Blockchain economic panorama and future: Fintech evolution engine (on)

Since the birth of Bitcoin in 2008, the core technology that supports its underlying operations, the blockchain technology, has become increasingly mature and has entered the mainstream financial technology world with the rise of Bitcoin prices. The 46th World Economic Forum Davos Annual Conference will include blockchain along with artificial intelligence and autonomous driving in the "Fourth Industrial Revolution". The "Economist" magazine once introduced the blockchain in the cover article "Trusted Machines" in October 2015-"The technology behind Bitcoin may change the way the economy operates".

On June 18, 2019, the official website of Facebook's global digital cryptocurrency Libra was officially launched, and the Libra white paper was released. According to the white paper, Libra will build a simple, borderless currency and a financial infrastructure that will serve billions of people. The Libra coin has received widespread attention since its launch. On the one hand, it has pushed the digital currency to a new climax, and on the other hand, it has caused concern among regulators in various countries.

Recently, the central government emphasized that the integrated application of blockchain technology plays an important role in new technological innovations and industrial changes. We must regard blockchain as an important breakthrough in independent innovation of core technologies, clarify the main attack direction, increase investment, focus on overcoming a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation. Leaders pointed out that the application of blockchain technology has extended to many fields such as digital finance, the Internet of Things, intelligent manufacturing, supply chain management, and digital asset trading. At present, major countries in the world are accelerating the development of blockchain technology. China has a good foundation in the field of blockchain. We must accelerate the development of blockchain technology and industrial innovation, and actively promote the development of the integration of blockchain and economy and society.

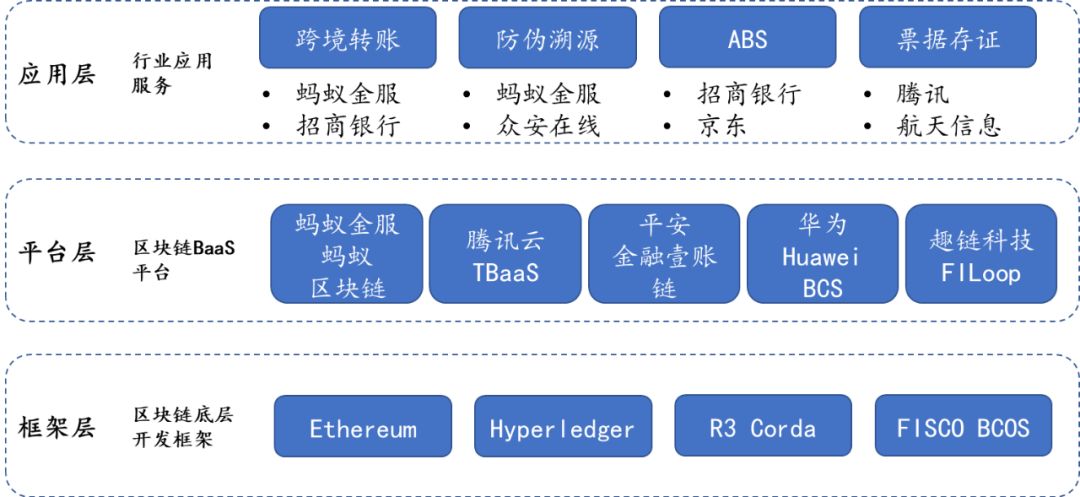

The central government pointed out that blockchain technology is not limited to the crypto asset industry. It has begun to play an active role in the frontier innovation areas of financial technology, such as clearing and settlement, payments, electronic invoices, supply chain finance, and trade financing. At present, the main open source architectures of the blockchain include Bitcoin, Ethereum, Hyperledger Fabric, R3 Corda, etc.In China, there are major blockchain platform service providers such as Ant Financial, Ping An, Tencent, and Wanxiang.

- Introduction to Technology | Understanding Bulletproofs of Zero Knowledge Proof Algorithms –Range Proof III

- Babbitt Column | Digital Economy and Digital Rule of Law

- Research report | Observation of the exploration of decentralized community governance from DAO, DCR to Polkadot

Figure 1 China's major blockchain platform service providers, BlockVC industry research

In the historical trend of continuous technological breakthroughs, increasingly perfect supervision, and continuous progress of the industry, BlockVC industry research is based on technology, focusing on financial technology. For the three parts of upper, middle and lower, try to take the first principle as the guide, from the blockchain: origin, mechanism and characteristics, the blockchain: reinventing fintech, Libra and DC / EP, fintech companies embrace the blockchain Multiple dimensions, such as technology and industry development prospects, fully demonstrate the strong potential of blockchain technology and the technology's changing financial development path.

