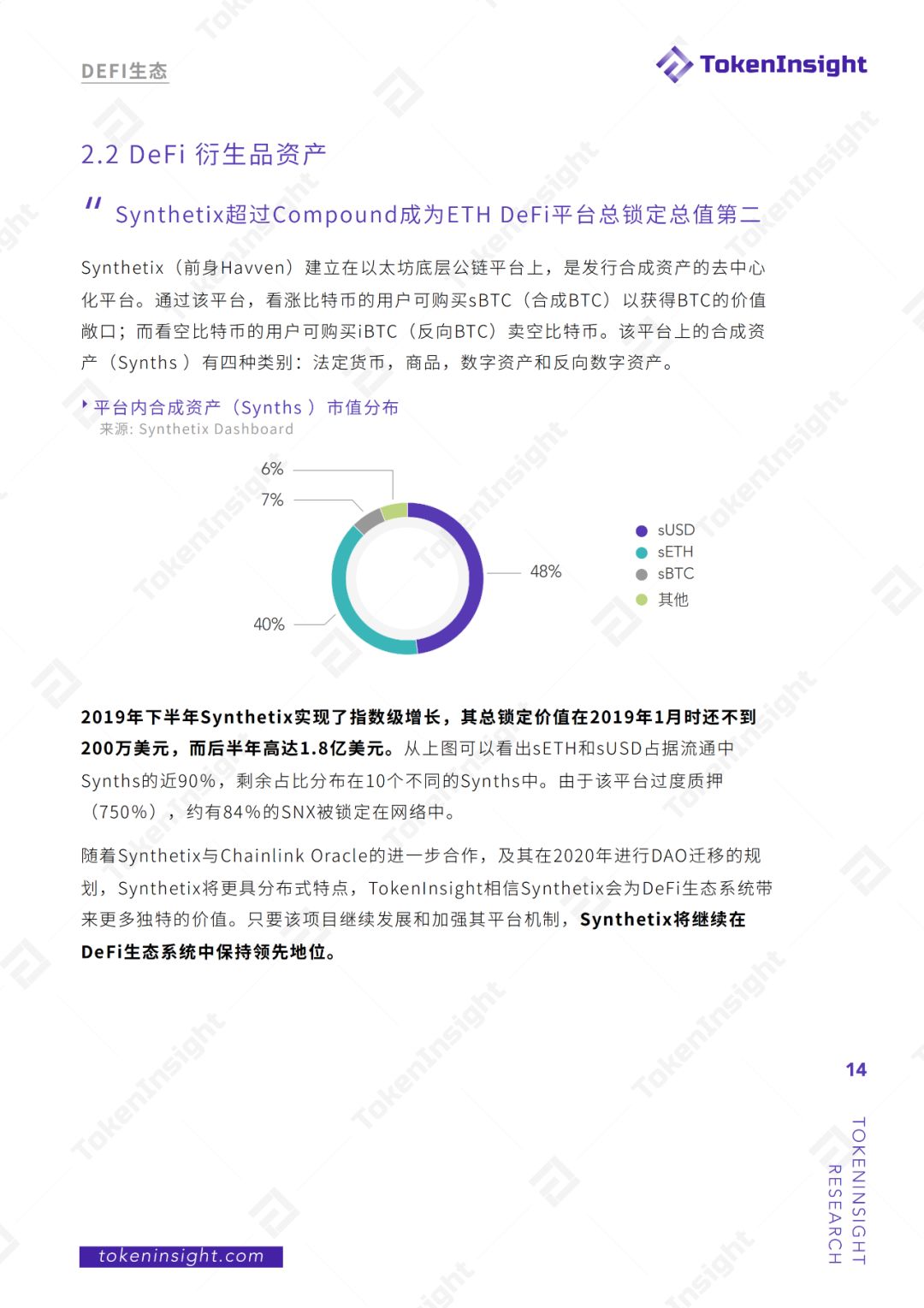

2019 DeFi Industry Research Report: DeFi lending continues to grow and expand in 2020, and stablecoins will continue to grow

Editor's Note: The original title was "DeFi Industry Research Report 2019"

○ ●

Key takeaways:

