Q4 Outlook Cancun Upgrade, RWA and Game Investment Logic Analysis

Q4 Outlook Cancun Upgrade, RWA, and Game Investment Logic AnalysisThis article will analyze some potential investment-worthy crypto assets from three aspects: Cancun Upgrade, RWA, and gaming.

Let’s talk about the tokens that have been receiving attention and layout recently.

Cancun Upgrade

Cancun Upgrade is the most important narrative recently. Large narratives often bring a lot of emotional aspects and traffic aggregation (not because of changes in technical aspects that bring about price changes). However, Cancun has not announced a specific time yet, so it has not brought about synergy. From the current progress, devnet9 is likely to be the last testnet, and the public testnet will follow. But there is also a possibility that devnet9 is a short-term testnet, and devnet10 may be the final testnet.

- Senegal Birth of Hope for the Next Bitcoin Beach

- Insights from Segregated Witness Bitcoin’s Stagnation and Layered Scalability

- MARA CEO Bitcoin halving narrative is a fantasy, but Bitcoin is the best Layer 1.

In the public testnet stage, the possibility of announcing the specific date (block time) of Cancun Upgrade will increase. However, it may take until mid-October or November to announce this time point.

The target of Cancun Upgrade is nothing more than Layer2, Arbitrum, Optimism, and Metis (Metis plans to become Ethereum’s first decentralized L2 this year, allowing its community to take over critical centralized components of the network), as well as some other Layer2. In addition, Mantle is also pushing for the growth of its own network, but currently $MNT is performing average. Cancun Upgrade is also good news for Coinbase’s stock price.

In addition, the sentiment will spread to protocols on Layer2. The preferred choice on Arbitrum is $GMX. On Optimism, $VELO may have a difficult task, mainly due to $VELO’s high inflation and the weakness of the Optimism ecosystem. $SNX may be a better choice. But if I have to choose one target in these ecosystems, I will choose $GMX.

Why?

There are two main reasons:

First, I am optimistic about the future development of the Arbitrum ecosystem and the further development of GMX as a leading protocol (there are also GMX tasks in the Odyssey event);

Second, I am optimistic about future volatility (slowed liquidity contraction).

Let me explain the first point in detail.

Arbitrum recently passed a proposal to provide 50M $ARB as a support fund for the ecosystem protocols, and GMX will definitely get a corresponding share. It mainly depends on whether GMX will promote the development of v2 through $ARB incentives. With the deployment of additional incentives for GMX + the expectation/reduction of airdrops from other protocols, there is also an opportunity to regain its glory.

Also, I personally think there is no need to worry about 50M $ARB. Instead, this action will make the car lighter, which is a good thing for $ARB. (It depends on how many layers you think)

The advantages and disadvantages of GMX v2 are obvious. The disadvantage is that it is not very friendly to large funds, liquidity is scattered, and support for long-tail assets is not thorough enough. However, correspondingly, the advantages of v2 are cost-friendly, better composability, and higher capital utilization rate, etc. Overall, although the market expectations for GMX v2 are not high, the corresponding changes are solving some previous problems, which is always a good thing.

In summary, choosing $GMX is a choice that seeks to capture expected reversals.

A few words about Arbitrum. I am quite optimistic about what Arbitrum has been doing recently, such as its collaboration with Espresso Systems to explore solutions for shared sorters; the launch of XAI (Layer3), promoting the development of the gaming track (the gaming track may have a small explosion in the near future, which will be mentioned later), including Offchain’s co-founder also mentioned that gaming is one of Arbitrum’s growth areas; Arbitrum has launched Stylus, which supports developers to build applications on the Arbitrum Nitro chain using traditional EVM tools and WASM-compatible languages (such as Rust, C, and C++). Also, Arbitrum has reopened the Odyssey event, which actually doesn’t have much to say, no airdrops or rewards, only badges, which may need to be paired with 50M $ARB rewards.

But in the end, these things are all changes in technology, whether they can cause price changes still depends on market feedback.

RWA

FXS

$FXS is a coin with high expectations and also a difficult coin to handle. Although it gained widespread attention in the market through its own Lend module mechanism, it has now returned to the price it was when Curve had an incident.

My personal judgment is that $FXS will not maintain a sustained rise, and this round of price changes can only rely on the short-term expectations provided by new products. Its subsequent expectations include but are not limited to: frxETH v2 (node operator lending model), Frax v3, FPI (Coinbase CEO believes that “flatcoins”, stablecoins that can track inflation rates, will be the next generation of stablecoins), sFRAX (and FXB, RWA), Fraxchain, frxBTC (questionable, implementation will be more difficult, but it appears on the team’s roadmap), and so on.

From the perspective of fundamental changes in the project, perhaps only sFRAX (if FraxDAO’s management model is more organized than MakerDAO) can reverse the decline of $FXS and promote the growth of its stablecoin and positive income. I will closely monitor this matter.

Overall, there are too many Frax products and the buried lines are too complicated, making it difficult to achieve sustainable gains – especially in the current situation of FRAX supply contraction, FraxBP TVL decline, and weak frxETH growth.

