A Review of Eight Hot Events in the Cryptocurrency Market in Q3

Q3 Cryptocurrency Market Review Eight Hot EventsThe market in the third quarter was relatively sluggish, experiencing a brief pullback after a period of low volatility. This was expected as the third quarter has historically underperformed. Only through a thorough cleansing can the chips be concentrated in the hands of diamond hands with faith. Even in a sluggish financial market, we have still seen exciting industry progress and new applications. Let’s review the eight hotspots of Q3 together.

Ripple – A Milestone Victory for the Cryptocurrency Market

On July 13th, the U.S. Southern District of New York Federal Court ruled on the SEC’s charges against Ripple, stating that XRP, as a digital token, does not meet the “contract, transaction, or plan” requirements of the Howey test and is not a security. The use of XRP for investment, funding, transfers to executives, and order book sales on exchanges is not considered securities. However, institutional sales, OTC, ICO, and IEO are considered securities.

If XRP, as a relatively centralized cryptocurrency, is not a security, then more decentralized cryptocurrencies are even less likely to be securities. In response to this news, XRP surged by 90%, and BTC and ETH followed suit. SOL, MATIC, and other tokens previously identified as securities by the SEC also experienced significant gains. Coinbase subsequently relisted XRP. This is a major victory for the cryptocurrency industry in the face of the SEC’s increased regulation in recent years. It temporarily clears the haze over the cryptocurrency industry and indirectly supports the legitimacy of token trading provided by cryptocurrency exchanges. (Previously, the SEC sued Binance and Coinbase for providing unregistered securities transactions.)

- Variant联创 Li Jin The main obstacle to the mainstream adoption of cryptocurrencies is the issue of product-market fit.

- BRC-20 speculation is prevalent, will the new FT protocol Rune released by Ordinals founder bring a new trend?

- LianGuai Daily | HTX hot wallet was stolen about 8 million US dollars; US SEC opposes Celsius distributing tokens to customers through Coinbase

The SEC subsequently applied for an appeal against the ruling. The showdown between the SEC and Ripple is ongoing. The lack of clear regulatory policies remains a cloud over the cryptocurrency market. Clear legislation is needed to better protect investors. Industry practitioners should also actively engage in dialogue with regulators to help them better understand the market and achieve mutual benefits.

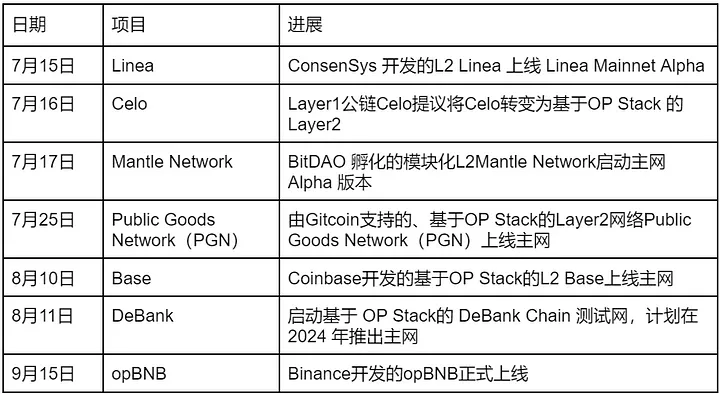

Layer 2 – Not Enough ETH Tokens!

The enthusiasm for Layer 2 networks on Ethereum shows no signs of waning and is developing rapidly. Many L2 solutions have been launched, and even some competitors like Celo have joined the Ethereum L2 camp. However, with so many L2 options, airdrop hunters are expressing that they don’t have enough ETH tokens.

