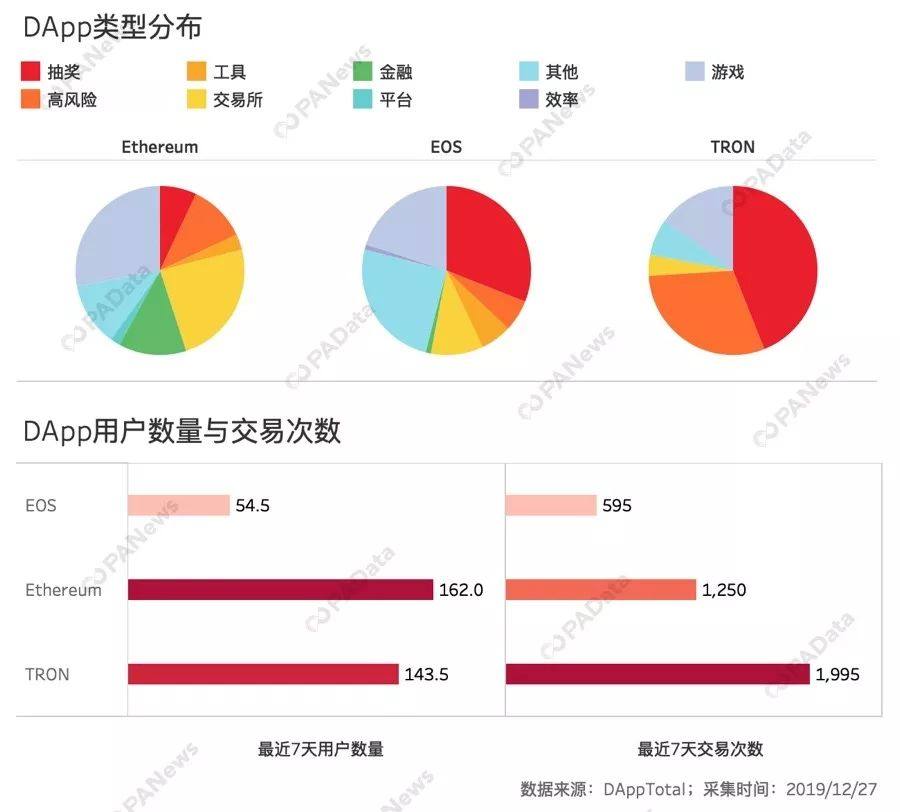

DApp is an important part of the public chain ecology. Any public chain facing the C-end market has once built or is still trying to build a DApp ecology. Although there are many public chains for building DApp ecology, there are very few public chains that have truly established the ecology and flourished.

According to DAppTotal statistics, as of December 27, there are only 50 DApps on the well-known domestic public chain Ontology, and the most popular application is Yundoulong. The 7-day active user is about 2810, but the second-most user application is 7 days There are only 613 active users, and the number of application users and transactions after the 10th place are all zero. The situation of another domestic public chain IOST claiming an “ecological outbreak” is similar. As of December 27, there were a total of 42 DApps. The first-ranked application had 2310 7-day active users, and the second was only 571,30. Applications outside Kaikai have basically no active users and on-chain transactions.

At present, the more popular public chains of DApps recognized in the market are Ethereum, EOS, and TRON. Major DApp information websites have included and monitored their DApps. PAData ranked the list according to the number of users on DAppTotal on December 27. Each of them selected the top 100 DApps for analysis. According to statistics, DApp types of Ethereum and EOS are very rich, covering 8 types, and TRON's DApp types only cover 5 types. Among them, Ethereum still has the largest number of games, accounting for 28 of the top 100, followed by exchanges and finance, accounting for 24 and 13 respectively. EOS and TRON are mainly for lottery applications, with 31 and 44 respectively.

Since the overall performance of the DApp ecosystem of each public chain is greatly affected by the performance of the head application, from the perspective of the median performance that can better reflect the general level, the average number of users per DApp is 7 days (here, the "7 day users" ”Refers to the number of deduplication addresses that have accumulated interactions with the contract within 7 days.) The most is Ethereum, which reached 162 people (assuming one address corresponds to one person), followed by TRON, which reached 143.5 people.

From the number of transactions, the total number of draws and high-risk DApps reached nearly 3/4 of TRON. The average number of transactions per DApp in 7 days reached 1995, followed by Ethereum, which reached 1,250.

Based on the observations made by PAData at the end of August 2019, the number of DApp users and transaction times on Ethereum are basically stable, but the changes in EOS and TRON are more dramatic. There are 222.5 users in 7 days, and this time there are only 54.5. From this perspective, the Ethereum ecosystem is not only more prosperous, but also more stable.

Data description: [1] Tezos is open sourced on other open source platforms and is not counted; Ethereum Classic and Bitcoin Gold have not queried the exact Github open source archives and are not counted.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- On Decentralized Liquidity Mechanism: Taking Uniswap, Bancor, etc. as Examples

- Opinion | Central bank digital currency and other digital currencies, both temporarily or little impact

- 2019 DeFi Industry Research Report: DeFi lending continues to grow and expand in 2020, and stablecoins will continue to grow

- Technical Interpretation | On-chain Capacity Expansion Technology Guide (1): Data Layer and Network Layer

- Research Report | Analysis Report on Quantum Mechanics and Blockchain Security Technology

- IMF urges Philippine central bank to collect crypto exchange transaction data and use data for macroeconomic analysis

- Technology Dry Goods | Zero Knowledge Proof Learn by Coding: An Introduction to libsnark