Doubtful Bull Market Is Here, How to Prepare to Ride the Narrative?

Navigating a Uncertain Bull Market Preparing to Embrace the NarrativeBull market is “crazier” than you think.

Written by: IGNAS | DEFI RESEARCH

Translation: Deep Tide TechFlow

- LianGuai Morning Post | NFT trading volume in October increased by 32% compared to September. Tether to issue 1 billion USDT.

- OpenSea NFT Marketplace Trims Down Staff Crypto Cleanup or Tactical Maneuver?

- Web3 Pioneer Treehouse Ventures into NFT Analytics Uncovering the ‘Origins’ of Digital Collectibles

Not so fast: Is this the beginning of a new bull market?

Interest rates have reached their highest levels in decades, people are struggling to pay their bills due to high inflation, two major wars are underway, and the S&P 500 index has dropped 9%. As I write this article, even Google’s stock price has dropped by 10%.

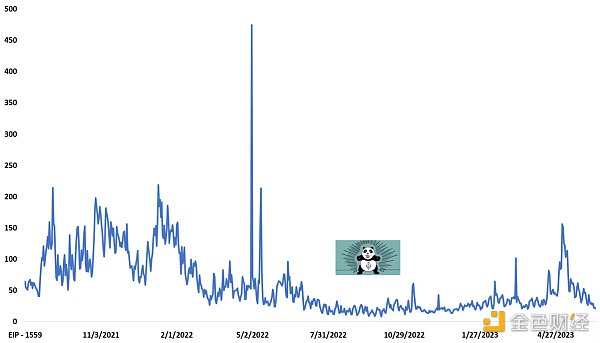

Despite the bearish macro environment, Bitcoin (BTC) has been stable above $34,000 for over a week. You must have read “Wall Street Cheat Sheet: The Psychology Of Market Cycles” over a hundred times now, and it seems like we are experiencing a “doubt” style bull market.

Four months ago, Delphi Digital released an eye-catching market research report called “Catalysts Stacking – Narratives Driving Fundamentals”?

The report is paid, but I wrote a summary on X explaining how the narratives are evolving and identified the catalysts that drive them.

Delphi identified three important core narratives: the Federal Reserve’s liquidity cycle, wars, and new government policies. They explained how each one impacts and will continue to impact cryptocurrencies in the short and long term. This article was prescient in terms of accuracy, as many negative events are now turning into positive ones. Since then:

-

The U.S. Securities and Exchange Commission failed in court against Grayscale (and XRP), paving the way for Grayscale BTC spot ETF and putting Gary’s position in the SEC in jeopardy. The (hopefully) continued buildup of momentum through further failures with Binance, Coinbase, etc., will drive the bull market.

-

China has started combating deflation by providing a budget support of $137 billion, and the cryptocurrency has always benefited from liquidity expansion driven by China.

-

The approval of Bitcoin spot ETF by Blackrock and others is almost certain. This will continue to bring much-needed liquidity to the cryptocurrency space.

It is not yet clear when the Federal Reserve will start lowering interest rates, but the worst of the rate hikes seems to be over. Arthur Hayes believes that the end of the fiat currency era and the rise of artificial intelligence will contribute to the development of cryptocurrencies.

With the evolution of macro catalysts, they perfectly align with the Bitcoin halving in April 2024. The repetitive pattern of macro cycles is why Bitcoin has followed a similar trajectory as in the past.

So, is this the start of a bull market? I believe it is.

But even if I am wrong, I can wait for any dips and continue learning and researching cryptocurrencies to prepare for the next bull market. I can’t sit on the sidelines and miss out on the crazy bull market.

The bull market is “crazier” than you imagine

Inverse Finance ($INV) is just an example of the madness of the previous bull market. However, the launch of INV began with the YFI token.

yEarn, a yield aggregator created solely by Andre Cronje, required what we call “governance”: the maintenance and decision-making of setting fees, rules, etc.

Therefore, they released YFI, “a completely valueless 0 supply token.”

“We emphasize again, it has no financial value. No pre-mine, no sale, not for purchase, won’t be on Uniswap, no auction. We have none.” – YFI Blog

Anyone could provide liquidity on protocols like Curve (as far as I know) and get YFI for free. I provided liquidity, and to my surprise, I earned a 1000% annualized return!

