What are the backgrounds of these 27 projects that received investments from top crypto VCs in April?

What are the backgrounds of 27 crypto projects that top VCs invested in last April?Author | Heimi, White Birch Research Institute

Despite the current market environment still being relatively bad, investment and financing events continue to occur every day, and top crypto VCs are still making big investments in NFTs, Web3 games, CeFi, DeFi, L1&L2, Web3 services, infrastructure, and other areas.

What kinds of projects in which areas have VCs been bullish on recently? This article will take stock of 27 projects that received investment from top crypto VCs in April, helping readers to quickly understand.

1. DeFi

Nibiru Chain

- Listing 5 Catalyst Projects / Narrative: Level Finance, Metavault, Lybra Finance…

- Hong Kong’s new crypto policy is about to take effect. Here are 6 crypto projects worth investing in:

- How can blockchain projects legally raise funds?

-

April 4, 2023

-

Seed Round of $8.5 million (valuation of $100 million)

-

Investors: Tribe Capital, Jump Crypto, Republic Capital, NGC Ventures, Original Capital

Nibiru Chain is a Cosmos SDK-based blockchain dedicated to DeFi, with features ranging from spot AMM, leveraged futures trading to its self-built NUSD stablecoin.

However, Injective Protocol has long been running DeFi functionality in the Cosmos ecosystem, and the arrival of the dYdX application chain is also imminent. Given these market conditions, it remains to be seen how Nibiru Chain, which is currently in the testnet phase, will develop in the future.

M^ZERO

-

April 5, 2023

-

$22.5 million

-

Investors: Blockingntera Capital, Road Capital, Standard Crypto, AirTree, SALT, BlockingraFi Capital, Distributed Capital, Kraynos, Earlybird, Mouro Capital

M^ZERO is a decentralized currency protocol that will allow users to issue decentralized currencies through governance to establish a connection between developers and consumers.

Swaap Finance

-

April 19, 2023

-

Seed Round of $4.5 million

-

Investors: Signature Ventures, New Form Capital, C² Ventures, Klima Ventures, Blockingreto Holdings, Entrepreneur First, etc.

Swaap Finance is a DEX based on Polygon. Swaap proposes a novel concept called Matrix Market Maker (MMM), which minimizes liquidity providers’ impermanent loss risk by using oracles and dynamic spreads.

However, given the previous security vulnerabilities with GMX, it is clear that using oracles for asset valuation can bring several potential vulnerabilities, which could lead to problems if there is significant discrepancy between liquidity pool balances and actual market prices. It remains unclear whether Swaap Finance will establish adequate safeguards to prevent this situation.

Thetanuts Finance

-

April 24, 2023

-

$17 million

-

Investors: Polychain Capital, Hyperchain Capital, Magnus Capital

Thetanuts Finance is a Decentralized Option Vaults (DOV) protocol aimed at providing fund management for DAOs, where users can easily operate various structured product vaults.

DFlow

-

April 26, 2023

-

$5 million

-

Investors: Framework Ventures, Cumberland, Coinbase Ventures, Circle Ventures, ZeePrime Capital, SBlockingrtan, Wintermute

DFlow is a decentralized order flow market that has built the application chain DFlow Chain through Cosmos SDK, aiming to create a fair Payment For Order Flow (PFOF) market. The order flow is sold to makers through decentralized and permissionless order flow auctions (OFA). This allows retail investors to get secure trades and best executions while makers can create more business opportunities.

II. CeFi

Bitget

-

April 4, 2023

-

$10 million

-

Investors: Dragonfly Capital

Bitget is a cryptocurrency derivatives exchange that supports spot, margin, and futures trading. The funds will be used for global expansion and launching other services such as LaunchBlockingd and Earn products.

Fractal

-

April 17, 2023

-

$6 million

-

Investors: QCP, 6th Man Ventures, Archetype, Avalanche Blizzard Fund, CMT Digital, Golden Tree Asset Management, CoinShares, Spartan Group, Circle Ventures, Hack VC

Fractal is a platform for cryptocurrency traders that enables more transparent clearing and settlement processes. Users can monitor counterparties in real time using Fractal to reduce counterparty risk. The bankruptcies of institutions such as 3AC, Genesis, and FTX have been attributed to a lack of transparency in the use of funds, which can be avoided by using Fractal.

