Galaxy Report The Revolution of Bitcoin Itself

Galaxy Report Bitcoin's Self-RevolutionAuthors: Brandon Bailey, Gabe LianGuairker, Guillaume Girard, Simrit Dhinsa; Source: Galaxy; Translation: Lynn, MarsBit

This is the second report in Galaxy’s series of reports on Bitcoin Inscriptions and Ordinals, which provides a comprehensive overview of significant developments in the Ordinals infrastructure and compares Ordinals activities on Ethereum, Solana, and Polygon. For information about the ecosystem, predictions for the target market, and the historical context and development of the ecosystem, please refer to Galaxy’s original report from March 2023.

Key Points

- Bitget Survey Chinese Investors Have Higher Investments in Cryptocurrencies

- Will the super bear steepening of the US Treasury yield curve be a blessing or a curse for the cryptocurrency market?

- LianGuai Daily | Hong Kong officially regulates stablecoins and temporarily does not allow retail trading; El Salvador launches its first Bitcoin mining pool

Within the first 200 days since the first Bitcoin Inscription, a total of 1.14 million image-based Inscriptions have been created, surpassing the total number of NFTs minted in the first 200 days on Ethereum, Solana, and Polygon respectively.

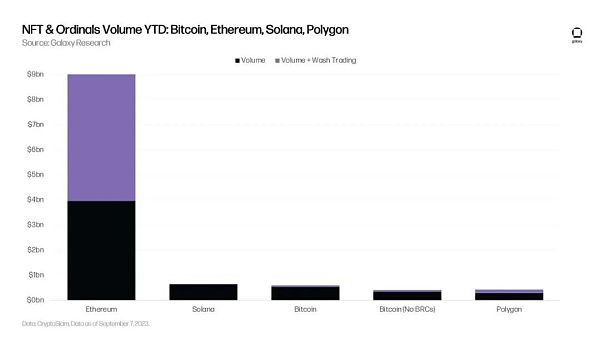

From January 1st to September 1st, the cumulative trading volume of Bitcoin Ordinals was $596.4 million, making Bitcoin the third largest NFT network by trading volume, only behind Ethereum and Solana.

Ordinals activity has led to the longest period of uncleared pending transactions on Bitcoin since 2021.

Even excluding BRC-20 from the total Ordinals, Bitcoin remains the third most popular chain in digital collectibles activity. The cumulative trading volume of the top 50 BRC-20 tokens accounts for only 30% of all Ordinals trading volume.

In terms of daily trading volume, the major markets for Ordinals activity are Magic Eden, Unisat, and OKX, with market shares of 20%, 34%, and 44% respectively.

There is a growing demand for numbers inscribed on rare Satoshis. There is now a robust framework to measure the rarity of Satoshis and some rare satellite markets that allow users to easily acquire and trade rare satellites.

Recursion is a novel innovation that allows Inscribers to build Ordinals beyond the 4MB block size limit and create high-resolution artworks for a fraction of the cost required to mint an Inscription.

Introduction

In March 2023, Galaxy Research and Mining released a report highlighting the emergence of Ordinals – the new frontier of Bitcoin digital collectibles. At that time, Galaxy Research and Mining predicted that the market value of the Ordinals market would reach $500 million by 2025 with only 260,000 registrations. Fast forward to now, the ecosystem has grown to over 33 million Inscriptions, experiencing an explosive growth of about 126 times from March 2023 to September. The significant growth of Ordinals not only demonstrates the inherent appeal of Bitcoin digital collectibles but also reflects the rapid maturation of the ecosystem. The Ordinals landscape continues to evolve through improved wallet and marketplace infrastructure, new use cases for Inscriptions, and scalability improvements.

This report serves as an update on the Ordinals ecosystem since our last writing in March 2023. It provides a comprehensive overview of significant developments in the Ordinals infrastructure and compares Ordinals activities on Ethereum, Solana, and Polygon. The report also investigates the impact of Ordinals on Bitcoin fees and highlights that the majority of fee spikes in the past 6 months were not caused by Ordinals-related transactions. The data provided in the report suggests that Bitcoin users generally pay high fees for transactions, regardless of whether these transactions are related to Ordinals or not.

Current Status of Ordinals Infrastructure

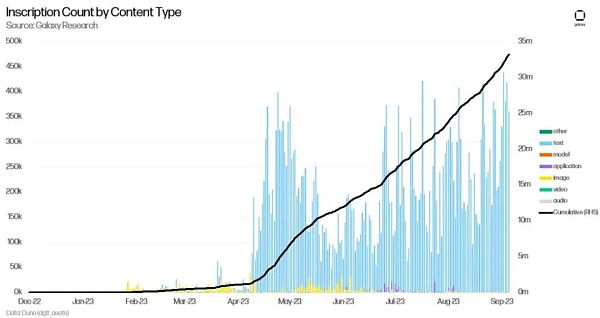

Since the public release of the software that allows writing arbitrary data onto the blockchain (referred to as the Ord client) in January 2023, the growth of the Ordinals ecosystem and the development of critical infrastructure have achieved an incredible amount. Currently, there are over 33 million inscriptions, with text files being the most common file type, primarily due to the BRC-20 token standard.

The BRC-20 token standard still remains an inefficient way to mint and transfer inscriptions, as they require users to execute multiple transactions to complete a single operation. Currently, there are several proposed token standards for Ordinals, which are more efficient and robust protocols for creating tokens on top of Bitcoin, such as ORC-Cash and ORC-69.

Although text-based inscriptions supported by the BRC-20 token standard dominate the total number of inscriptions, most of the excitement and key technological developments in the Ordinals field are focused on collectible digital artifacts. Tools supporting image-based inscriptions have made significant progress. Three major wallet options have emerged to store image-based inscriptions: Xverse, Hiro Wallet, and Unisat Wallet. These wallets act as browser extension wallets, allowing users to connect to exchanges, send and receive Bitcoin or inscriptions, and view Ordinals collections, providing a user experience comparable to Ethereum’s Metamask. The Xverse wallet also provides a mobile application solution.

There are various inscription-as-a-service products, such as Ordinalsbot and Unisat. Binance Mining, the mining department of the world’s largest cryptocurrency exchange Binance, also launched inscription-as-a-service on August 31, 2023. From a market perspective, Magic Eden has always been the most popular exchange for trading ordinals. However, Ordinals Wallet, Gamma, and Binance are also becoming competitors in this field.

The Ordinals infrastructure now supports inscription gating on platforms like Discord, where access to digital communities is exclusive through verification of inscription ownership. It also leverages Discreet Log Contracts (DLCs), which are Bitcoin’s native transaction programmability feature, allowing collectors to use ordinals as collateral to obtain Bitcoin-denominated loans.