Blockchain: Origin, Mechanism and Features

definition

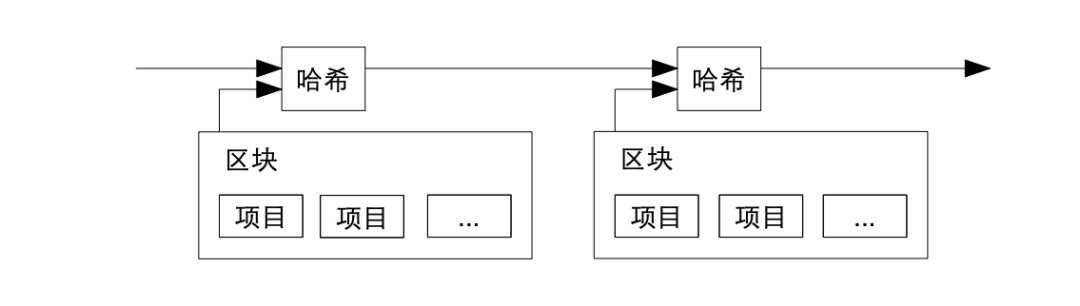

The definition of "blockchain" in Wikipedia refers to a growing list of records (ledgers) that connects transaction records (blocks) through cryptography (hash function pointers). This ledger usually exists in the form of transaction blocks and grows in chains. In fact, in the Bitcoin white paper "Bitcoin: A Peer-to-Peer Electronic Currency System", only Block and Chain appeared. Later, experts and scholars abstracted this ledger technology to form the basic characteristics and technical framework of Blockchain. So "blockchain" and "bitcoin" are twins. In a nutshell, blockchain technology is a trusted distributed database technology. In a blockchain, data is recorded and stored by all nodes of the system, so detrusting between different nodes can be achieved.

Figure 2 A simple schematic of the blockchain structure, BlockVC industry research and Bitcoin white paper

Core mechanism

Blockchain technology combines and applies the three core mechanisms of cryptographic principles, hash algorithms and asymmetric encryption technologies, Merkel tree data storage structures, and consensus algorithms, to pioneeringly realize the trusted value of distributed detrust. transmission.

- Principles of cryptography: hash algorithm, asymmetric encryption

Hash algorithm is a collective name for a class of encryption algorithms, which means that a string of arbitrary length can be input. A hash algorithm can produce a fixed-size output. In layman's terms, the output of the hash algorithm, that is, the hash value, can be understood as the "home address" or "mobile phone number" in the blockchain world. The characteristic of the hash algorithm is that the specific content of the block is deduced from the hash value, that is, the content encrypted by the hash algorithm is extremely secretive.

- data structure

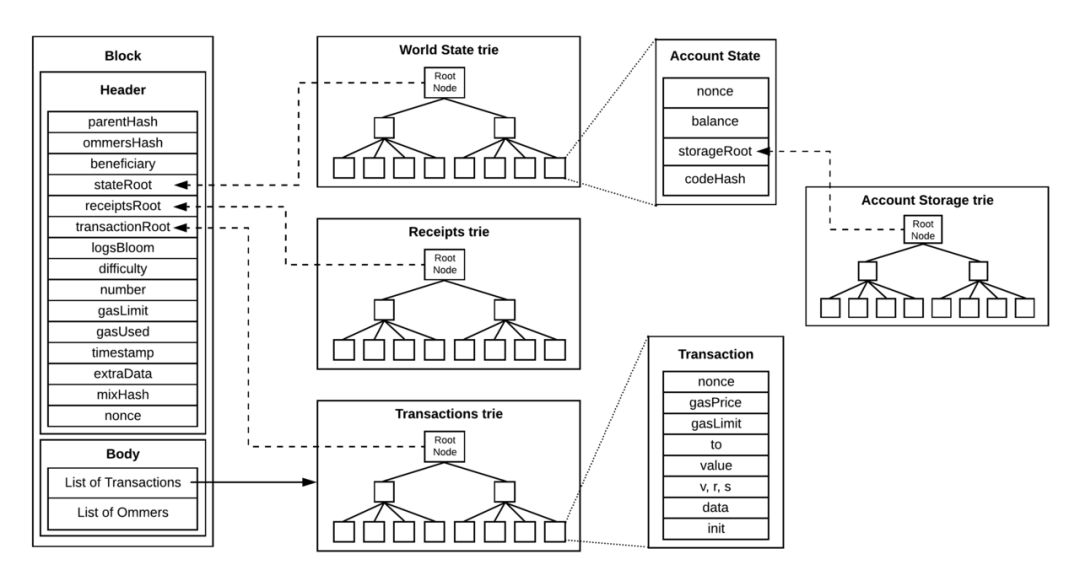

The data structure used by general blockchains is the Merkle Tree. This tree-like data structure is very efficient in quickly inducing and verifying the integrity of large-scale data. In the Bitcoin network, the Merkel tree is used to summarize all transactions in a block. The root of the tree is the hash value of the entire transaction set. The lowest leaf node is the hash value of the data block. Non-leaf nodes Is the hash of the concatenated string of its corresponding child node.

