On the eve of the birth of China's digital currency: the pilot of the central bank, the four major horse races, can it lead the world?

Author: "financial" correspondent Zhang Wei

Edit: Yuan Man

The four major state-owned commercial banks, the three major telecom operators, Huawei … The main institutions have entered the bureau, and China's legal digital currency is driven by the central bank's innovative power and is about to enter the life application scenario. In the era of global digital currency, China is becoming a leader.

- Lingting 2020 New Year's Eve speech lineup announced, 5 highlights and big exposure

- Babbitt Column | Deng Jianpeng: On USDT Risk and Protection of Chinese Investors' Rights

- Microsoft Azure blockchain platform opens more features, launches token and data management services

Despite much controversy, the torrent of technological innovation has pushed digital currencies to the point of the times. The competition for key nodes comes from government forces-various central banks' research and judgments and bets on fiat digital currencies, and the People's Bank of China may become the frontrunner.

For three years of quietness, the research and development of legal digital currencies by the People's Bank of China has quietly accelerated. Huang Qifan, deputy director of the China International Economic Exchange Center, and Huang Yiping, deputy dean of the National Development Research Institute of Peking University, have recently given expectations that the People's Bank of China is likely to become the first central bank to launch digital currencies in the world. The basis is that the People's Bank of China has been studying DCEP since 2014 and has matured.

DCEP (Digital Currency Electronic Payment) is an electronic currency developed by the People's Bank of China. It is a type of DIGICCY. The complete meaning of DCEP is the digital currency electronic payment. When the scan code payment is taking the world by storm, DCEP is considered the only cash terminator because of its unlimited legal status.

Not just the industry and academia. On November 28, Fan Yifei, deputy governor of the People ’s Bank of China, said at the “Eighth China Payment and Clearing Forum” that the central bank ’s legal digital currency DC / EP has basically completed the top-level design, standard formulation, function research and development, and joint testing. One step will be to rationally select the pilot verification area, scenario and service scope, and steadily promote the introduction and application of digital form of fiat currency.

According to the reporter of Caijing, the pilot project of the statutory digital currency of the central bank jointly led by the People's Bank of China, the four major state-owned commercial banks of Industry, Agriculture, China Construction, and China Telecom, China Telecom, and China Unicom is expected to be in Shenzhen , Suzhou and other places.

This is almost three years before the first digital currency test of fiat currencies.

On the eve of the Spring Festival in 2017, the People's Bank of China first tested digital bill transactions on its in-system platform, and five financial institutions such as ICBC and Bank of China fully cooperated.

Compared with the previous pilot, this time the central bank's legal digital currency pilot will go out of the central bank system and enter real service scenarios such as transportation, education, and medical treatment, reaching C-end users and generating frequent applications. Pilot banks can carry out according to their own advantages. Scene selection.

The pilot project was led by the Central Bank's Currency, Gold and Silver Bureau, and the Digital Currency Research Institute specifically implemented it. According to a reporter from Caijing, at the end of last year, the anti-counterfeiting department under the Central Bank's Currency Gold and Silver Bureau was changed to the digital currency and anti-counterfeiting management office, as the only official authority of the central bank's digital currency.

"Not long ago, the Digital Currency Research Institute of the Central Bank introduced the horse racing model. Under the premise of voluntariness, each bank chose a scenario to try first in Shenzhen. Which one is better in the future, it does not rule out adopting this model directly. " A person close to the pilot project disclose.

In addition, the testing of relevant standards of fiat digital currencies and payment system access are also progressing simultaneously.

The close to the pilot project team said that the pilot (Shenzhen digital currency currency pilot) plan is divided into two phases. At the end of this year, it is a phase. The pilot will be closed in a small-scale scenario, and next year will be the second phase, which will be widely promoted in Shenzhen. .

If the pilot work progresses smoothly, the central bank's legal digital currency will make substantial progress, which can be said to be a real "coming soon."