According to data from L2Beat, there are 31 L2 solutions listed, with 18 of them having a TVL (total value locked) exceeding $10 million. Currently, Arbitrum leads the pack with a TVL of $5 billion, accounting for 54.31% of the market share, far surpassing Optimism’s TVL of $2.42 billion (25.31% market share). ZkSync Era, based on ZK Rollup, ranks third with a TVL of $428 million, but only captures 4.47% of the market share. It’s evident that OP Rollup has a clear first-mover advantage. However, this doesn’t necessarily mean that OP Rollup will have better development prospects or that it will develop separately from ZK Rollup. Some projects, such as Polymer, are exploring combining the strengths of ZK and OP to provide new solutions. L2 solutions currently adopting OP Rollup might also transition to ZK Rollup in the future.

Polygon co-founder Sandeep Nailwa stated at TOKEN 2049 that today’s Ethereum is more like a chain-to-chain model, transitioning from a user-to-chain model. In the next 2-4 years, Ethereum will become the foundational settlement layer, providing security, settlement assurance, and security features to these chains.

Worldcoin — The Savior of the Artificial Intelligence Era?

On July 24th, Worldcoin released an open letter signed by co-founder Sam Altman of OpenAI, announcing the official launch of the WLD token, which was listed on major exchanges immediately.

Worldcoin aims to create a new identity system and financial network that is collectively owned by everyone. It aims to provide new economic opportunities and solutions that differentiate artificial intelligence from human identity in the era of artificial intelligence. While protecting privacy, it explores a possible path to achieve a global basic income funded by artificial intelligence by distributing tokens to verified unique human identities’ wallet addresses.

In the era of artificial intelligence, it is foreseeable that a large number of labor forces will become unemployed due to the increase in productivity, and artificial intelligence companies will gain significant profits. Worldcoin hopes to redistribute the profits of artificial intelligence, allowing each verified unique human individual to receive a basic income.

To realize Worldcoin’s vision, the first step is to achieve unique identity verification for every individual to prevent fraud and duplicate applications. After considering government IDs and trust models on the internet, Worldcoin finally chose biometric technology based on iris scanning. Worldcoin uses a specialized device called Orb, which scans the iris to detect whether the subject is a real person and ensures that a real person can register an identity on Worldcoin. Orb uses a specially designed camera and algorithms to extract iris feature information, completes all processing on the local device, does not save user images, and only outputs signed iris codes. It avoids leaking user privacy by decoupling zero-knowledge proofs from user wallets. As of September 15th, 2.298 million people have been authenticated on Worldcoin.

This is a very challenging and forward-looking project that has attracted widespread attention from the community. However, there are also criticisms. Vitalik has raised concerns about the project’s privacy, centralization, security, and accessibility. In addition, residents of some economically underdeveloped countries have sold their irises at low prices, which goes against the intended results. In August, Kenya, one of the first countries where Worldcoin was launched, temporarily suspended registration in the country due to security, privacy, and financial issues.

Telegram Bots — Innovations and Speculation in Cryptocurrency Trading

Unibot is a trading bot on Telegram, and its token market value has soared from around $30 million on July 7th to $2 billion on August 10th, attracting widespread attention from players in the cryptocurrency market to Telegram bots and related tokens.

Unibot allows users to interact with the bot, monitor liquidity pools, receive alerts for newly minted tokens, trade tokens, and perform copy trading. Unibot’s trading execution speed is six times faster than Uniswap. Token holders can receive 40% of the trading fees and a dividend of 1% of the total $UNIBOT trading volume. Unibot’s high-speed execution, innovative features, and robust revenue distribution model make it stand out among many competitors. Especially in the current phase of no new technological innovations and a sluggish mainstream market, some cryptocurrency users are seeking high profits by trading meme coins or “dog coins,” and Unibot happens to provide services similar to centralized exchanges for these users.

These robots meet the needs of degen players, and as Unibot becomes successful, various types of trading robots have emerged on the market, such as LootBot, Bridge Bot, and MEVFree robots, to provide different crypto services. The security risks should not be ignored. Importing private keys into robots can lead to asset theft.