I couldn’t comprehend how a seemingly “valueless” token was trading at thousands of dollars per token. Cryptocurrency discussions on Twitter were filled with speculations on the price of YFI, ranging from $0 to $1 million. But YFI was a completely new concept, and our traditional investment framework didn’t apply. YFI changed our understanding of token launches entirely.

In the end, I sold my YFI at around $3,000 per YFI, only for its price to skyrocket to $90,000 months later. That was a potential 2900% profit that I missed out on. I wasn’t prepared for how wild the market could become at the time.

Since then, I have kept an open mindset and remained open to things that confuse me the most. These things could either disappear or completely change the dynamics of the industry. DeFi and NFTs are significant examples of this, creating a generation of wealthy degens, just like early BTC and ETH buyers.

YFI is just one of the seven tokens that have changed my understanding and the dynamics of token economics. The other six are AMPL, OHM, COMP, CRV, NXM, and SNX.

But all of these tokens have crazy stories and valuable lessons. Olympus DAO, a Ponzi scheme with a four-digit APY, could inflate OHM’s market cap to $4.3 billion as long as no one sells—(3.3), surpassing AVAX’s current market cap.

Everything was going smoothly until the Ponzi scheme collapsed.

Olympus PTSD made me dislike the Friend Tech 3.3 game. Don’t be naively deceived by new marketing tricks (Olympus should be DeFi 2.0). Sell some profits at least during the upward trend.

When the bull market returns, there will be more bull market memes, WAGMI chants, and promises of larger Ponzi schemes. You will see some degen stories of people earning huge profits. In short, we will become reckless, and the bull market will be crazier than you imagine.

We need to be cautious, but not too cautious, lest we miss out on “once in a lifetime” opportunities. We need to adjust our thinking but stay calm, easier said than done.

How to Ride the Narrative in the Upcoming Crazy Bull Market

In the crypto field, there is always a bull market. Even in this bear market, we had the sudden appearance of PEPE, and recently the rise of SocialFi.

How does one know where to look for early clues to new narratives? The Delphi article I mentioned above shared why narratives are important and how they form.

Narratives are crucial because they help us make sense of this complex, intimidating, and seemingly random world. When explicit communication is impossible, we rely on shared knowledge, common sense, and social norms to make decisions. These decisions often depend on prominent cues, known as Schelling points.

“Two people face a series of numbers [2, 5, 9, 25, 69, 73, 82, 96, 100, 126, 150], and if they both choose the same number, they will be rewarded. If these two people are mathematicians, they are likely to choose 2 — the only even prime number. Non-mathematicians might choose 100 — a number that is not more special than the other two square numbers for mathematicians. Illiterate people might choose 69 — which may be for different reasons for those interested in numbers rather than mathematics, due to its special symmetry.” — Delphi Digital.

Crypto degens are likely to gather around the number 69, for meme reasons. Do you think it’s a coincidence that Bitcoin’s all-time high price was $69,000?

In other words, decision diversity is essential; it drives the market. Despite people being driven by emotions and stories, the market thrives on collective consensus and narratives. These narratives help us make sense of seemingly random events happening around us.

PEPE successfully captured the imagination of a bored but profit-desiring crypto community. In a market where no other significant events were happening, PEPE’s captivating story made it stand out, and the smaller advantage in market cap compared to competitors like Doge and Shiba Inu really helped boost morale.

But bear markets are tricky because these opportunities are rare and often short-lived. In bull markets, multiple narratives emerge simultaneously, so opportunities are plentiful. And things can get crazier than you can imagine.

My advice is to keep an open mind, try out those new things that confuse you the most, research them, and never sell all the new tokens you acquire at once. Even tokens that face criticism or negative views are worth exploring. New ideas that challenge the status quo often provoke unease in the older generation.

This is exactly what Bitcoin is doing to traditional finance (TradFi), and it is what Ordinals is doing to the Bitcoin maximalists. The criticism of Ordinals by Bitcoin maximalists is one of the reasons why I’m bullish on it. It shows that even they recognize its importance and believe it’s worth paying attention to.

I believe the crypto market rewards those who are early to discover emerging narratives and remain open-minded to adapt quickly to new market dynamics. Even the “real yield” tokens, which are fundamentally driven, eventually become another sellable narrative. In fact, I check the performance of “real yield” tokens before and after the emergence (and decline) of a narrative to confirm this.

What are some bullish narratives?

I’ve mentioned before that narratives emerge from a combination of new technological innovations and compelling storytelling.