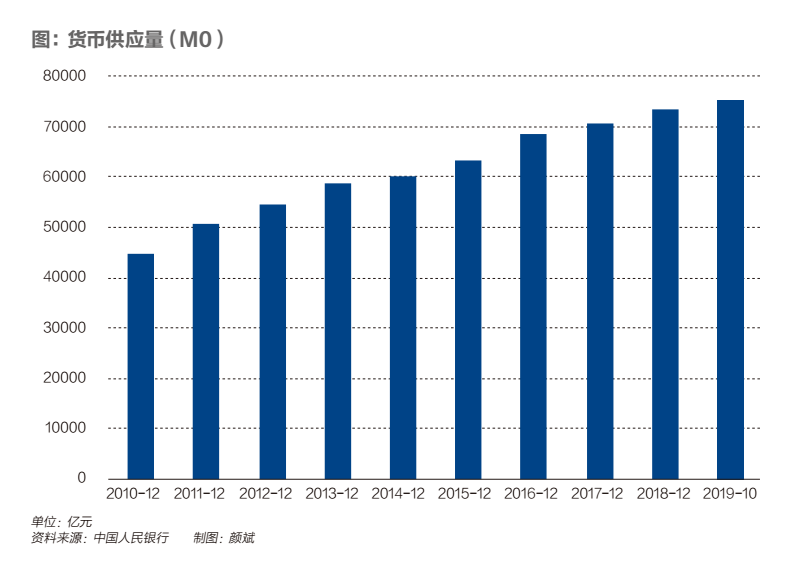

Fan Yifei once said that M1 (narrow sense currency) and M2 (broad money) are based on commercial bank accounts and have been implemented electronically or digitally. There is no need to use digital currencies to digitize again. The central bank's digital currency focuses on replacing M0 (cash in circulation), and maintains the attributes and main characteristics of cash, meeting the needs of portability and anonymity, and will be the best tool to replace cash.

Although radical fintech advocates see the Chinese central bank's DCEP as a conservative route for digital currencies. Even so, some analysts believe that a small step in DCEP will bring great changes, especially in the payment and clearing market.

In 2016, the status of QR code payment was re-approved, and the code scanning specifications clearly defined the small and convenient payment positioning of code scanning. After that, scanning code payment represented by WeChat payment and Alipay swept the country and gradually replaced cash.

On this basis, the necessity of launching fiat digital currencies has been discussed by the industry. "In order to protect our currency sovereignty and fiat currency status, we need to plan ahead. " Mu Changchun, director of the Digital Currency Research Institute of the Central Bank, pointed out in the "Get" course.

Greenspan even put it bluntly at the "Finance" annual meeting, and the central bank's legal digital currency is a political issue.

Yi Gang, the governor of the People ’s Bank of China, has publicly stated that there is no timetable for the launch of digital currencies, and there will be a series of research, testing, pilots, assessments, and risk prevention, especially the cross-border use of digital currencies. A series of regulatory requirements such as financing.

Obviously, the pilot is only the first step. There is still a lot of work to be done in the future, and it is not without challenges. A senior technical solution source said that the central bank has done a lot of preparations, including the popularization of currency and products, but from a technical perspective, there is still a long way to go. With the acceleration of the central bank's research and development of digital currency and pilot projects, it is foreseeable that the industry chain related to the printing, issuing, returning, and storage of banknotes will face new changes.

Pilot speedup

In August this year, the Central Committee of the Communist Party of China and the State Council issued the "Opinions on Supporting Shenzhen to Build a Pioneering Demonstration Zone with Chinese Characteristics" and proposed to create a pilot zone for the development of digital economy innovation and support the development of digital currency research and mobile payment applications in Shenzhen.

"A very important reason for choosing Shenzhen as a pilot for digital currency is to support Shenzhen as a pilot demonstration area. " Those close to the project team admitted frankly.

In June 2018, the Digital Currency Research Institute of the Central Bank registered and established a wholly-owned subsidiary in Shenzhen, Shenzhen Fintech Co., Ltd., to lay the groundwork for the central bank's digital currency landing in Shenzhen.

On November 4, Fan Yifei went to Huawei's Shenzhen headquarters for investigation. During the period, the People's Bank of China Clearing Center signed a strategic cooperation agreement with Huawei, and the People's Bank of China Digital Currency Research Institute and Huawei signed a cooperation memorandum on financial technology research.

A technical person from a large technology company told a reporter from Caijing that the central bank's research and development of digital currencies requires cloud technology. At present, the impact of Huawei Cloud in China cannot be underestimated; the second technology pillar is 5G, which is also Huawei's core technology. Advantages, digital currency application scenarios involve a large number of edge computing, terminal use, mobile wallets, etc.

Huang Yiping said in an interview in Shenzhen a few days ago that Shenzhen, as the world's leading technology and financial innovation center, will play an important role in the experiment of digital currency. This will not only further enhance Shenzhen's innovation ability, but also contribute to the national financial strategy. .

According to a reporter from Caijing, in addition to Shenzhen, the pilot digital currency of the central bank is expected to land in Suzhou. Recently, a public information showed that the Yangtze River Delta Financial Technology Co., Ltd., a subsidiary of the People's Bank of China (hereinafter referred to as the "central bank"), is rushing to recruit blockchain-related talents.

According to the official introduction, the Yangtze River Delta Financial Technology Co., Ltd. is a fintech company set up by the Central Bank Digital Currency Research Institute and relevant units in Suzhou City. It will undertake the construction and stable operation of legal digital currency infrastructure; undertake key technical breakthroughs and trials of legal digital currency Scenario support, supporting R & D and testing; focus on cutting-edge directions in financial technology such as blockchain and cryptography.