Figure 3 Schematic diagram of the Ethereum network Merkel tree, BlockVC industry research

Figure 3 Schematic diagram of the Ethereum network Merkel tree, BlockVC industry research

- Consensus algorithm mechanism

The consensus mechanism is the core value of the blockchain network. In simple terms, the consensus mechanism is a mechanism for blockchain nodes to reach a consensus on the entire network of block information, which can ensure that the newly generated blocks are accurately added to the previous blockchain and the blockchain information stored by the nodes is consistent. Forks can even defend against malicious attacks. To achieve this effect in practice, two conditions need to be met: one is to select a unique node to generate a block, and the other is to make the distributed data record irreversible. In order to realize these two characteristics, the current mainstream consensus mechanisms include the PoW proof-of-work mechanism adopted by Bitcoin; the PoS proof-of-stake mechanism designed and adopted by Ethereum.

Basic Features

Blockchain is not a brand new species created out of thin air, but continues the development context of ledger technology in human history. Judging from the evolution of the data structure of the ledger, human history has gone through two stages, namely the physical ledger stage and the electronic ledger stage. The physical ledger stage has run through thousands of years of human history, and the electronic ledger was born in the computer Only then appeared. The blockchain is also an electronic ledger, but it is no longer a simple electronic ledger relying on a single computer, but a distributed ledger based on the global Internet. The new electronic ledger of the blockchain has the following characteristics (take the Bitcoin model as an example):

- distributed

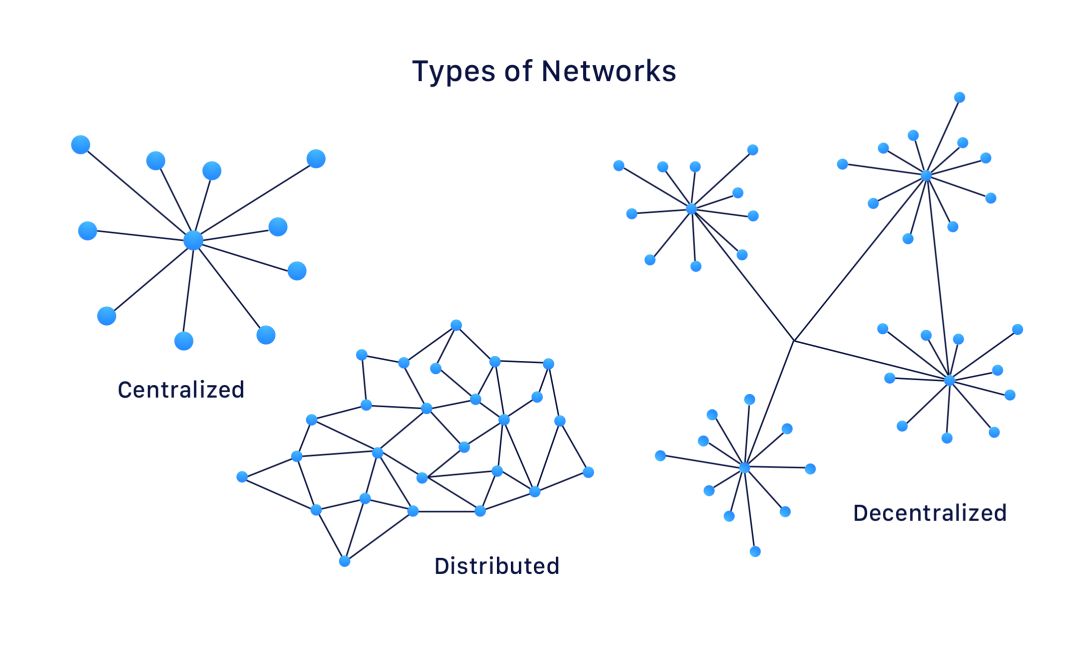

One of the basic characteristics of the blockchain is distributed, which is mainly reflected in the fact that the blockchain network is a P2P peer-to-peer network. The nodes in the network retain a complete network ledger, so the distributed ledger feature of the blockchain can be effective. Prevention of "single point of failure" in traditional internet or database architecture. But distributed is not the same as decentralization, so decentralization is not a necessary feature of the blockchain.

Figure 4 Typical network topology, BlockVC industry research

-

Distrust intermediation

With the prosperity of human trade and commercial activities, the double-entry bookkeeping method has gradually replaced the single-entry bookkeeping method in the initial period, and the tampering behavior and accounting errors of the books can be easily found through reconciliation. In order to further ensure the credibility of the ledger, on the basis of the double-entry bookkeeping method, people have introduced a trusted third-party institution to save the public ledger, which has further developed into a tri-type bookkeeping method. In a general sense, a third-party trusted institution can be played by a large financial institution with credibility, provided that both parties to the transaction must maintain trust in the third party. On the basis of the three-type bookkeeping method, the blockchain replaces trusted third parties through a trusted third-party network. Nodes in the third-party network will maintain a complete full-network ledger, which greatly reduces Tripartite trust risk.