Coinflow

-

April 19, 2023

-

$1.45 million seed funding

-

Investors: Jump Crypto, Reciprocal Ventures, CMT Digital, DCG, Gumi Crypto, etc.

Coinflow is a payment stack designed specifically for Web3 companies, supporting traditional payment systems such as credit cards as well as cryptocurrency payments, maximizing user experience by simplifying the payment process. If cryptocurrency payments become widespread in the future, the platform is expected to be widely adopted by Web3 companies.

Rise

-

April 25, 2023

-

$3.8 million seed round

-

Investors: Sino Global Capital, Polymorphic Capital, Draper Associates, W Ventures, P2P, Paradigm Shift Capital, Hashkey Capital, etc.

Rise is a platform designed to facilitate easy payment of salaries using cryptocurrency, allowing companies to pay their employees in legal tender and cryptocurrency.

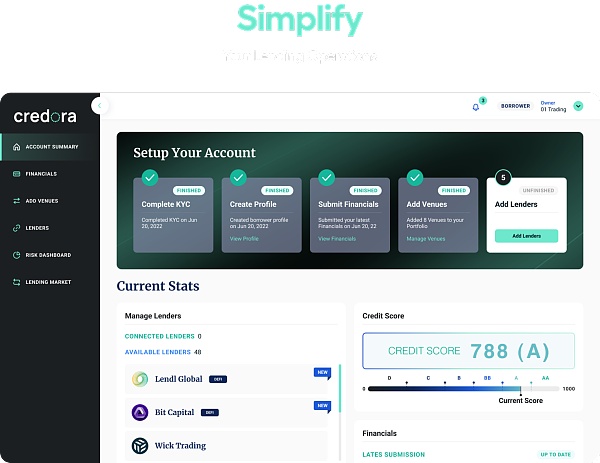

Credora

-

April 25, 2023

-

$6 million

-

Investors: Coinbase Ventures, S&P Global, Hashkey Capital, Spartan, CMT Digital, GSR, Kucoin Ventures, Amber, etc.

Credora is a platform that evaluates the credit of cryptocurrency market institutions in real time using zero-knowledge proof, while hiding sensitive parts such as positions. Although blockchain has the basic properties of decentralization and transparency, the transparency of centralized entities, mainly in the blockchain market, cannot be guaranteed, leading to many bankruptcies last year. Credora is expected to play an important role in this regard.

Zodia Custody

-

April 27, 2023

-

$36 million

-

Investors: SC Ventures (VC of Standard Chartered Bank), SBI Holdings, etc.

Zodia Custody is a subsidiary of Standard Chartered Bank focusing on cryptocurrencies, mainly providing custody services for institutions. This round of funding will enable the company to support more tokens and expand globally.

III. Web3 Games, NFT

Lore

-

April 7, 2023

-

$4 million

-

Investors: Multicoin Capital, Seed Club Ventures, North Island Ventures, Balaji Srinivasan, Zeneca, Mischief Ventures, Sfermion, CMT Digital, Blockingtricio Worthalter, Spice Capital, Sublime Venture, etc.

Lore is a platform that allows Web3 communities and game guilds to collectively own and manage NFTs. Community members can collectively fundraise to purchase NFTs and collectively manage NFTs.

Gameta

-

April 10, 2023

-

$5 million seed round

-

Investors: Binance Labs, Huobi Ventures, Arcane Capital, Ceras Ventures, StartVC, Gate.io Labs, W3Coins, Redline Dao, DefinanceX, Rana Capital, Infinity Labs

Gameta is a Web3 mobile gaming platform that offers a variety of games. Users can earn token rewards while playing these games. One of the platform’s significant attractions is that it offers many simple mobile games, which have the potential to attract a large number of active players.

Protecc Labs

-

April 14, 2023

-

$1.5M seed round

-

Investors: Dialectic, UOB Venture Management, Signum Capital, Interlinked Capital, Side Door Ventures, 0xVentures, Kronos Ventures, 3.0 Capital, Concave Ventures, Cogitent Ventures

Protecc Labs is a market maker focused on NFTs, which is a novelty compared to most market makers that focus on cryptocurrencies. As more and more NFT-Fi protocols emerge, including trading markets, lending protocols, AMMs, etc., the demand for market making in the NFT ecosystem will be essential.