"In the middle of doing it slowly, this time suddenly accelerated. " A number of commercial bankers passed to Caijing reporters the changes in the central bank's development of digital currencies in their eyes.

On June 18 this year, Facebook, the world's largest social networking site, released the "Libra" digital currency white paper, announcing that it will build a simple, borderless currency and a financial infrastructure that will serve billions of people. As a new virtual cryptocurrency launched by Facebook, Libra plans to become an encrypted digital currency that does not pursue the stability of the exchange rate against the US dollar, but pursues a relatively stable actual purchasing power. As a global digital native currency, it focuses on payment and cross-border remittances.

"There is no digital currency like Libra that can cause tension in the entire currency and financial world. " Mu Changchun said in the "Getting" course. Libra's influence on global central banks' research and development of digital currencies is evident.

It is understood that the design logic of DCEP is similar to Libra in many places, but it does not imitate each other.

In fact, the research and development of the digital currency of the People's Bank of China has been leading the world. In 2014, Zhou Xiaochuan, then governor of the central bank, put forward the idea that "the central bank's digital currency is a substitute for paper money"; in 2017, the central bank of China conducted digital currency testing through a digital bill trading platform, becoming the first country in the world to do such experiments .

However, the digital currency test in 2017 is more about technology reserve and knowledge accumulation, which is not the same concept as the real issue of digital currency. After the test of that year, the central bank's research and development of digital currency entered a slow pace.

People close to the central bank believe that the reasons for the above situation include two points: first, the currency circle was rectified, and whether digital currency R & D adopted the blockchain technology closely related to the currency circle is controversial; on the other hand, the central bank promoted legal digital currency Unlike private digital currencies, if you want to speed up further, you need to consider more factors.

At that time, another unexpected news was that in September 2018, Yao Qian, the first director of the Digital Currency Research Institute of the Central Bank, left and was transferred to the general manager of China Securities Depository and Clearing Corporation. Yao has a strong theoretical foundation for digital currency, and has contributed to the central bank's research and development of digital currency.

After that, the market's interest in the Digital Currency Institute dropped for a time. In addition, as electronic payment methods are so developed, the need for central banks to develop digital currencies has also become an indirect discussion topic. Mu Changchun stated in the above course that, first of all, in order to protect his currency sovereignty and legal currency status, he needs to plan ahead. Secondly, the current bill, coin issuance, printing, returning, and storage costs are very high. It also requires the cost of some anti-counterfeiting technology. The circulation system is cumbersome and inconvenient to carry.

The turning point occurred in early August this year. The central bank mentioned in the working video conference held in the second half of 2019 that it will speed up the development of China's legal digital currency and track and study the development trend of domestic and foreign virtual currencies.

According to "Financial and Economics" reporters, the relevant supporting work of the central bank's digital currency pilot is also progressing in an orderly manner. The Golden Standards Committee's legal digital currency standards working group established in 2018 was set up at the Central Bank's Digital Currency Research Institute and has completed the preparation of some standards for distributed ledger security specifications.

"Since it was established in the Digital Currency Research Institute, the research standards will be compatible with fiat digital currencies." A person close to the central bank said that the formation of an innovative thing is to first study technology, small-scale experiments, and form a unified consensus and standard. "Before launching on the market on a large scale, setting standards is important. "In addition, the central bank also tested the development of digital currency access payment systems. According to a clearer, the existing payment system supports digital currencies to a certain extent and does not require major changes.

Regarding the design ideas of the central bank's digital currency, Zhou Xiaochuan recently summarized five points: 1. It is necessary to support the development of science and technology and prevent problems. 2. Some technologies of different systems may develop in parallel, which can encourage multiple collaborative development and fast switching, but mainly to give play to market enthusiasm. 3. The central bank needs to accurately measure and calculate and establish escrow rules to achieve 100% reserve to maintain stability and correct the incentive mechanism. 4. The pilot should still limit the scope as much as possible, and the ex-ante design of exit is like writing a "will testament in life". How do I exit if something goes wrong? Design it in advance. Technology inventors and innovators may not be enthusiastic about this design, and the central bank should require it to do adequate design. 5. It is necessary to prevent the burning of money and disguised subsidies (including direct subsidies and cross subsidies) to grab market share and distort the competition order.

A professional told a reporter from Caijing that whether digital currency can be launched as a fiat currency depends on several factors: whether it has the least impact on the entire economy, whether the technology is strong, whether the country is determined, and whether the people are willing to accept it.

Daxing Competition

Officials of the People ’s Bank of China have publicly stated that the Bank of China ’s digital currency will adopt a two-tier investment and two-tier operation structure (the upper layer is the People ’s Bank of China to commercial banks, and the lower layer is a commercial bank to the people) Roles. Figure / IC

Officials of the People ’s Bank of China have publicly stated that the Bank of China ’s digital currency will adopt a two-tier investment and two-tier operation structure (the upper layer is the People ’s Bank of China versus commercial banks, and the lower layer is from commercial banks to ordinary people). Important role.