- Not easy to tamper with

The non-tampering of the blockchain mainly comes from multiple aspects, such as the large number of ledger copies in the network can ensure that the ledger errors or data omissions of some nodes can be accurately corrected. In addition, the blockchain also brings two important anti-tampering methods: First, the blockchain technology uses a large number of cryptographic methods to ensure the anti-attack of data structures and the security of assets, such as trading blocks. One-way hash function is used to ensure the block order, and all accounts are secured by asymmetric encryption algorithms. Second, according to the different blockchain consensus algorithms, the blockchain network will be given different levels of security. For example, Bitcoin's "workload algorithm" ensures that unless the entire Bitcoin network has more than 50% of the entire network computing power, it will not be able to rollback or tamper with transactions.

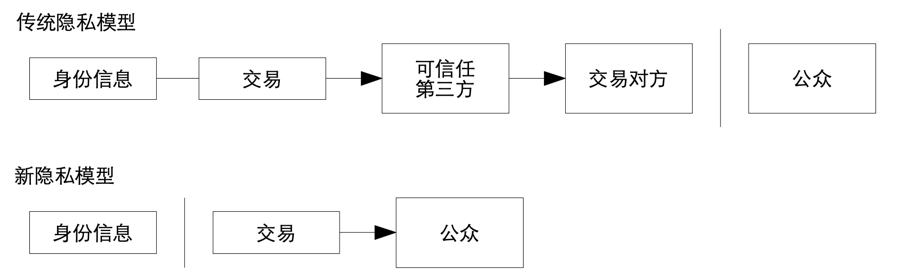

- Privacy

The account model in the blockchain network is generally provided by an asymmetric encryption algorithm, where the public key is the account address and the private key is the account key. Creating a new account in the blockchain network does not require identity authentication, but uses a randomly obtained string as the account address, so it can alleviate the leakage of personal information to a certain extent. However, because the blockchain ledger is open on the entire network, once the personal real ID information is associated with the account on the network, the privacy will be greatly reduced.

Figure 5 Blockchain privacy model, BlockVC industry research and Bitcoin white paper

Figure 5 Blockchain privacy model, BlockVC industry research and Bitcoin white paper

-

Token

Before the birth of the blockchain, tokens were widely used in computer systems to implement functions such as access control of data or files or other security controls. The blockchain originates from the Bitcoin network, which provides an incentive to help coordinate participants across the network: BTC. Technically, the token itself represents the right to use scarce resources in the entire blockchain network (such as computing resources, storage resources, and bandwidth resources). In a broad sense, through the flexible use of tokens, it is possible to achieve large-scale network collaboration between organizations and individuals, thereby promoting the further development of distributed organizations and distributed collaborations, and enabling sovereignty through tokens in blockchain networks. Currency credit and value radiate and influence on a larger scale.