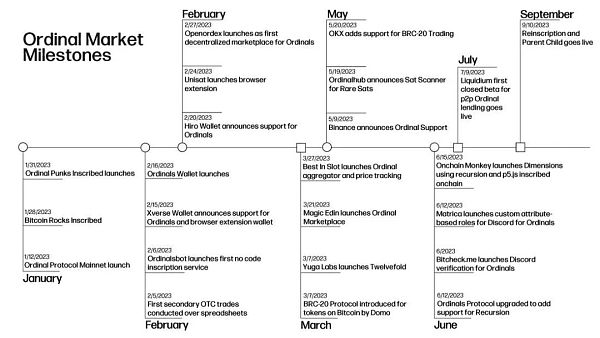

After about 8 months of Ordinals development, Bitcoin developers have built NFT tools on par with other major Layer-1 blockchains like Ethereum, Polygon, and Solana. Several companies are actively working on secret builds and improvements to the Ordinals infrastructure. Here is a timeline that combines many milestones in the Ordinals field over the past 9 months:

Despite the general decline in the market volume of Ordinals and NFTs since early 2023, the development of the Ordinals infrastructure continues to progress rapidly, indicating that Ordinals is not just a passing trend.

Ordinal Market Activities

The NFT minting activity on Ethereum began in August 2015 with the launch of the Terra Nullius NFT series. The first NFT minting record on Polygon occurred in May 2020, and the first minting record on Solana occurred in October 2020. NFT minting activities started on Ethereum, Solana, and Polygon before the summer of 2021 when NFTs gained mainstream media attention. Compared to the minting activities after the NFT bull market in the summer of 2021, the minting activities in the first 200 days on these networks were relatively few. For reference, when Solana and Polygon NFT activities were first launched in 2020, the total market value of the entire NFT ecosystem was only $41 million. In just two years, by 2022, the NFT market value on all three blockchains had grown to $32 billion.

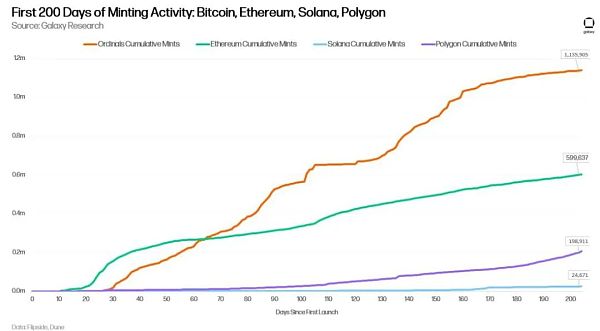

The following chart tracks the number of mints that occurred in the first 200 days since each blockchain’s birth. The chart excludes inscriptions from BRC-20 mints and is based solely on image inscriptions.

The Ordinals ecosystem witnessed impressive user engagement in its initial 200 days of activity. During this period, Bitcoin users minted (i.e., inscribed) 1.14 million digital artifacts. Considering that Ordinals was launched during a bear market for cryptocurrencies, its rapid growth is noteworthy. In the first half of 2023, the number and floor prices of blue-chip collectible NFTs declined rapidly. Despite the broader NFT market’s struggle to recover from the bear market, Ordinals has gained significant attention, and the concept of Bitcoin digital artifacts has flourished.

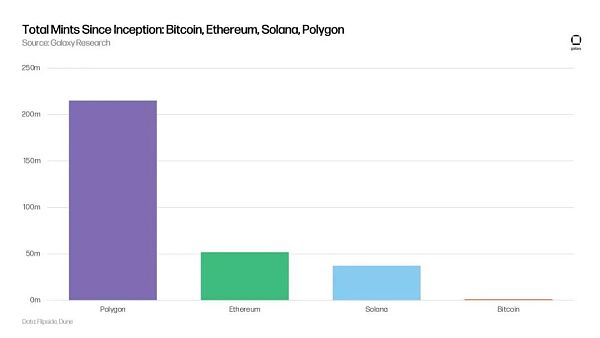

While Bitcoin had significant minting activity in the first 200 days, it still falls far behind the total minting activity on other general-purpose blockchains, indicating that Ordinals has a long way to go in terms of adoption compared to the broader NFT ecosystem. One of the apparent reasons for the significant differences in total minting volume across chains is that Ethereum, Solana, and Polygon have been supporting NFT activities for years. Additionally, with the help of the NFT boom cycle in 2021, Ethereum, Solana, and Polygon experienced accelerated adoption. If Ordinals continues to gain traction in the next NFT bull market cycle, we may see Bitcoin start to compete with Ethereum, Solana, and Polygon in terms of total minting volume.

Transaction Activities

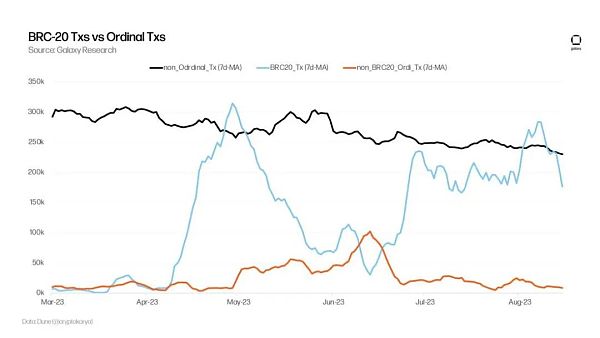

While it is important to exclude non-image transactions from our metrics when compared to other NFT ecosystems, including all types of inscriptions is crucial for understanding the overall impact of emerging technologies. Ordinal transactions refer to all types of inscription activities: images, text, applications, audio, and other types of digital content. The advent of inscriptions enables the construction of other meta-protocols, such as tokenization schemes, where BRC-20 is the most popular one so far. BRC-20 transactions are entirely based on text inscriptions, and BRC-20 transactions significantly surpass non-BRC-20 Ordinals transactions. By observing the trading volume of the top 50 BRC-20 tokens, we find that most BRC-20 transactions have lower values.

In order to better compare the Ordinals trading activity with the broader NFT trading activity, we attempt to exclude BRC-20 from the calculation of Ordinals trading volume, which will be detailed in the next section of this report.

Volume

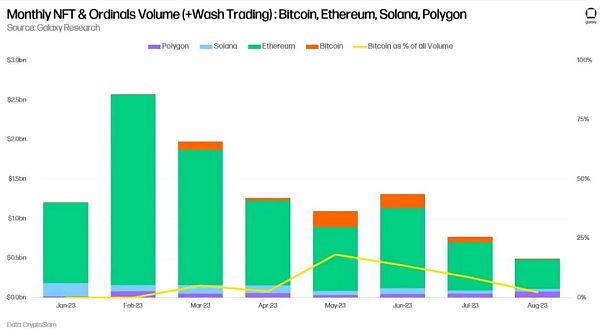

NFT trading volume in 2023 saw a significant decline. From February to August 2023, monthly NFT trading volume declined for six consecutive months. August 2023 was the worst-performing month for NFTs this year, with trading volume dropping to $500 million, a four-fold decrease from February 2023. Despite the unfavorable market conditions for NFTs in 2023, Ordinals achieved meaningful growth. It is worth noting that Ordinals accounted for 18% of all NFT trading volume in May.