According to the reporter of Caijing, as early as November, the supervisory authorities have convened a pilot bank to hold a meeting in Shenzhen and conducted in-depth communication on the selection and refinement of application scenarios. The pilot banks selected the scenario from their own advantages and reported it. Central bank.

A person close to the central bank said that as the central bank attaches great importance to the DCEP pilot, various pilot banks have actively participated. As a matter of fact, as early as the end of October, some banks held related meetings on the pilot digital currency pilot work and pilot scenario plans to discuss the feasibility of the related plans. Each commercial bank has different project names for digital currency pilot projects. In terms of internal promotion, a major department in the bank is the project's lead department, and other departments cooperate.

"Under the premise of voluntariness, each bank chooses a scene to try first in Shenzhen. Which one is better in the future does not rule out adopting this model directly. " A person close to the pilot project revealed that this is the horse racing model promoted by the central bank.

In the competition mode, the cooperation mode chosen by the pilot banks is not the same. According to a reporter from Caijing, the four major state-owned commercial banks of Industry, Agriculture, China, and Construction, as well as the three major telecommunications operators of China Mobile, China Telecom, and China Unicom have jointly entered the central bank's legal digital currency pilot program. With regard to the selection of specific pilot cooperation models, some banks tend to cooperate with telecom operators, and some banks prefer to pilot independently.

Due to the different cooperation partners of the pilot, the development model of DCEP is also inconsistent. A person from a commercial bank introduced that the bank that chooses an independent pilot tends to choose the wallet APP; under the model of cooperation with the operator, the operator tends to promote their own wallet and SIM card. Combined. "Strings can be stored in the APP or in the SIM card. "

"The digital bill trading platform chosen in 2017 as a pilot application product is that the platform is relatively simple and closed compared to retail, and belongs to the central bank's own system, which makes it easier to control. Now when it comes to scene entry, it becomes more complicated and difficult. "The banker said. The people's bank system (note-issuing system) needs to be further improved. Pilot commercial banks also started trials in their closed systems at first.

Fan Yifei once pointed out in a post. The issuance of digital currency by the People's Bank of China is actually a very complicated project. A country as large as China has a large population. The economic development, resource endowment, and population base of each region are quite different. Therefore, the entire process of design, issue, and circulation , We must fully consider the diversity and complexity we face. If we adopt single-tier launch and single-tier operation, it is equivalent to an institution of the People's Bank of China to face all consumers in China. The environment is complex and the test is very severe.

On the other hand, commercial banks and other commercial institutions have matured in IT infrastructure applications and service systems, accumulated a lot of experience in fintech, and have a sufficient talent reserve. There is no need for the central bank to set aside cash. In some commercial banks, the IT infrastructure is rebuilt and rebuilt.

To this end, commercial banks need to do a lot of service work. Liu Xiaochun, deputy director of Shanghai New Finance Research Institute and former president of Zheshang Bank, told reporters in Caijing that one is to invest in science and technology and build its own digital wallet (equivalent to (Treasury for cash) and digital currency operation system docking with the central bank digital currency issuance system and docking with customers' digital wallets; the second is to ensure the exchange of digital currencies with bookkeeping currencies, banknotes, and coins. In terms of accounts, in cash accounts In addition, it is necessary to increase the digital currency account; third, the agent central bank does a good job of issuing and managing digital currency to the society, including the return of digital currency; fourth, making digital wallets for customers. This may be the biggest difference between digital currency and cash. When using cash, the customer is to bring their own wallet or safe, and individuals can also tuck it directly into their pockets. Digital currency must have a special digital wallet, which can only be issued by the central bank or commissioned by a commercial bank.

At present, the fields of transportation, education, medical care, and consumption will become the key choice scenarios for DCEP pilot banks. According to "Financial and Economics" reporters, in order to be able to do a good job in the digital currency pilot work, several large banks not only delve into the Shenzhen scene selection, but also have locations in Beijing and set up closed development project teams.

Scenarios do not depend entirely on technology, but are more related to people's habits, culture, interests, and privacy awareness. "The pilot banks are all choosing feasible scenarios, and at the same time reserve some key area scenarios, ready to go online at any time, and hope to take advantage in the horse race enclosure." A commercial bank person admitted. This pilot scenario needs to consider the needs of both ends of the BC, involving the concepts of mother wallet, child wallet and personal wallet.

It is understood that banks other than the four major banks have not yet participated in the DCEP pilot. However, some pilot banks have already considered finding excellent small and medium banks and exploring new cooperation models.

