Opportunities and Reflections on Ethereum Block Space in the Future

Future Ethereum Block Space Opportunities and ReflectionsAuthors: Drew Van der Werff and Alex Ma, Frontier Research; Compiled by: Plain-language Blockchain

TLDR:

1. History shows that derivatives can strengthen the spot market and provide additional tools for stakeholders in the supply chain to manage their business. Similarly, the Ethereum spot gas market may benefit from the derivatives market.

2. With the development of Ethereum Gas derivatives, there is an opportunity to launch a suite of products to provide better user and developer experiences (i.e., they can rely on paying a fixed Gas price) and increase the efficiency of Ethereum block space price discovery. In addition, in most markets, the number of derivatives greatly exceeds the number of spot products, providing important opportunities in a wide design space.

- Introduction to Aave Cross-chain Communication Abstraction Layer a.DI

- Exploring the Complexity of the LSD Stablecoin Protocol: What are Its Characteristics and Risks?

- “Human flesh search” tool? Founder connected to CIA? Arkham accused of privacy breach.

3. When designing these products, regulatory/legal, market, and protocol-specific factors need to be considered. In addition, the maturity of market stakeholders must be increased to support active trading of these products.

4. It is difficult to know when this market will develop, but the integration of gas buyers (i.e., due to the development of L2/account abstraction), an increase in products available for hedging (i.e., pledge products), and an increase in the complexity of various stakeholders in the trading supply chain (i.e., through infrastructure improvements).

Throughout history, there have been examples of commodity markets experiencing increased volatility due to external events. While factors outside the market help to reduce the risk of commodity production and consumption (i.e., globalization leads to more efficient shipping/transportation and networking), derivatives serve as a tool for broader price discovery. Additionally, derivatives can be used to better manage businesses that depend on the commodity. There are similar opportunities in the Ethereum block space. With the development of block space derivatives, stakeholders can provide better user experiences, have more tools to manage their business, and increase the efficiency of block space price discovery. Below we take a look at the current state of the Ethereum block space.

I. Introduction to Ethereum Block Space

Ethereum’s business model is the sale of block space. Various participants interact with BlocksBlockingce and smart contracts to provide support for applications, support additional infrastructure layers, or directly settle transactions. However, like most resources, supply is limited. To determine who or what consumes these supplies, Gas was created. Stakeholders use Gas to specify how much they are willing to pay for the included transaction.

Gas and its usage in Ethereum have evolved, with the most recent significant changes occurring in August 2021. With the London hard fork and the implementation of EIP-1559, Ethereum transitioned its fee market to one composed of a base fee that gets burned and a tip sent to validators. Through this change, the market now has a protocol-driven reference rate via the base fee and ensures that for physical transactions, the cost associated with including a transaction in a block is minimized.

September 2022, Merger Complete! This changes some dynamics related to any potential derivative markets. With the merger, validators responsible for proposing and ultimately finalizing new blocks are known ahead of time by two epochs, giving the market about 12 minutes of lead time to know who will be stacking the next block (which could have interesting implications for potential physical delivery markets).

Finally, in the short term, the community may introduce a new fee market related to data storage called EIP-4844. This market would be Ethereum’s first multi-dimensional fee market that separates data storage and execution. This will be discussed in detail below, along with the impact of other roadmap projects.

II. What can we learn from other commodity markets?

To begin to understand the potential design and market structure of a blockspace derivatives market and its potential impact on spot, we surveyed traditional markets and observed various attributes. Here are some key market metrics we believe are most comparable.

1. Non-tradable underlying asset: In its current form, Ethereum gas is not directly tradable but rather a fee generated by trades; we look for markets based on non-tradable underlying indices.

