Binance Research Current Status and Project Progress of the RWA Market

Binance Research RWA Market Status and Project ProgressCompiled by: LianGuai0xxz

1. Key points

The tokenization of real-world assets (RWAs) continues to gain popularity as user adoption rates increase and large institutions enter the space.

Combined with lower decentralized finance (DeFi) yields, rising interest rates have sparked interest in tokenized government bonds.

Currently, the funds invested in tokenized government bonds exceed $600 million, with an annualized yield of around 4.2%.

- Who is LaunchLianGuaid really fooling with the ‘三无’ project IEO OPNX?

- Projects awarded with Ethereum ERC-4337 bounties Cross-ChAAin, Seal Seal Seal, zkLianGuaiymaster.

- WorldCoin officially launches its token. Will it become the next epic-level crypto project?

By 2030, the tokenized asset market is expected to reach $16 trillion, with significant growth potential far surpassing the $310 billion in 2022.

Many protocols have integrated RWAs or participated in their growth. This article provides a brief introduction to MakerDAO, MapleFinance, OndoFinance, and others.

2. Overview

It has been over four months since Binance first released a report on real-world assets (RWAs) (related reading: Binance Research Report: Tokenizing Real-World Assets (RWAs) – Bridging TradFi with DeFi). What changes have occurred in the market landscape since then? What are the latest developments? This report will explore all of this.

2.1 Introduction to Real-World Assets

Before diving into charts and the latest market data, we summarize several key points about real-world assets (RWAs) in this section. This covers the basic concepts of RWAs and serves as a quick introduction to the field.

What are real-world assets?

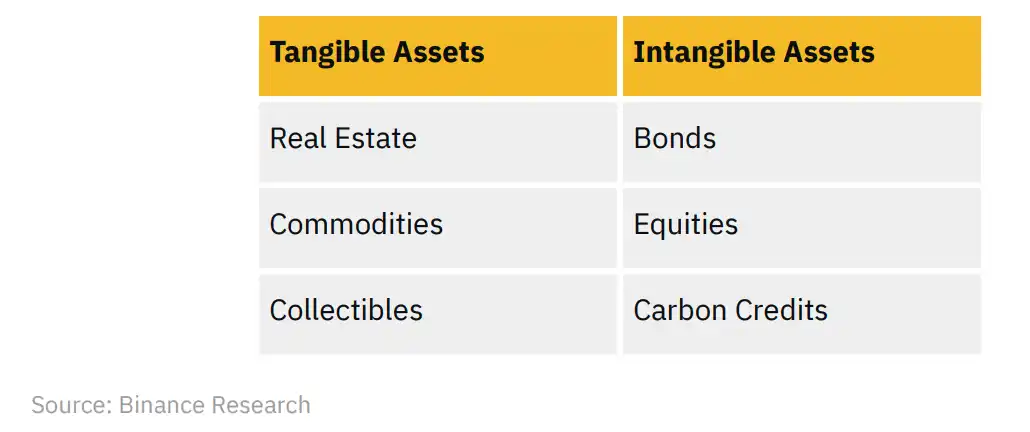

As the name suggests, real-world assets represent tangible and intangible assets in the real world (such as real estate, bonds, commodities, etc.). Tokenizing RWAs allows us to bring these off-chain assets onto the blockchain, opening up new possibilities in terms of composability and potential use cases.

Figure 1: Examples of Real-World Assets

By tokenizing RWAs, market participants can enjoy higher efficiency, increased transparency, and reduced human error, as these assets can be stored and tracked on-chain.

How does the tokenization process work?

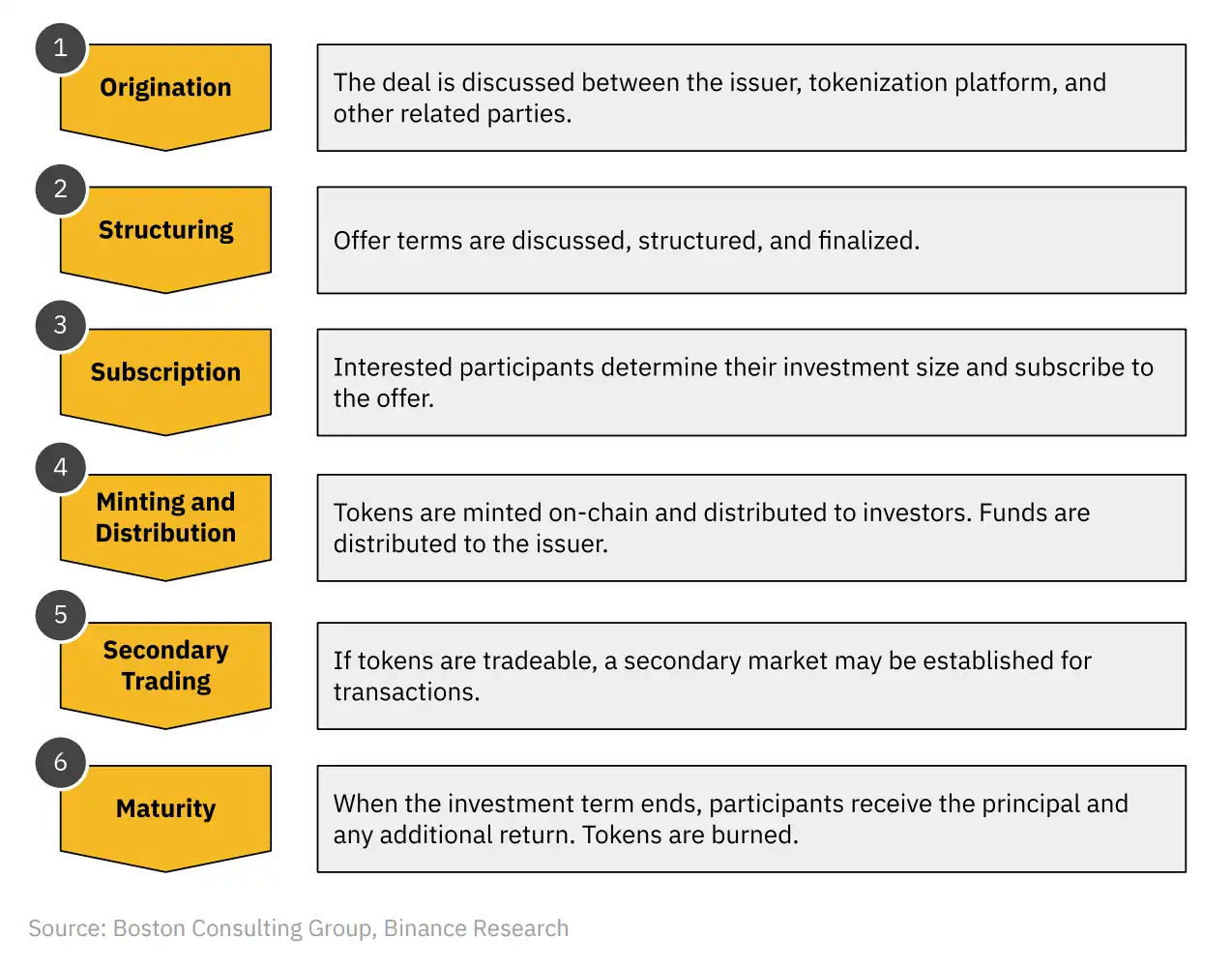

To bring RWAs onto the blockchain, ownership and representation of the assets must be recorded on the blockchain. While the specific mechanisms may vary, the typical process involves tokenizing the assets on-chain after formulating the transaction terms.

