An in-depth analysis of LPDFi Can it spark the next wave of DeFi narrative? What are the projects worth paying attention to?

Analyzing LPDFi Can it drive the next DeFi wave? Which projects deserve attention?LSDfi has risen with the upgrade of Ethereum, like a torrent that has swept the entire DeFi field, bringing the LSD (Liquidity Staking Derivatives) war. LSDfi refers to the ability for stakers to convert staked ETH into a tradable asset, thereby increasing liquidity. LSD also lowers the threshold for users to stake ETH, allowing any amount to be staked, and enables users to obtain LST after staking, while also generating multiple sources of income. This not only enhances liquidity but also solves the problem of idle ETH in users’ hands, bringing considerable TVL to many DeFi protocols focused on the LSD track.

In addition to catching up with the Ethereum upgrade, the popularity of LSDfi is more due to its practical solution to the problem of crypto user income, making it an important part of the DeFi narrative. Today, we will explain in detail a new narrative called LPDfi (Liquidity Providing Derivatives), and this article will mainly introduce the problem of poor liquidity in the DeFi field and what practical problems LPDfi solves. Can it become the next major narrative in DeFi?

Liquidity Problem of DeFi Protocols

Previously, the release of Uniswap V3 significantly improved the capital efficiency of the DeFi market, but it also brought some liquidity issues. For example, liquidity providers through CLMM (Concentrated Liquidity Market Maker) face some strategic issues. The main problem with CLMM is that it needs to constantly rebalance LP positions to avoid impermanent loss. This strategy is often complex and difficult to execute.

- Binance Research Current Status and Project Progress of the RWA Market

- Who is LaunchLianGuaid really fooling with the ‘三无’ project IEO OPNX?

- Projects awarded with Ethereum ERC-4337 bounties Cross-ChAAin, Seal Seal Seal, zkLianGuaiymaster.

Later, some protocols appeared on the market that provide active liquidity management solutions to handle algorithmic MM strategies. These protocols are crucial for CLMM. However, currently, liquidity management protocols are only effective within a relatively broad range. Many market makers try to hedge asset volatility by purchasing options, but the liquidity of DeFi options is also insufficient, and hedging impermanent loss comes at a high cost. In addition, for retail investors, the concept of options is relatively complex. Furthermore, in the DeFi field, there is no option basket that can effectively hedge impermanent loss of active LP positions.

Another strategy to hedge impermanent loss is to short volatile assets using Money Markets (AAVE or Compound). This strategy works well, but its capital utilization efficiency is low. Currently, all methods to hedge impermanent loss cannot unleash the full potential of Uniswap V3, which is also the problem that Logarithm Finance is working hard to solve.

Logarithm Finance and LPDfi

First, let’s briefly introduce Logarithm Finance. Logarithm Finance is a decentralized liquidity management and market-making protocol designed for market makers and DeFi users. Users do not need to constantly manipulate their positions to find high APY, but can profit from market-making activities.

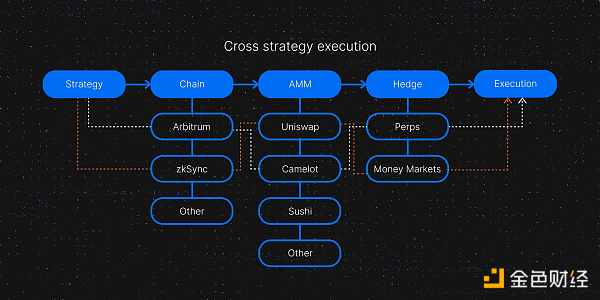

The concept behind LPDfi, introduced by Logarithm Finance, aims to deliver liquidity across various LPDs and hedge the volatility of assets, achieving the highest available capital efficiency in the market. Logarithm Finance primarily provides liquidity for LP-centric protocols, actively managing LP positions while earning higher returns. The protocol focuses on earning automated compounding fees on Uniswap-like AMMs and minimizing the risk of volatile assets by creating short positions on composable DEXs using delta-neutral strategies.

Currently, users can join their official Discord channel and wait for the launch of the BETA version.

Logarithm Finance Products

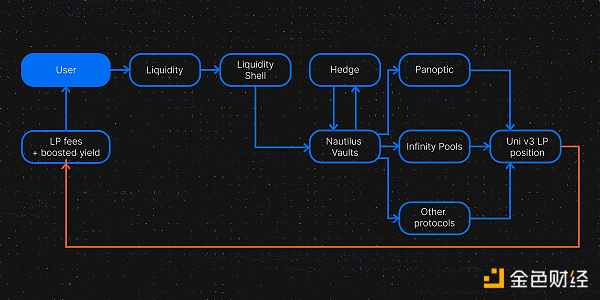

Logarithm Finance will launch two main products – Nautilus Vault and Liquidity Shell. Logarithm plays a crucial role in guiding LPD liquidity (Liquidity Shell) and hedging impermanent loss, contributing significantly to the development of the entire LPDfi narrative.

Liquidity Shell – The Main Product of LPDfi Narrative

Logarithm Liquidity Shell helps Logarithm users maximize their returns by routing LP tokens to the best liquidity venues in the market. It is the main product that guides the emerging LPDfi narrative. In simple terms, Liquidity Shell can be seen as a yield aggregator or liquidity router, aiming to provide Logarithm users with the highest possible returns by deploying deposited assets into various strategies (LianGuainoptic, Smilee, Infinity Pools, Limitless, etc.) of LPDfi protocols.