In the first three quarters of 2023, Ethereum dominated NFT trading volume, surpassing the total of Solana, Bitcoin, and Polygon. Although Ordinals had minimal trading volume in January 2023, Bitcoin ranked third in cumulative network NFT trading volume, reaching $596 million. Even if BRC-20 is excluded from the total Ordinals trading volume, Bitcoin remains the third-largest popular blockchain for digital collectibles, after Ethereum and Solana.

(Note: To exclude BRC-20 trading volume from the calculations below, we subtracted the cumulative trading volume of the top 50 BRC-20 tokens ($187.5 million) from the total Ordinals trading volume ($596.4 million). The top 50 BRC-20 tokens account for the majority of BRC-20 trading volume.)

On May 11, 2023, Ordinals set a new record for daily trading volume, with the first wave of BRC-20 tokens minted through Unisat and the Ordinals wallet. From May 1, 2023, to July 18, 2023, the daily trading volume of Ordinals generated a total volume of approximately $207 million, with an average daily trading volume exceeding $2.5 million.

The chart below shows the daily trading volume of Ordinals for BRC-20 transactions from February to September 2023. To convert the trading volume data for BRC-20 transactions in the chart, we eliminated the trading volume data during the period from May 5 to December 12, 2023. During this period, Unisat generated sales of over $56 million solely through BRC-20. As it is difficult to accurately categorize the volume of text-based inscriptions based on images and other types of inscriptions from the market, there may be instances of BRC-20 trading volume on other points in the market that we cannot eliminate except for Unisat.

The chart also does not include off-market trading data for Ordinals and Twelvefold minting factories, as these transactions do not exist in the market trading volume data tracked by Dune Analytics. Yuga Labs’ TwelveFold minting factory generated approximately $16.5 million in Ordinals trading volume in a single day. In terms of image-based Ordinals trading volume, off-market transactions by Ordinals accounted for at least 10 BTC (approximately $270,000). The chart represents our best estimate of daily trading volume for Ordinals, excluding the frenzy of BRC-20.

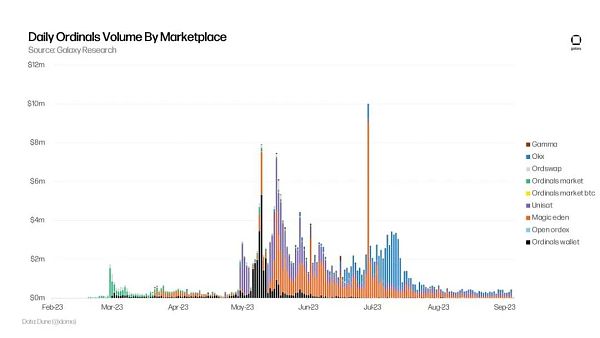

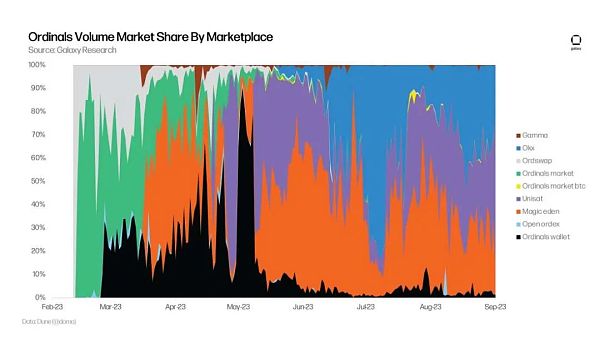

Before gaining meaningful support from major NFT markets, there were some early Ordinals trading markets. From February 2023 to April 2023, the Ordinals market, Ordinals wallet, and Ordswap dominated the trading volume of Ordinals. However, when Magic Eden launched support for Ordinals in March 2023, the dominance of market trading volume shifted from the early markets. Magic Eden’s entry into the Ordinals field shocked the market as they were the first major NFT market to support Ordinals on other chains.

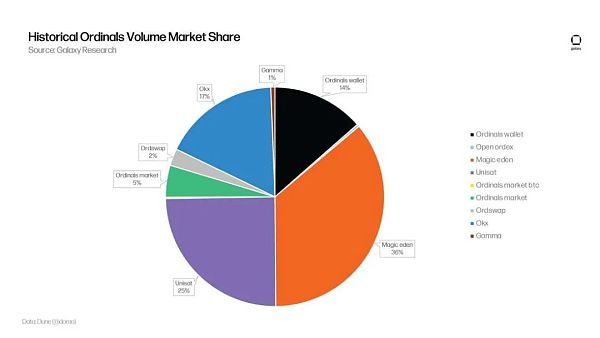

When Magic Eden launched support for Ordinals, Magic Eden was the fifth largest NFT market by trading volume, with over 1.3 million users. In terms of Ordinals trading volume, the most significant markets now are Magic Eden, Unisat, and OKX, accounting for 28%, 28%, and 38% respectively.

Although Magic Eden and OKX started relatively late in the Ordinals ecosystem, they account for 36% and 25% of the total Ordinals volume respectively since their establishment.

In the next section of the report, we analyze the impact of Ordinals trading activity on the Bitcoin mempool and transaction fees.

Impact of Ordinals on the Bitcoin Mempool and Transaction Fees

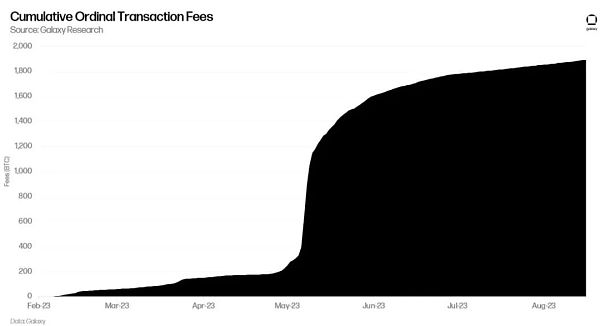

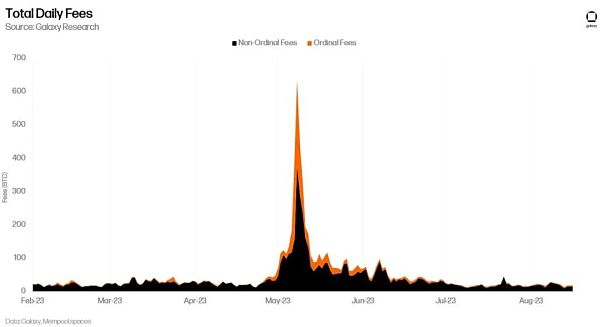

In the first half of 2023, miners accumulated a total of 8,684 BTC in fees. It is worth noting that in the first half of 2023, the volume of transactions related to Ordinals reached 1,779 BTC, accounting for 20% of the total miner revenue. In comparison, the fees in the first half of 2022 were 2,325 bitcoins, and the total fees for the whole year of 2022 were 5,375 bitcoins.