One such narrative is Bitcoin DeFi with Ordinals, Stacks, and BitVM, aiming to enhance Bitcoin’s smart contract capabilities without forking.

But here are a few narratives that I think can explode in a bull market, benefiting from 1) technological innovation and 2) currency (token) production capacity.

-

Liquidity re-staking tokens.

-

The fusion of artificial intelligence and crypto. Arthur Hayes promotes Filecoin (FIL) tokens because of the need for storage, but Arweave (AR) or newer tokens could also shine at the right time (both have performed poorly). With the development of AI and other technologies, the narrative of machine-to-machine micro-payments is also possible to revive.

-

Modular and single-chip blockchain narratives. Ethereum and Cosmos are typical examples of modular blockchains, although they have different implementation visions. Solana is leading in the single-chip L1 narrative, and time will tell which approach will dominate the next decade.

-

New generation decentralized exchanges (DEXs). I closely watch projects that recently raised funds from top-tier venture capital firms. In the new DeFi protocols that raised funds, most are DEXs. This is not surprising since one of the primary use cases for crypto is speculation. As trading volumes increase in a bull market, the valuation of DEXs and their tokens will rise.

-

New generation DeFi stablecoins. The collapse of UST is clearly not the final attempt to solve the three-dilemma problem of stablecoins. Liquity V2 is said to do this, and Frax V3 and DAI leverage RWA for scaling up. Ethena offers a different (though not decentralized) scalability approach, and I expect new models to continue providing new ways to get rich.

However, in every bull market, there is usually a new narrative that can transcend each of the aforementioned narratives. It’s like Friend tech and SocialFi suddenly appearing.

The protocols that successfully create new narratives and early adopt these narratives will be the winners of the next bull market.

In the book “The 22 Immutable Laws of Marketing” by Al Ries and Jack Trout, they mention the “law of leadership”. According to this law, it is easier to position yourself as the first in someone’s mind than it is to convince them that your product is better than the first successful one.

So, all these SocialFi forks that market themselves as the better “Friend tech” have really helped Friend tech establish itself as the leader in that category.

Remember, when a new narrative emerges, it is usually wiser to bet on the original protocol rather than a fork. There are some exceptions, like LianGuaincakeswap and Velodrome, where most forks promise you heaven but end up taking you to hell.

Celestia is a good example. They mastered another marketing law mentioned in the book, the “law of category”. Celestia wasn’t the first protocol to venture into modular blockchain narratives, but unlike the hundreds of L2s focused on the “execution layer” today, they focused on the data availability layer. How many DA solutions do you know?

Some forks actually perform well in the short term, so completely avoiding them might mean missing out on short-term opportunities.

Lastly

Everyone’s experience and lessons learned are different. That’s why there’s a saying in crypto that you need to go through 3 cycles to be “successful” in crypto: one for learning, one for making money, and one for financial freedom.

No matter how crazy the market gets, make sure it doesn’t completely destroy you. You can lose 10%, 20%, or even 50% of your net worth on a protocol, but if you lose it all, you won’t have another chance.

The crypto market is full of what Nassim Taleb calls “fat-tailed” distribution events. These extreme events happen frequently, but we cannot predict them. FTX, Celsius, Terra, etc. were major players in the last bull market, but they are now lamentable.

So, prepare for the upcoming crazy bull market while also preparing for the worst-case scenario. Risk management may sound boring until you start losing money. In terms of USD, my biggest loss occurred on the Osmosis OSMO/UST pool during the Terra crash. Because there was a two-week lock-up period, I couldn’t withdraw my LP, so since then, I no longer lock my “stablecoins” in time locks.

Therefore, even if the market becomes crazier than we expect, it’s not an excuse for us to become crazy and foolish. Learn, prepare, and enjoy the ride!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Crypto Chronicles NFT Winter Lingers On, Tattoos Get Digital Twins, NEAR and Berklee College of Music Join Forces!

- Laugh and Invest: Nitto ATP Finals Introduce Fan-Customizable Posters, NFT Style!

- Elon Musk Roasts NFTs on Joe Rogan Podcast, Sending Bitcoin Enthusiasts Into Ecstatic Frenzy

- Battle of the Crypto Titans: Bitcoin vs. NFTs

- Mox Capital Splashes $410 Million to Dive Deeper into the Digital Asset Pool

- Dialogue with Variant Fund Co-founder How can the crypto world save traditional social networks?

- Musk NFTs are not even on the blockchain, it’s just a URL pointing to a JPEG.