Figure 2: Example of On-Chain Tokenization Process

2.2 RWA Ecosystem

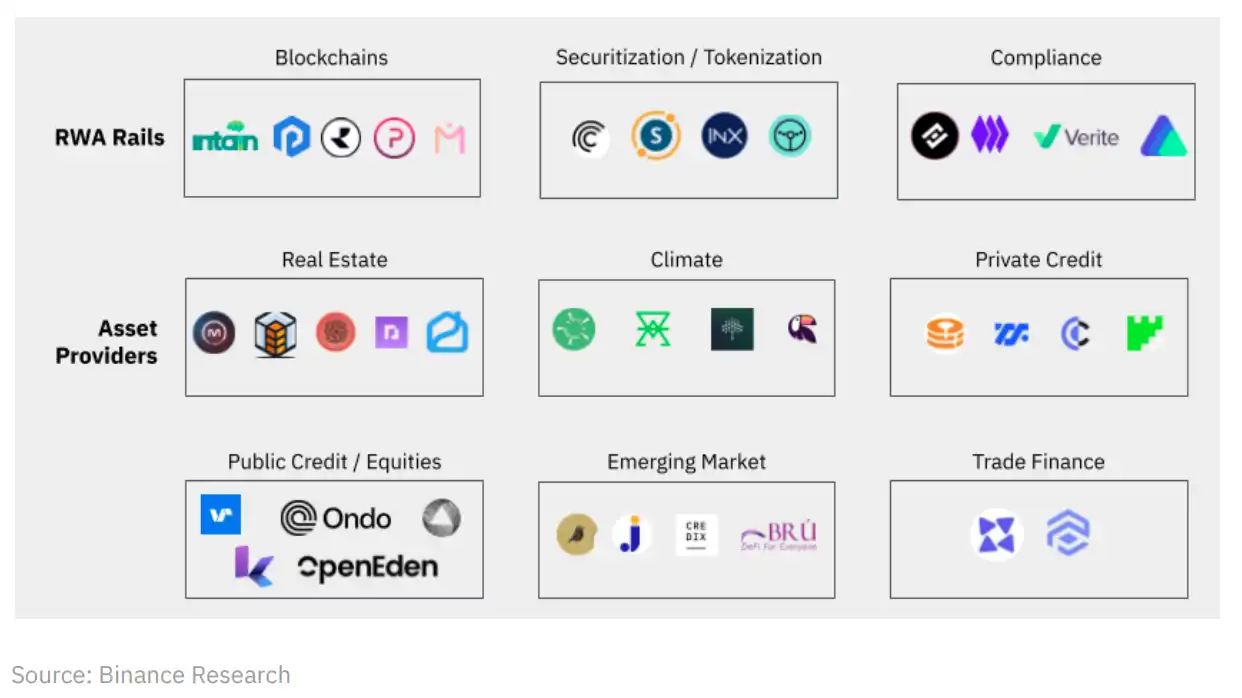

The RWA ecosystem is diverse and steadily expanding as more projects enter the market. Some projects provide support in terms of regulations, technology, and operations, allowing real-world assets to enter the crypto space. We broadly refer to these projects as “RWA infrastructure.” Additionally, there are “asset providers” focused on proposing and creating various categories of RWAs, including real estate, fixed income, stocks, etc.

Figure 3: RWA Ecosystem Map

Blockchain: A permissioned and permissionless blockchain specifically designed for RWAs.

Securitization/Tokenization: Bringing RWAs onto the blockchain.

Compliance: Ensuring compliance services for investors and issuers.

Real Estate: Introducing and creating RWAs supported by real estate.

Climate Products: Introducing and creating RWAs supported by climate assets.

Private Credit: Introducing and creating RWAs supported by private fixed income.

Public Credit/Equities: Introducing and creating RWAs supported by public fixed income and equities.

Emerging Markets: Introducing and creating RWAs from emerging markets.

Trade Finance: Introducing and creating RWAs supported by trade finance.

3. RWA Growth and Prospects

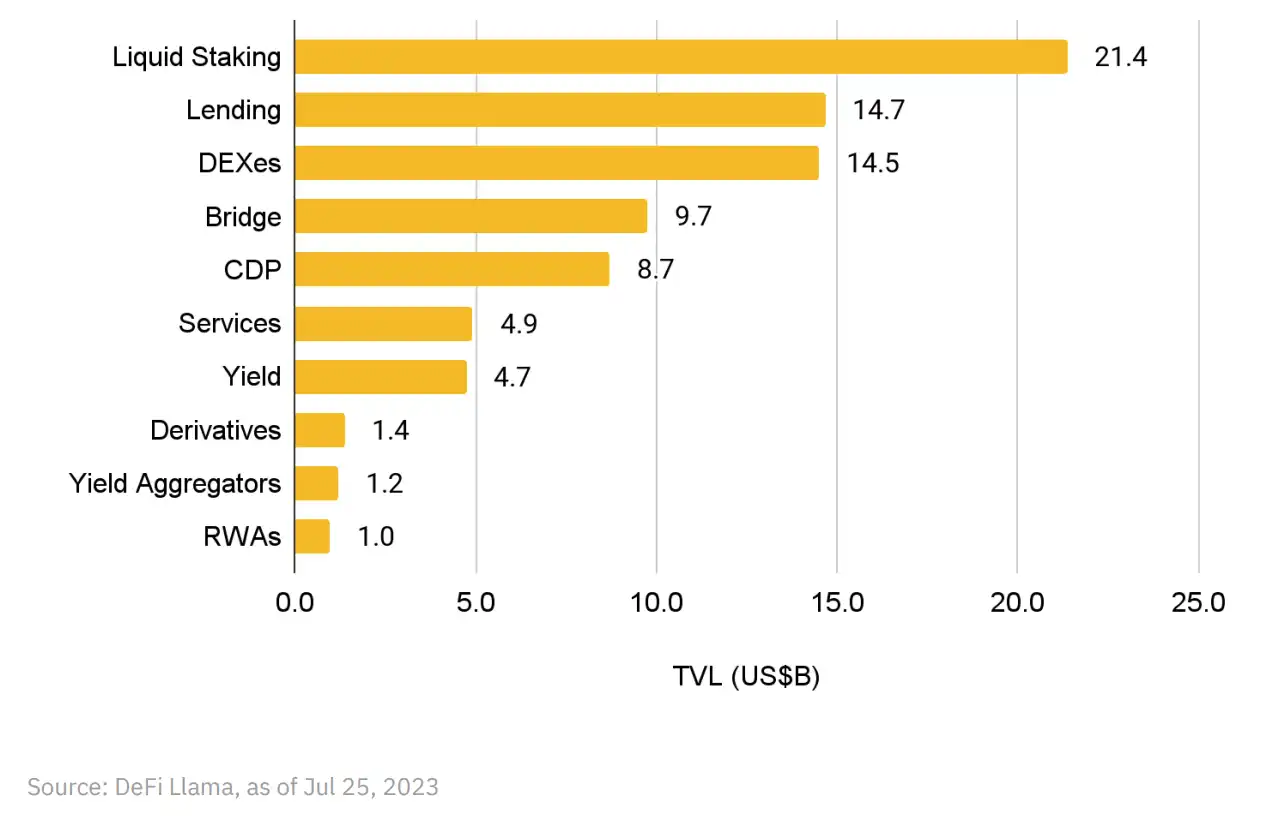

The RWA market is in the early stages of development but has shown signs of growth, with the Total Value Locked (TVL) also increasing. Currently, according to protocols tracked by DeFiLlama, as of the end of June 2023, RWAs rank as the tenth largest sector in DeFi, up from thirteenth a few weeks ago. One significant contributor is the launch of stUSDT in July, which allows USDT stakers to earn yield based on RWAs.

Figure 4: RWAs ranked tenth on DeFiLlama

It should be noted that the above data may be underestimated as it does not capture all protocols, and data may be difficult to obtain when tokenizing on private blockchains. Nonetheless, the rise in rankings of RWAs as a track demonstrates increasing adoption of RWA protocols.

