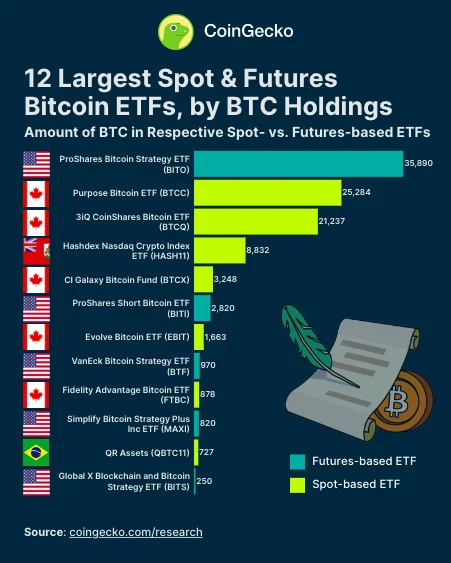

An overview of the top 12 Bitcoin ETFs worldwide ProShares takes the lead, holding over 35,000 Bitcoins.

Top 12 Bitcoin ETFs worldwide, led by ProShares holding over 35,000 Bitcoins.Author: CoinGeckoMiguel Benitez

Translation: Odaily Planet Daily Nian Yin Si Tang

Editor’s Note: CoinGecko has recently released the report “12 Largest Spot & Futures Bitcoin ETFs”, providing a comprehensive overview of the current status of Bitcoin ETFs worldwide. The following is a translation by Odaily Planet Daily:

Bitcoin ETF has always been one of the most anticipated developments in the cryptocurrency field.

- Wu said Zhou’s selection The Federal Reserve did not raise interest rates, Mt Gox repayment date postponed, Tether crazy purchases of GPUs, and the top 10 news (0916-0922).

- Bitwise has withdrawn its application for a Bitcoin and Ethereum market-cap-weighted ETF.

- First Market Observation A Brief Discussion on Derivatives, Ton, Games, and ZK New Trends After Token2049

Although Bitcoin ETFs have already been traded in countries such as Canada, Brazil, and Europe, the US market for spot Bitcoin ETFs still faces regulatory barriers. However, there are several popular futures-based ETFs and multiple spot ETF applications awaiting approval from the SEC in the US.

The ProShares Bitcoin Strategy ETF is the first Bitcoin ETF traded on major US exchanges, launched in the fourth quarter of 2021 – at the peak of the bull market. Currently, this ETF holds 35,890 bitcoins, making it the oldest and largest fund in the field. Two of the top 12 Bitcoin ETFs (holding 16.6% of the assets of Bitcoin ETFs) are managed by ProShares and can be traded in the US.

With the emergence of more and more ETFs and ETPs globally, the amount of bitcoins held by investment tools is increasing every year. In total, the top 12 Bitcoin ETFs hold 102,619 bitcoins, slightly less than 0.5% of the total supply of bitcoins (21 million). Due to the regular rebalancing of ETFs, the amount of bitcoins held by them follows the price changes. The frequency of ETF rebalancing can range from daily to yearly. For example, the Purpose Bitcoin ETF (BTCC) rebalances once a month, while the S&P 500 Index rebalances once a quarter.

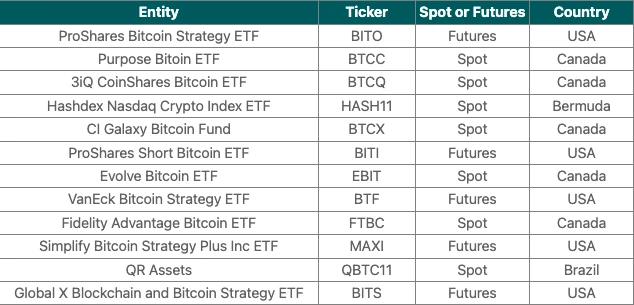

Who are the Top 12 Bitcoin Spot and Futures ETFs?

The top 12 tradable Bitcoin spot and futures ETFs are as follows:

Bitcoin ETFs Outside the US

In fact, several countries have approved Bitcoin ETFs for direct investment in Bitcoin ahead of the US. The top spot Bitcoin ETFs include:

-

Purpose Bitcoin ETF (BTCC)

The Purpose Bitcoin ETF was launched in February 2021 and is the first spot Bitcoin ETF in North America. As of September 2023, it currently holds over 25,000 bitcoins. This ETF is traded on the Toronto Stock Exchange and has been very popular, with assets under management exceeding $1.1 billion.

-

3iQ CoinShares Bitcoin ETF (BTCQ)

This is another Canadian Bitcoin ETF, also traded on the Toronto Stock Exchange, holding over 21,000 bitcoins as of September 2023.

-

QBTC11 by QR Asset Management (QBTC11)

The first Bitcoin ETF in Latin America was launched on the Brazilian Stock Exchange in June 2021. As of September 2023, the QBTC11 ETF currently holds 727 bitcoins.

