How can blockchain projects legally raise funds?

How can blockchain projects fundraise legally?Bullish on the market, bearish on work

Smart friends have started making relevant layouts before the next bitcoin halving market, which will be accompanied by a bullish market. The most obvious is that there are more friends who come to consult the Manquan team on project financing.

During the communication with the entrepreneurs, we inevitably talked about SAFT (Simple Agreements for Future Tokens), which is often said in the circle. What is the legal effect of SAFT? Can it really meet the legal compliance requirements of Chinese entrepreneurial teams? In this article, we will chat about it.

Legal attributes of SAFT

- Quickly review 5 LSDFi projects worth paying attention to recently: Swell, unshETH, Pendle, Gravita Protocol, and Blockingrallax Finance.

- Is it worth buying The Llamas, an NFT project in the Curve ecosystem?

- Will the next bull market bring about cryptographic projects that surpass Bitcoin and Ethereum?

SAFT is a kind of investment agreement specifically designed for Web3 projects built on the blockchain network. It was published by a US law firm named Cooly on October 2, 2017.

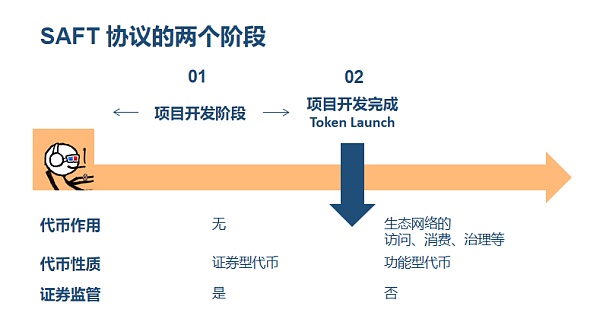

SAFT aims to provide a compliant token issuance path for Web3 projects based on the US securities law system. SAFT agreed that the project party would use the subscription right of the token on the future network as the consideration for the investor’s current funds, which would be used for the development and construction of the project network. As equity tokens (Security Token) are the key regulatory objects in various jurisdictions, SAFT avoids the regulatory supervision of the US Securities and Exchange Commission and related laws on Web3 project token financing and financing behavior by establishing a set of protocol mechanisms and ultimately achieving the effect of functional token (Utility Token) network launch.

(from: https://saft-project.org/)

The financing of SAFT is mainly divided into two steps:

(1) Project development stage

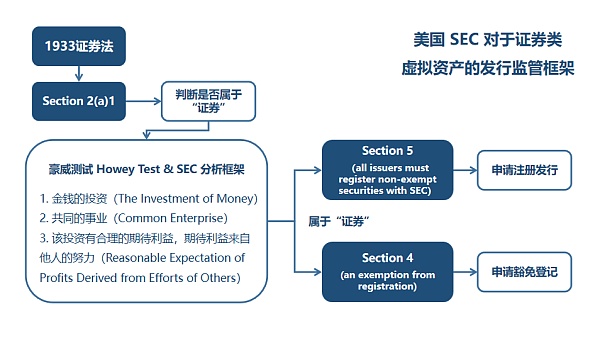

For Web3 projects that are still under development, investors’ expected profits depend on the project development team’s management and development of the network after monetary investment. Since the token has no practical utility, the token nature at this stage is more like a value representation of equity, capturing the ability of Web3 project’s future cash flow.

This investment behavior may meet the standard of the Howey Test and belong to the “investment contract”, which will be included in the strict securities supervision of the US Securities and Exchange Commission. However, it can apply for exemption according to the US securities law Regulation D Rule 506, and there is no need to register securities, limiting investors to qualified investors (Accredited Investors).

(2) Project development completion and launch phase

For projects that have been developed and launched on the network, the issued tokens (Already-functional Utility Token) have many functions (use, consumption, governance, etc.) that allow users to access the Web3 project ecosystem. The nature of the token in this phase is a value representation of usage rights, which is defined as a utility token.

Since the token already has practical attributes, the main purpose of investors purchasing the token is generally to obtain the practical value of the project network, not for the purpose of pure profit. Moreover, for a decentralized token economic system or governance system, the price of the token in the secondary market is completely affected by the supply and demand relationship in the market, and is not dominated by the contribution of the project development team.

This is in stark contrast to the role of tokens in the project development phase. Therefore, the SAFT white paper believes that such a utility token does not have the attribute of “securities” and generally will not be subject to strict supervision by the U.S. Securities and Exchange Commission.

The SAFT protocol is not secure

It should be noted in particular (emphasis added) that the purpose of SAFT is to comply with the rules of the U.S. SEC, and strictly speaking, it is only applicable to professional investors (Accredited Investment), and is not suitable for most small and medium-sized investors.

(from: Kraken’s Legal Chief Has No Time to Educate Firms About Crypto)

The SEC has raised many challenges to SAFT in the recent Kik and Telegram cases, which shows that there are flaws in the design and issuance rhythm of utility tokens.

As one of the drafters of the SAFT white paper, Marco Santori, one of the lawyers who knows the most about crypto and U.S. securities law, and currently the general counsel of Karken, was overturned by the SEC in February 2023 due to Karken’s Staking as a Service business, not to mention the SAFT agreements of projects with different network designs, token function designs, token economic designs, and investors.

In addition to SAFT, there are many legal ways for Web3 investment and financing, such as SBlocking (Share Purchase Agreement) involving equity, SAFE (Simple Agreement for Future Equity), TBlocking (Token Purchase Agreement) involving tokens, SAFT (Simple Agreement for Future Tokens), or the combination of SAFE + Token Warrant/Side Letter.

Which specific form to adopt needs to be based on the essence of Web3 investment and financing.