2. Cash versus spot settlement: Considering the dynamic changes between physical delivery in blockspace and cash settlement at expiry, we look for derivative markets settled in cash but with spot markets settled physically

3. Stakeholders: Significant activity and speculation require actual usage of the commodity/good to drive it

4. Market microstructure: The placement of trades in a block can have a significant impact/alter what buyers are willing to pay. Therefore, we look for markets with similar microstructural dynamics driven by quality, geography, and other metrics

Based on these factors, we found the most relevant markets to be oil and the VIX (Volatility Index). More detailed information will be discussed below, but it is worth noting that both markets have been heavily utilized by various stakeholders to achieve a range of objectives (i.e., better business management, hedging, watching markets, etc.).

1. Petroleum

Until the 1980s, the petroleum market was primarily controlled by a specific group of market participants (i.e., parties with significant oil exports). By the end of the 1980s, a healthy spot market had developed, gradually replacing fixed-term pricing contracts. However, even with such developments, there was still one issue—the market required physical delivery. Given the complexity of petroleum transportation, these markets were still dominated by a small number of participants with long-term partnerships, rather than being open to a wider group of participants.

As these markets continued to mature, benchmark standards such as the US WTI were developed to track the sum of various grades of spot prices in certain regions. This allowed the market and other stakeholders to support and exchange petroleum in a standardized way (i.e., you don’t need to know the subtle differences in petroleum trading regions or markets). Through this development, not only were more participants able to form views on prices, increasing market liquidity depth, but derivatives can now be developed on this index (cash-settled products primarily based on the index). The result is more stakeholders contributing to price discovery, improving efficiency, and providing stronger tools for producers and consumers to manage their businesses. Currently, the petroleum output of WTI and Brent futures contracts on ICE and NYMEX trading platforms can reach billions of barrels per day, while global petroleum demand is about 100 million barrels per day; futures trading volume is more than 25 times the daily petroleum consumption.

2. Volatility Index/VIX

The VIX market originated from financial economics research in the late 1980s to early 1990s, proposing a set of volatility indices that can serve as underlying assets for futures and options trading. Similar to market indices, traders can speculate on a basket of stocks or, in the case of VIX, speculate on potential volatility within a broader market. This allows participants to both speculate on future market uncertainty and hedge against market downturns when volatility rises and investor stock portfolios may be impacted.

However, unlike stock indices, VIX itself cannot be traded. Therefore, only derivatives settled in cash on top of VIX can be traded. Despite this, since the establishment of the VIX futures market in 2004, it has grown from an average daily trading volume of only about 460 contracts to approximately 210,000 contracts in 2022. This market structure is similar to the current natural gas market. Underlying natural gas cannot be traded. However, the Ethereum block space market has observable and quantifiable properties. Therefore, creating a standardized Gas reference price is necessary for cash settlement of futures/options/forwards/ETPs. Fortunately, it has become easier after EIP-1559, which acts as a reliable oracle for block space.

III. Considerations for Product Design

While we can draw historical analogies to demonstrate the potential impact of the derivatives market on the Ethereum block space market’s robustness, Ethereum block space has unique functionalities that will also determine how reference benchmarks and derivative products are designed. We believe that the following should be primary considerations for anyone looking to develop a market/product. The following breakdown is around considerations for:

1. Market structure: This section covers considerations around participants in the block space/natural gas market, whether price makers can effectively hedge, potential consolidation of buyers, reference rate design, regulation, and miscellaneous.

2. Protocols/Roadmaps: This section covers considerations around multi-dimensional spot natural gas markets, heterogeneity of block space, miscellaneous, and potential future roadmap items.

3. Cash vs. Physical Settlement: Defining cash vs. physical settlement and discussing some design potentials for physically-settled block space.

1. Market Structure

Participants in the block space/natural gas market: In any such market, there are price takers and price makers:

1. Price takers need to interact with the market to manage their business risks. Going back to the oil market, these are both oil producers as well as downstream supply chain participants involved in refining or commercial use of oil. Similarly, in the natural gas derivatives market, there are validators providing block space, but subsequently developers/users of applications that need block space. Stakeholders may want to secure fixed income from block space in advance, while applications/wallets may want predictable fixed costs for their future block space needs. These participants ultimately want to find a way to avoid being impacted by dynamic spot market price changes, but two opposing sides are formed:

1) A: One party commits to selling block space in the future at the currently agreed-upon price. The other faces the risk of selling future block space at a cheap ether price;

2) B: One party commits to buying block space in the future at the currently agreed-upon fixed price. This faces the risk of paying too much for future block space.