In the RWA track, I am also paying attention to $MKR and $CFG. I think $MKR has the opportunity to test $1600 (even higher than Ethereum’s price before the split). If we think from the perspective of DeFi blue chips, I would also consider $AAVE. Currently, $AAVE has been committed to solving the problem of $GHO detaching (detaching has no direct impact on the price of $AAVE).

Games

Web3 games will be the main area of my focus in Q4. Let’s talk about a few coins related to games.

Gas Hero

The main reason for paying attention to Gas Hero is related to its creator Stepn, who has put in some effort to market and generate early excitement, so I personally think it is worth paying attention to this game.

From the whitepaper, Gas Hero does not have any obvious advantages compared to other Web3 games, and the gameplay does not have much novelty. It is a combination of idle games and Ponzi schemes. Since Gas Hero has not yet announced the part about gold-making income, I cannot assert whether the game can maintain its popularity through the Ponzi model. At the same time, the game of $GMT in the secondary market is also very complicated. If you want to formulate trading strategies solely from the perspective of Gas Hero consuming $GMT, it is obviously untenable.

Prime

LianGuairallel is a chain game that I really like. Although there are some flaws in the balance of game design, the overall production of the game (you can tell by how much money and how many production personnel have been invested) is still good. It is a card battle game, similar to Hearthstone, with card collection similar to Magic: The Gathering.

The most important thing is that LianGuairallel has deeply integrated $PRIME into the game economy. For example, in the game, each NFT card can accumulate reputation for this card through the game, and the accumulation of reputation allows players to consume a certain amount of PRIME to mint Echo (phantom cards). The amount of PRIME consumed to mint phantom cards will be dynamically adjusted according to the demand for minting Echo (for example, the higher the market popularity of NFT cards, the higher the PRIME consumed). At the same time, players do not need to buy expensive cards, they can directly purchase replicated Echo through PRIME/ETH. As the number of onboard players in the game continues to grow, the demand for $PRIME will be magnified, forming a flywheel effect.

However, the investment cycle of $PRIME is expected to be long, so “buying points” is very important.

MC

The main trend of Merit Circle is to rename $MC to $BEAM and then split it 1:100. Beam is built on the Avalanche subnetwork. Merit Circle claims that Beam has “a powerful network consisting of more than 60 cooperative games, dozens of contributors, developers, tools, and investors”.

GHST

Aavegotchi chain is coming soon. Although the official said that the testnet will be launched in September, there is no news yet as September is coming to an end. However, from the interaction between the official and Polygon, they are working hard to promote this matter (including launching the Game Center). The main problem is that the project’s progress is too slow.

Others

LINK

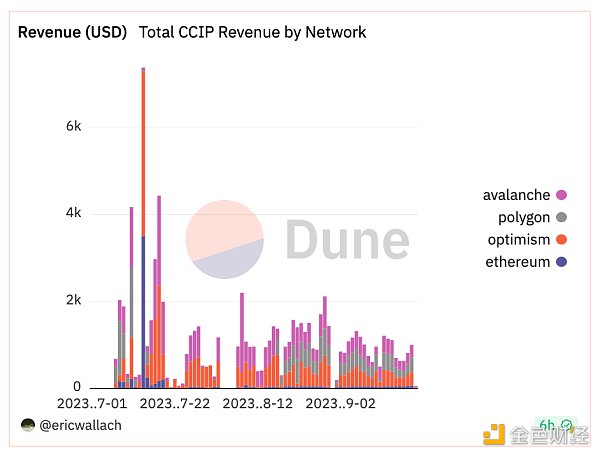

Regarding $LINK, I mainly refer to the current price trend of LINK and @jyosamson’s opinion. Jyosamson believes that Chainlink will hold the Smartcon conference every year on October 2nd, and there may be major announcements. Secondly, the price of $LINK is also closely related to the income of CCIP, and currently CCIP’s income does not have any obvious highlights (also related to the downturn in the chain).

SOL

The reason for paying attention to $SOL is that Solana has been very active in hackathons recently, and there are many KOLs/media in Europe and America who are calling for it. From the perspective of hackathon funding, the Solana Foundation is relatively rich. However, this is not directly related to the price of $SOL. The selling pressure from FTX has a relatively large impact on the price of $SOL. It has been confirmed that the $SOL held by FTX is not fully circulating, mostly investment shares, so its influence on the market is not that great.

Finally, it should be noted that in this article, there is a distinction between the logic of corresponding tokens, so it is best to read it carefully.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- MARA CEO Halving narrative is a fantasy Bitcoin is the best Layer 1

- Interpreting the Current Situation of Cryptocurrency Markets Outside the United States

- Block space is a scarce commodity, how to objectively evaluate it?

- How do the interest rates and future prospects of the Federal Reserve affect the cryptocurrency market?

- Data What is the crypto market like outside of the United States?

- Dialogue with Circle CEO How can USDC recover the market lost due to SVB’s bankruptcy?

- Common situations and criminal defense strategies for embezzlement of executive positions in the cryptocurrency industry