In addition to bringing high returns to users, this product also benefits other LPDfi protocols. Essentially, its liquidity routing mechanism can improve the liquidity of LPDfi protocols like LianGuainoptic and Smilee, thereby enhancing the liquidity of DEXs like Uni V3. Furthermore, Liquidity Shell can eliminate the costs, risks, and complexities associated with liquidity mining. These different aspects of the LP process can be simplified because it is built on top of LPDfi protocols.

In the future, Liquidity Shell plans to enable cross-chain functionality to enhance LP routing efficiency, allowing users to access more extensive returns and provide liquidity to LPDfi protocols beyond Ethereum and L2. Ultimately, Logarithm aims to become the destination for LPD liquidity.

Liquidity Shell operates by guiding user deposits into the highest-yielding strategy protocols within LPDfi to maximize efficiency. Users will be able to provide single-sided liquidity and decide whether to use the Nautilus Vaults strategy. If users choose to use Nautilus Vaults, their LP positions will be hedged using the GMX perps delta-neutral strategy. Additionally, users can choose to bypass Nautilus Vaults and only use Liquidity Shell, which will yield higher returns through the asset deployment strategy of Liquidity Shell.

Nautilus Vault – Derivative Product of LPDfi Narrative

Nautilus Vaults is the first product of Logarithm Finance, where users can deposit USDC to access high APR strategies. Logarithm Finance will utilize the logic of Nautilus Vaults to build other products, such as Liquidity Shell and leveraged LP mining, to unlock more liquidity for market makers.

The operation method of Nautilus Vaults is that users need to deposit USDC into Nautilus Vaults. There is no time limit for adding and withdrawing liquidity, but there may be TVL restrictions depending on market fluctuations. The size of Vaults depends on the available liquidity on decentralized derivative trading platforms. Nautilus Vaults is committed to cooperating with other trading platforms to achieve the maximum market capacity of Vaults.

When USDC is deposited, the protocol will open active and high-volume LP positions on Uniswap V3 within a narrow range and hedge volatility assets using decentralized derivative trading platforms. Backtesting data shows that Nautilus Vaults has an APR of over 12%.

Users can choose to auto-compound APR for more significant returns. All deposits are in the form of USDC. In the future, Logarithm Finance also plans to build other products based on Nautilus Vaults, such as creating a one-stop liquidity management layer on a protocol centered around LP.

LPDfi Development Prospects

In summary, the advantages of LPDfi include:

Realizing cross-chain liquidity aggregation, LPDfi aggregates liquidity from different chains, bridging the gap between various DEXs and achieving true cross-chain liquidity. Users can flow assets between different chains at any time.

Improving capital utilization efficiency, in LPDfi, the liquidity provided by users can serve multiple DEXs simultaneously, improving capital utilization efficiency. Users can enjoy high liquidity and earn more profits.

Decentralizing risks and increasing stability, LPDfi achieves risk decentralization through liquidity reserves on different chains. Compared to relying on a single platform, LPDfi has stronger stability and risk resistance.

Reducing slippage and improving transaction execution efficiency, liquidity aggregation reduces the slippage of transactions within LPDfi, reducing the cost of user transactions and improving execution efficiency.

It can be seen that Logarithm Finance can become a cross-chain liquidity hub in the future, connecting the entire decentralized trading network and promoting DeFi to a more advanced stage of development.

Introduction to Some Other LPDfi Projects

In addition to Logarithm, there are some LPDfi protocols on the market:

LianGuainoptic

LianGuainoptic is a Uniswap-based options DeFi protocol that uses Uniswap v3 liquidity positions for minting, trading, and market-making of options that are available 24/7.

Limitless

Limitless Finance is an unliquidated, permissionless leverage tool built on top of Uniswap V3. It aggregates spot and lending liquidity in one architecture, reducing liquidity fragmentation between trading and lending. Limitless mitigates impermanent loss and provides higher returns for liquidity providers. Borrowers will be able to borrow any liquidity assets provided by LPs. They enjoy unliquidated and high LTVs by paying a premium to LPs (lenders). Traders can use up to 2000x leverage to go long/short assets without being subject to forced liquidation on prices.

Smilee Finance

Smilee Finance is the first protocol for decentralized volatile assets, providing liquidity similar to DEX to earn predictable USDC APR, hedge on-chain asset risks, and aims to reduce impermanent loss. In addition, Smilee can also be used to build new volatility products, such as inverse impermanent income – short LP positions to profit from impermanent loss.

Infinity Pools

There is no need to introduce Infinity Pools too much, you can refer to “InfinityPools: Realizing 1000x leverage unleveraged perpetual contracts?”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- WorldCoin officially launches its token. Will it become the next epic-level crypto project?

- Review of the 13 award-winning projects at the ETHGlobal LianGuairis Hackathon

- Quick Look at the Cosmos Ecosystem Project TVL Data Changes

- LianGuai Daily | Twitter may change its logo to X-related; Terraform will release 9 projects but will not launch new tokens.

- A Review of the 20 Award-winning Projects at ETHShanghai 2023 Hackathon

- Telegram Bots are rising unexpectedly, which projects are worth paying attention to?

- Review of the 20 award-winning projects from ETHShanghai 2023 Hackathon