Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

Rug? Nima Capital, an investment institution, sells tokens to fund luxury home sales. It has previously invested in 16 projects.Author: Joy, LianGuaiNews

Nima Capital entered the domestic crypto community, but unexpectedly in the form of a suspected rug pull.

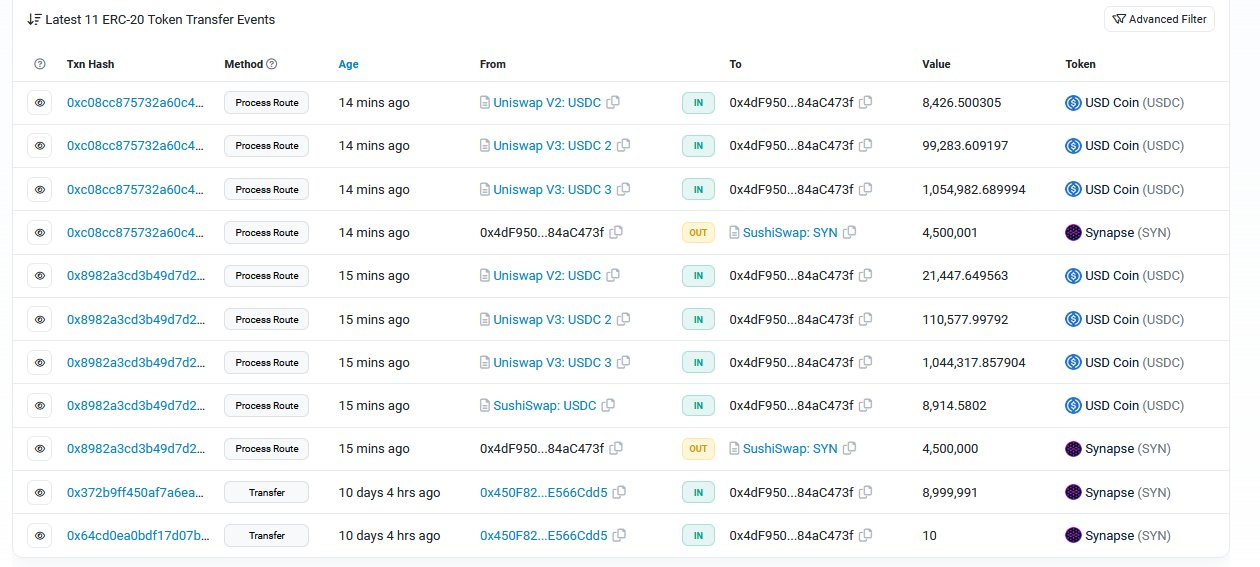

On September 5th, the cross-chain protocol Synapse experienced a price crash. The official response stated that a Synapse liquidity provider sold its SYN tokens and withdrew liquidity. The community later discovered that the liquidity provider was Nima Capital. Within one minute, Nima Capital sold 9 million SYN tokens worth $3.1 million through Sushiswap and withdrew over $37.5 million in stablecoin liquidity from Synapse. The swift and unconcerned sell-off caused the SYN price to drop by 22% in three hours.

In March of this year, Synapse approved a proposal from Nima Capital, which promised to provide $40 million in stablecoin liquidity within 12 months. However, SynapseDAO needed to provide a grant, as well as 33% of the bridging and transaction fees. In the proposal, Nima Capital claimed to have a liquidity-focused cryptocurrency team specializing in various DeFi projects, such as on-chain market making, real-time liquidity, node operations, and transaction reliance on the mempool. They also claimed to have been one of the largest users of core protocols such as AAVE, Compound, Yearn, Convex, and Canto.

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

- 20 Worth-Watching Unreleased Coin Projects

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?

However, Nima Capital did not fulfill the agreement, and Synapse stated that they were unable to contact Nima Capital. As of now, there has been no response from Nima Capital’s official website or related personnel. The official Twitter account has been locked, and the founder Suna Said’s Twitter account has not been updated for over a year. These phenomena have led the community to speculate whether Nima Capital has pulled a rug pull.

Coincidentally, in August, The Wall Street Journal reported that a set of apartments owned by Nima Capital was sold for approximately $80 million. The institution had previously spent $65.59 million in 2020 to purchase these apartments facing Central Park in New York. According to another report by The Wall Street Journal in February of this year, Suna Said and her husband Scott Maslin bought a Silicon Valley estate worth about $45 million from Joel Peterson, the former chairman of JetBlue Airways.

In reality, Nima Capital’s reputation in the crypto community was not high before, and they did not actively participate in public activities in the crypto industry. According to LinkedIn, Nima Capital was founded in 2013 and is a large single-family office headquartered in New York City. The founder, Suna Said, claims to have been investing vertically in the crypto field since 2016, including incubators, early-stage investments, token investments, and liquidity mining. She is also an advisor to Bitwise, co-founder of music NFT company OneOf, and a board member of the DeeLianGuaik Chopra Foundation.

Nima Capital Founder Suna Said

According to DeFiLIama data, Nima Capital’s investment portfolio is more biased towards DeFi and trading, with over half of the projects focused on this track. In addition to Synapse, public investments also include Flow, Fordefi, Dexguru, Bitwave, AnChain.ai, Axelar, Notional, Risk Harbor, Liquity, 0x, TAP Network, 1Inch, Coinme, Flexa, Celo, and NuCypher.

Compared to other investment institutions, Nima Capital, as a family office, mainly manages proprietary funds. It is understood that Suna Said’s husband, Scott Maslin, is the founder of Woodglen Investments, a real estate investment company, and also the founding partner of Alpha Blue Ventures, which focuses on the acquisition, development, and management of real estate projects in New York and Southeast Florida. Therefore, it is not surprising that Nima Capital is involved in high-value real estate projects.

Currently, no one knows what has happened inside the low-profile and mysterious Nima Capital. As the community speculates, Nima Capital’s financial situation may be in trouble. There are four different possibilities: 1. Nima Capital was hacked; 2. Nima is insolvent/involved in legal troubles; 3. The US SEC found infringement of NRV (a project previously founded by the team) by the Synapse protocol; 4. A combination of the above scenarios.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding the Cross-Chain Leveraged Trading Aggregator MUX in One Article

- Two-tier reversal, friend.tech still agreed for you to be friends with the imitation platform.

- TRB, the oracle mining coin project, has experienced a skyrocketing price against the trend. Is it due to improved fundamentals or speculative capital?

- EigenLayer Official Inventory of 12 Early-stage Projects in the Ecosystem

- Product Expansion and Mechanism Update of Lybra V2

- An Analysis of the ‘Nintendo’ Treasure DAO in the Cryptocurrency World

- Reviewing the exciting developments and data highlights in the DEX sector over the past two weeks