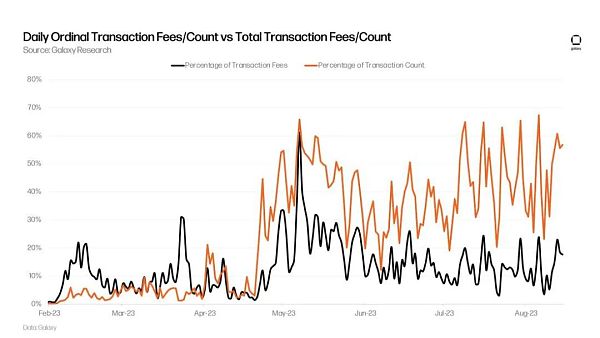

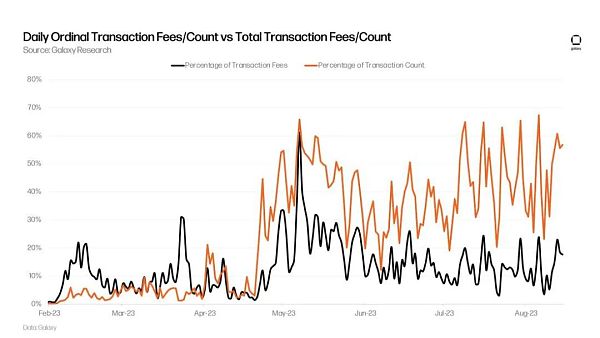

From May 2023 to July 2023, the share of Bitcoin transactions related to Ordinals remained relatively unchanged, decreasing from 47% of all Bitcoin transactions to 46%. During the same period, the share of Bitcoin transaction fees for Ordinals decreased from 30% to 12%.

Except for the transactions in May 2023 that caused a surge in fees, most transactions that had fees higher than the median fee rate in the block were not related to Ordinals. Although Ordinals account for a significant portion of the total transactions, they are not the most profitable transactions in the block.

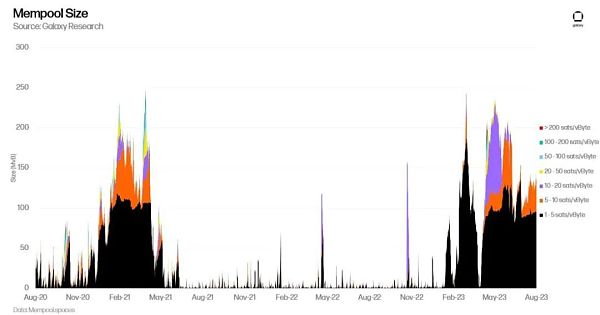

Although Ordinals are not the most expensive transactions on Bitcoin, they have caused a backlog of transactions, clogging the Bitcoin mempool (the pool of unprocessed Bitcoin transactions). The mempool has been backlogged since April 22, 2023, for about 4 months. This is the longest active state of an uncleared mempool since the surge in on-chain activity in early 2021.

Whether someone pays the Ordinals fee or conducts a regular transaction to transfer Bitcoin from one address to another, Bitcoin users usually pay excessive fees for block space. In the next section of the report, we will analyze in detail the surge in transaction fees in the first half of 2023.

Factors driving the increase in Bitcoin fees

The two main factors leading to the increase in Bitcoin fees are:

Time differences in block space consumption leading to voluntary overpayment. Block space consumers exhibit different time preferences, which means differences in urgency and strategic timing decisions, resulting in different block space consumption patterns and driving fee increases during peak demand.

Overpayment due to erroneous fee estimation rather than voluntary overpayment. Users may inadvertently pay a premium on standard transaction fees due to calculation errors or a lack of understanding of the current fee structure.

The behavior of low time preference users can be reasonably explained and visualized on the chain. These users always bid higher than the lowest possible fee level widely accepted for memory pool clearance (the default size of the memory pool is 300 MB, so when it reaches capacity, it starts to clear or remove transactions starting from the lowest fee rate). Anything higher than this “clearance level” can be considered a “time preference premium” because it implies a desire to be included in a block faster than X, where X represents the entire memory pool being cleared and the “clearance level” returning to zero sat/vByte.

However, high time preference users are optimizing for different trade-offs such as opportunity costs, and analyzing their behavior requires making subjective assumptions. Using this framework, we can start quantifying and specifying the size of the “time preference premium” that users are willing to pay. In a sense, this “time preference premium” can often be thought of as how much users are willing to “overpay” to be included in the next block (or multiple blocks). This will be described as voluntary overpayment (e.g., BRC-20 users attempting to mint new tokens before reaching maximum supply). Some users may pay excessive fees due to other non-economic factors, such as poor fee estimation by wallets and exchanges. These types of transactions will be described as involuntary overpayment.

Below is a case study illustrating an example of voluntary overpayment in Bitcoin.

Case Study: DeGos Mint

In March 2023, DeGods Mint serves as an illustrative case study to conceptualize why users would voluntarily pay extra transaction fees. As background, DeGods was a collection of 10,000 NFTs initially launched on the Solana blockchain in 2021. In March 2023, the creators of DeGods launched a version of their NFT collection on Bitcoin. Prior to this, the creators of DeGods sold their collection through Discord giveaways. On Bitcoin, DeGods Mint operated on a first-come, first-served basis on-chain. Starting from block 781,279, inscriptions were sold at a minting price of 0.333 BTC. Users who were able to have their transactions included in the first 500 confirmed transactions for the Mint would be the lucky ones who could purchase DeGods inscriptions at the minting price.

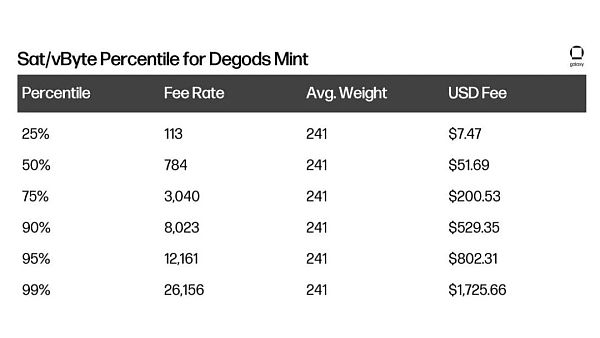

The DeGods inscription casting process has caused a frenzy among users, as many have had to wildly speculate on the appropriate fees attached to their transactions in order to succeed in casting. DeGod’s minters paid fees ranging from $7 to $1,725 for their transactions, as shown in the table below:

Other simple facts about DeGod’s minting factory include:

During the minting process, the highest fee rate observed in a block was 39,177 sat/vByte, and the total transaction fee of 10,000,000 sat (0.1 BTC) was 932 times higher than the median fee rate in that block.