In the process of central bank digital currency research and development, whether to adopt blockchain technology has attracted much market attention. Zhou Xiaochuan once bluntly stated that the digital currency is still developing, and the blockchain technology behind it has not achieved the expected high TPS (Transaction Per Second, the number of transactions or transactions that the system can process per second. It is a measure of the system's processing capacity Important indicators) performance. The central bank is promoting the application of blockchain in two low TPS trading markets: one is bill trading and the other is letter of credit financing transactions.

The above-mentioned senior technical solution person also further pointed out that at present, the blockchain technology alone cannot meet the application requirements of the Chinese digital currency scene, unless some major changes occur in the future. However, he also acknowledged that although blockchain is not the perfect technology, it is currently the only relatively comprehensive and necessary technology he has seen.

"The central bank will not interfere with the technical route selection of commercial institutions. When commercial institutions exchange digital currencies with ordinary people, what technology is used to exchange them? Is it a blockchain or a traditional account system? Is it an electronic payment tool or a mobile payment? Tools? No matter which technological route is adopted, the central bank can adapt at this level. " Mu Changchun said in the above-mentioned course that our starting point is to fully mobilize market forces, achieve system optimization through competitive selection, joint development, and common operations. It is good for integrating resources and promoting innovation. "Of course, there are other considerations in the two-tier operation system. One is to avoid financial disintermediation. At the same time, it can fully mobilize the enthusiasm of the market, use market mechanisms to achieve resource allocation, and motivate commercial banks and commercial institutions.

Under the two-tier release and two-tier operation structure, the release of digital currency by the central bank is expected to be consistent with the process of issuing banknotes. The process of issuing banknotes includes: the People's Bank prints the banknotes, the commercial bank pays the currency issuance fund to the People's Bank, and then sends the banknotes to outlets, and then the people go to the outlets to exchange cash.

After the People ’s Bank of China issued DCEP, the form of currency circulation was “commercial banks open an account with the central bank and pay 100% of the reserve, and individuals and businesses open digital wallets through commercial banks or commercial institutions.” Mu Changchun said that for users, , You do n’t need to go to a commercial bank, just download and register an app, then you can use it.

It is understood that, as with cash, commercial banks will set a certain threshold for DCEP in accordance with current cash management regulations in the future to prevent run-in crises under special circumstances.

Payment shock

Although radical fintech advocates see the Chinese central bank's DCEP as a conservative route for digital currencies. Even so, some analysts believe that a small step in DCEP will bring great changes, especially in the payment and clearing market.

The cash removal in the payment field originates from the electronic currency, and digital currency, as an iterator of electronic currency, is regarded as the terminator of cash (banknotes, coins) payment.

"There is an inheritance relationship between electronic currency and digital currency. Electronic currency conversion is more about the flow of funds behind payment information, and digital currency is reflected in the 'root' of the monetary system, that is, M0 is digitized, and the structure of M0 will change. "A digital currency researcher told a Caijing reporter.

Earlier, an Internet finance practitioner expressed his opinion on cash: cash should not only include paper cash, but also include payment instruments issued by all payment institutions approved by the central bank. The latest financial data released by the central bank shows that as of the end of October, the balance of currency in circulation (M0) was 7.34 trillion yuan, a year-on-year increase of 4.7%, and net cash withdrawals for the month were 73.4 billion yuan.

Although, the definition of cash M0 in the financial field shows a growth trend, and the ordinary people's understanding of cash in daily life is obviously different, the latter thinks that cash is banknotes and coins. With the rise of two-dimensional code payment, the use of banknotes and coins in people's lives is obviously declining, and the cash operations at bank outlets have significantly declined, requiring only a mobile phone to achieve "cashless" travel.

After the two-dimensional code payment compliance in 2016, the two giants, Alipay and WeChat Pay, began to push offline code payment, gradually replacing cash transactions, and then monopolizing the offline mobile payment market. Recently, iResearch released the "China Third-Party Payment Industry Data Release Report" for the first half of 2019. Data show that in the first half of this year, the scale of third-party mobile payment transactions was about 110.4 trillion yuan. The year-on-year growth rate is 23.76%, and the growth rate has slowed down compared to 2018.

Among them, Alipay and Caifutong still maintain absolute monopoly. The two giants occupy about 93% of the market share, and other institutions grab less than 7% of the market share.

In the future, can the central bank's legal digital currency change the current payment pattern?

There is a radical voice that legal fiat currencies will create the only opportunity to kill Alipay and WeChat. However, from the perspective of individual giants, the launch of the central bank's digital currency will not affect the existing payment structure. According to the reporter of Caijing, the two payment giants have closely communicated with the regulatory authorities on related matters and intend to enter the legal digital currency experimental field.