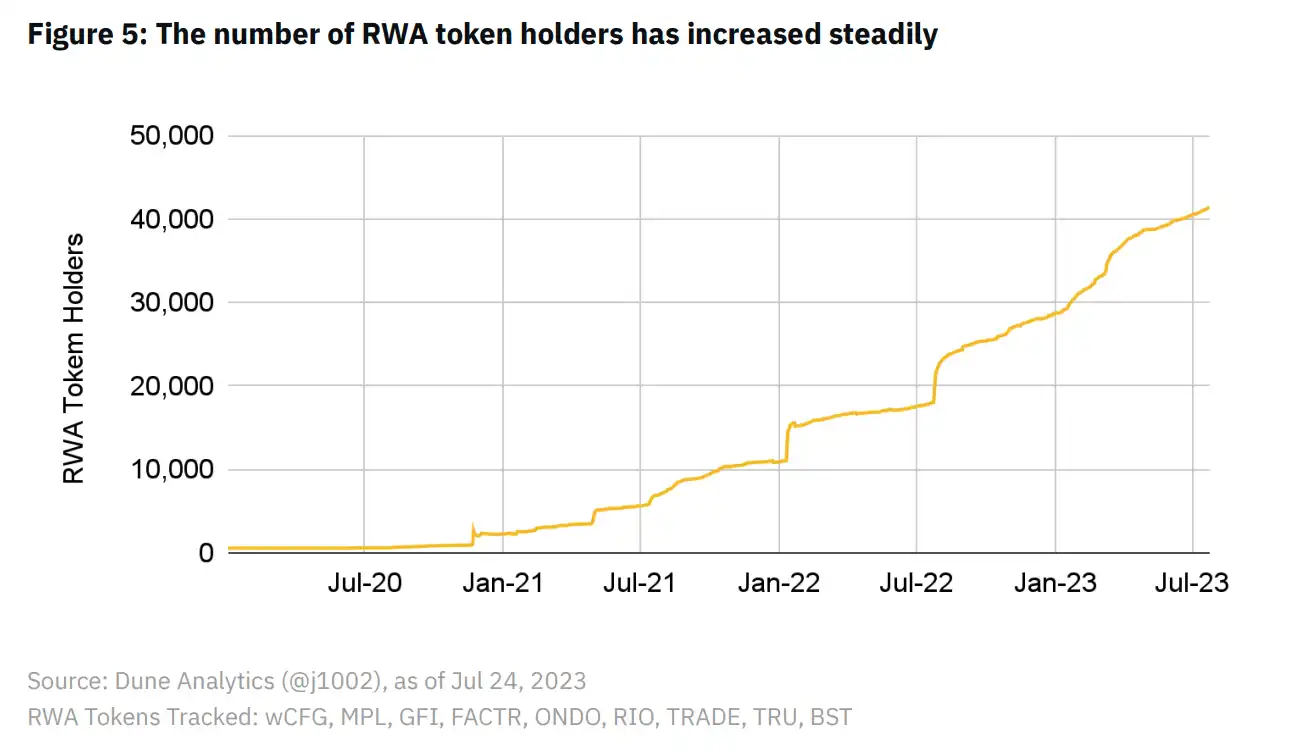

By using the number of RWA token holders as a proxy for RWA adoption, we also observe a steady growth in this data point. Currently, there are over 413,000 RWA token holders on the Ethereum blockchain. While this may not be a large number, the number of RWA token holders has significantly increased compared to a year ago, more than doubling from 179,000 to the current 413,000.

Figure 5: Steady growth in RWA token holders

3.1 Rise of US Treasury Bonds

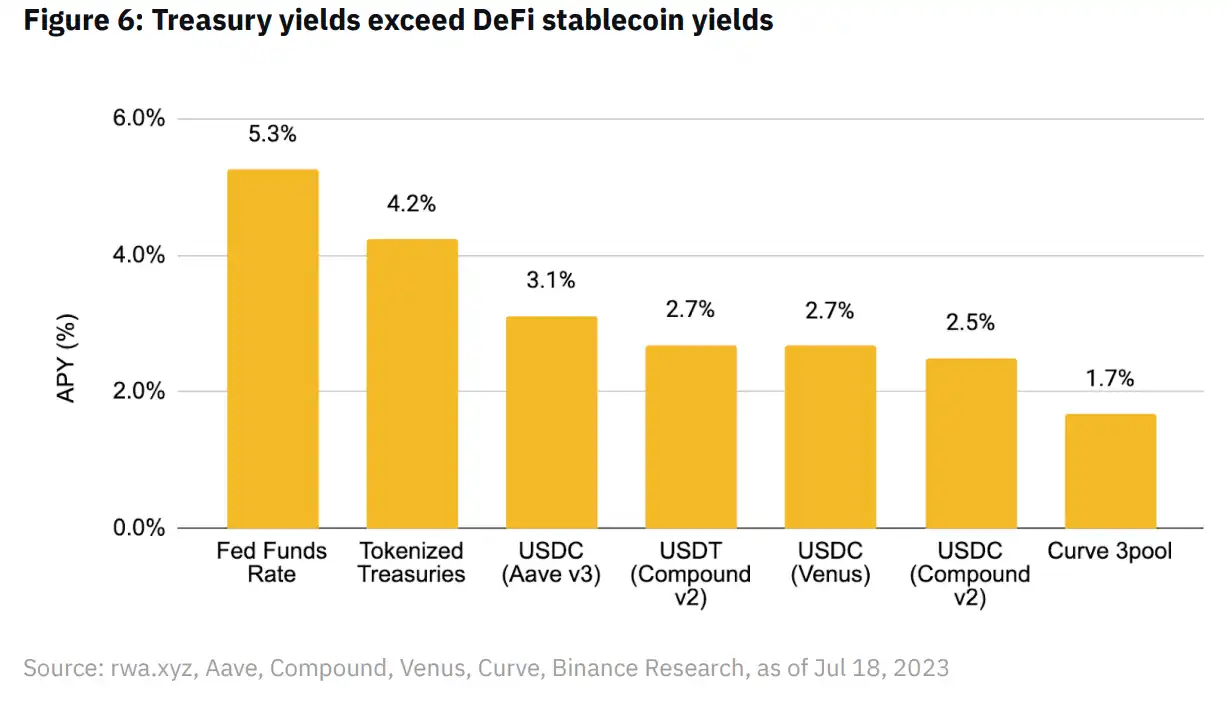

One highlight in the RWA space in recent months has been the tokenization of US Treasury bonds. US Treasury bonds refer to sovereign debts issued by the US government, widely regarded as risk-free assets in traditional financial markets. With rising interest rates, US Treasury bond yields have steadily increased and now significantly exceed DeFi yields.

Figure 6: US Treasury yields exceed DeFi stablecoins

Intuitively speaking, assuming other factors remain constant, capital will flow to the most competitive yield, and US Treasuries are particularly prominent in this regard. Today, investors can achieve real-world returns by investing in tokenized US Treasuries without leaving the blockchain. This fully demonstrates the practicality of RWAs.

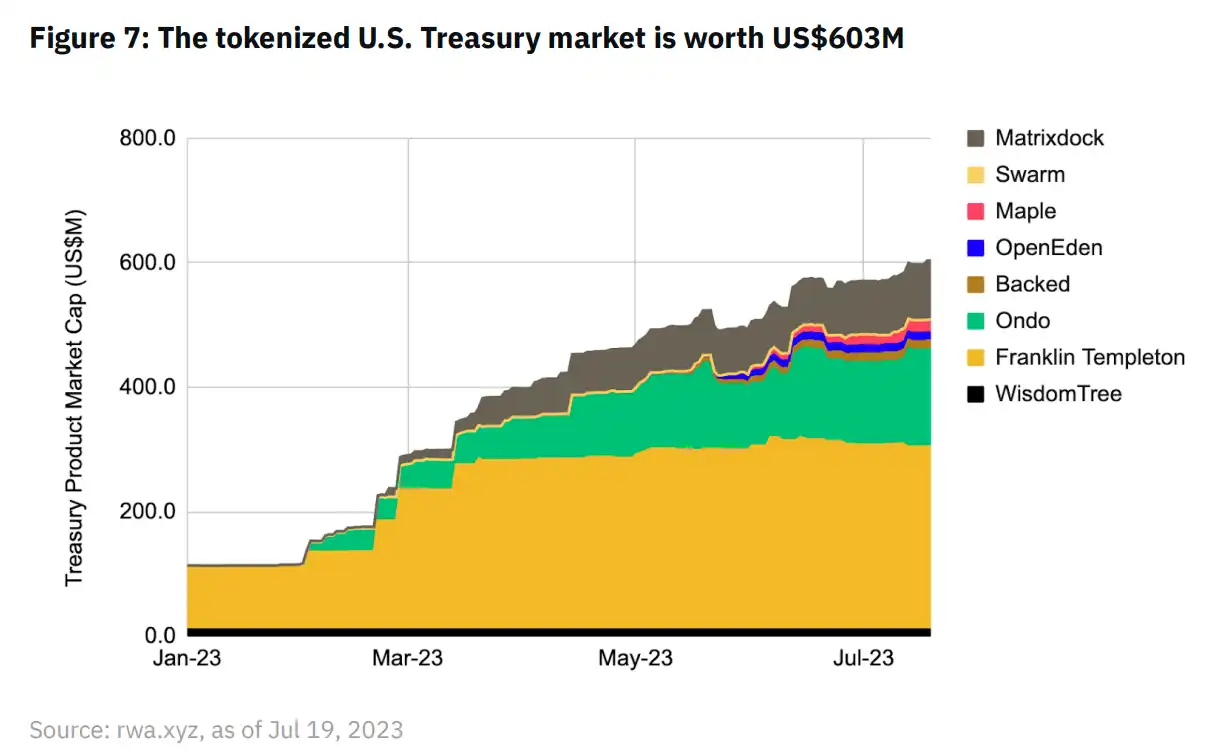

In fact, the tokenized US Treasury market is currently valued at approximately $60.3 billion, which means that investors have actually lent this amount to the US government with an annualized yield of approximately 4.2%.

Figure 7: Tokenized US Treasury market value of $60.3 billion

The protocols and companies involved in the US Treasury market include Franklin Templeton, Ondo Finance, Matrixdock, and others. Compound’s founder, Robert Leshner, recently announced the launch of his new venture, “Superstate,” and submitted documents to the US Securities and Exchange Commission to create a short-term government bond fund that uses the Ethereum blockchain as a secondary accounting tool.

It should be noted that investing in tokenized US Treasury bonds is not without risks. For example, investors holding US Treasury bond positions are exposed to term risks associated with such investments, such as price fluctuations due to interest rate changes (although short-term notes have lower term risks). Other key considerations include tokenization structure, fees, and KYC processes.

