LSDFi Summer is coming, quickly understand 6 LSDFi projects worth paying attention to.

Quickly learn about 6 LSDFi projects worth paying attention to this summer.Author | Heimi, Baize Research Institute

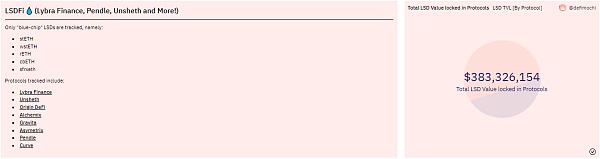

LSDFi’s total locked value (TVL) has surpassed $380 million, with tokens from projects such as Pendle and Lybra seeing significant increases in value, once again heating up the narrative around LSD and LSDFi.

After the Shapella upgrade on Ethereum, the LSD (liquidity staking derivatives) protocol and LST (liquidity staking tokens) concept have swept through the DeFi world. They not only serve as a channel for ETH stakers to withdraw their staked assets at any time, but also provide holders with new ways to earn profits and increase capital utilization, in addition to trading. Many old and new DeFi projects have begun to develop related businesses based on LSD.

- Research Report on Interchain Operation Protocol LayerZero

- Introducing the important upgrade of MIM: the first Omnistable built on the OFT standard based on LayerZero.

- Which BRC20 projects can I actively participate in?

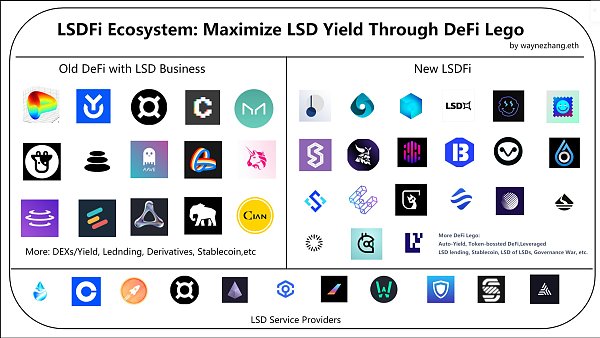

The “internal competition” for staked assets and liquidity has stimulated the emergence of more innovative strategies. Different projects are now competing to create more extensive and user-friendly features for their LSD, including not only DeFi components such as DEX, but also yield strategies, stablecoins, and yield speculation that utilize the unique properties of LSD.

These new DeFi projects built on the LSD protocol are LSDFi.

This article will sort out 6 LSDFi projects worth paying attention to.

1. Lybra Finance: a stablecoin supported by LSD

Lybra Finance’s selling point is that it allows holders to receive real-time automatic interest-bearing stablecoin $eUSD with 7.2% APY.

“We give you a stablecoin that will multiply in your wallet as long as you hold it.”

To mint $eUSD, you need to deposit ETH or stETH. The protocol will distribute the earnings generated by stETH to $eUSD holders. In other words, by depositing ETH or stETH into the protocol and minting $eUSD, you can earn about 8.3% APY.

Due to the recent popularity of Lybra Finance on Twitter, the price of $LBR has skyrocketed, attracting more and more people to earn rewards by minting $eUSD.

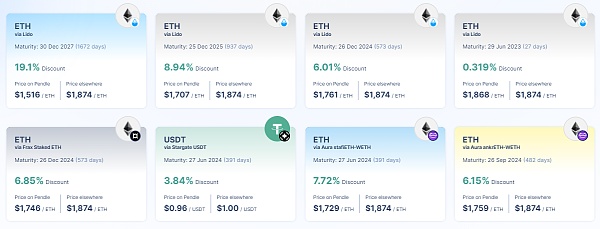

2. Pendle: an interest rate swap market

Recently, Pendle’s TVL has reached a historical high of nearly $100 million.

Pendle’s vision is to empower users to trade assets and their yields separately.

In Pendle, yield-bearing assets are split into two parts: PrinciBlockingl Tokens (PT) and Yield Tokens (YT). PT represents the principal of the yield-bearing asset, while YT represents the yield portion of the yield-bearing asset. Both YT and PT can be traded on the Pendle AMM.

