Why should we pay attention to the stability of LianGuaiyLianGuail in the entry of stablecoins?

Why is LianGuaiyLianGuail stability important for stablecoin adoption?Last week, payment giant LianGuaiyLianGuail officially announced the launch of the stablecoin LianGuaiyLianGuail USD (PYUSD). Less than 24 hours after the announcement, LianGuaiyLianGuail issued 26.9 million PYUSD.

Interestingly, on the night of the announcement, LianGuaitrick McHenry, Chairman of the U.S. House Financial Services Committee, issued a statement saying that “if stablecoins are issued under a clear regulatory framework, they are expected to become the backbone of the 21st century payment system.” He also stated that we are currently at a crossroads in keeping the United States at the forefront of digital asset innovation, and Congress is strengthening legislation to ensure that the United States leads the future financial system.

The next day, the Federal Reserve issued a statement stating that it will strengthen the regulation of bank activities involving digital assets and blockchain technology.

When these three pieces of news are connected, they seem contradictory. On the one hand, giants like LianGuaiyLianGuail are entering the stablecoin race, and on the other hand, the Federal Reserve continues to exert pressure on digital asset regulation.

- On the eve of Cancun’s upgrade, taking a look at the world of zkEVM in Ethereum.

- The past, present, and future of Cancun’s upgrade

- Interpreting the potential profit opportunities of Base Velodrome, DackieSwap, Baseswap…

However, if we consider the timeline of the news, the launch of the stablecoin by LianGuaiyLianGuail seems to have received some kind of affirmation, otherwise why would they dare to take such a risk before the “new regulation” arrives?

In the recent 2023 Q2 financial report released by LianGuaiyLianGuail, the data shows that the total payment volume on the platform has reached $376.5 billion, with a transaction volume of 6.1 billion. The total number of active accounts in the past 12 months is 431 million, and the platform serves more than 200 countries.

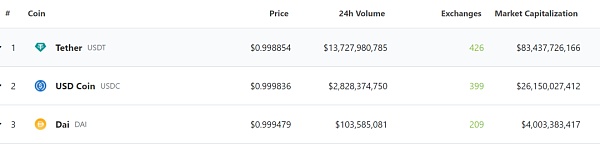

Compared to the current mainstream stablecoins in the market with market values of hundreds of billions of dollars, LianGuaiyLianGuail’s scale is still “in its infancy”. However, according to the data in its financial report, if 10% of the transaction volume adopts PYUSD, its market capacity could reach nearly $10 billion, ranking directly among the top stablecoins.

Therefore, in terms of market size, with the help of LianGuaiyLianGuail’s platform, PYUSD is highly likely to become another leader in the stablecoin industry in a short period of time.

On the other hand, in terms of globalization and user base, the adoption of mainstream stablecoins in the market is still not widespread enough and the capacity is limited. However, with the payment influence of LianGuaiyLianGuail, in today’s digital era, the role played by PYUSD is no less than the “QR code” for digital payments promoted domestically in the past.

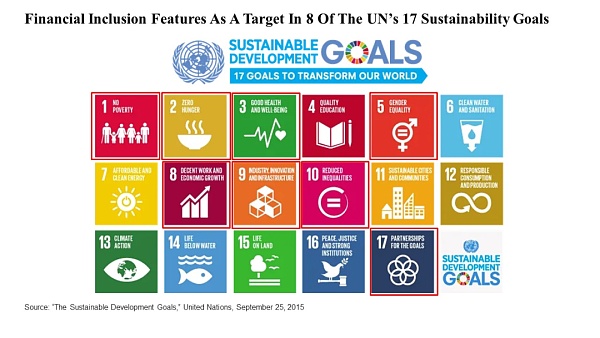

According to the Global System for Mobile Communications Association (GSMA), the global daily mobile payment transaction volume reached $3.5 billion in 2022, with 1.6 billion people worldwide registered for mobile payment accounts, a year-on-year increase of 13%. At the same time, approximately 1.4 billion people worldwide still do not have bank accounts.

If financial digitization is a trend, then how to enable users around the world to use convenient mobile payments is the next big issue. After all, it would be inconvenient for many Chinese people to go abroad without the embarrassment of not being able to use QR code payments, and this is the “big market” (inclusive finance) that payment giants like LianGuaiyLianGuail are targeting.

Of course, regarding the issuance of PYUSD, it is supported by the U.S. dollar, short-term treasury bonds, and cash equivalents. So what does this reflect?

The latest data shows that the share of the U.S. dollar as an international reserve currency has decreased from 71% at the beginning of this century to less than 60% now. The proportion of U.S. bonds held by foreign investors has decreased from 50% before the 2008 financial crisis to 30% in 2022. Therefore, how to improve the resilience of the U.S. dollar and the market rate of U.S. bonds may be an important “mystical problem” in the wave of digitalization.

But it seems that someone has figured it out. What Satoshi Nakamoto did not expect is that the concept of free finance proposed in 2008 has become a stepping stone on the path of development more than a decade later. Some have soared, while others are moving forward against the waves.

So, is the issuance of PYUSD by LianGuaiyLianGuail worth paying attention to? The answer has already been engraved on the news of LianGuaiyLianGuail enabling BTC payment in 2014.

Leading by nearly 10 years.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion GMX v2 will become a bigger cornerstone than GLP.

- No longer hesitant, two bills reveal the latest ideas on cryptocurrency regulation in the United States.

- Insights from the gambling industry From GGR to NGR – The law of attraction for cryptocurrency games?

- In 2023, AI chip companies are undergoing a deadly three-question challenge.

- In less than a week, MakerDAO has attracted a deposit of 700 million US dollars. Is the 8% interest rate really that enticing?

- Exploring the future trends of the NFT space through eths

- Even older than Ethereum itself? A Brief History and Current Situation of MEV