3.2 Prospects of RWAs

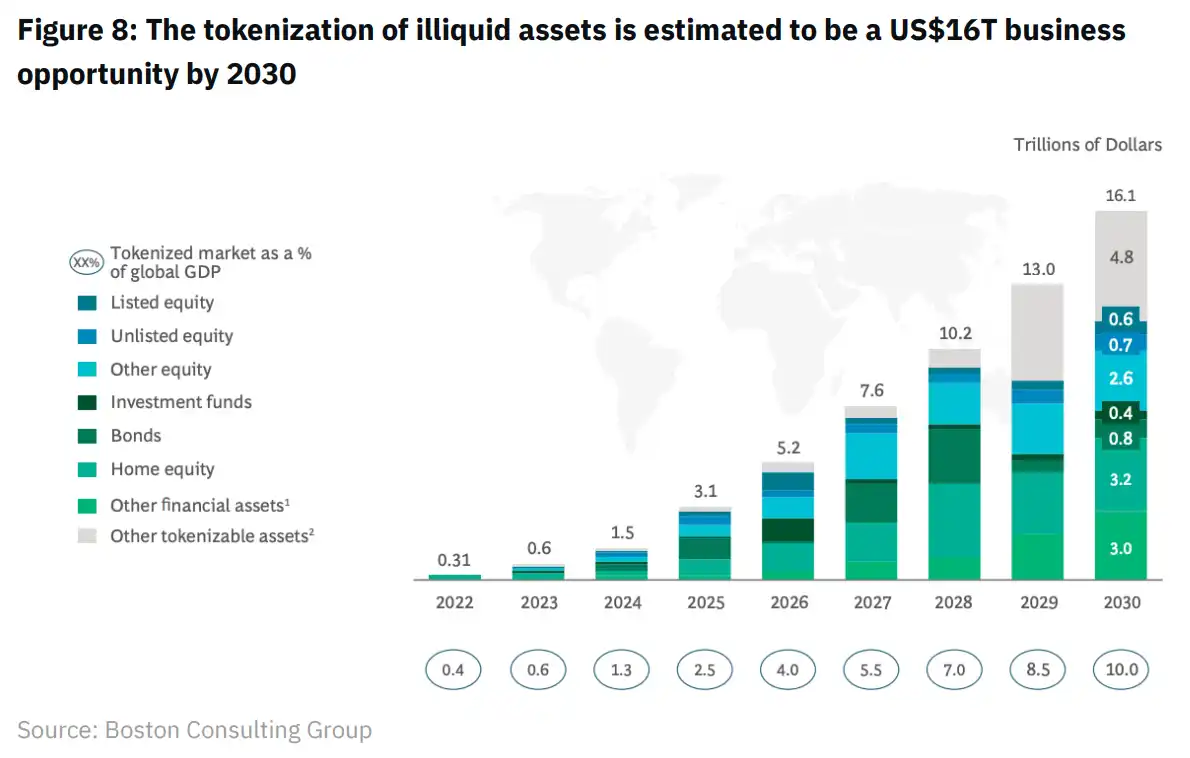

According to a report by Boston Consulting Group, the market size of tokenized assets is expected to reach $16 trillion by 2030. This will account for 10% of global GDP at the end of the 2030s, a significant increase compared to $310 billion in 2022. This estimate includes the tokenization of on-chain assets (more relevant to the blockchain industry) and the fragmentation of traditional assets (such as Exchange-Traded Funds (ETFs) and real estate investment trusts). Considering the potential market size, even capturing a small portion of this market will have a huge impact on the blockchain industry.

Figure 8: Market size estimate of $16 trillion for non-liquid assets tokenization by 2030

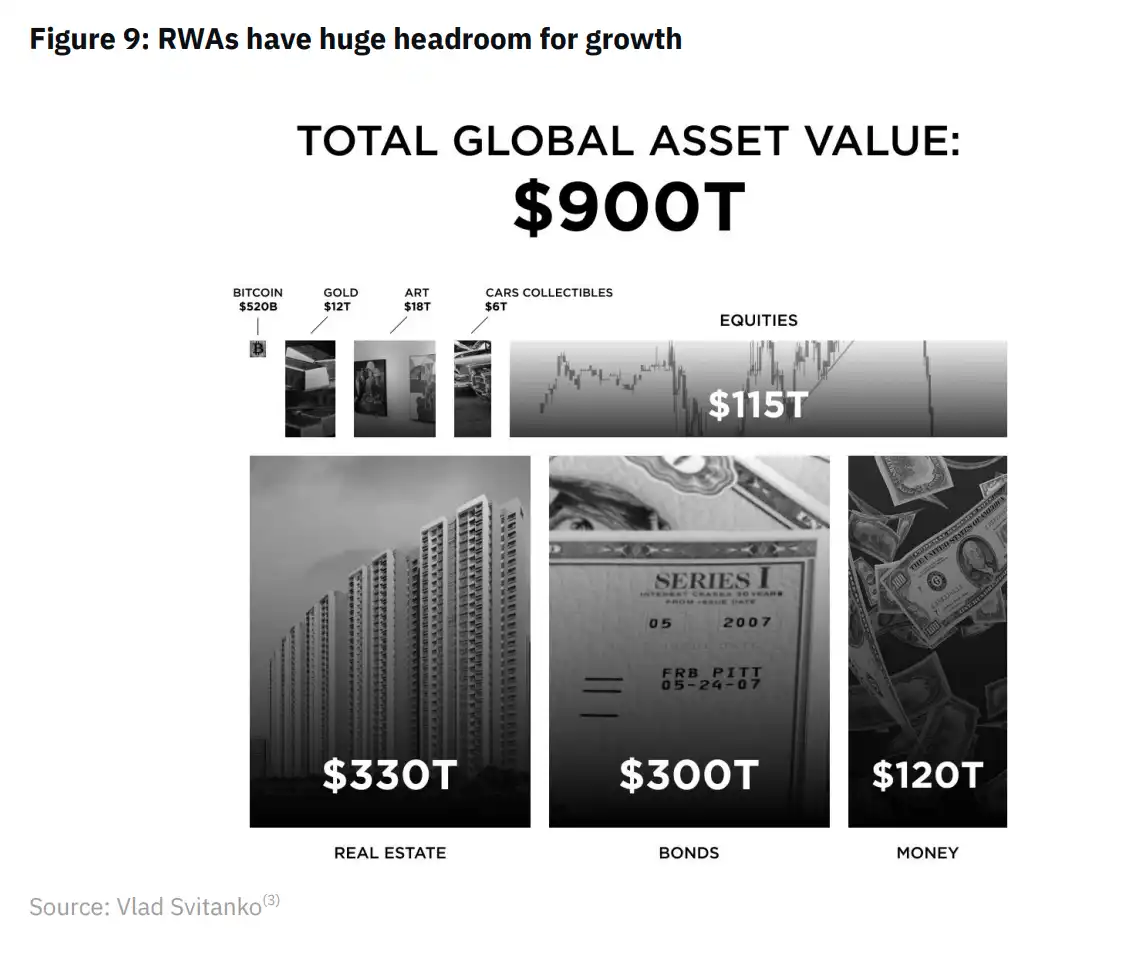

Even at $16 trillion, tokenized assets are still only a small fraction of the current global total asset value, estimated at $900 trillion (less than 1.8%, and without considering the growth of global total asset value in the future). It can even be considered that the real potential market is the entire global asset market, as anything that can be tokenized can be represented on-chain as RWAs.

Figure 9: RWAs have tremendous growth potential

4. What are the RWA protocols?

In order to demonstrate how some protocols integrate RWAs, this section focuses on some market participants. In addition to the following protocols, our previous reports also covered Centrifuge and Goldfinch, among others.

Note: Mentioning specific projects does not constitute endorsement or recommendation of those projects. The mentioned projects are only used to illustrate the adoption of RWAs. Additional due diligence should be conducted to better understand these projects and the associated risks.

MapleFinance

MapleFinance is an institutional capital network that provides infrastructure for credit experts to engage in on-chain lending activities, connecting institutional borrowers and lenders. MapleFinance has three main stakeholders: borrowers, lenders, and pool representatives.

– Institutional borrowers can access financing options on MapleFinance.

– Lenders can earn returns by lending assets to borrowers.

– Pool representatives are credit professionals who assess, manage, and underwrite loans.

While MapleProtocol previously focused on unsecured cryptocurrency loans, it has recently ventured more into RWA-based lending. Previously, unsecured cryptocurrency loans left Maple with over $50 million in bad debt. These losses stemmed from the collapse of centralized exchanges last year, which spread to Maple’s cryptocurrency-native borrowers.