For example, if you deposit 1 stETH, you will mint 1 PT-stETH and 1 YT-stETH, where 1 PT-stETH can be redeemed for 1 stETH, and 1 YT-stETH entitles you to all the yield generated by the deposited 1 ETH (stETH) in Lido.

If you are a risk-averse investor seeking stable returns, you can purchase PT without yield to earn fixed income; if you are a yield farmer and believe that a particular asset may appreciate, you can purchase YT.

In last month’s meme season, a large number of Ethereum transactions led to higher rewards for validators, i.e., higher staking yields. If you pre-purchase YT, you can reap huge rewards.

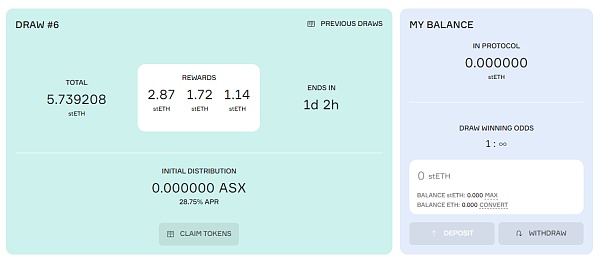

3. Asymetrix: LSD Yield Lottery

Asymetrix is a decentralized, non-custodial protocol designed specifically for asymmetric yield distribution generated by staking to make Ethereum staking more exciting and attractive to small participants. (Due to the relatively low yield, traditional ETH staking does not offer as much return for small participants holding a small amount of ETH.)

Suppose 100 users each deposit 1 stETH, resulting in a total of 100 stETH. These stETH generate 5 stETH in staking rewards over 24 hours, which will be randomly distributed to one of the participants.

Like a lottery, even if you deposit a small amount of stETH, you have a chance to win a large reward, or no reward at all.

Regardless of the outcome, depositors can receive corresponding governance tokens ASX as a reward.

4. Index Coop: LSD Index

Index Coop is a DAO-managed protocol designed to provide users with structured DeFi products and strategy tokens.

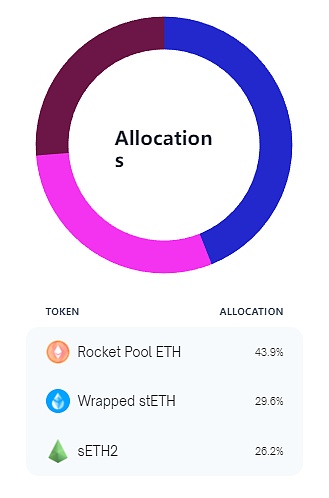

With the current development of the LSD protocol and LST, Index Coop offers two index tokens for ETH holders to simplify the process of earning yield: diversified ETH staking index ($dsETH) and compounding ETH index ($icETH).

dsETH:

With more and more LSD protocols appearing, some stakers find it difficult to choose based on yield. As these LSD protocols and LST are based on the Ethereum mainnet, storing ETH in multiple LSD protocols or buying multiple LST from the secondary market for diversified investment may be costly. Index Coop solves this pain point by bundling popular LST into a single ERC20 token dsETH.

icETH:

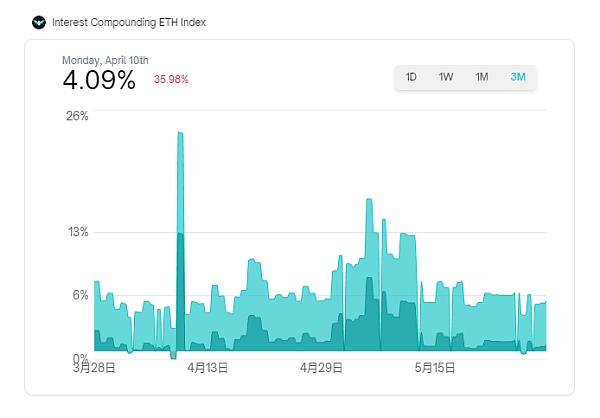

Some ETH stakers are keen on compounding ETH holdings. icETH provides users with higher ETH returns through a leveraged liquidity staking strategy based on Set Protocol. Users deposit stETH and receive the same amount of icETH. icETH uses stETH as collateral to deposit into Aave v2 and borrows ETH to get more stETH. Therefore, icETH holders not only hold stETH spot, but also have a yield that is twice as high as holding stETH simple (variable, as it is affected by collateral ratio and borrowing cost).