Karate Combat

-

April 19, 2023

-

$18M seed round

-

Investors: Bitkraft Ventures, Alpha Wave, Hashkey Capital, Delphi Ventures, Contango, The Operating Group, Lattice, M13, etc.

Karate Combat is a US-based real-life karate organization that recently launched a blockchain-based betting platform. Through the platform, users can bet on who will win real-world matches and earn governance token $KARATE. As the platform has a real-life use case, it is worth long-term attention to see if the platform can achieve mass adoption and whether the token is sustainable.

Tribe3

-

April 26, 2023

-

$2.1M

-

Investors: SBlockingrtan Capital, Newman Capital, Infinity Ventures Crypto, Modular Capital, Cogitent Ventures, Blockbuilders, Founderheads, Lapin Digital, Blockhype, etc.

Tribe3 is a decentralized NFT futures exchange that borrows from Perpetual Protocol’s vAMM. vAMM does not require liquidity, but allows users to trade using collateral.

Currently, NFT series such as BAYC, MAYC, AZUKI, and CryptoPunks are supported for trading on Tribe3.

IV. L1&L2

Sei

-

April 11, 2023

-

$30 million (valuation: $800 million)

-

Investors: Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Blockingrtners, Flow Traders, Hypersphere Ventures, Bixin Ventures

Sei is an L1 blockchain focused on DeFi, built on Cosmos and highly optimized for scalability by modifying the Tendermint core. In addition, Sei provides its own oracle and order matching system to provide an optimized trading environment.

Astria

-

April 5, 2023

-

$5.5 million seed round

-

Investors: Maven 11, 1kx, Delphi Ventures, Figment Capital

Astria is a modular blockchain focused on the sorting layer. With a large number of rollup networks emerging in 2022-2023, a new problem has arisen: the decentralization of sorters. Sorters are entities that receive and sort user transactions on rollup networks, and most rollup networks currently only have one sorter. Whether sorters are centralized or not is not important because the validity of transactions is verified by the Ethereum network, not the sorter. However, if sorters are centralized, there is a high risk of malicious offline activity without countermeasures. Therefore, various projects focused on the sorting layer have recently emerged.

Intmax

-

April 13, 2023

-

$5 million seed round

-

Investors: HashKey Capital, Bitscale Capital, B Dash Ventures, SNZ, Antalpha Ventures, Scroll, Mask Network, Dora Hacks, East Ventures, MZ Web3 Fund, Hyperithm, Stacker Ventures, Cryptomeria Capital, WAGMI Ventures, Alchemy Ventures, and more.

Intmax is a ZK Rollup network built on Ethereum that differs from other ZK Rollups in that it uses a stateless structure. The benefit of this approach is that it allows validators to build a highly scalable environment without storing historical data.

Berachain

-

April 20, 2023

-

$42 million investment

-

Investors: Polychain Capital, Hack VC, dao5, Tribe Capital, CitizenX, Shima Capital, Robot Ventures, and others

In our previous article “Berachain, the new public chain that raised $42 million at the beginning,” we introduced Berachain, an L1 network built using the Cosmos SDK that focuses on DeFi liquidity and uses a novel mechanism called liquidity proof (validators and users can collateralize over ten tokens such as BTC, ETH, and USDC on the chain to receive staking rewards). The network adopts a three-token model, where $BERA is used for staking rewards and gas fees, $BGT is the governance token, and $HONEY serves as the native stablecoin. This name comes from an NFT project called Bong Bears.

It is worth mentioning that, since Berachain originated from the well-known NFT project Bong Bears, it already has a community even before the mainnet launch.

5. Web3 Services

Ramper

-

April 11, 2023

-

Strategic investment, undisclosed amount

-

Investor: Coin98

Ramper is a Web3 login service that allows users to easily use Web3 services without a crypto wallet by logging in with accounts such as Google and Twitter, and also provides exchange services between fiat and crypto currencies.