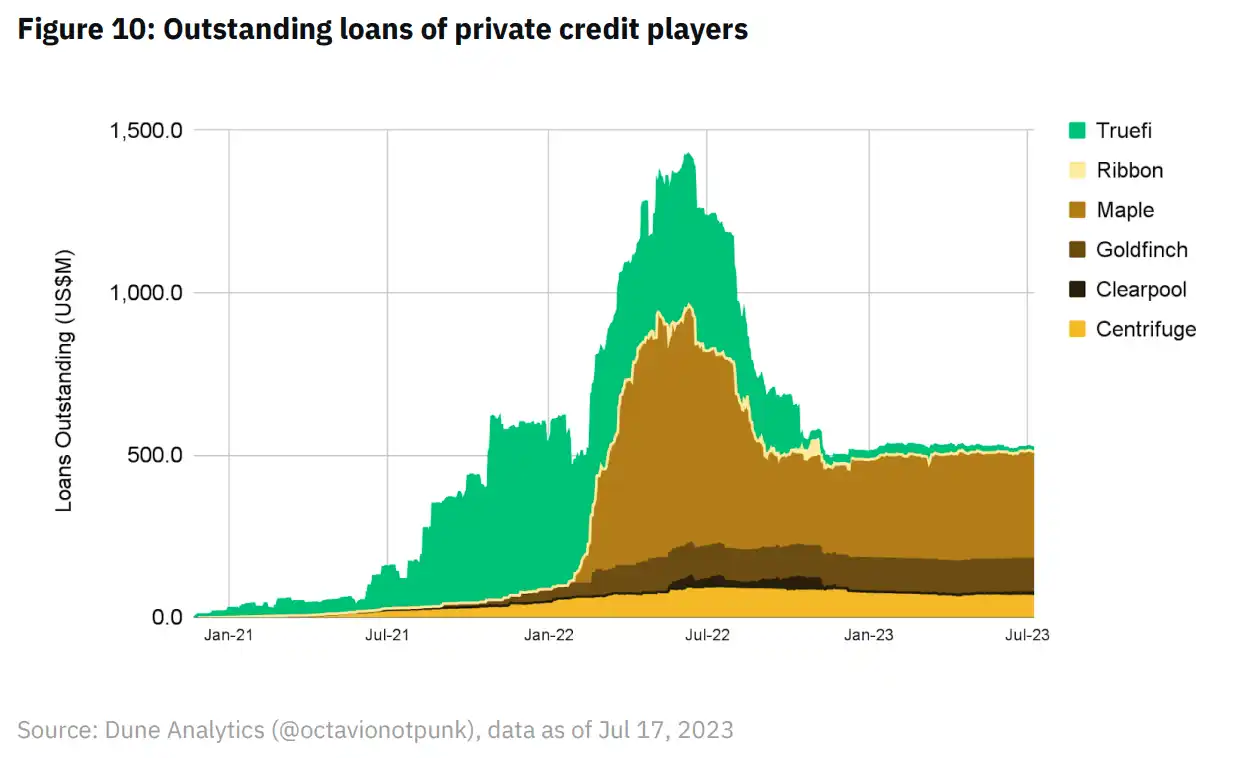

Currently, MapleFinance is one of the market leaders in the private credit sector, with over $332 million in outstanding loans.

Figure 10: Outstanding loans of private credit companies

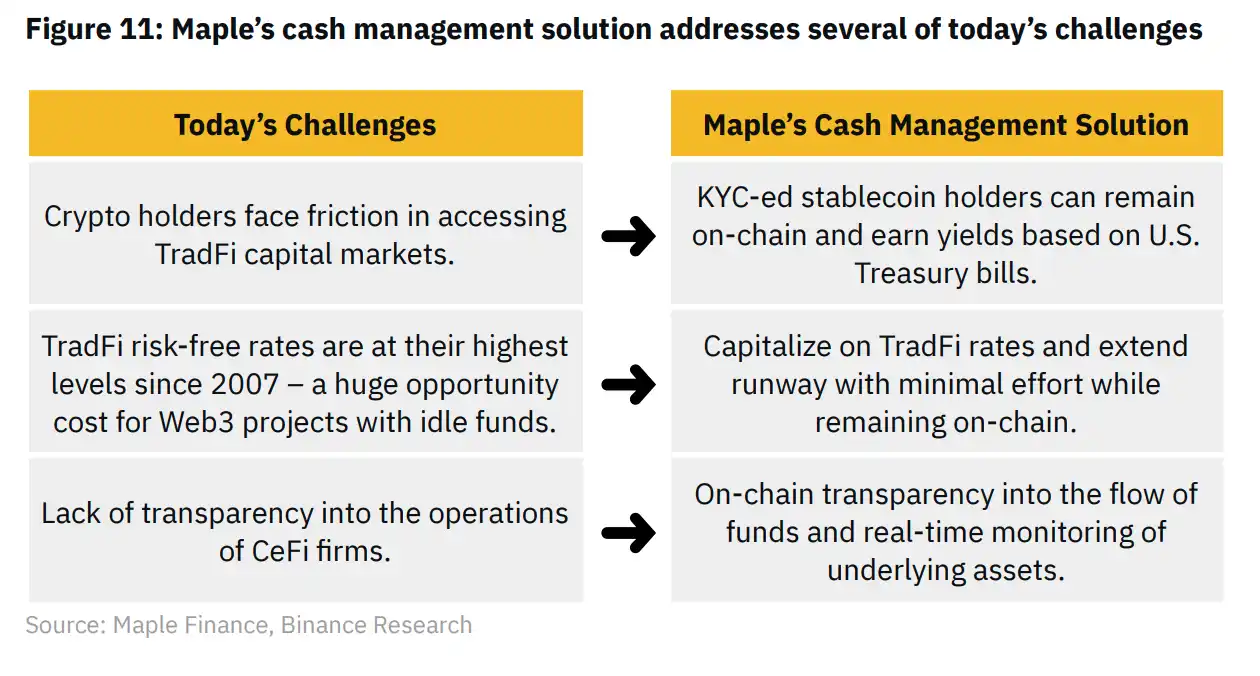

With the increasing demand for US government bonds, Maple launched a US Treasury pool in April, allowing non-US accredited investors and entities to directly access US government bonds. This pool is backed by US government bonds and reverse repurchase agreements, with a target net annualized yield of the current one-month US Treasury rate minus 1.0% annual fees and expenses. This essentially provides cash management solutions for stablecoin holders, enabling them to earn returns.

Overall, products like RWAs offered by MapleFinance demonstrate the potential to address today’s challenges while providing another way for crypto users to earn returns on their holdings.

Figure 11: Maple’s cash management solution addresses some current challenges.

MakerDAO

As the protocol behind the DAI stablecoin and the third-largest DeFi protocol, MakerDAO is undoubtedly a familiar name to many in the crypto space. Borrowers deposit collateral into MakerDAO’s vaults and can then withdraw debt denominated in DAI.