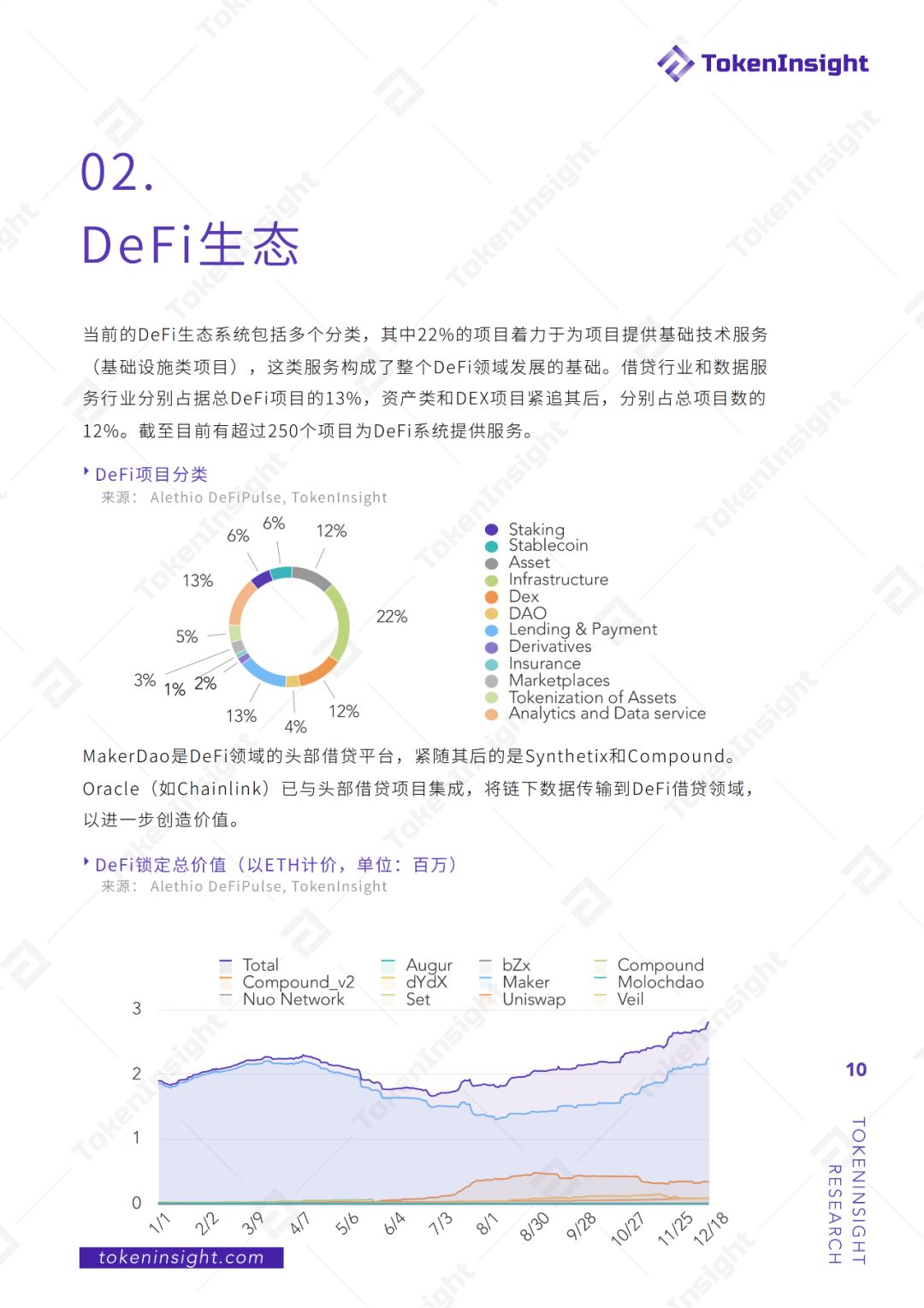

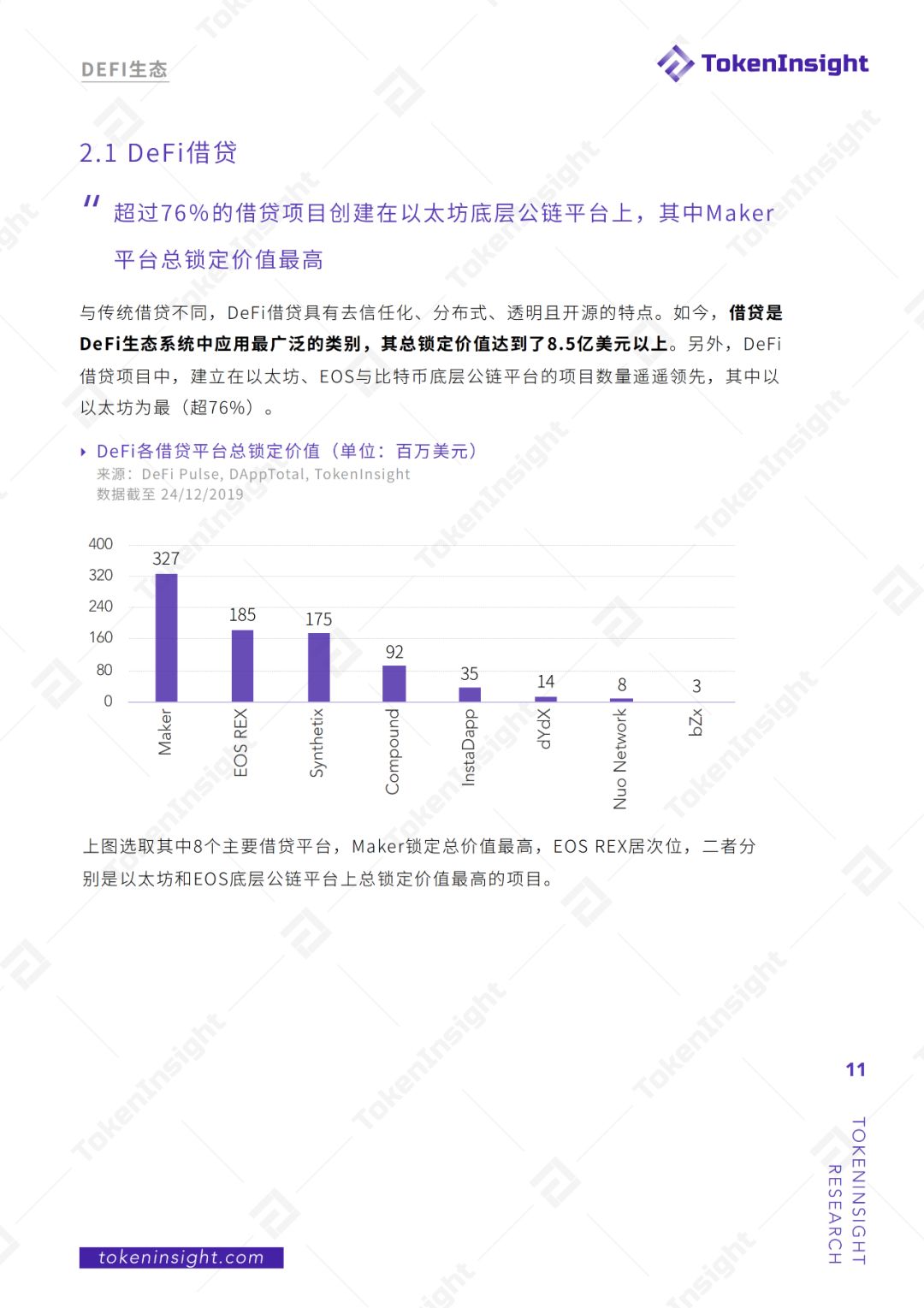

1. MakerDao accounts for about 50% of Ethereum DeFi.

- Technical Interpretation | On-chain Capacity Expansion Technology Guide (1): Data Layer and Network Layer

- Research Report | Analysis Report on Quantum Mechanics and Blockchain Security Technology

- IMF urges Philippine central bank to collect crypto exchange transaction data and use data for macroeconomic analysis

2. At least $ 850 million worth of assets are locked in the DeFi ecosystem.

3. About 7% of EOS in circulation is locked in the EOS-based DeFi ecosystem.

4. The supply of ETH locked in DeFi accounts for about 2.5% of the current circulating supply.

5. Despite the recent decline in the digital asset market price, the total value (USD) locked in Ethereum DeFi increased from US $ 290 million to US $ 680 million in 2019, more than doubling its value.

6. The outstanding debt in the DeFi ecosystem increased from US $ 68 million to US $ 154 million, more than doubling the amount.