5. 0xAcid: Earnings Management Protocol for ETH Long-Term Holders

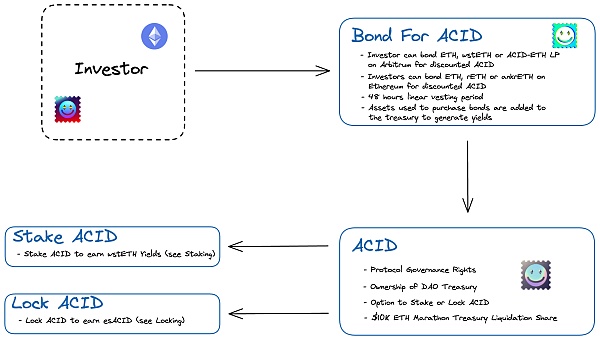

0xAcid is a rather alternative earnings management protocol that aims to optimize the return of LST such as stETH, rETH, and frxETH by providing a much higher yield than normal LST (4-5%), which is more suitable for users who are long on ETH. The native token of 0xAcid is ACID, with no upper limit on supply, and the initial supply is 7370 through token sale.

In addition to buying directly on Blockingraswap, users can also obtain ACID by purchasing “bonds” and depositing stETH, rETH, and ankrETH into the treasury. Users holding ACID indirectly hold LST and diversified income in the treasury, as the protocol distributes all LST in the treasury to ACID holders whenever the ETH price reaches $10,000.

If users stake ACID, they will receive sACID at a 1:1 ratio, which is a staking certificate (unlocked) that can be exchanged for ACID at any time. As a staking reward, stakers will not only receive governance token esACID, but also 5% to 10% of bond sales revenue.

6. Gravita Finance: LSD Interest-Free Borrowing

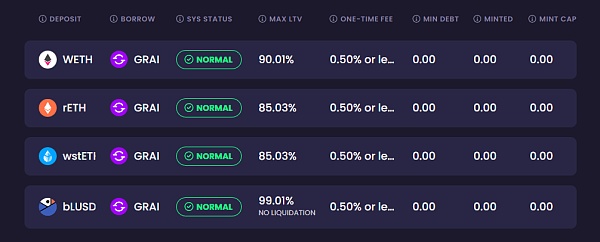

Gravita Finance is an interest-free borrowing agreement that uses LST as collateral, much like the Liquity Protocol version of LSDFi.

After pledging ETH for rETH, wstETH, and other LST in the LSD protocol, users can deposit them into Gravita to receive GRAI stablecoins as a reward. Users can also borrow GRAI stablecoins from Gravita for consumption or to buy collateralized LST at a discounted price in the stable pool.

Highlights:

a. If users repay the loan within six months (approximately 182 days), interest will be refunded proportionally, with a minimum interest rate equivalent to only one week’s interest.

b. In order to reduce the volatility of GRAI, a redemption mechanism similar to Liquity has been developed, allowing GRAI holders to redeem 1 GRAI with collateral worth $0.97, actually resulting in a 3% redemption fee.

Risk warning:

According to the “Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Please strictly abide by local laws and regulations and do not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- First OrdiBots project with a thousand-fold increase? Understand the GBRC721 protocol with this article.

- Explaining the GBRC721 protocol and its ecosystem projects that have been boosted by OrdiBots’ thousand-fold increase

- What are the backgrounds of these 27 projects that received investments from top crypto VCs in April?

- Listing 5 Catalyst Projects / Narrative: Level Finance, Metavault, Lybra Finance…

- Hong Kong’s new crypto policy is about to take effect. Here are 6 crypto projects worth investing in:

- How can blockchain projects legally raise funds?

- Quickly review 5 LSDFi projects worth paying attention to recently: Swell, unshETH, Pendle, Gravita Protocol, and Blockingrallax Finance.