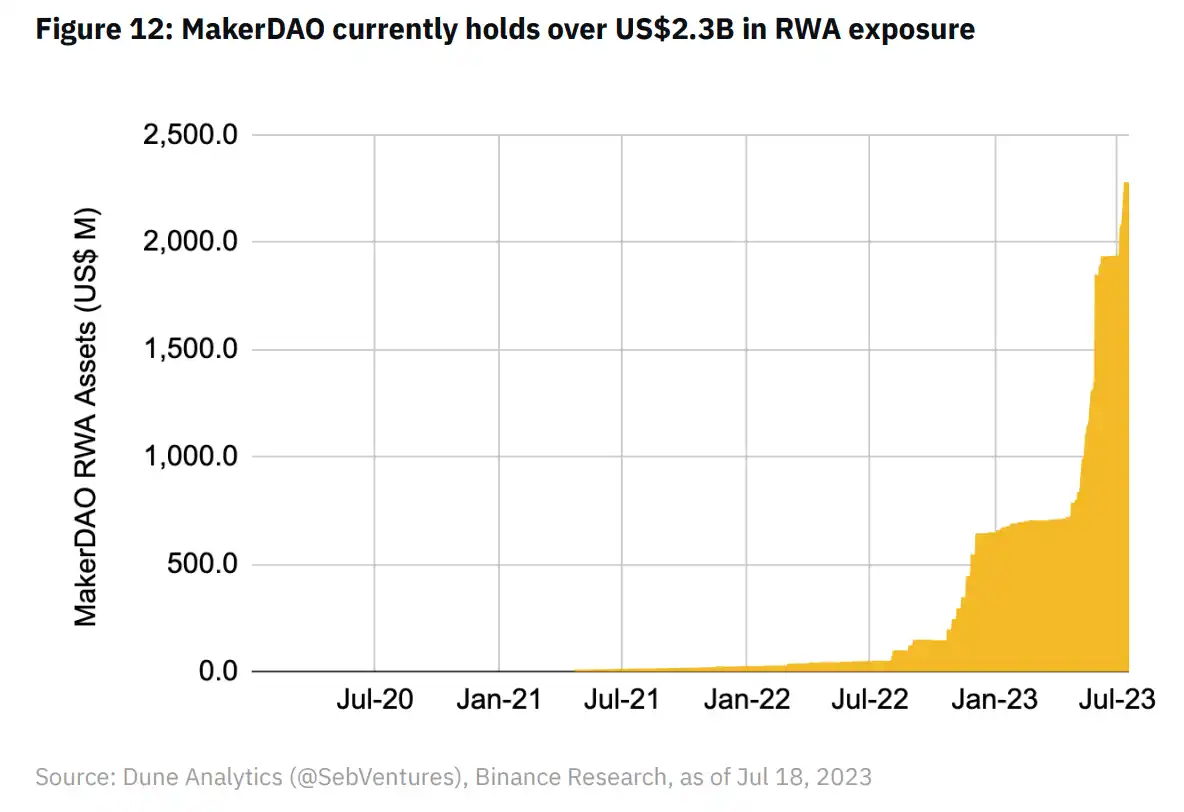

The MakerDAO’s attempt to integrate RWAs can be traced back as early as 2020 when MakerDAO voted to allow borrowers to collateralize RWA-based assets in the collateral vaults. Since then, MakerDAO’s RWA collateral vaults have grown to 2.3 billion USD. It is worth noting that the growth of their RWAs has mainly occurred in the past year, coinciding with the increase in real-world yields.

Figure 12: MakerDAO currently holds over 2.3 billion USD in RWA positions.

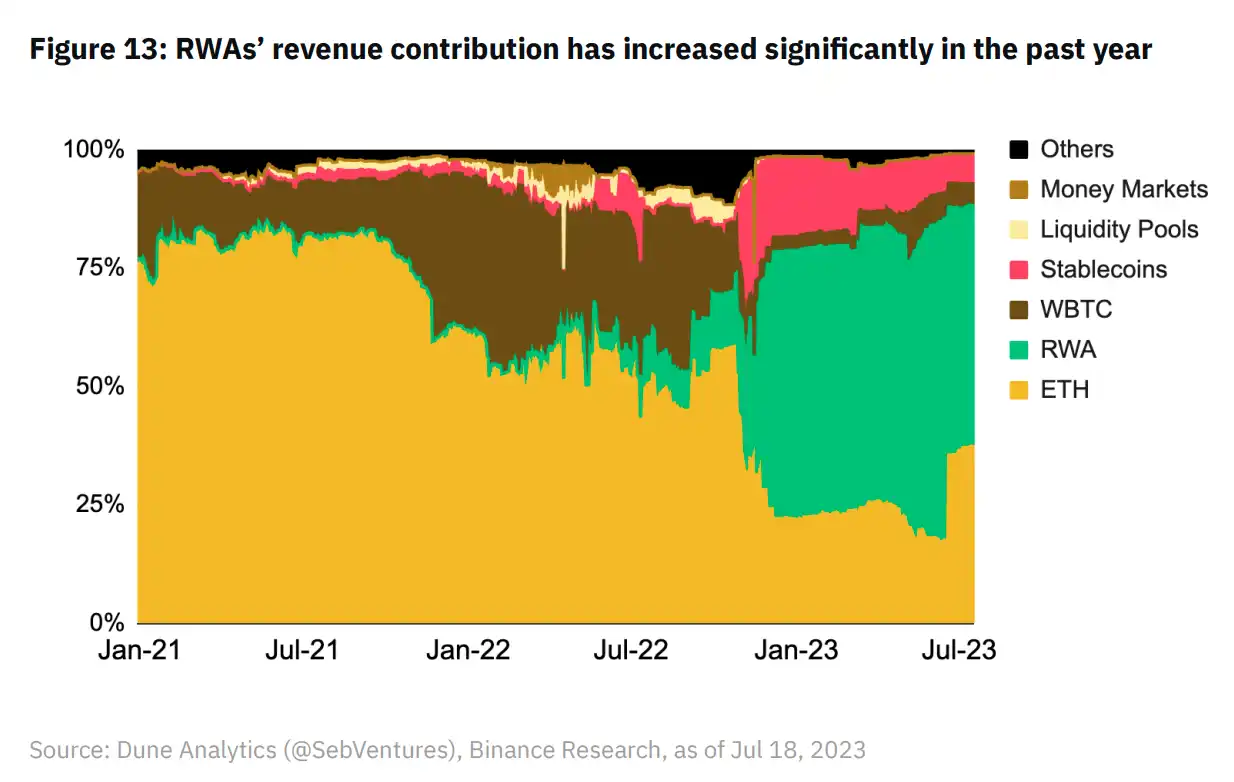

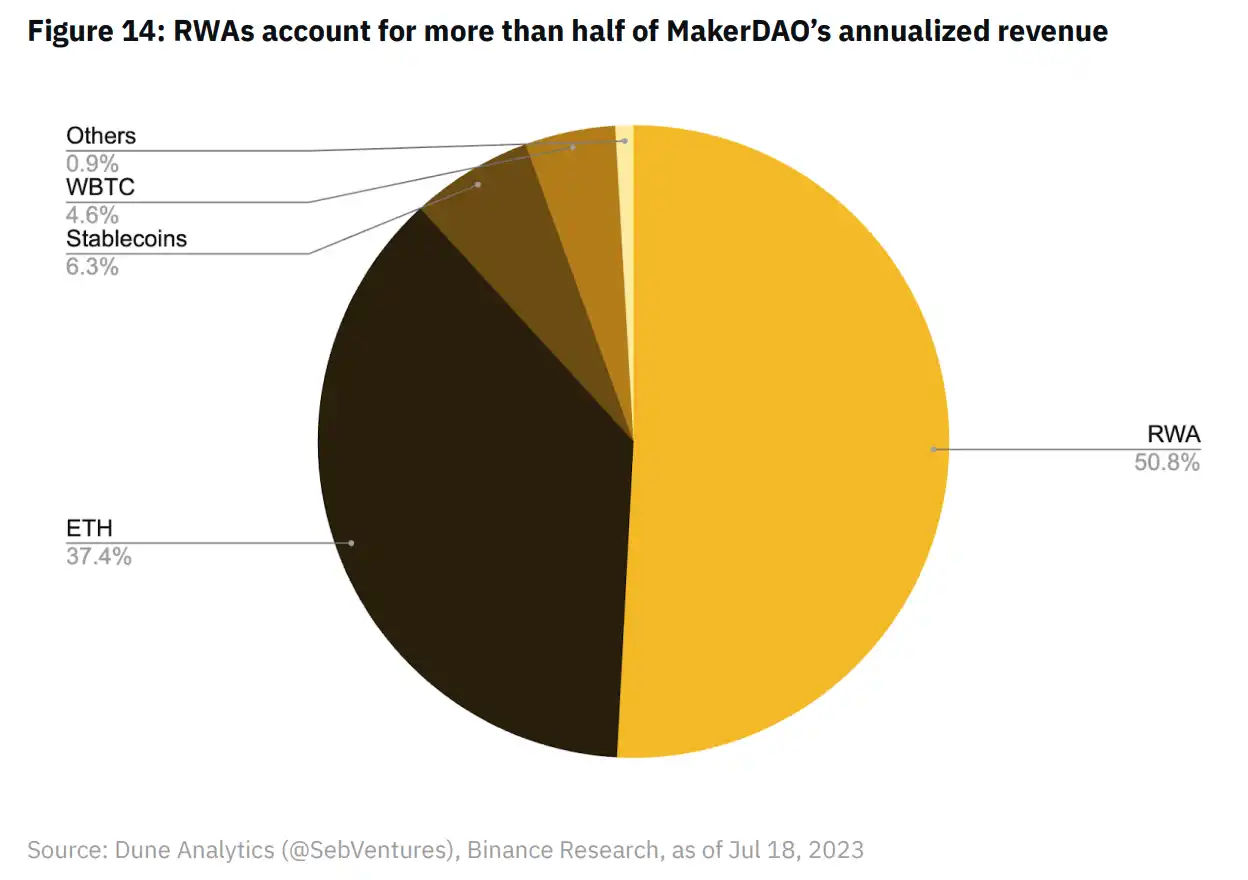

Considering that RWAs account for 49.2% of MakerDAO’s total assets, they are also a significant contributor to the protocol’s revenue. Specifically, since the end of 2022, the share of RWAs in the protocol’s revenue has significantly increased and currently accounts for 50.8% of the revenue.

Figure 13: The significant increase in RWAs’ contribution to MakerDAO’s revenue over the past year.

Figure 14: RWAs account for over half of MakerDAO’s annual revenue.

RWAs, especially U.S. government bonds, may continue to play an important role in MakerDAO’s balance sheet in the foreseeable future. Recently, MakerDAO purchased 7 billion USD worth of U.S. government bonds in June, increasing its holdings to 12 billion USD. Having a diversified collateral base, including RWAs, allows MakerDAO to take advantage of the current yield environment and mitigate risks.