2. Price Maker is a market participant who speculates and takes pricing risks. In traditional markets, these roles are played by the market-making departments of banks, asset management companies, high-frequency trading entities, etc. These participants are crucial for creating more liquid and efficient markets. In the gas market, we see digital asset market makers, investment firms, and validators themselves playing roles in the long term (just as oil producers own their own trading businesses). However, there are currently not enough price makers in the market, mainly due to the lack of a liquid spot market to hedge block space risks.

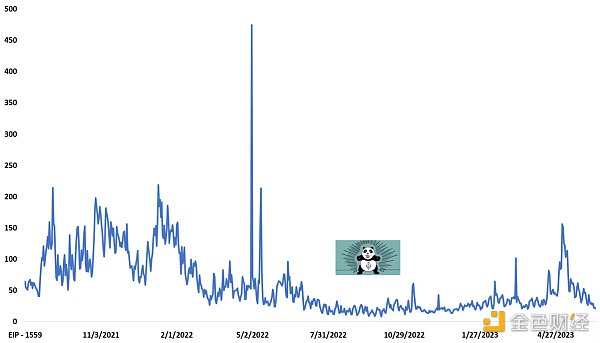

1) Inability of price makers to hedge effectively: The auction mechanism that drives block space base fees can be manipulated (especially in the short term), and tips can be unrestricted. As shown below, the average gas price fluctuates greatly, and if observed on a block-by-block basis, it fluctuates significantly.

Ethereum average gas price (Gwei)

These factors present significant risks to price makers, who put themselves at variable costs with unlimited block space. Some of these issues can be addressed by time-based exponential smoothing of variable block space costs (reducing the impact of one-time cost spikes on reference rates) or using alternative investment products that limit losses/gains. However, these methods require trade-offs as they may not meet the needs of sellers/buyers and usually reduce the hedge effectiveness of long/short derivatives. Given this, we expect validators, block builders, and searchers to play a role in initially seeding the market short, as they have natural supply or existing abilities to access, optimize, and use physical block space supply,

2) Consolidation of buyers: With the development of L2 and the shift of most users to access block space through aggregation/rather than L1, we expect buyers of L1 block space to consolidate through L2 operators/transactions completed on L1. Outside of L2, we expect further consolidation of block space buyers to shift towards infrastructure and participants that abstract users from purchasing block space, such as block builders/AA/MPC+ middleware. Designing products for these stakeholders rather than individual consumers with widely different goals and needs should help narrow the scope of product design.

Given the behavior of consumers in each microstructure, derivatives may need to consider these dynamics or be designed specifically for these participants. Although difficult to estimate, we looked at quantitative and qualitative sources to understand where historical user preferences are located to help understand where short- and long-term opportunities may exist.

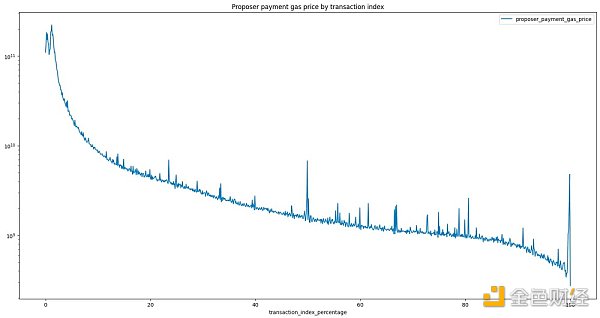

Proposer payment gas prices (in wei) divided by transaction position in the block (effective gas price – base gas price)

In the above figure, we can see that some users are willing to pay exponentially higher prices for block-top and block-back block space (i.e. contention), but most users simply pay to get through transactions faster (i.e. congestion). A leading researcher at the Ethereum Foundation recently speculated that many users prioritize congestion rather than contention. While there may be a short-term competitive market related to MEVs, it is expected that the largest block space derivatives market will be focused on congestion solutions in the long term.