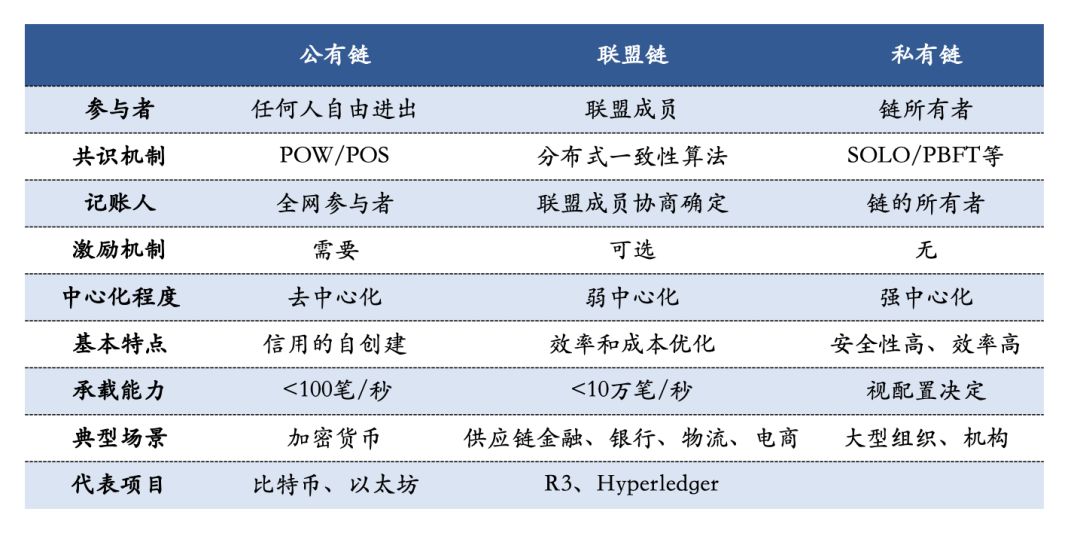

classification

"Blockchain" originates from Bitcoin, but it is much more than Bitcoin technology. Experts, scholars, and engineers have conducted further research and expansion on the basis of the blockchain technology represented by Bitcoin. According to the difference in control of network permissions, broad-based blockchain technology is divided into public chains, alliance chains, and private chains. Among them, public chains do not classify and control the participants of the entire network, and nodes on the entire network have the same status. The alliance chain restricts network access rights and accounting rights. As for the private chain, it is similar to the internal management system of an enterprise. All permissions belong to the owner of the chain. The following table lists the basic characteristics of the three types of blockchain.

Figure 6 Blockchain classification and basic characteristics, BlockVC industry research

Figure 6 Blockchain classification and basic characteristics, BlockVC industry research

Bitcoin is generally referred to as the "blockchain 1.0" system, and the "distributed application platform Ethereum" characterized by "smart contracts" has opened the development stage of "blockchain 2.0". To this day, blockchain technology has not only been confined to the chain blockchain structure, including new data structures (directed acyclic graph (DAG) and distributed hash table (DHT), etc.) and new consensus mechanisms ( POS, DPOS, POA, etc.) blockchain systems have been continuously developed. New technologies to improve the performance of the blockchain (such as privacy and scalability) have also been further developed, such as sharding technology, lightning network, state channel technology, and cross-chain technology. Among them, cross-chain technology has received universal attention. Once this technology is successful, it will open up the currently fragmented blockchain system and realize the free cross-chain circulation of blockchain information and assets, thus making the "blockchain Internet" become possible.

Blockchain: reinventing fintech

According to the many characteristics of the blockchain technology above, it can be seen that the core advantages of the blockchain technology are through cryptography and consensus mechanisms, etc., on the premise of ensuring the uniqueness of the data and extremely difficult to tamper with, to achieve multi-party Letter value transfer. This feature makes the blockchain naturally suitable for fintech scenarios that require “multi-party sharing”, “high-frequency repetition”, and “long transaction chains”.

Blockchain technology can serve a wide range of financial fields such as payment and clearing, bill deposit and insurance, as well as real economy fields such as supply chain management, industrial internet, product traceability, energy, knowledge and copyright. In modern society, almost all industries involve transactions, so an honest and reliable trading environment is required as the prerequisite support for the healthy development of the industry, and this is where the core value of blockchain technology lies. Blockchain creates trust through mathematical principles rather than third-party intermediaries, which can reduce system maintenance costs and transaction costs. For traditional financial institutions, the operation and labor costs of online links such as reconciliation, clearing, and auditing will be reduced; for non-financial industries, blockchain can reduce information asymmetry in each link of the value chain, thereby improving collaboration efficiency, Reduce overall transaction costs; for individuals, unfamiliar parties or parties can cross the limit of physical distance and safely transfer value on the network, thereby creating more supply and demand.

Although the combination of blockchain and tokens has great potential for impacting existing business logic, BlockVC industry research believes that blockchain technology is currently more suitable for scenarios where the value chain is long, the communication links are complex, and there are game behaviors among multiple parties. Blockchain technology will effectively improve the efficiency of cross-subject collaboration, reduce the cost of related links, upgrade traditional information technology, and realize leapfrog optimization of existing business environments. In cross-enterprise and cross-subject business scenarios, due to the lack of mutual trust mechanisms, there is still a great deal of human and material resources for communication and collaboration. For example, when performing reconciliation verification between different institutions, it is often necessary to export the data from their respective information systems, send it by e-mail, or even print and stamp it, and then compare and verify it after receiving it. In such a cross-agent collaboration scenario, blockchain technology can effectively reduce the information asymmetry of each participant by maintaining the security, transparency, and consistency of the ledger between the various entities.

BlockVC industry research will elaborate on the practice, prospects and path of blockchain to reinvent financial technology from multiple aspects, including cross-border payments, global trade logistics, supply chain finance, credit reporting, LibraDC / EP, and many other aspects.