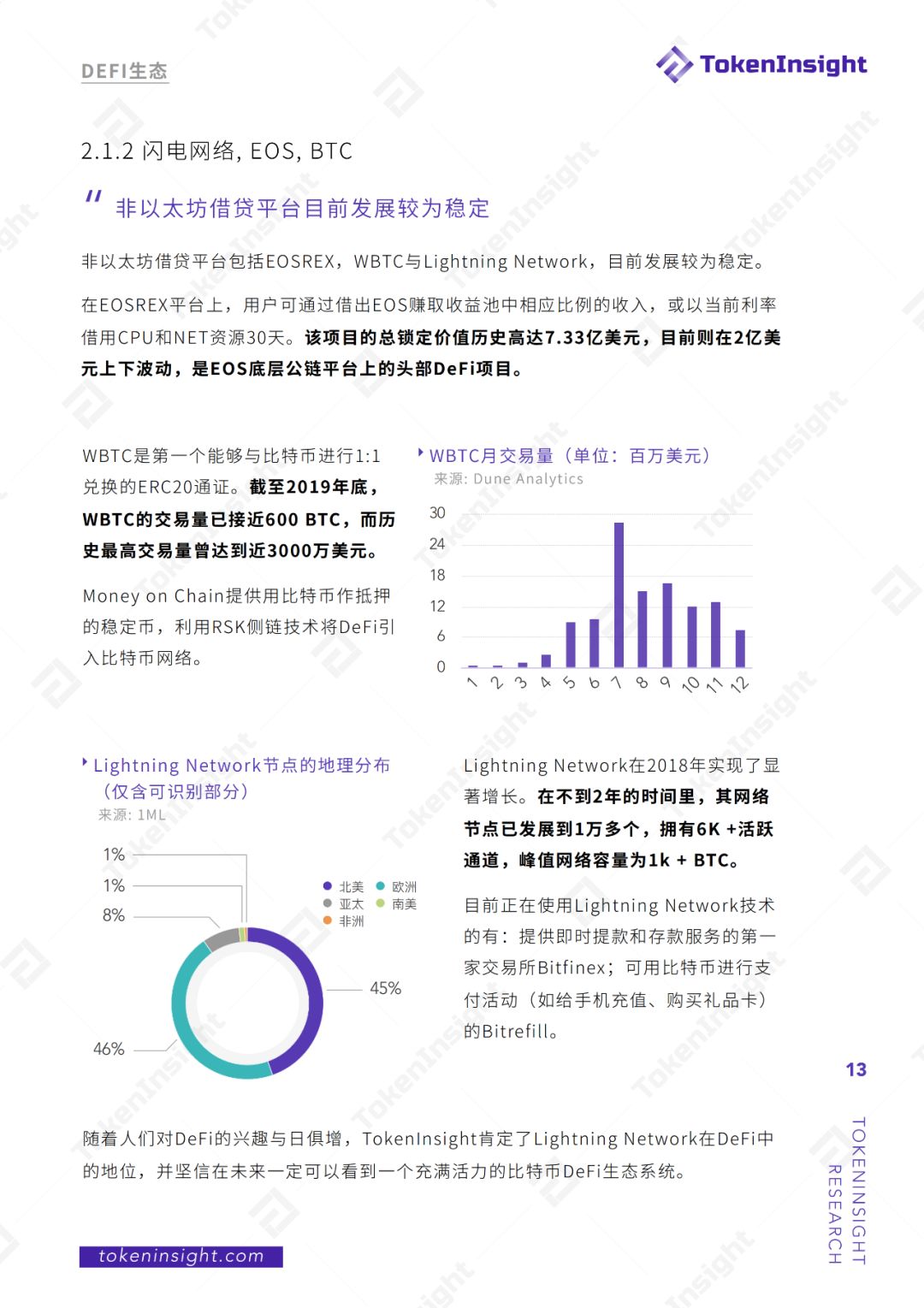

7. The number of BTC locked in the Lightning Network doubled from approximately 504 BTC to a peak of 1,100 BTC.

8. Over the past year, the growth of DEX transactions has slowed down and stabilized, with an average daily trading volume of approximately USD 2 million. The transaction volume of the head centralized exchange is about 600 million US dollars, and DEX still has a lot of room for growth.