The functions and attributes of the digital currency of the central bank are exactly the same as those of paper money, and are translated as "digital payment tools with value characteristics", which means that similar to paper money payment, no account is needed to realize value transfer. The specific payment path is: DCEP digital wallet is installed on the mobile phones of both parties. Even if there is no network, as long as the mobile phone is turned on (with sufficient power), two mobile phones can complete the currency transfer with a touch, and there is no need to bind any bank card . However, mobile phone holders still need to bind a bank account if they charge money to or withdraw funds from the digital wallet.

Furthermore, can digital currency be directly tied to credit cards? According to a reporter from Caijing, related banks are also studying. If a credit card is bound, similar to the current credit card withdrawal, the bank charges the relevant withdrawal fee.

According to Mu Changchun's lecture, the central bank's digital currency replaced M0 instead of M1 and M2. This means that the digital currency of the central bank is still a liability of the central bank and is legally compensated. This is more effective and secure than Alipay and WeChat payment. They (Alipay and WeChat payment) are not the central bank currency for settlement, but business Bank deposit currency is used for settlement. In this case, there is a problem of centralized depository of reserve funds.

"Wechat and Alipay have not reached the same level as paper money in terms of legal status and security." Mu Changchun explained that, in theory, commercial banks are likely to go bankrupt, so the People's Bank of China has established a deposit insurance system these years; but Suppose WeChat is bankrupt, and the money in the WeChat wallet has no deposit insurance, and you can only participate in its bankruptcy liquidation. For example, if you had 100 yuan before, you can only pay you back 1 cent. You can only accept it. Protection of the lender of last resort. "Of course, this possibility is small, but you cannot completely rule it out. "

Another major advantage of the central bank digital currency is also reflected in the occurrence of natural disasters. For example, Mu earthquake, such as a severe earthquake cut off communication, and then block electronic payment, there are only two payment methods: one is paper money, the other is the central bank digital Currency-"Dual offline payments" that do not require a network.

"In legal digital currency, the biggest difference from Alipay and WeChat is that banks have always focused on payment itself, and the two giants have penetrated customers and opened up the industry chain." A commercial bank source told a reporter from Caijing that the comparison of payment institutions The tension is that DCEP will lean towards free services.

For market-oriented Alipay and WeChat Pay, high-density customer binding that was once heavily subsidized is a double-edged sword. While bringing customer traffic to the two giants, it also brings large cost expenditures.

Take the convenient credit card repayment function as an example. Previously, the free credit card repayment of the two was very popular with customers. According to market industry speculation, the credit card repayment scale of Alipay and WeChat is close to one trillion yuan. The tolls cost several billion yuan. Later, under the promotion of strict regulatory policies such as centralized reserve deposits and cut off direct connections, this huge cost has resulted in two payment giants having no choice but to embark on the road of credit card repayment charges.

"Some payment giants believe that the central bank's digital currency will not comply with business rules. " A person close to the project team admitted. The purpose of fiat digital currency is to replace cash and loose change, but it is not as flexible as Alipay, WeChat, or cash convenient. "It is unlikely that it will be used. WeChat and Alipay are very good at replacing small change. Although fiat digital currency cannot be rejected, customers have the right to use it."

By comparison, now private payment institutions or platforms generally set up payment barriers. For example, WeChat and Alipay cannot scan each other's codes. However, for central bank digital currencies, where electronic payment is used, the central bank's digital currency must be accepted. In the industry's opinion, if the two really compete, it depends on who can really win the favor of customers.

Liu Xiaochun believes that the impact of central bank digital currencies on the current payment structure depends on how popular central bank digital currencies are in reality and in which fields or scenarios are more suitable for use. In fact, digital currency is not generated based on demand, which is different from Alipay. Although Satoshi Nakamoto's original purpose was to provide a payment method like cash for online transactions, Bitcoin has deviated from this original intention from the beginning. After that, all the ideas about digital currency are deduced from the technology itself.

Global demonstration

Former US Federal Reserve Chairman Alan Greenspan said at the 17th Annual Financial Outlook Conference of China Finance and Economics that central banks of all countries do not need to issue digital currencies. He said, "Currencies in various countries are backed by sovereign credit, which cannot be provided by other organizations. The basic sovereign credit of the United States is far beyond Facebook's imagination. "

At the same time, Greenspan also pointed out that the issue of sovereign digital currencies by the central bank is not a topic in the economic field, but a topic in the political field.

However, major central banks around the world are developing digital currencies.