OndoFinance

OndoFinance provides institutional-grade investment products and services on the blockchain. The company is led by former Goldman Sachs employee Nathan Allman and has received support from notable investors such as Peter Thiel’s Founders Fund, Coinbase Ventures, and Tiger Global.

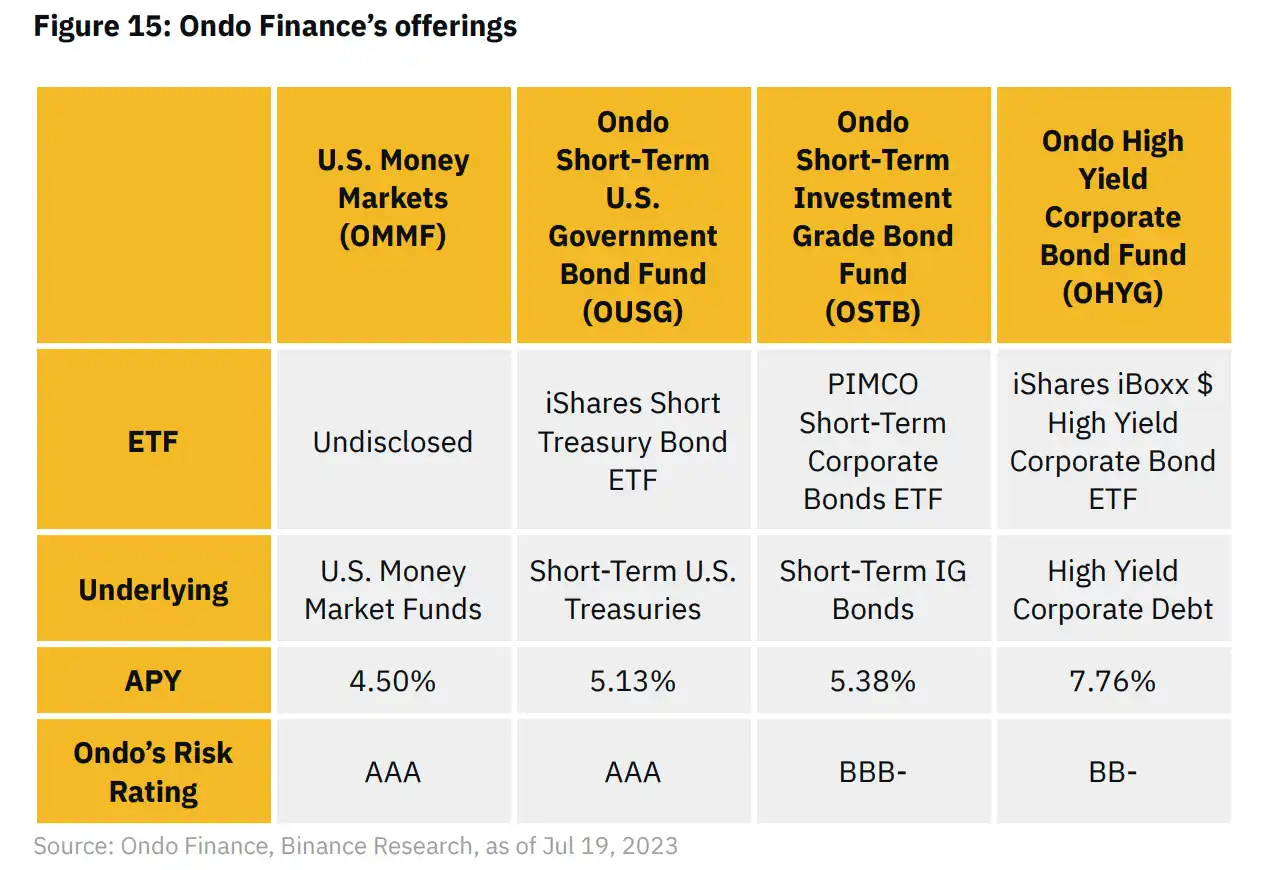

Ondo offers four RWA products, providing investors with access to a range of cash management products and bond funds. During the process, investors can deposit USDC, convert it to USD, and use it to purchase assets such as ETFs or funds. In return, new liquidity providers receive a custody certificate that can be further used in other protocols.

Figure 15: OndoFinance’s products.

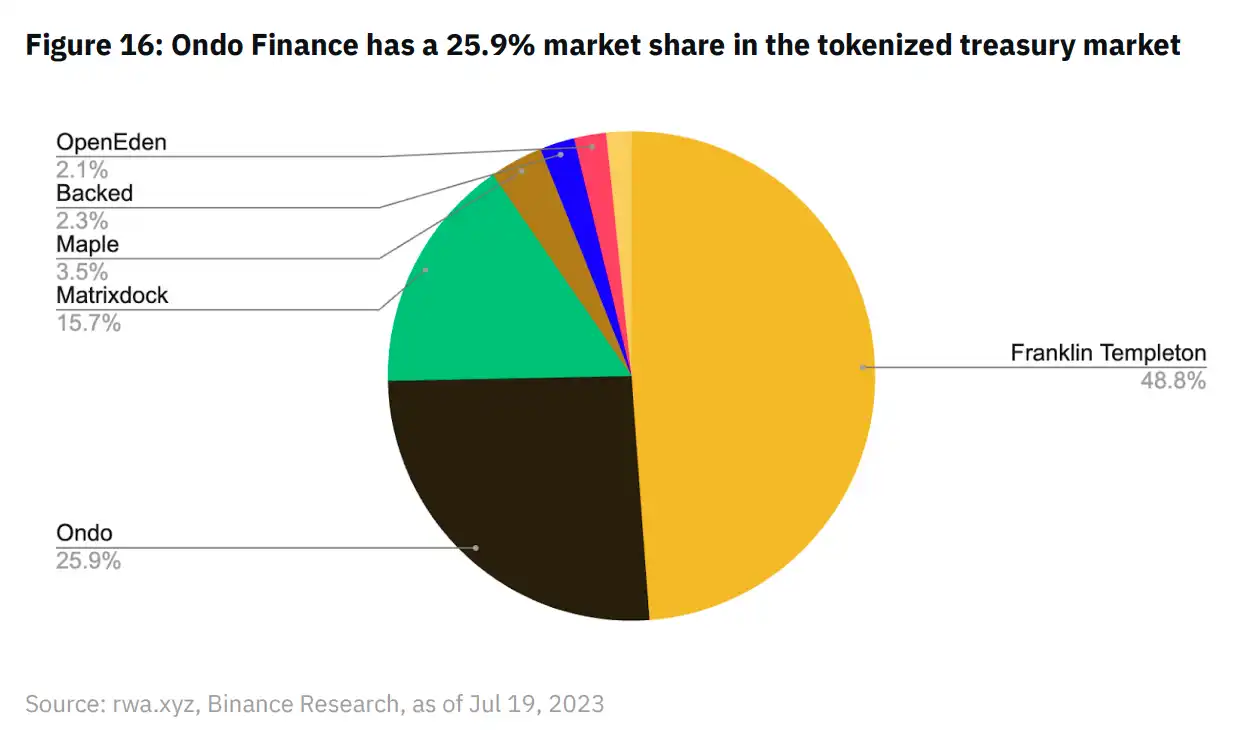

OndoFinance is currently one of the market leaders in the tokenized U.S. government bond space, second only to traditional financial asset management firm Franklin Templeton.

Figure 16: OndoFinance holds a 25.9% market share in the tokenized U.S. government bond market.

It is worth noting that OndoFinance has recently expanded its business to the Polygon network as part of a “strategic alliance”, launching its OUSG token on the Polygon network, which tokenizes Blackrock’s iShares Short Treasury Bond ETF. This is OndoFinance’s first expansion beyond the Ethereum network, and we will pay attention to the impact of this move on adoption rates.

5. Notable Developments

In 2023, tokenization has been referred to by JPMorgan as a “killer application” for traditional finance and described as the “future market” by Larry Fink, CEO of BlackRock.

Interestingly, we have noticed that in addition to DeFi protocols, traditional financial institutions are also showing increasing acceptance of tokenized RWAs. For example, global asset management company Franklin Templeton has launched its own funds on public chains. In addition, some institutions are also exploring the establishment of their own private blockchains for asset tokenization.

Looking ahead, it is foreseeable that traditional exchanges may play a role in secondary trading of tokenized RWAs, especially as adoption rates increase. It has been reported that the Australian Securities Exchange may consider listing tokenized RWAs on its platform in the future. Regulatory developments will be a driving force behind mainstream adoption as this field continues to mature.