The median fee rate of block 781,279 was 6 times higher than the median fee rate of the previous block.

The total fee for this block was 3.552 BTC or $96,000. The block confirmed a total of 2,602 transactions.

Out of the 2,602 transactions, 559 were related to DeGod’s minting factory. The total fee for DeGod’s minting-related Bitcoin transactions was 2.969 BTC or $80,000 (83.6% of the total fee).

The median fee rate paid by those attempting to mint DeGod was 784 sat/vByte, which is 18.6 times higher than the median fee rate of all transactions in the block.

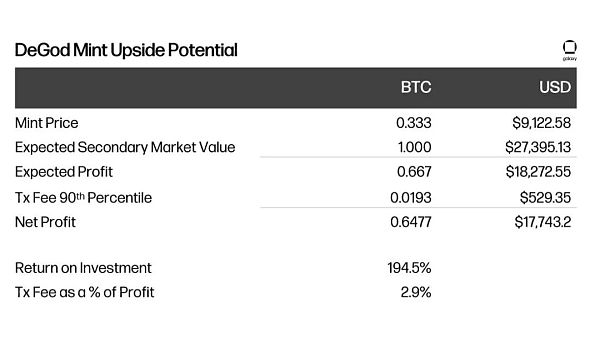

From the perspective of the minters, determining how much fee to pay for a transaction is essentially a cost-benefit calculation. If the minting factory believes they can profit from the item by immediately selling it, they will attempt to optimize the transaction by determining the item’s selling price on the secondary market and adding a certain fee to ensure a positive price difference between the minting factory’s casting price and the secondary spread.

After the initial casting, the secondary market value of DeGod Ordinals was 1 BTC. Compared to other minters, those who paid 90% or more extra for DeGod could still profit from secondary sales if they immediately sell, as shown in the table below:

The next section of this report will delve into the factors driving Bitcoin fee increases.

Quantifying the “Excessive Payment” in Bitcoin Transactions

Based on these characteristics, we can quantify the on-chain “excessive payment” activity between user casting and exchanging ordinals and user sending and receiving regular Bitcoin transactions. Here is a breakdown of the methodology:

For major inscription transactions (i.e., Ordinals transactions), they are identified by the transaction IDs listed on Ordinals.com. All other transactions during the same period are classified as regular Bitcoin transactions. It should be noted that some of these regular Bitcoin transactions may be secondary market transactions that are not captured on Ordinals.com. However, as shown by the NFT data aggregator CryptoSlam, the number of secondary sales has significantly decreased from its peak on May 8, indicating that even if included, the impact on the fee rate is likely to be small.

“Overpayment” is defined as the fee amount (in sats/vByte) of a transaction in a block being higher than the median sats/vByte of the same block. We choose the median sats/vByte level of a block because we believe that if you are a high time preference user, bidding around this level will provide a reasonable chance of being included in the next block.

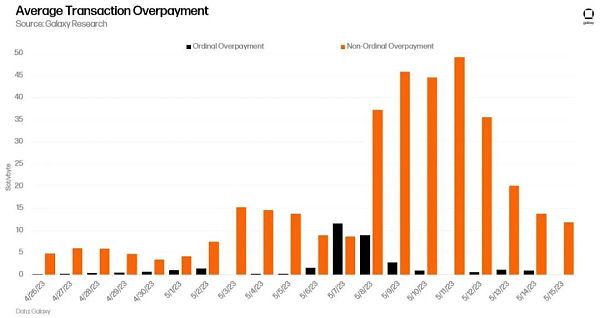

Based on the above method, the following figure shows the average overpayment amount on Bitcoin per day for Ordinals and non-Ordinals users during the period from April 2023 to May 2023, when the block space market was dominated by users with higher time preference trying to participate in the block space.

Due to the continuous development of the mempool (and the block time is designed to be unstable, longer block time will increase the fee for a given block as users have more time to bid for the next block), rational high time preference users will not bid when they see that the fee rate in the mempool is lower than the median fee rate of the mempool. For example, in the figure above, on May 9, 2023, Ordinals/BRC-20 users on average paid 2.8 sats/vByte, higher than the median fee rate of the block, while non-ordinals users on average paid 45.9 sats/vByte, 16 times higher than the median fee rate of the block.

On the transaction level, data shows that during the period from April to May 2023, most of the fee pressure did not come from Ordinals/BRC-20 users, but from “regular” Bitcoin users. Contrary to popular belief, during a significant increase in fees, blockchain regular users who engage in so-called “financial transactions” largely bear the responsibility for pricing Ordinals transactions. In addition, the figure below shows that although ordinals account for over 70% of the mempool transaction volume, they have never accounted for more than 30% of the total miner transaction fees.

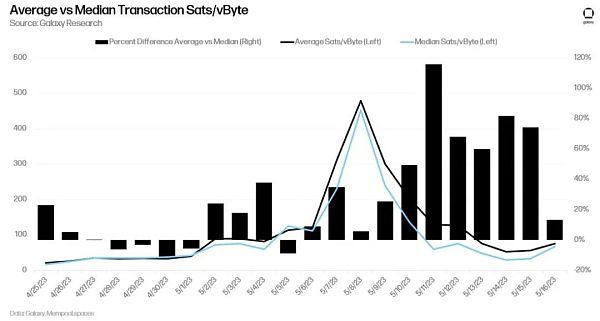

The final insight about overpayment is that during periods of significant fee volatility, there is a significant difference between the average sats/vByte and the median sats/vByte. The figure below shows that both the average sats/vByte and the median sats/vByte reached their peak on May 8th. Before May 8th, the average sats/vByte and the median sats/vByte usually changed synchronously. However, after May 8th, the percentage difference between the two sharply widened, reaching a peak of 116% (the average sats/vByte was 116% higher than the median sats/vByte). This difference may be due to the overall fee volatility during the period of fee increase, which makes fee estimation from wallets difficult during this period.

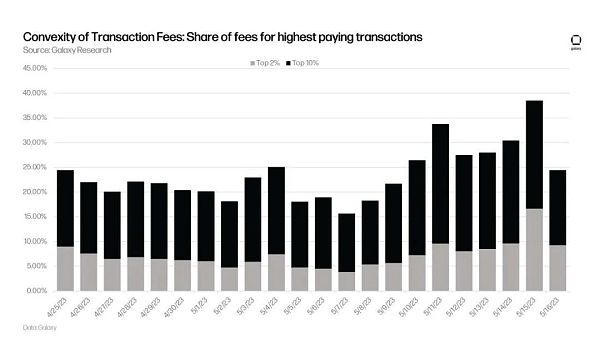

From a statistical perspective, the average value may be influenced by outliers, which in this case refers to transactions with excessive fees. During periods of low volatility, the average fee and the median fee are similar, while during periods of high volatility, these two indicators show significant differences, further highlighting the impact of overpayment on fee dynamics. By measuring the convexity of Bitcoin fees, we know that very few transactions are the main cause of on-chain fee increases.