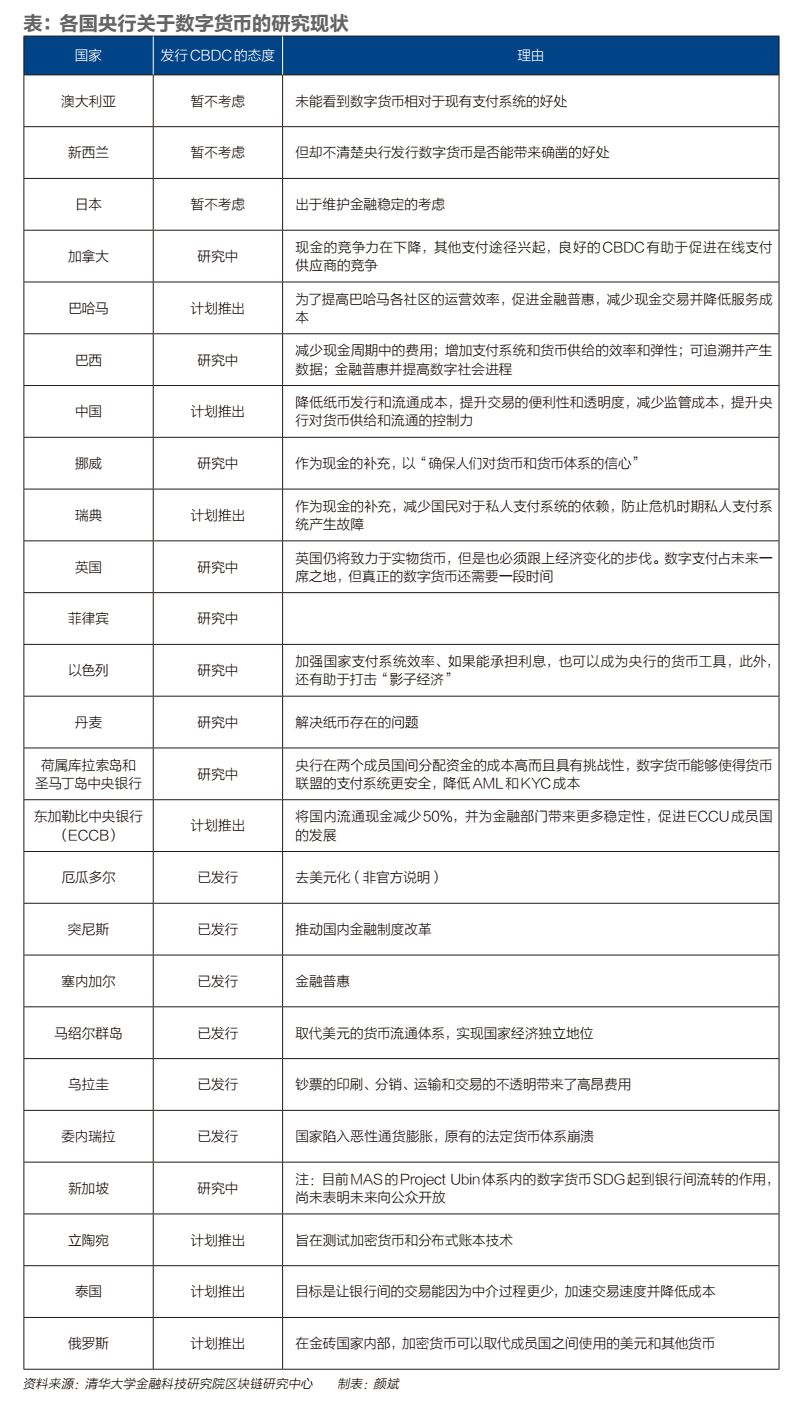

The research report released by the Tsinghua University Institute of Financial Technology's Blockchain Research Center earlier this year sorted out the current status of digital currency research by central banks in various countries. Of the 25 central banks, there are 7 central banks that plan to launch CBDC (Financed Digital Currency), 9 are under exploration, 6 have been issued, and 3 are not considered for the time being.

The report pointed out that at present, most developed country central banks are considering issuing digital currencies in order to avoid the monopoly of private payment companies, and developing countries and African countries are mostly because of financial inclusion and sanctions breakthrough.

Public reports indicate that Tunisia recently announced the launch of a digital version of its national currency, Dinar (E-Dinar), or the first country in the world to issue a central bank digital currency (CBDC). At present, "E-dinar" has officially started testing.

At the same time, a senior European Central Bank official said recently that the feasibility study of digital currencies supported by the European Central Bank is expected to make progress in the next few months, but this project faces challenges and is long-term.

Recently, ECB President Christina Lagarde told the ECON committee of the European Parliament that the digital currency of the Central Bank will allow citizens to directly use the currency of the Central Bank in daily transactions. However, by its design, central bank digital currencies can pose risks. For example, they can change how monetary policy is implemented and how it is passed on to the real economy. They may also have an impact on the functioning and stability of the global financial system. Therefore, the issue of central bank digital currency and its optimal design is worth further analysis. Our ultimate goal is to promote more secure, innovative and integrated Euro payments. This will also benefit everyone in the euro area and strengthen the euro's international influence.