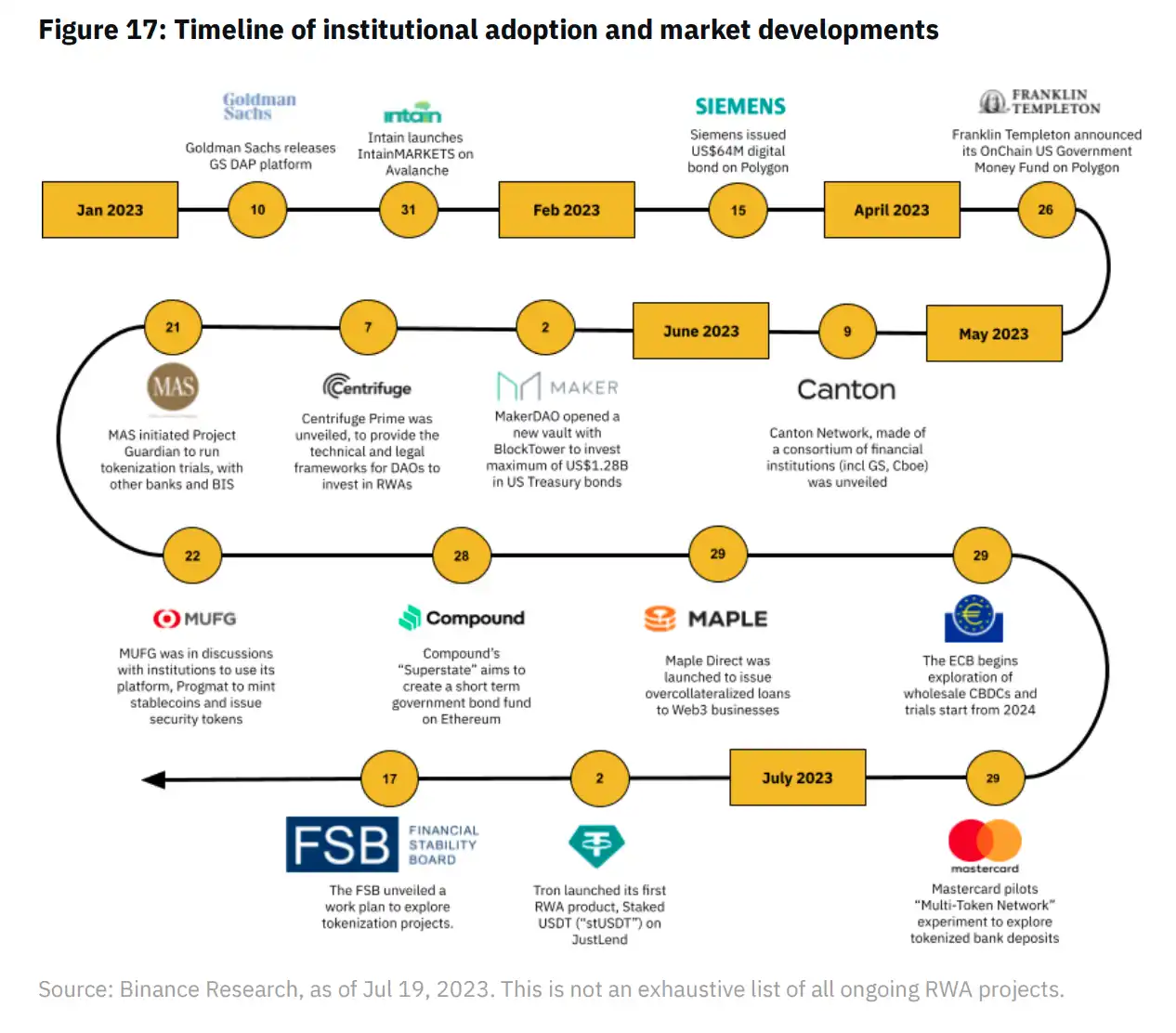

Figure 17: Timeline of Institutional Adoption and Market Development

January 10, 2023: Goldman Sachs launches its new digital asset platform GSDAP, developed using the Daml smart contract language and its privacy-supporting blockchain Canton. Its goal is to achieve digital representation of assets and automate workflows within the ecosystem, including “tokenized assets, digital currencies, and other financial instruments.”

January 31, 2023: Intain launches its IntainMARKETS solution on Avalanche, providing a tokenized market for structured financial products.

February 15, 2023: Siemens, Europe’s largest industrial manufacturer, issues a 64 million USD digital bond on Polygon with a maturity of one year. Investors include Dresden Bank and Union Investments, aiming to simplify processes and eliminate the need for central clearinghouses.

April 26, 2023: Franklin Templeton announces the on-chain deployment of its US Government Money Market Fund on the Polygon blockchain. This 272 million USD fund primarily invests in government bonds, cash, and repurchase agreements.

May 9, 2023: CantonNetwork launches a consortium of financial institutions on its blockchain, including BNP Paribas, Chicago Options Exchange, Goldman Sachs, and Microsoft. It will provide a decentralized infrastructure for tokenization and blockchain interoperability.

June 2, 2023: MakerDAO has approved multiple proposals to open up the RWA vault to generate income for its assets USDC and DAI. In April, the protocol opened up an insurance vault for Coinbase custody, approving up to $500 million USDC stablecoin for a 2.6% yield. Subsequently, on June 2, the community voted again to approve a partnership with BlockTower to open a new insurance vault, with a maximum investment of $1.28 billion in short-term US Treasury bonds.

June 7, 2023: Centrifuge launches its new product CentrifugePrime, providing technical and legal frameworks for DAOs to invest in RWAs. Previous partners include Aave and MakerDAO, both of whom have used the Centrifuge platform.

June 21, 2023: The Monetary Authority of Singapore collaborates with the Bank for International Settlements to propose a framework for designing tokenized digital assets open and interoperable networks. The tokenization experiment, known as “Project Guardian,” has been conducted in wealth management, fixed income, and foreign exchange, with participating banks including Standard Chartered, HSBC, DBS Bank, and Citibank.

June 23, 2023: Mitsubishi UFJ, Japan’s largest bank, is in discussions with institutions to use its blockchain platform Progmat to issue stablecoins pegged to foreign currencies, including the US dollar, for global use. The bank also plans to utilize the platform to facilitate the issuance of securitized tokens by third parties.

June 28, 2023: The founder of Compound has applied to launch “Superstate,” a project that will create a short-term government bond fund on the Ethereum blockchain. It will invest in “ultra-short-term government bonds,” including US Treasuries and government agency bonds.

June 29, 2023: MapleFinance’s new lending department, MapleDirect, will offer overcollateralized loans to Web3 businesses. These loans will be secured by BTC, ETH, and wrapped ETH.

June 29, 2023: The European Central Bank outlines its exploration of wholesale central bank digital currencies and explores other options to support DLT transactions. This will include conducting trials with central bank fiat currencies starting from 2024.

June 29, 2023: Mastercard is experimenting with a project called “Multi-Token Network,” first exploring tokenized bank deposits. Future plans include transitioning to central bank digital currencies and regulated stablecoins.

July 2, 2023: TRON’s first RWA product, “stUSDT” (secured USDT), is officially launched on JustLend. Users who collateralize USDT on the platform will receive stUSDT. The collateralized assets will be invested in RWAs to generate income.

July 17, 2023: The Financial Stability Board announces a work plan to explore asset tokenization projects and assess their vulnerabilities and policy implications for the financial system. This is in line with the Committee on Payments and Market Infrastructures’ exploration of the “benefits, risks, and challenges of central bank digital currencies in a tokenized financial ecosystem.”

6. Conclusion

For blockchain technology, tokenizing real-world assets provides a strong use case that could bring the next wave of users into cryptocurrency. By offering greater transparency and efficiency, tokenization can be an attractive alternative to existing mechanisms. We have already seen traditional institutions exploring this technology, which could address the inefficiencies in current solutions.

The diffusion of tokenized RWAs is also a positive development for cryptocurrency investors, as they now have more opportunities beyond the crypto ecosystem. In addition to being able to benefit from higher government bond yields, the introduction of RWAs also brings more stable assets and increases the diversity of collateral in the DeFi space. Looking ahead, we expect continuous innovation and development in the RWA field, bringing more use cases and driving the adoption of cryptocurrencies.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Review of the 13 award-winning projects at the ETHGlobal LianGuairis Hackathon

- Quick Look at the Cosmos Ecosystem Project TVL Data Changes

- LianGuai Daily | Twitter may change its logo to X-related; Terraform will release 9 projects but will not launch new tokens.

- A Review of the 20 Award-winning Projects at ETHShanghai 2023 Hackathon

- Telegram Bots are rising unexpectedly, which projects are worth paying attention to?

- Review of the 20 award-winning projects from ETHShanghai 2023 Hackathon

- Bankless Inventory of Eight Important Project Progresses in EthCC 2023