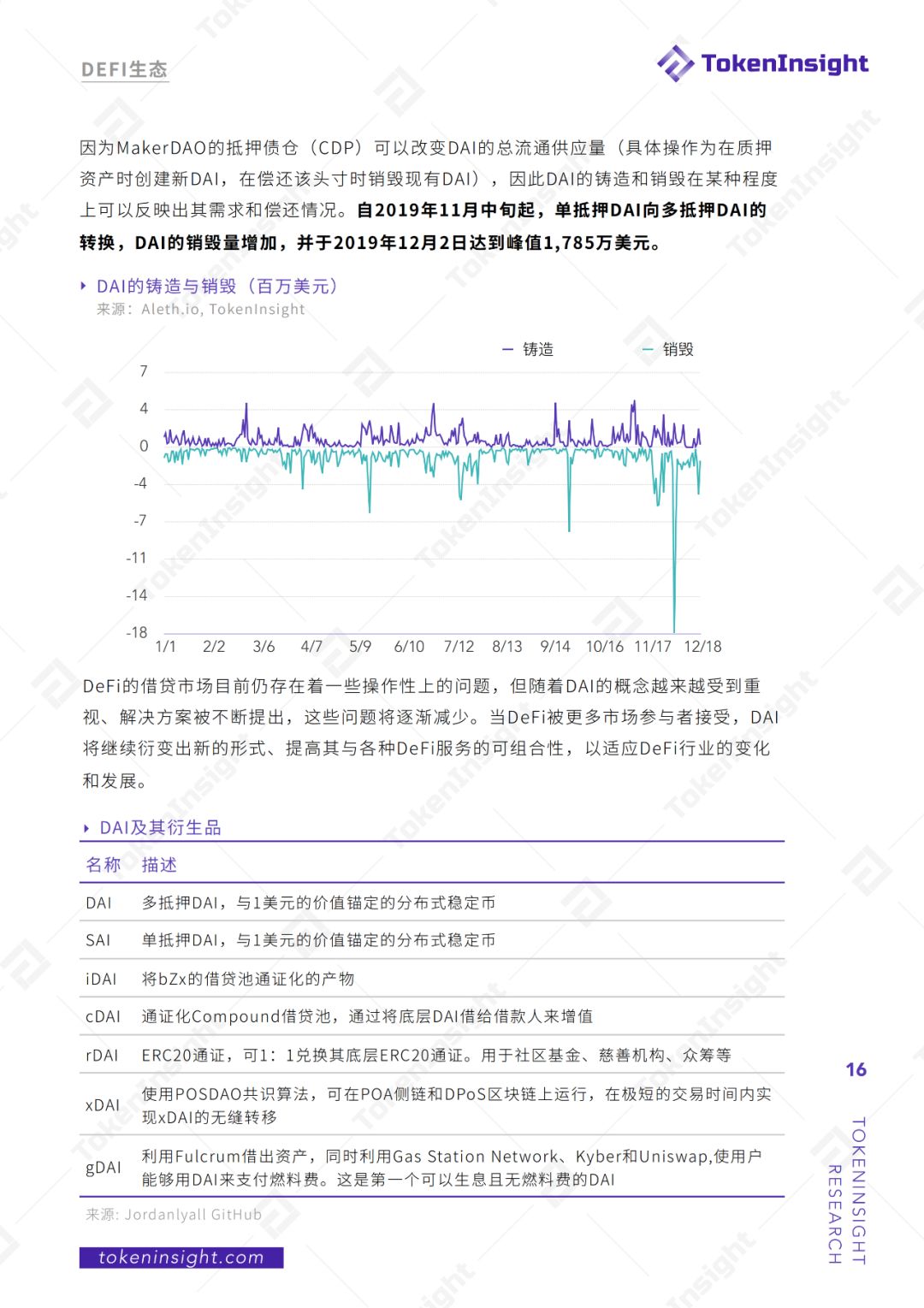

9. It can be seen from DAI that it has strong market demand. The DAI locked in the DeFi market has grown exponentially from the beginning of the year with a value of only $ 3 million, reaching a maximum of $ 30 million, a 10-fold increase.

10. DeFi lending will continue to grow and develop in 2020, and auxiliary services such as Oracle and DAO required for its operation will receive more attention.

11. Centralized exchanges will still dominate the market, but with the development of liquidity aggregation tools and market-making robots, DEX will grow at a faster rate in 2020.