Essence of Web3 Financing

When valuing traditional equity projects, more attention is paid to the company’s ability to generate future cash flow, since shareholders have a legitimate right to share in the company’s profit distribution.

When valuing token-based projects, the traditional cash flow valuation model is not applicable, and more attention is paid to the network effects of the project, the demand between the network and the token, and the functionality of the token. Therefore, compared with token financing projects, token economics is very important.

(from: Connecting Web3 Wallet to Twitter Account)

We can give two examples to visually compare them.

(1) Twitter’s Web3 Hypothetical

Currently, the creator ecology of the Web2 Internet giant Twitter is run through a corporate organizational structure, with the goal of maximizing shareholder interests, reflecting shareholder capitalism, and the value of investment lies in the company’s ability to obtain future cash flow, with the stock price reflecting the value of future cash flow.

But imagine a Twitter based on the Web3 new economic model, incentivizing all participants in the network ecology (content creators, developers, validators, other market participants, etc.) with its tokens to jointly maintain the Twitter ecological network and promote governance. The utility of the token is not only as a medium of exchange, but also provides users with access to the Twitter ecosystem, consumption of products/services on the Twitter ecosystem, governance of decisions on the Twitter ecosystem, and other functionalities.

This Web3 new economic model releases economic benefits and governance power from centralized entities to the entire decentralized ecological network, where all stakeholders can share in the value they create, reflecting stakeholder capitalism.

In this model, Twitter’s equity may not be meaningful, and Twitter’s tokens will replace equity to capture greater value on the Twitter ecological network, with the token price reflecting the supply-demand relationship of the ecological network for the token.

(from: https://dune.com/hildobby/NFTs)

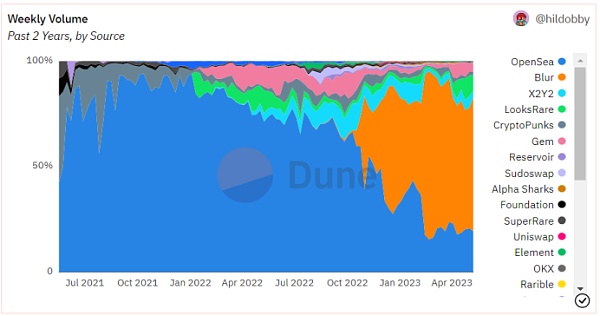

(2) Opensea and Blur

Once the world’s largest NFT trading platform, Opensea, raised $300 million in funding from Blockingradigm and Coatue in January 2022, valuing it at $13.3 billion. Opensea’s cash flow is primarily supported by its transaction fees, and these types of projects, such as Opensea, can be understood as typical equity investment projects in Web3, and in many ways can apply traditional business models, where investors capture the value of the company’s future cash flow, making equity investment more desirable.

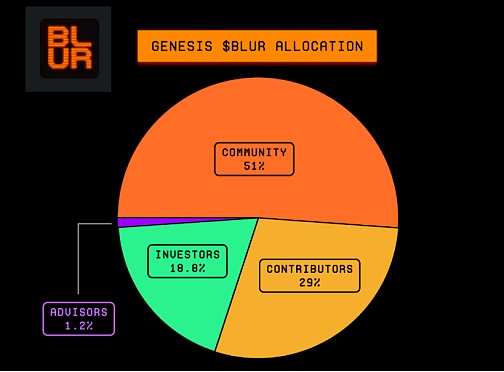

In March 2022, Blur received a $11 million investment from Blockingradigm. A year later, Blur bypassed Opensea’s network effect by activating the community (in the form of airdrops of tokens to community participants), opening up a liquidity feast in the NFT market. Blur’s project can be understood as a typical token investment and financing project in Web3, where investors capture the network effect of Blur’s ecosystem. The larger the ecosystem application and user volume, the higher the market demand for the functional token, and the price of the token relies on market value discovery.

However, considering the depression of the Blur token after listing and the limitations of the token function, it can be seen that how to design the token function and token economic model is the top priority for the project’s long-term operation.

(from: https://docs.blur.foundation/tokenomics)

Therefore, the significant improvement in the value liquidity of Web3 projects has raised higher requirements for project parties to be able to describe the future model and token economic arrangement of the project relatively clearly in the white paper financing stage, otherwise it will be difficult to connect the later SAFT and development planning.

Summary:

-

The purpose of SAFT is to avoid the regulations of the US SEC. It is only applicable to professional investors and is not suitable for most small and medium investors, let alone investors who are all Chinese citizens.

-

As Chinese entrepreneurs, when financing in the early stages of entrepreneurship, SAFT is not the only or best choice. Equity financing + token clause settings (SAFE + Token Warrant/Side Letter) can also be used. On the one hand, it can also solve the purpose of avoiding US securities regulation of SAFT, on the other hand, it can also provide a way for project equity financing while retaining the possibility of token financing.

-

The most important thing is that the purpose of entrepreneurship is not only to raise money and financing, but also to return to the basics of business, to solve social problems with the money raised, to create more commercial value. No matter how much money is raised, it can’t resist our blind tossing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does Hourglass tokenize “opportunity cost” when time is money?

- Analysis of the Jimbos Protocol Attack: Was the Project that Brother Maji Invested in Hacked?

- What is Polyhedra, the cross-chain project that everyone is talking about recently? This article explains in detail the differences between it and L0.

- Here’s a list of 10 noteworthy projects recently invested in by Blockingradigm: Ulvetanna, Code4rena, Conduit…

- Quick look at a16z’s investment landscape for Q1 2023

- Exploring the truth behind PulseChain’s 13.7 billion fundraising: ultimate innovation or Ponzi scheme, risk or opportunity?

- Interpreting Injective (INJ): A comprehensive evaluation of DeFi project based on SWOT