As time goes by, the demand for Bitcoin block space continues to increase. Wallet providers will need to optimize their fee estimation schemes or provide solutions such as Replace-By-Fee (RBF) and fee selection to better serve users and prevent them from paying excessive fees for transactions. The overpayment of Bitcoin transactions can be alleviated through more sophisticated fee estimation services provided by wallets and exchanges. Ordinary Bitcoin users will benefit from the fee estimation optimization and improvement pursued by wallets focused on Ordinals such as Xverse, Hiro, and Unisat. In particular, in the face of increasing block space demand and the resulting fee fluctuations, fee estimation schemes will become a key component of next-generation wallet technology to prevent users from overpaying transaction fees.

Other insights and points about Bitcoin fee dynamics

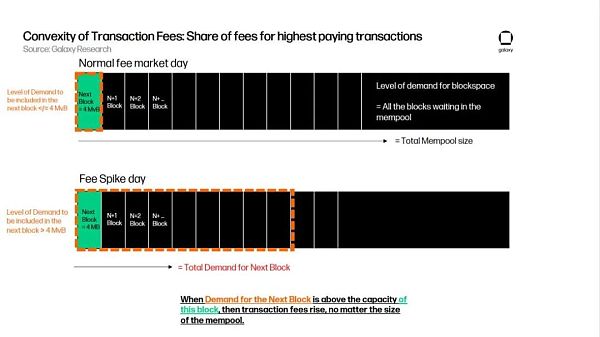

During the BRC-20 frenzy, one surprising development that has caught market participants off guard is how quickly fees in the mempool skyrocket during periods of high demand. This is because the driving force behind transaction fees is not the size of the mempool (i.e., the general demand for Bitcoin block space from low-time preference and high-time preference users), but rather the demand from fully high-time preference users for the transactions included in the next block adjacent to them.

In the figure below, we illustrate this relationship by showing that fees typically do not skyrocket when the demand for the next block (in red) is less than or equal to the capacity of the next block. However, when the demand for the next block exceeds the capacity of the next block, fees rise. While this may seem obvious to temporary mempool observers, it underscores an important assumption when discussing transaction fees on the network in the future. As long as the network can maintain a level of demand for the next block that does not exceed its natural capacity, the overall demand for block space is (almost) irrelevant.

The framework used above to understand block space demand is relevant to discussions about Bitcoin’s security budget. The discussion should not focus on “whether transaction fees will rise enough to provide miners with sufficient income,” but rather on “how do we ensure a sustained demand for block space exceeding 4 MvB?”

When examining fee peaks during periods of high demand for the next block, we observe that a significant portion of the total fees paid by that block is driven by a small number of users paying extremely high fees, indicating strong convexity. However, this relationship becomes less apparent on days with lower fees. To illustrate the two-way dynamics of Bitcoin fees, the figure below shows that on May 15th, the top 2% of transactions accounted for over 15% of the total fees. On average, the top 10% of transactions accounted for 21.05% of the total fees in a block. However, the percentage of transactions from the top 2% of fees dropped significantly during the peak fee period in May and then rebounded.

Under normal circumstances, when the Bitcoin fees are not skyrocketing, most of the fee pressure is driven by abnormal transactions, which we define as the top 2% of transactions in blocks calculated by sats/vByte fees. This is also reflected in the difference between average sat/vBytes and median sat/vBytes, which is likely due to involuntary overpayments or a lack of understanding of the mempool dynamics during fee fluctuations.

During peak fee periods, these outliers account for a smaller proportion of the overall fee pressure, indicating that while users are increasing the fees they are willing to include in the next block, they may not necessarily be paying excessively high fees compared to other users with high time preferences. They are also bidding to be included in the same block.

In the next section of this report, we will delve into the new developments in Ordinals infrastructure and coinage technology.

New Developments in Ordinals

Bitcoin transactions, especially those involving ordinals, have greatly benefited from previous protocol-level upgrades such as SegWit, which reduced the transaction weight and therefore the overall fees for these transactions. However, SegWit was not originally designed for ordinals, and neither was Taproot (the Bitcoin upgrade that made the creation of ordinals possible). The existence and spread of ordinals on Bitcoin became possible for unexpected reasons, but since their creation earlier this year, the Bitcoin development community has now come together to intentionally support such activities by building tools centered around ordinals. (For a deeper discussion of the factors that led to the creation of ordinals and their impact on Bitcoin development, see the report from March 2023.)

This section of the report will focus on the new technologies being developed on Bitcoin to facilitate the growth and maturation of the ordinals market.

Recursion

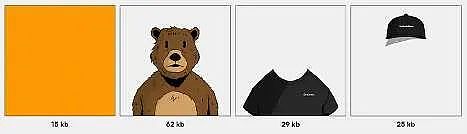

In June 2023, major Ordinals block explorers were upgraded to enable recursive inscriptions and added support for JavaScript and CSS file types. Recursion allows users to link one inscription to another using the /content/ format. Through recursion, users can add JavaScript and CSS libraries to create rich HTML files directly on Bitcoin. One of the best examples of the benefits of recursion is provided by the OrdinalsBot team, which we will describe below:

Example of recursive ordinals. Source: OrdinalsBot

If each layer above were engraved into a single image, the file size would be 250 kb before any compression techniques are applied. Assuming a collection size of 10,000 pieces and an engraving fee of 10 sat/vybte, the cost would be approximately 1.8 million dollars.

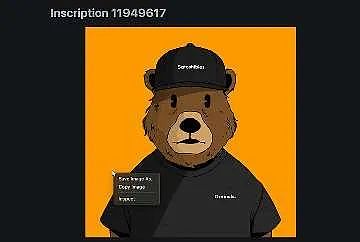

HTML ordinals can be created through recursion. Engravers can use JavaScript to create graphics using the HTML canvas element, as shown in the image below:

HTML <canvas> element used for creating graphics with JavaScript. Source: OrdinalsBot

Then, recursion can be used to reference the JavaScript logic that has been written, which can significantly reduce the use of block space and reduce the associated costs of generating the final image.

This process is operated through a comprehensive script that includes a single drawing function. The function takes a canvas element and a series of ordinal links to coordinate the loading of all image layers.

