Token issuance of Sui’s ecological project faced setbacks including token unlocking delay and team unlocking, resulting in a difficult start.

Sui's ecological project had a difficult start due to setbacks in token issuance, including delays in token and team unlocking.Public chains have always led the narrative of blockchain. After Facebook’s Libra project was halted, two new public chains, Aptos and Sui, which are also based on the Move language, have attracted wide attention from the market. The billions of dollars in primary market valuations during the bear market, hourly rates of up to $1,200 for Move language developers, and generous airdrops and almost gift-like whitelist IEOs all prove the attractiveness of Aptos and Sui.

However, when Aptos went online, its ecosystem appeared to be lacking. Sui had high hopes before its mainnet launch, but with the launch of the first batch of projects, the heat of the ecosystem did not continue, and even extinguished the enthusiasm of many users.

Cetus price and TVL fall by 30%, first LaunchBlockingd project Suia breaks

Cetus is a representative decentralized exchange (DEX) in the Sui ecosystem, which was selected as the second round of developer funding projects for Sui, and the seed round was invested by OKX Ventures, KuCoin Ventures, Jump Crypto, Animoca Ventures, etc. Cetus has the function of concentrating liquidity of Uniswap V3. Before the IDO, there was already more than $20 million in liquidity. At the same time, Cetus also has a LaunchBlockingd platform, which can participate in IDO with $SUI or $CETUS.