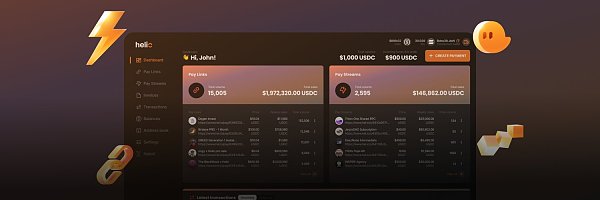

Helio

-

April 13, 2023

-

$3.3 million seed round

-

Investors: Peak, Lightspeed Faction, RockawayX, Solana Labs, and others

Helio is a Web3 payment platform that allows users to connect their crypto wallets to access Helio’s dashboard to use various other functions, such as creating links for payments using crypto, regular payments, and creating invoices.

Yoz

-

April 20, 2023

-

$3.5 million seed round

-

Investors: Electric Capital, Collab+Currency, Coinbase Ventures, Dapper Labs, Form Capital, North Island, Mike Krieger, Naval Ravikant, and more

Yoz is a Web3 notification service. For example, we can set a DAO reminder, and when the DAO proposes a governance proposal, Yoz will send you a reminder.

According to the project’s presentation, the currently supported projects include CryptoPunks, Fractional.art, Aave, and Nouns.

TinyTap

-

April 25, 2023

-

$8.5 million (valued at $100 million)

-

Investors: Sequoia China, Polygon, Liberty City Ventures, Kingsway Capital, Shima Capital, and more

TinyTap was acquired by Animoca Brands for $39 million in June 2022. It is a Web3 education platform that provides a variety of educational games. Animoca Brands aims to completely change education and creator economics through the TinyTap platform.

Six, Infrastructure

Polyhedra Network

-

April 4, 2023

-

$15 million Series A

-

Investors: Polychain Capital, ABCDE, SBlockingrkle Ventures, HashKey Capital, Foresight Ventures, Kucoin Ventures, NGC Ventures, Arcane Group

Polyhedra Network is a technology company based in California that provides interoperability, scalability, and privacy solutions using zero-knowledge proof technology. Its products include zkBridge, ZK-DID, and ZK-NFT. zkBridge is the most famous product, allowing two chains to verify each other’s consensus through zk-SNARKs technology (the product is currently available to many L1 and L2 users).

LayerZero

-

April 4, 2023

-

$120 million Series A (valuation: $3 billion)

-

Investors: a16z, Christie’s, Sequoia Capital, Samsung Next, Circle Ventures, etc.

LayerZero is a full-chain protocol that many current protocols are using. The most prominent example is Stargate Finance, which is a cross-chain bridge that allows tokens to be transferred between multiple EVM networks. Although LayerZero’s token hasn’t been launched yet, the name ZRO token can be seen in the code. LayerZero has received investments from many top VCs and, given its current widespread use, it is definitely a protocol worth paying attention to in the cross-chain field.

Satsuma

-

April 4, 2023

-

$5 million seed round

-

Investors: Initialized Capital, Archetype, OpenSea, Y Combinator, Homebrew, South Blockingrk Commons

Satsuma is a SaaS platform based on The Graph open-source protocol that makes it easier for users to query blockchain data. Currently, platforms such as Decentraland, Syndicate, Superfluid, and Aragon are using Satsuma.

Risk warning:

According to the “Notice on Further Preventing and Resolving the Risks of Virtual Currency Trading Speculation” issued by the central bank and other departments, the content of this article is only for information sharing and does not promote or endorse any business or investment activities. Readers are strictly required to comply with local laws and regulations and not participate in any illegal financial activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Quickly review 5 LSDFi projects worth paying attention to recently: Swell, unshETH, Pendle, Gravita Protocol, and Blockingrallax Finance.

- Is it worth buying The Llamas, an NFT project in the Curve ecosystem?

- Will the next bull market bring about cryptographic projects that surpass Bitcoin and Ethereum?

- How does Hourglass tokenize “opportunity cost” when time is money?

- Analysis of the Jimbos Protocol Attack: Was the Project that Brother Maji Invested in Hacked?

- What is Polyhedra, the cross-chain project that everyone is talking about recently? This article explains in detail the differences between it and L0.

- Here’s a list of 10 noteworthy projects recently invested in by Blockingradigm: Ulvetanna, Code4rena, Conduit…