According to CoinGecko data, Unibot’s token $UNIBOT skyrocketed 27 times at its peak, but only 27 days later, it plummeted 70.47% from its all-time high. Once again, it confirms that the crypto market is filled with financial speculation while undergoing technological innovation.

Friend.tech – Refactoring Web3 Social

Friend.tech is a new social app launched on Base on August 10th, where users can purchase tokenized stocks of KOLs on Twitter to gain exclusive access to private group chats with these social celebrities.

In just the first week of launch, the trading volume on Friend.tech exceeded 7,000 ETH, demonstrating its strong market appeal. As of September 12th, over 210,000 users have completed 3.734 million transactions on the platform. This rapid growth is not only due to its close collaboration with crypto Twitter KOLs but also due to its unique Progressive Web Application (PWA). Users can experience it directly in their browsers without the need to download, making it easy for newcomers who don’t understand cryptocurrencies to use.

The innovation of Friend.tech lies in using tokens as ownership when interacting with crypto enthusiasts. Owning tokens is equivalent to holding shares of specific companies. An increase in token holders on Friend.tech leads to a rise in token value. Trading tokens incurs an additional 10% transaction fee, with 5% going to the protocol and 5% to the creators. Within just one week, creators’ total revenue reached $13.25 million. On August 19th, Friend.tech announced an exclusive $100 million funding from LianGuairadigm and introduced a scoring system to incentivize user participation.

Although user growth has slowed down, Friend.tech is still in the beta testing phase, and the introduction of new features is expected to further stimulate user growth. In addition, subscription-based content platforms have proven their business value by involving fans in creator economies. However, the sustainability of fan token growth requires specific case-by-case analysis.

On August 21st, it was revealed that Friend.tech’s provided API allowed direct querying of user wallets and Twitter information, resulting in the leakage of data from over 100,000 users. Privacy issues still need improvement. In addition, tokenized stocks may attract SEC investigations.

PYUSD – Web2 Financial Payment Company Joins Stablecoin Battle

Stablecoins are important tools for cryptocurrency investors to preserve value and are an important part of the DeFi ecosystem. In addition to Tether and Circle, which are based on fiat currencies and have a first-mover advantage, DeFi native protocols such as MakerDAO, Aave, and Curve compete for market share by minting decentralized stablecoins through over-collateralized cryptocurrencies. After giving up BUSD, Binance has started supporting stablecoin FDUSD issued by a Hong Kong trust company.

Companies and protocols that issue stablecoins can enjoy interest income from underlying assets or minting. The current risk-free short-term US Treasury yield is as high as 5%, which has also attracted LianGuaiyLianGuail to announce its entry into stablecoin issuance on August 7, becoming the first major financial company in the United States to issue its own stablecoin.

LianGuaiyLianGuail uses LianGuaixos as its issuer, and the underlying assets are fully supported by US dollar deposits, short-term US Treasury bonds, and similar cash equivalents. Therefore, PYUSD can be considered a centralized USD stablecoin similar to USDT and USDC. However, unlike USDT, LianGuaiyLianGuail is open to US users.

As a veteran electronic payment company from Web2, LianGuaiyLianGuail has a distribution channel that Web3 companies cannot match. Even if the on-chain use cases are limited at the beginning, considering its good reputation in the payment field, if LianGuaiyLianGuail takes measures to stimulate existing massive users to use PYUSD or reduce merchant fees to encourage merchants to support PYUSD payments, PYUSD may quickly gain more users than the pioneers of stablecoins in the short term. On September 12, LianGuaiyLianGuail launched cryptocurrency-to-USD exchange services for US users, providing a choice for secure withdrawals for cryptocurrency players. Therefore, we can see that LianGuaiyLianGuail may promote further expansion of cryptocurrency and make stablecoins a daily payment method for people.

Considering the high pressure on DeFi policies and regulatory uncertainties surrounding stablecoins in the United States in recent years, the development of PYUSD still needs to be observed.

FTX Liquidation – Can the market withstand the selling pressure?