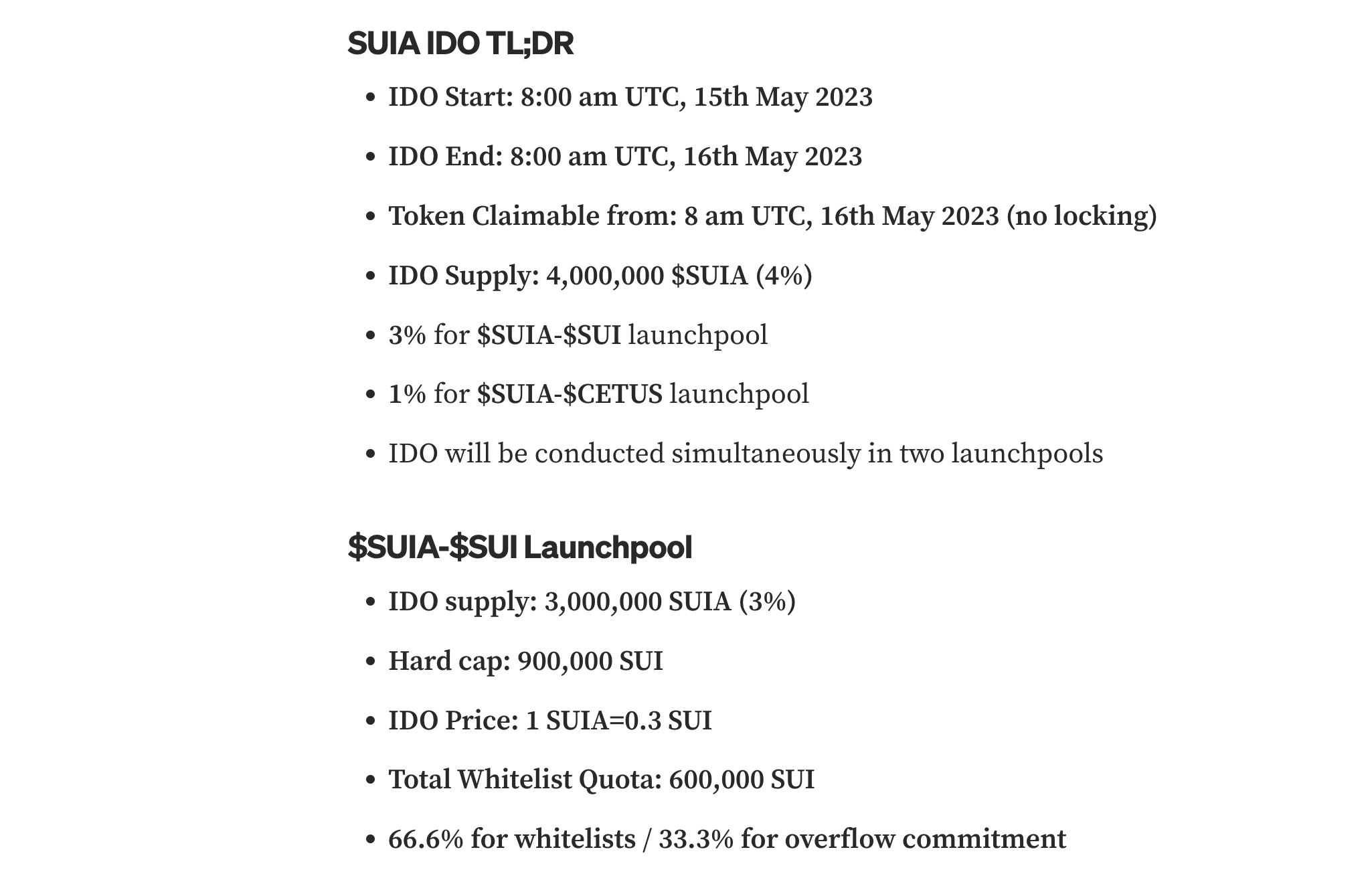

The first bucket of cold water poured on the Sui ecosystem was Suia’s IDO. As the first IDO project on Cetus other than its own platform currency $CETUS, considering that $CETUS was oversubscribed by 135 times and rose by about 3 times, even if Suia did not have public Telegram and Discord community information, this IDO was also highly concerned. As expected, Cetus users actively participated in Suia’s IDO. In the pools with a hard cap for Sui and Cetus, the participation funds were 44.76 times and 18.95 times the hard cap, respectively, and the excess participation funds would be refunded to users.

- Listing 10 low-market cap LSD-fi projects:

- The absurdity in the Meme season: me, Ben.eth, sending money

- NFT as a wallet: What innovations will the new standard ERC-6551 bring to NFTs?

However, unlike the popularity in DEX, $SUIA fell below the IDO price in Cetus within minutes after it was listed on centralized exchanges such as Kucoin, and at this time, the tokens of IDO users could not be collected yet. Subsequently, the Cetus community was filled with information such as Suia project fraud and Rug, even though Cetus opened liquidity mining for the CETUS-SUIA and SUI-SUIA two trading pairs. However, $SUIA’s price fell by 50% below the IDO price after it was listed for trading on the first day.

As a result, the price of $CETUS was affected. According to official website data, a total of 47.39 million $CETUS participated in this IDO, while according to CoinGecko’s data, only 80 million $CETUS were in circulation, with a participation rate of more than 50%. Many users held $CETUS with the intention of participating in the IDO. When there was no money-making effect in the IDO and the $CETUS held would also fall, more and more users began to sell $CETUS. As a result, the price of $CETUS fell by 10% in a little over an hour after it was redeemable and fell by a total of 30% over the next two days. TVL on Cetus fell from $30 million before IDO to $21 million, a 30% drop.

Questioning the delay in Cetus IDO redemption

Unlike the hot situation of oversubscription on the DEX, $SUIA was listed on centralized exchanges such as Kucoin immediately after the IDO and fell below the IDO price within a few minutes. Users holding large amounts of Sui and Cetus tokens on-chain can only get a small amount of chips, while users on centralized exchanges can directly buy at a cheaper price, creating a strong contrast between the two.

According to Cetus’ rules, the $SUIA tokens should be claimable immediately after the IDO. However, in the case where the price has already fallen below the issue price, $SUIA on Cetus was delayed for half an hour before it could be claimed, and $SUI and $CETUS participating in the IDO could not be redeemed directly, which also caused strong doubts in the community. Some people believe that the Cetus team deliberately prevented IDO users from claiming tokens, allowing Cetus, Suia team and other stakeholders to sell on centralized exchanges first.

Cetus team’s response to this is “due to overload, time is needed for calculation”, but not many users believe it. After that, the Cetus team said that the Telegram group was deleted because of “systematic violation of community rules”, and the Discord chat was set to slow mode.

Turbos and BlueMove’s IDOs also fell below the issue price

Similar to Cetus, Turbos Finance is also a DEX with centralized liquidity features and a LaunchBlockingd platform. Turbos is invested by Jump Crypto and Mysten Labs, and in the absence of top-tier institutional investment in Sui ecology projects, Turbos and Cetus, with the current investment lineup, have the background strength to become the head projects in the Sui ecology.