Other considerations: In addition to the above, there may be other considerations that could affect the derivatives market. These include forks and probabilistic finality, inclusion rates, and potential scrutiny by block builders and/or validators.

Further developments: While it may take several years, there will be further dynamic impacts on block space and any derivatives products. In addition to EIP-4844, we believe the most relevant and important changes are MEV-Burn, any changes in validator limits/staking economics, single slot finality, and ePBS.

3. Cash Settlement and Physical Delivery

Gas derivatives can be settled by “cash” or “physical delivery”. More detailed information is provided below, but cash-settled products typically cannot perfectly replicate the deliverable spot market as they are typically offered on the basis of a reference rate for the commodity. Therefore, the existence of a derivatives mechanism with physical delivery settlement capability is crucial to ensuring that a broader derivatives market in the block space accurately reflects the deliverable spot market.

Physical Delivery: Physical delivery of Ethereum block space (or any commodity market, for that matter) is more complex than in the cash market. When derivatives expire, both parties to such derivatives must actually settle the commodity. In the case of transactions between validators and applications, this would require validators to provide block space to buyers. We discuss some potential methods for physically delivering block space below:

1) Block builders offer it as a service: As mentioned earlier, due to economies of scale and technical requirements around full wet shards, block building may continue to be dominated by a small number of participants who are in a favorable position to actively participate in these areas. market. Block builders are clearly the natural buyers / sellers of block space (after all, they are engaged in managing / optimizing block space business) and can also run services for block space physical delivery for applications / consumers of block space;

2) Validator coordination / middleware: In addition to block builders, validators are also major stakeholders in the physical delivery market of block space. This will be a desire to help manage the currently unstable revenue of the entire validation business, and allow the development of a new market where validators can sell future block space for a premium. To do this, validators need to come together and use middleware as a coordination mechanism;

3) Sale of future block space within the protocol: While this requires significant protocol changes, others have also considered using in-protocol mechanisms to sell future block space, some precedents from other networks have discussed designs, as well as Vitalik’s research post on an inclusion list, Barnabe Monnot / Ma around the initial PBS research, Alex Stokes on soft pre-confirmation. We also see some teams trying to utilize smart contracts and over-the-counter trading-style transactions to obtain PoC in the Ethereum test network. Finally, other POS chains have considered integrating and adopting in-protocol block space futures to more effectively allocate block space based on consumer demand.

Four, Wen Block Space Derivatives

We recognize that people have made various attempts at computing power derivatives around the Bitcoin network. Some of these markets have seen some growth, but are still limited at the moment.

Nevertheless, we also recognize that it is still too early now. After all, the futures trading volume of the more mature ETH market is still far behind the derivative trading volume of traditional commodity markets. In addition, in order for this market to flourish, participants such as block builders, validators, etc. as competition intensifies between these parties, applications will need to become more complex so that teams can use these products to gain competitive advantages over each other, or provide a unique product block space that is largely dependent on managing the future.

Even considering the timing, we believe that block space futures may have a unique impact on Ethereum, helping stakeholders better manage the friction surrounding gas and strengthening block space. We hope this article will inspire a wave of discussion, developer patches, some hackathon projects, and innovation for the next decade.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring ZK/Optimistic Hybrid Rollup

- The Hidden Concerns of MakerDao, Not Just Exposures to RWA

- Ethereum 2023 Q2 Data Research: Gross Profit of $700 million, ETH Burn Rate Accelerates from 0.3% to 0.8%

- Fei team faces collective lawsuit, never expected to see a court account on Discord one day.

- Crash and Reshape: Drawing Lessons from the History of the Gaming Industry and Looking Forward to the Future of NFTs

- Court takes over Discord community? A brief recap of the Fei team’s collective lawsuit event.

- Cregis Research: The Value of Ethereum Account Construction Archaeology and Account Abstraction