Therefore, it facilitates the seamless creation of the canvas, ensuring that only the complete image is rendered rather than gradually loading individual layers, providing a simplified and more cost-effective visualization process.

The final recursive ordinal. Source: OrdinalsBot

The final result is a complete image that can be resized or saved like a normal image. Compared to 250,000 bytes, the final HTML ordinals are only 621 bytes, but the image can still be viewed at full size or at a resolution of 250,000 bytes.

Assuming a collection size of 10,000 blocks, the recursive process can save 99.7% of the total size (6.21 MB compared to 2.5 GB).

Assuming a fee rate of 10 sats/vByte, the total cost of minting the collection is approximately $12,000, compared to $1.8 million if minted separately without recursion.

In summary, recursion can be used as a compression technique to allow for larger collection sizes and reduce minting costs. Through recursion, collections can record the attributes that generate or create PFP collections as their own separate layers and use recursive calls to generate the file image from these separate layers. The other three main benefits of recursion are:

Creators can exceed the 4 MB block size limit. By leveraging recursion, complex digital artifacts can be assembled to reflect the process of piecing together a puzzle. Initially, the individual components (similar to puzzle pieces) are minted separately. Subsequently, the final ordinals integrate these different elements, synthesizing them into a cohesive and singular image, thus presenting a unified visual from segmented ordinals.

Recursion enables composability, unlocking various use cases. One of the major benefits of the composability provided by recursion is the ability to conduct on-chain art display processes. Onchain Monkey (OCM) Dimensions is the first series to be exhibited on-chain. Another use case unlocked by recursion is the ability to conduct open edition and limited edition prints. Gamma recently released “Prints,” which they labeled as a new version. Prints are achieved by utilizing recursion, with artists inscribing on a high-resolution original artwork, and then Gamma creates packaging for creating digital versions.

By embedding the print number directly into the digital asset, the version number of the print can also be viewed on any display. Other features include conducting on-chain lotteries and utilizing the ability of the on-chain minted code library. The Onchain Monkey team has included the p5.js and Three.js libraries, which allows them to create their own Dimensions digital artifact collections. Users are also starting to incorporate more advanced libraries, such as react.js and Animate.css.

Recursion makes it more feasible to create games directly on Bitcoin. Developers can write in popular game libraries and create more complex native on-chain 3D games by referencing these libraries through recursion.

To a certain extent, ordinals have the ability to transform the Bitcoin block space into a global hard drive, and recursion effectively optimizes storage and data, making it cheaper and more composable, thus expanding the possibilities and design space. The market and browser are equivalent to web browsers, used to explore and experience content on the Bitcoin blockchain. As more and more people write code into Bitcoin, these code libraries can be referenced, making it easier for all creators to build more immersive experiences and artworks. Ordinals collector Jokie88 has launched a GitHub repository that tracks a list of all code libraries recorded so far. The list currently includes 40 different libraries that can be referenced recursively.

Re-Engraving

Re-engraving allows users to engrave multiple pieces of data onto the same satoshi (the smallest unit of Bitcoin). In order to re-allocate a satoshi, the user needs to own it, so artists cannot re-allocate the satoshi containing their artwork after it is sold. Re-engraving was launched in the Ord client version 0.9.0 released on September 11, 2023. It should be clarified that re-engraving does not affect the immutability of ordinals. Re-engraving does not overwrite or delete previously engraved data on the satoshi, but creates an array of data. All data re-recorded on the satoshi appears in chronological order.

The five main benefits of re-engraving are:

All recursive elements contained in a single satoshi: Re-engraving combined with recursion allows individuals to engrave all recursive elements on the same satoshi, creating larger and more complex digital artifacts.

Version control technology: Re-engraving can be used to upgrade or version control code libraries or other on-chain applications.

Reduced risk of fungibility issues: While ordinals have minimized the risk of fungibility for Satoshi, re-engraving further reduces this risk as multiple assets can be stored on a single satoshi.

New metadata and storytelling opportunities: Through re-engraving, artists can effectively create entire art galleries or series on a single satoshi. Artists can also use re-engraving to create dynamic or living artworks. For example, re-engraving can be used as a better way to engrave books, where each page can be engraved on a single satoshi and then viewed in chronological order through a browser.

Re-engraving also provides a mechanism to execute proof of ownership for all buyers: After purchasing an engraving, collectors can re-write the text file with their own name and then sell it to a new owner to show the history of the art collector.

Envelope

On August 28th, Ordinals trading platform Ordinalhub released a blog post detailing envelopes and why they are beneficial to ordinals and Bitcoin experiments. Envelopes help indexers analyze witness data on Bitcoin and determine if there are ordinals in the witness data and which data constitutes the ordinals. Envelopes achieve this by using a series of data pushes, with each data push not exceeding 520 bytes. The first data push is “OP_Push ord,” which indicates that the following is a segment of ordinals in the envelope. The indexer looks for this string to identify if ordinals exist in the witness data. One of the use cases for envelopes explained in the Ordinal Hub post is the ability to create dedicated tools for tracking BRC-20 type tokens. Envelopes open up the design space for Bitcoin data storage.

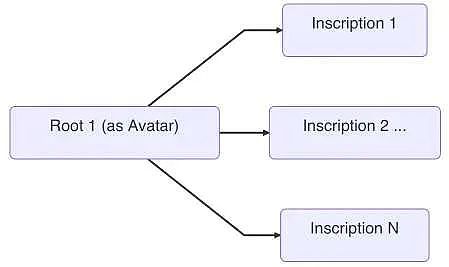

Parent-Child Ordinals

Parent-child ordinals are a way to enhance the provenance guarantee of ordinals. Provenance refers to the ownership history, creator, and creation time of artworks. Determining provenance is crucial for verifying the authenticity of artworks. The authenticity of NFTs on Ethereum and other general-purpose blockchains is determined through accounts and smart contracts. The source is determined by the wallet address that deploys the issuing smart contract. However, Bitcoin does not use an account-based model, making the Ethereum-based traceability approach impractical.

The creator of Ordinals, Casey Roadamor, did not associate the provenance with a Bitcoin wallet address, which includes privacy considerations and lack of customization. Instead, he envisioned the concept of root ordinals, which would serve as avatars or logos for future works. Root ordinals are the “parents,” and future ordinals, known as “children,” can be linked back to the parents. In practice, it works by using the sum of the root ordinal as the input for revealing transactions. When the outputs created by the submitted transaction are spent, it displays the ordinal content on the chain, which is called a display transaction. This creates a lineage tree, as shown in the figure below:

Simple design of parent-child ordinals Source: Medium, Cypherpork

The pull request for the Parent-Child Ordinals standard was merged into the Ordinals client in September 2023 and is currently in operation.