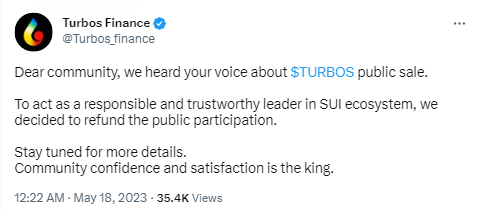

However, Turbos’ IDO performance was also poor, with an IDO price of about $0.0055, which had fallen to $0.004 by May 18. The community questioned whether the team had unlocked a large number of tokens after the IDO, and the Turbos team also said on May 18 that they would refund the funds raised in the IDO.

IDOs with similar performances are not uncommon in Sui ecology projects, such as Alpha Sui’s IDO on another DEX BlueMove, where community users claim that the project also has no Telegram and Discord, and $ALPHA tokens fell 70% after the IDO was completed for 1 minute.

Sui’s ecological development is not going well, and the reason is the general difficulties in project development

Based on experience from the past few years, DEX may become the highest valued project on public chains. If the valuation of DEX is low, the ceiling for other projects on public chains will not be too high either. Currently, the performance of Cetus, Turbos, and Suia’s IDO project is not optimistic, and there may be several reasons for this.

There are too many new public chains, and it is difficult for the ecology to develop. Whether it is the EVM chains launched by Filecoin and EOS in the near future, or Aptos, Sui’s competitor that has already been launched, there are no representative projects in the ecosystem, and there are multiple projects that have run away. The high valuations of public chains and the rare use of ecological projects form a contrast, like the “ghost towns” with high vacancy rates that appear everywhere after the construction boom of urbanization.

In contrast to the previous market rate, DeFi projects without profit expectations are no longer favored. In the absence of functional innovation, the threshold for the DeFi track is not high, and the competition is fierce. For example, there were multiple DEXs on Arbitrum that attracted hundreds of millions of dollars in TVL in a short period of time, but they were quickly forgotten by everyone. The project itself has no core competitiveness.

The team’s token unlocking arrangement is inappropriate. Based on the situation of tens or even hundreds of times over-raising on the chain, IDOs in DEXs are still popular, while centralized exchanges have greater selling pressure, creating a contrast between the two. Suia’s document shows that the $SUIA tokens allocated to the team, early contributors, and the community will be linearly unlocked from the beginning. Similarly, Turbos was also questioned about the team unlocking a large number of tokens. In other projects, team tokens may not be unlocked when they go online.

Liquidity concentration is not omnipotent. Liquidity concentration is conducive to improving capital efficiency, and only a small amount of funds can form a large amount of liquidity near the transaction price. Both Cetus and Turbos have liquidity concentration functions, but compared with Ethereum, the volatility of tokens such as $SUI, $CETUS, and $SUIA traded in the Sui ecosystem is greater than that of mainstream coins on Ethereum. According to the situation in the SUI/CETUS trading pair, a small amount of liquidity is concentrated near the trading price, and this part of the funds may be provided by professional liquidity providers and adjusted when the price fluctuates. In this situation, other liquidity providers can only serve as followers, bearing greater impermanent losses and unable to obtain higher returns. With the opening of liquidity mining incentives, the TVLs on Cetus and Turbos are only $20 million and $6 million respectively, and more than half of them are stablecoin trading pairs such as USDT/USDC.

In the development of public chains, developers, ecosystems, and users are the three pillars, and each link is indispensable. A negative cycle can occur if any of the three is weak. For a new public chain, users are the weakest link. Projects can be obtained through grants, but the stickiness of users needs to be cultivated for a long time. For new public chains like Sui, this is just the first step on a long journey.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Where’s the next opportunity? A review of the potential projects that will issue tokens on the Sui blockchain.

- Overview of Bitcoin DeFi ecosystem projects

- Project Research | Aptos In-Depth Study Report on MOVE’s New Public Chain

- MEV vs. Flashbots: A Story of Natural Rivals and the Delicate Balance of Building DeFi Systems

- From Wealth Effect to Organic Growth: Revealing the Secrets to the Success of High-Quality Cryptocurrency Projects

- HyperCycle: An innovative blockchain architecture for AI algorithm data

- Project Research | Canvas: Focused on DeFi, Layer2 Protocol Based on StareWare ZK Rollups