On September 14, according to CoinDesk, a judge ruled that FTX can sell, pledge, and hedge the cryptocurrencies it holds to repay creditors. Currently, FTX has about $3.4 billion in well-liquid A-class cryptocurrency assets, including about $1.2 billion in SOL, $560 million in BTC, and $192 million in ETH. In addition, it is difficult to realize B-class assets such as SRM and MAPS due to low liquidity.

In addition to cryptocurrencies, FTX also has about $4.5 billion in venture capital. Equity investments include $500 million in AI star company Anthropic and $1.1 billion in the important Bitcoin mining company Genesis. In addition to equity investments, FTX also cooperates with multiple funds for asset management and provides loans to financial technology companies. Considering the good fundamentals of some of FTX’s investment projects, there is a possibility of obtaining high valuation returns in the future.

According to Messari’s statistics on September 11, FTX and Alameda hold about 1% of the BTC and ETH traded weekly, and their impact on the overall market is expected to be small. FTX holds about 81% and 74% of the weekly trading volume for SOL and APT respectively, but these assets are currently in the unlocking period, which means there may be long-term selling pressure in the future. In addition, the liquidation also has a certain impact on TRX, DOGE, and MATIC, with FTX holdings accounting for 6% to 12% of the weekly trading volume. There are reports that FTX’s weekly liquidation limit is $100 million, and it is unlikely to complete the liquidation of a single currency within a week. The actual impact of the liquidation on the market has already been priced in to some extent.

From the liquidation of assets on FTX, it once again warns investors to pay attention to the liquidity of investment products. Although altcoins may have a higher increase during the rise period compared to mainstream assets such as Bitcoin, their liquidity should be closely monitored, otherwise it is just paper wealth. Decentralization is the value of Web3, and only with sufficient decentralization can it be more secure.

Snaps — MetaMask’s Self-Disruption

MetaMask wallet, which is almost essential for crypto players, undoubtedly plays a crucial role in the Ethereum ecosystem, providing users with the ability to access EVM chains through RPC. Some non-EVM chains such as Cosmos, Solana, Sui, Starknet, etc. are loved by users and developers due to their unique technical advantages and ecological applications. However, when using these chains, users often need to use the corresponding specialized wallets, which greatly affects the user experience.

In order to solve this pain point, MetaMask has introduced the Snaps API access specification to integrate wallets for non-EVM chains, allowing MetaMask users to experience non-EVM chains in their original wallet and open up a new multi-chain world.

In addition to cross-chain interoperability, Snaps can also provide clear transaction insights, allowing users to understand potential security risks before interacting. This can greatly reduce the possibility of phishing attacks when self-custodying. Snaps can also obtain specific information that needs to be known in the wallet, adding communication functionality to the wallet.

Snaps is MetaMask’s self-disruption, transforming from the dominant EVM wallet to the traffic entry point for all-chain wallets and decentralized applications by integrating various wallets. Developers can use their imagination to expand functionality on MetaMask and create a brand-new Web3 experience for users.

Although MetaMask has undergone self-auditing and third-party auditing, there are still inherent potential code risks in Web3. However, Snaps is currently running only in a sandbox testing environment and cannot access MetaMask account information, isolating the original MetaMask assets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyst Bitcoin ETF may be approved in early 2024.

- Bitcoin price faces risks? The golden cross of the US dollar strength index has been confirmed.

- Web3 enters ‘late autumn’ ahead of schedule, how should industry builders respond?

- Calaxy Co-founder 3 Facts You Need to Know Before the Next Bull Market

- An overview of the top 12 Bitcoin ETFs worldwide ProShares takes the lead, holding over 35,000 Bitcoins.

- Wu said Zhou’s selection The Federal Reserve did not raise interest rates, Mt Gox repayment date postponed, Tether crazy purchases of GPUs, and the top 10 news (0916-0922).

- Bitwise has withdrawn its application for a Bitcoin and Ethereum market-cap-weighted ETF.