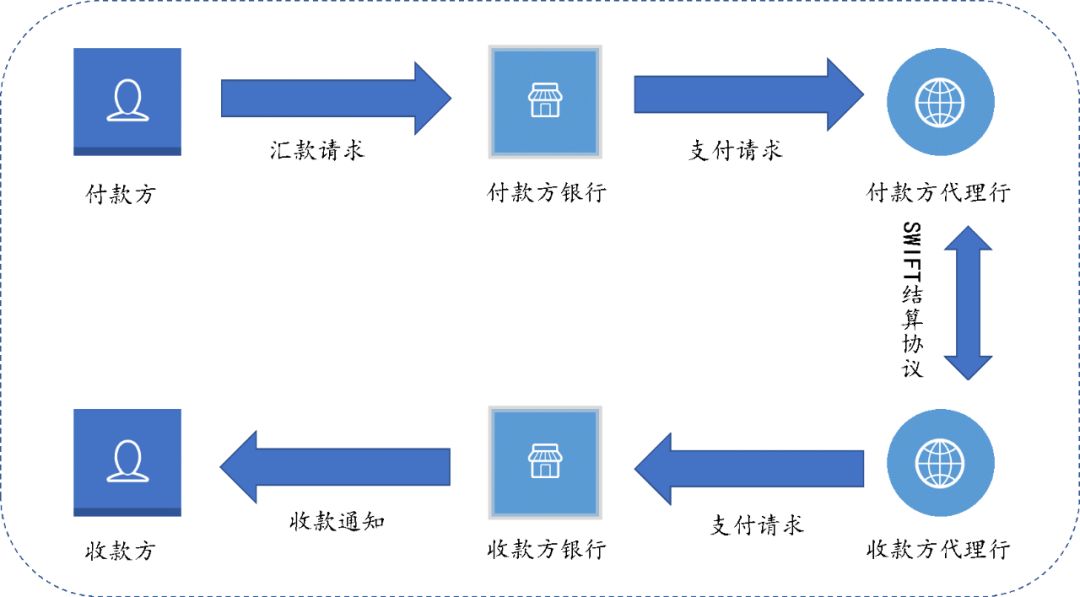

Blockchain reshapes cross-border payments: shortening transaction cycles and reducing transaction costs

Cross-border payment is a typical scenario where an intermediary provides value transfer services. At present, international payment business mainly uses SWIFT (Society for Worldwide Interbank Financial Telecommunication, Global Banking Financial Telecommunications Association). SWIFT provides financial exchange message exchange services for financial institutions' settlement, and provides unified financial industry security message services and interface services. Intermediaries such as SWIFT exist because cross-border financial institutions' systems are disconnected and direct settlement costs are high. At the same time, their business share is low and their counterparties are uncertain, making it difficult to build direct partnerships. The existence of the correspondent bank, the communication of the agreement and the repeated confirmation of the transaction information make the transaction confirmation through SWIFT often take 1-2 days. Although SWIFT is currently widely used around the world, with annual cross-border payments amounting to US $ 25 trillion-30 trillion, it still faces the problem of high fees (30-40 US dollars per transaction). These payment costs include, but are not limited to: bank fees, SWIFT channel fees, transaction delay losses and reserves, etc., among which the liquidity loss caused by excessive transaction time accounts for 34%, and the capital operation cost accounts for 24% .