Rare and Unique Satoshis

Many collectors want to engrave their artworks on satellites that have a certain level of rarity or uniqueness. Mining pools have also noticed people’s interest in “rare” satoshis. The mining pools Luxor, F2Pool, and Binance Pool, which account for about 50% of the total hash rate, are separating rare resources from the block rewards they receive. In the past few months, rare bitcoin markets have also emerged, making it easier for speculators and artists to acquire and trade these bitcoins. Some well-known markets include Magisat, Danny Deezy’s Sat Dispenser, and Lumisat. NFT markets and Ordinals explorers (such as Magic Eden and Ord.io) also embrace the popularity of the concept of rare satoshis, allowing users to sort and filter ordinals by rarity.

Here are some common examples of rare satellite groupings and methods:

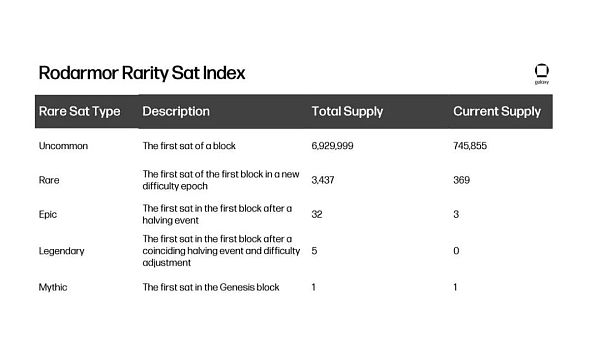

Rodamor Rarity Index. The Rodamor Rarity Index is a method created by Casey Rodamor, the creator of the Ordinals client, to identify rare satoshis.

Block 9 – Satoshi Sats. Block 9 satoshis are the oldest satoshis in circulation, mined by Satoshi Nakamoto and sent to Hal Finney in the first-ever bitcoin transaction. From a quantity perspective, the satoshis from Block 9 are not necessarily rare, as that block has 50 billion satoshis. It is currently unclear how many satoshis from this early block are still in circulation, as many complete bitcoins from these early blocks are believed to be lost or dormant, locked away in wallets whose owners can no longer access their private keys. Due to its historical and cultural significance, Block 9 satoshis are highly sought after. Some popular series engraved on Block 9 satoshis include Ordinal Maxi Biz (OMB) Green Eyes and Timechain Collectibles Series 2.

Block 78 – Hal Finney. Block 78 is the first Bitcoin block mined by someone other than Satoshi Nakamoto. Block 78 was mined by the renowned cryptographer and advocate for digital privacy, Hal Finney. In terms of quantity, block 78 may not necessarily be rare, just like block 9, because it contains 50 billion satoshis. Similarly, the circulating supply of these satoshis is still unclear. Due to their history and connection to Hal Finney, these satoshis are highly sought after. Some popular collections engraved on Block 78 Sats include Onchain Monkey (OCM) Dimensions and Ordinal Maxi Biz (OMB) Blue Eyes.

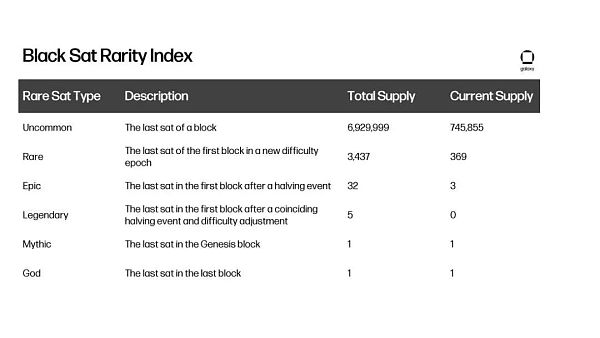

Black Sats – The last satoshi in a block. Black sats follow the Rodamor Rarity Index and are not the first satoshi in a block, but rather the last one minted within a block. The concept of black sats was created by @blackxbtx.

Palindrome Sats. Palindrome sats refer to satoshis that read the same forwards and backwards. There are approximately 9 billion palindrome sats, accounting for 0.0000043% of the total supply. Some popular collections engraved on palindrome sats include Geo Ordinals and LianGuailindromes.

Satoshi Names. Ordinals have various representations, such as integer notation, decimal notation, degree notation, percentile notation, and names. The most common representation is integer notation, which assigns satoshis based on their mining order. Recently, people have started to experiment and explore different representations of satoshi names. Bitcoin developer and engraver Danny Deezy launched his Satoshi Cards series, pushing the boundaries of satoshi name elements. The Satoshi Cards collection is a set of transaction card-style artworks engraved with human-readable words or phrases on satoshis.

The Ethereum Satoshi Card features Satoshi Nakamoto’s name “deepdarkweb”. Source: Ordinals.com

The Ethereum Satoshi Card features Satoshi Nakamoto’s name “deepdarkweb”. Source: Ordinals.com

Conclusion

Bitcoin is one of the top three blockchains for NFT minting and trading activities, trailing only Ethereum and Solana. By the end of 2023, the trading volume of Ordinals, including BRC-20, is projected to accumulate around $725 million. The adoption and value growth of Ordinals in recent months have been supported by new developments and tools in the Ordinals ecosystem.

One of the most exciting innovations of Ordinals is recursive ordinals, which provides a new framework for NFT creators to expand their digital collections in an economically efficient manner. New collections and file types on Bitcoin may emerge from recursive ordinals. In addition to recursion, techniques such as envelopes and parent-child ordinals are redefining how indexing and proving the origin of ordinals are done.

Part of the reason for the backlog of transactions in the mempool is the ongoing minting activities of Ordinals, which may exacerbate fluctuations in transaction fees. This could be positive for miners, especially with Bitcoin’s halving approaching, and may encourage crypto wallets and exchanges to adopt more sophisticated fee estimation strategies. Miners and mining pools are also embracing ordinals by collecting and selling rare sats.

Ordinals is driving Bitcoin into an unprecedented era of revolutionary innovation, giving birth to various new products that harness the untapped computational potential of blockchain. Looking ahead, the development path of Ordinals is not only full of hope, but also the maturation of infrastructure and the rising adoption rate point us in the right direction. This sustained momentum confirms the notion that Ordinals is not a fleeting trend, but a permanent fixture in the realm of blockchain-based digital collectibles.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understanding the Current Status and Future Development Direction of Blockchain Data Business with One Article

- NDV Practical Insights Profit and Cost Analysis of BTC Mining Industry

- Calls for the adoption of cryptocurrencies are rising in sub-Saharan Africa.

- Galaxy Digital Bitcoin Ordinals Protocol Research Report Important Data, Impact on Bitcoin, and Latest Developments

- Andrew Kang Cryptocurrency and stock market correlation has dropped to a low level and will continue to stay that way.

- LianGuai Observation | Explaining why Hong Kong can become the engine of the East Asian Web3 market

- LianGuai Morning News | The supply of Bitcoin on exchanges has decreased from 5.99% since September 1st to 5.73%.