At the micro level, some people in the industry pointed out that because digital currencies can achieve point-to-point transactions, they can speed up the turnover of funds, improve the efficiency of capital operations, and then reduce corporate leverage (asset-liability ratio).

At a macro level, "the implementation of digital currency on monetary policy is advantageous because this measurement is more accurate." People close to the central bank said. It cannot be ruled out that the future monetary policy framework will change, because the original macroeconomic control of monetary policy was based on unpredictable foundations, and there were more leaks in various links, more distortions, and slower feedback. Digital currency will make operations more accurate, information more transparent, feedback more timely, and demand more accurate. However, the two functions of the central bank are irreplaceable, the ultimate liquidation status and the function of currency creation.

Compared with private digital currencies, the legal digital currencies led by central banks in various countries have been promoted to the national strategic level by some admirers.

The Tongtongtong Research Institute released a report saying that in the future, digital sovereignty will form part of the comprehensive national strength of various countries, and digital sovereignty will be at least as important as financial sovereignty. Countries that introduced central bank digital currencies earlier are expected to get the first move in the digital currency trend Advantage. At the same time, digital currencies provide the central bank with new monetary policy tools, or help the central bank to make more accurate calculations of the money supply, structure, and circulation speed, which can help improve the central bank's monetary status and the effectiveness of monetary policy.

Huang Qifan said that the significance of DCEP is to greatly reduce the dependence of the transaction on the account, which is conducive to the circulation and internationalization of the RMB. At the same time, DCEP can realize the real-time collection of data such as currency creation, bookkeeping, and flow, providing a useful reference for currency investment and the formulation and implementation of monetary policies.

"The ultimate determinant of state-to-state competition in modern society is financial competitiveness." Huang Yiping believes that financial competition between countries in the future may occur in the field of digital finance, and digital currency may be the ultimate battlefield of this new competition . By mastering global digital currencies, you will have a great deal of influence in the global payment and monetary system.

The real goal of digital currency itself is to reduce a series of problems of cash, such as printing, storage, distribution, and recycling. However, from the perspective of all current technologies, in some developing countries, all the technologies faced by digital currencies are not mature enough. Well, at this time, the issuance of digital currencies by central banks in some countries is more of a gesture, but also an accumulation of experimentation and exploration.

"At this stage, we can't prove it, but we can prove that I have it." The above-mentioned senior technical solution analysts analyzed that for some developing countries that do not have the technical conditions, the introduction of digital currency is more of a gesture or a fumble. In contrast, the necessity of the central bank's digital currency is the pressure of external competition and the willingness of the central bank to innovate.

Judging from the current plan announced by the People's Bank of China, China is not only at the forefront of speed, but also the most open in terms of technology applications. Liu Xiaochun said that most institutions, including regulators, study digital currencies based on blockchain technology, and the People's Bank of China has broken through such thinking limitations. If it is only based on blockchain technology, then the use of digital currency can only be limited to the blockchain. The so-called scenarios have great limitations. The digital currency designed by the People's Bank of China can be used online or offline, even the network does not need it, let alone the blockchain? Therefore, the imagination space for using the scene is very large.

Liu Xiaochun judged that if the People's Bank of China is able to launch digital currency, it will be of great significance to the world . It can be summarized as the following five points: a technology demonstration. The digital currency of the People ’s Bank of China is not limited to blockchain technology, which provides more technical possibilities. The second is a demonstration of the issuance framework. The People ’s Bank of China uses a two-tier structure, which is related to the construction of the digital currency issuance system and operation management system. It is a demonstration of social acceptance, which determines whether digital currency has the ability to comprehensively replace the existing currency form, or it is only a supplement, or it may not be accepted. The fourth is the demonstration of social costs, and whether the operating cost of digital currency is really like people Expected to be lower than paper currency; the fifth is the extension of the display model, that is, through the development and application of digital currency, you can explore the application of related technologies in other aspects of the financial field.

Many people interviewed by Caijing reporter believe that in the long run, the disappearance of banknotes is an inevitable trend. As for when can the complete infrastructure of digital currency be as mature as bank payments, it needs to be verified in practice.

Yao Qian, former director of the Central Bank's Digital Currency Research Institute, said that in the longer term, digital currencies and banknotes will co-circulate. For ordinary people, when they come to the bank to withdraw money in the future, they can choose to exchange either physical cash or digital currency.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How many blockchain predictions in early 2019 have been implemented now?

- Perspectives | Ten Years of DeFi

- Regulatory sandboxes respond to blockchain innovation? Bank application scenarios are dominated by intermediate business

- Istanbul Fork Improves Ethereum Performance, Can Ethereum Become a "World Computer"?

- Introduction: Different types and similarities of Rollup for blockchain expansion

- Bitcoin-related products become popular among millennials, surpassing Disney and Microsoft stocks

- Japan's largest bank MUFG launches digital currency payment business, using MUFG Coin as a trading unit