Figure 7 SWIFT wire transfer settlement agreement, BlockVC industry research

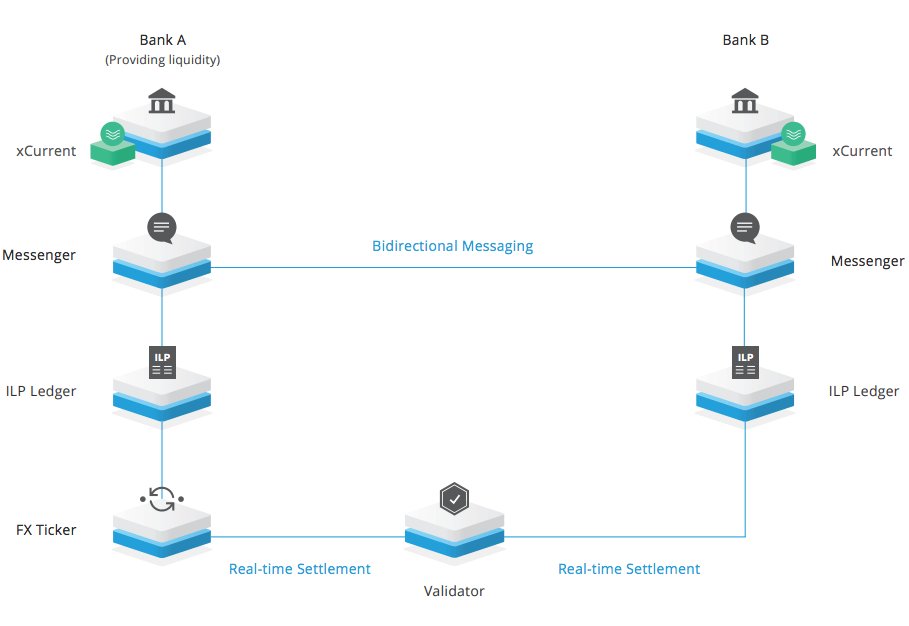

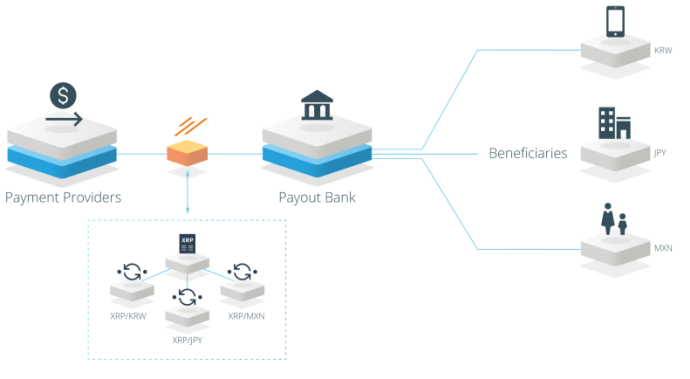

Take Ripple as an example: Ripple was established in 2012 and provides fast, low-cost cross-border payment services for banks, payment service providers, and enterprises through RippleNet based on blockchain technology. Currently, RippleNet has access to more than 100 financial institutions from more than 40 countries around the world, including Royal Bank of Canada, Standard Chartered Bank, and West Pacific Bank. RippleNet's specific services are divided according to paths, including xCurrent, xRapid and xVia solutions. Among them, xCurrent is mainly aimed at inter-bank cross-border payments; xRapid introduced Ripple (XRP) as a currency conversion medium in cross-border transactions, and payment providers using this service do not need to reserve local currencies in various markets in advance, thus reducing liquidity Cost; xVia provides a more standard and quick entrance for ordinary enterprises to access RippleNet. Overall, the simplification of the payment process has significantly reduced the cost of cross-border payments. According to Ripple's estimation, the cost of each transaction between banks will decrease from US $ 5.56 to US $ 2.21, a 60% decrease. Based on the number of more than 3 billion payment messages completed through SWIFT in 2016, approximately US $ 10 billion can be saved in 2016 cost of.

Figure 8 RippleNet service architecture diagram, Ripple

Blockchain + global trade logistics: simpler, faster, more transparent, and more secure

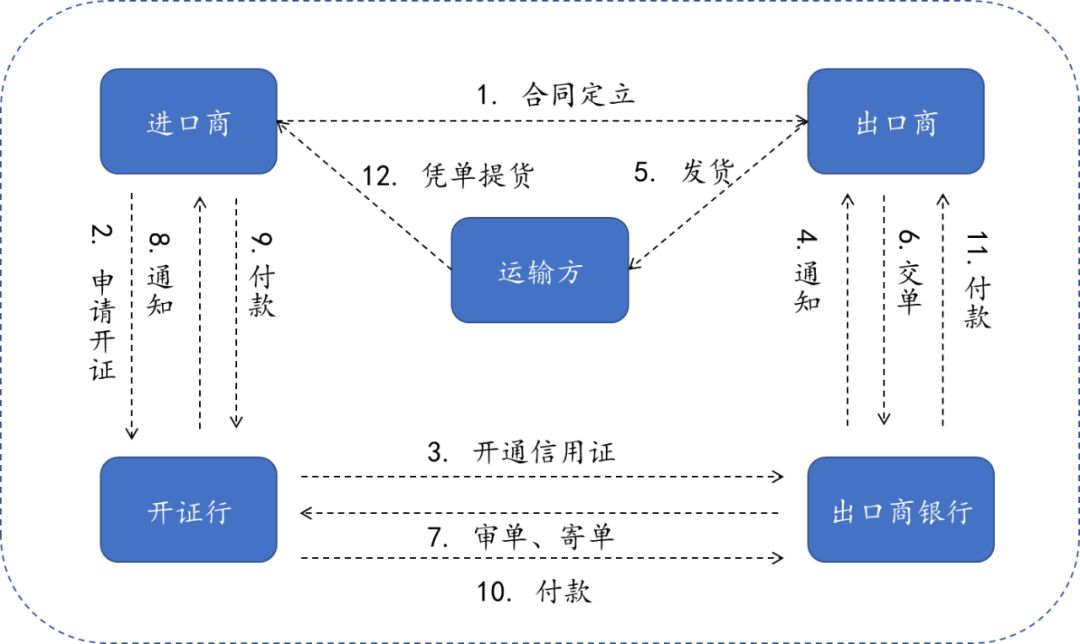

The current global trade mechanism consists of multiple entities including exporters, importers, consignees, contractors, transporters, and regulatory agencies. Among them, 90% of global trade volume is transported by sea, and more than 80% of consumer goods are transported by sea. At present, international trade is facing pain points such as long trade cycles and poor information. Take a transportation case from Maersk as an example. If a company wants to transport avocados and roses from Africa to Europe, it will take a month-long cross-border transportation, which will involve more than 200 subjects and more than 200 communications and interactions along the way. And each subject has its own different document flow for each interaction, and the total thickness of the document will be as high as 25 cm after the overall process is signed.