The success of these Bitcoin ETFs demonstrates strong investor demand. At the same time, compared to Bitcoin’s market value of about $1 trillion, the scale of ETFs undoubtedly still has a lot of room for growth. This may also indicate that once the spot Bitcoin ETF is launched in the United States, there will be a significant increase in Bitcoin’s price.

What is the current status of spot Bitcoin ETFs in the United States?

Although Bitcoin futures ETFs already exist in the United States, the prospects for spot Bitcoin ETFs are still uncertain. One of the main reasons for the lack of spot ETFs in the United States is regulatory concerns. The SEC has repeatedly rejected applications for spot Bitcoin ETFs, citing concerns about the liquidity, custody, and potential price manipulation in the Bitcoin market.

However, several applications from global asset management companies have recently been published in the Federal Register, taking a step closer to final approval. Some of these applications have been formally accepted for review and have entered a three-week comment period.

Which companies have applied for spot Bitcoin ETFs in the United States?

The following companies have applied for spot Bitcoin ETFs in the United States:

BlackRock, July 2023

WisdomTree, July 2023

Invesco/Galaxy, July 2023

Valkyrie, June 2023

In addition, other large companies that already have existing futures ETFs have also joined the ranks of reapplying for the first spot ETF in the United States, including VanEck and Fidelity. Companies that have not yet resubmitted their applications after being rejected include Global X, Kryptoin, and First Trust.

Another asset management company, Grayscale, is currently awaiting a ruling from the Federal Appeals Court to review its application to convert the Bitcoin Trust into an ETF. The Grayscale Bitcoin Trust (GBTC) is currently the largest Bitcoin ETP, holding 623,645 bitcoins. The ruling stated that the SEC did not provide enough information to explain why Grayscale’s application was not “substantially similar” to other approved futures ETFs – failing to convince the judge that the spot market is not as safe as the futures market for investors.

Some notable futures ETFs

Although many people expected that the launch of futures ETFs would increase the pressure to approve spot ETFs, there is little evidence to support this so far.

Several major Bitcoin futures ETFs have been launched since October 2021, but their accumulated assets are smaller than those of ETFs in Canada and Brazil. The performance of futures ETFs is also not as good as the Bitcoin price, which raises doubts about their effectiveness. The main futures ETFs include:

-

ProShares Bitcoin Strategy ETF (BITO)

This ETF holds 7,178 CME contracts, equivalent to over 38,000 bitcoins. As of September 2023, the AUM of this ETF is slightly less than $1 billion.

-

ProShares Short Bitcoin ETF (BITI)

This is ProShares’ second ETF product, holding 564 CME contracts, equivalent to 2,820 bitcoins.

-

VanEck Bitcoin Strategy ETF (XBTF)

This ETF holds 320 CME contracts, equivalent to 1,600 bitcoins.

How will the US Bitcoin ETF impact the market?

If the spot Bitcoin ETF is eventually approved, it could have a significant impact on the Bitcoin and cryptocurrency market for the following reasons:

-

Mainstream exposure: A spot ETF would provide exposure to Bitcoin for tens of millions of new investors through retirement and brokerage accounts in an unprecedented way.

-

Increase in legitimacy: SEC approval would increase the legitimacy of Bitcoin and reduce institutional investors’ and advisors’ skepticism about Bitcoin as an investable asset class.

-

Positive price effect: After the launch of ETFs in Canada and Brazil, Bitcoin experienced a significant price increase in 2021. The launch of a spot ETF in the US could similarly spark investor interest and lead to a similar bull market.

Although it is currently unclear when the SEC might approve a spot Bitcoin ETF, the launch of Bitcoin ETFs overseas and the recent publication of various applications in the Federal Register highlight the favorable regulatory momentum surrounding these products.

Note: This study assesses the availability of global spot and futures Bitcoin ETFs in 2023. Data was collected from BuyBitcoinWorldwide.com (spot ETFs) and Forbes (futures ETFs).

Only ETFs that exclusively trade Bitcoin or Bitcoin futures are included in the final list. Therefore, all ETPs, trusts, and ETFs that trade blockchain-related stocks or other cryptocurrencies are not included. This study is for illustrative and informational purposes only and is not financial advice. DYOR.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After Token2049 Discussing Derivatives, Ton Ecology, Games, and ZK in the Primary Market Trend

- The surge of the US dollar and the further decline of BTC, what does the high interest rate mean for cryptocurrency companies?

- Q4 Outlook Cancun Upgrade, RWA and Game Investment Logic Analysis

- Senegal Birth of Hope for the Next Bitcoin Beach

- Insights from Segregated Witness Bitcoin’s Stagnation and Layered Scalability

- MARA CEO Bitcoin halving narrative is a fantasy, but Bitcoin is the best Layer 1.

- MARA CEO Halving narrative is a fantasy Bitcoin is the best Layer 1