12. The stablecoin will continue to grow and become a link between the digital asset industry and traditional finance.

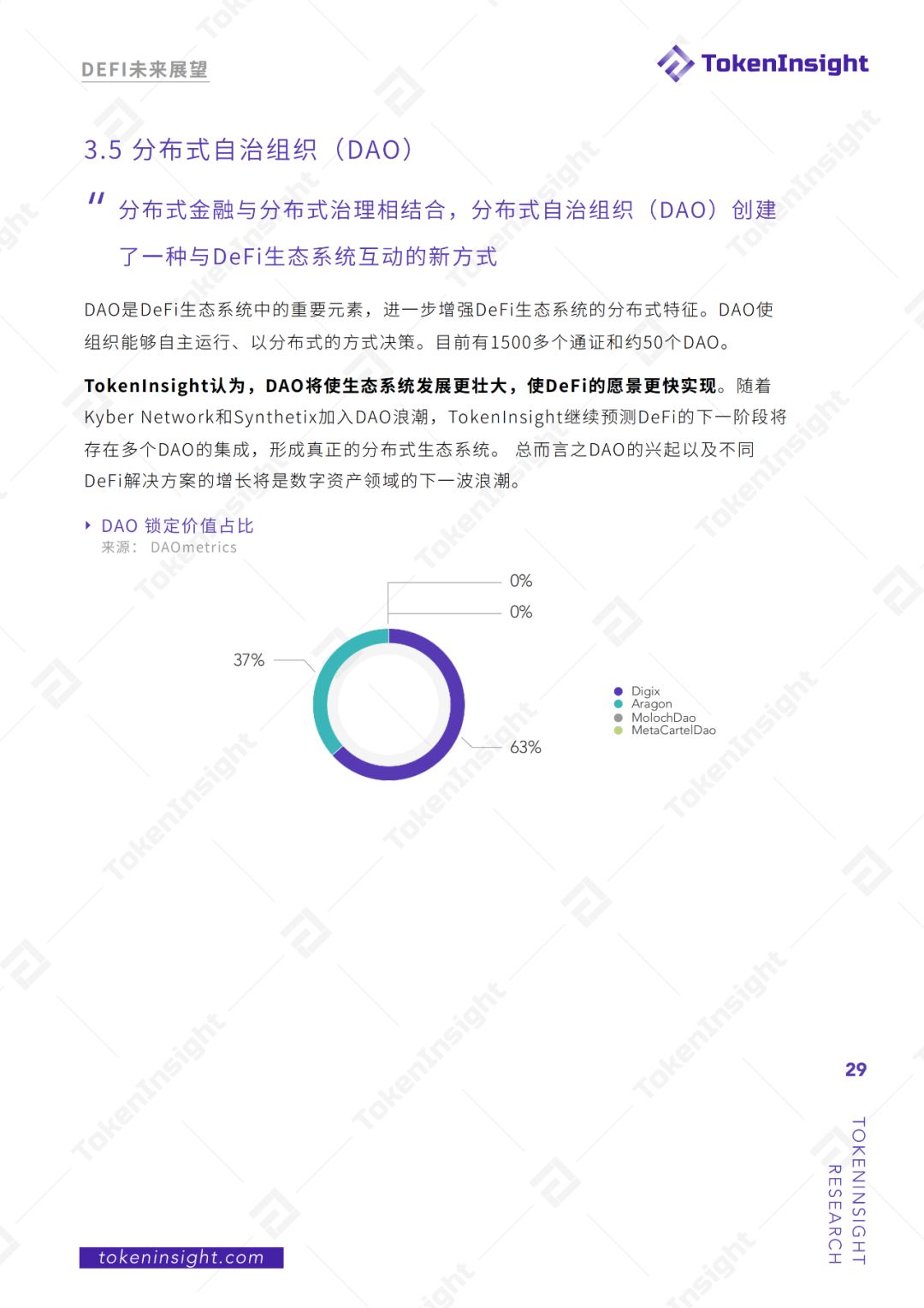

13. DAO can help DeFi projects establish a compliance governance model to address DeFi's existing compliance regulatory issues.

14. The industry will adopt some kind of false benchmark interest rate as the DeFi industry reference rate.

15. DeFi industry will add financial instruments such as options and swap contracts to help hedge the potential risks of DeFi.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Technology Dry Goods | Zero Knowledge Proof Learn by Coding: An Introduction to libsnark

- The main theme of foreign media reports in 2019: cryptocurrencies will not "die"

- Suzhou released 30 new industrial policies, including the construction of fintech supervision sandbox (full text)

- Bitcoin network UTXO reaches 64.5 million, continues to grow and hits record high

- QKL123 Blockchain List | Market Activity Declines, Mining Machines Are Renewed (201912)

- Alibaba releases 2019 annual report on counterfeiting: assisting 439 districts and counties to introduce counterfeiting

- Sending charcoal in the snow or contributing to the flames? See the pros and cons of CBDC from a practical perspective