The information is highly discrete between the subjects and exists in their own links. A large number of paper operations make the supply chain lack transparency and low collaboration efficiency. The large amount of collaboration and low transparency in the transaction process makes it difficult for the entities to understand the real-time status of cargo transportation in time, and it is prone to the risks of reduced resource utilization, prolonged transportation time, increased potential damage to goods, and increased costs.

Figure 9 Current international trade process, BlockVC industry research

Figure 9 Current international trade process, BlockVC industry research

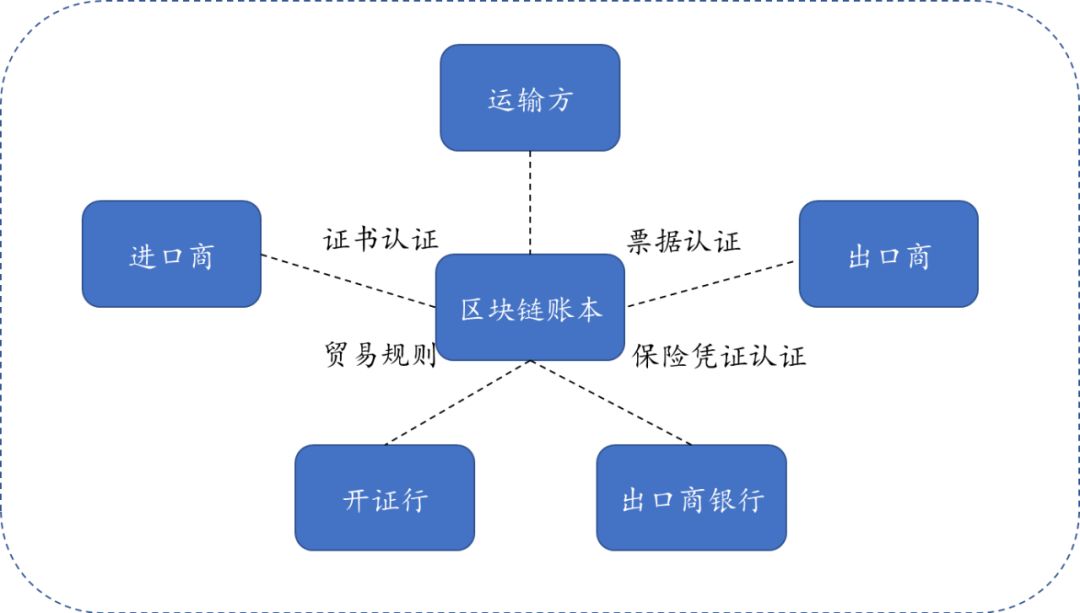

Take the IBM blockchain open logistics platform as an example: For the transparency of information circulation, the IBM platform is open to all participating entities, and any detailed information about logistics is verified by both parties and multiple parties through digital signatures and tokens . The five major management systems include logistics, port, customs, supply chain, and transportation, which are all coordinated and managed simultaneously to ensure that all information is shared electronically in real time. The real-time shared information guarantees the efficiency and effectiveness of each link in the entire logistics process, effectively reducing manpower and material expenditures.

For importers, exporters, and manufacturers, end-to-end information transparency among multiple parties can be used to monitor the entire logistics process in real time and increase the efficiency of communication at all links; for centralized management of ports and containers, improve empty container utilization and Resource mismatch rate; For customs and other inspection agencies, correct information can greatly improve the efficiency of approval; for transportation managers, optimize the transportation route and schedule of goods.

Looking back at the case of transporting goods from Africa to Europe, the similar tasks running on the IBM blockchain open logistics platform only took a total of two weeks, saving over 40% in time and reducing costs by over 20%. IBM blockchain technology improves the efficiency of digital management in all links, greatly reduces problems such as paper documents, container mismatches or vacancies, intermediate link fraud, and improves resource utilization while optimizing the management structure.

Figure 10 Schematic diagram of blockchain-enabled international trade, BlockVC industry research

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- About Token Classification Act, Libra, and SEC: Interview with Kristin Smith, Director of External Affairs, Blockchain Association

- Perspectives | MOV Ecology and Blockchain Thinking

- Babbitt Site | Super Ledger Beyond Fabric, 15 Projects in Progress, Reward 9 Cases

- Can't beat Bitcoin in 2019, where is the strength of Ethereum in 2020?

- ECB President makes clear statement on stablecoin: EU should lead the world in stablecoin projects

- Review Ethereum 2019: speak with data

- Industry Blockchain Weekly 丨 31 Provinces Release Policy Information, Blockchain Concept Stocks Expand