Reflections on the Game Marketplace, Asset Valuation Dimensions, Metaverse Interactions, and AI Games Triggered by the Treasure Trove

Thoughts on Game Marketplace, Asset Valuation, Metaverse Interactions, and AI Games Triggered by the Treasure Trove.Author: aiko, Source: substack

This is a very ordinary Sunday. I have about two research projects going on at the same time, one is a research report for the company, and the other is AI research. In order to find more inspiration and materials, I spent about two hours browsing the NetEase Treasure House. I have some insights to share, and writing a lot of words is like writing an article, so I plan to post it here.

This article will be divided into two parts:

1) Overview of the differences between web3 game marketplaces and the Treasure House, and suggestions for what a game asset marketplace should look like.

- Are cryptocurrencies, as legal assets, subject to taxation in mainland China?

- Can Bitcoin miners successfully transition to artificial intelligence and perfectly catch the next wave?

- August Cryptocurrency Market Summary Most indicators further corrected, and the total on-chain transaction volume decreased by 6.3% after adjustment.

2) Exploring the concept of “meta-economic interaction” and extending it to the field of AI + games.

Inspiration from the Treasure House for game marketplaces

I am particularly interested in transaction taxes, and even the company’s previous deck specifically explained “IAT” (In-app Taxation) as a new business model, but I have never written about a game vertical marketplace. In fact, I am skeptical of the possibility of such a platform created by a third party with only a simple game asset aggregation function being established in the past, present, and near future.

However, the research on the Treasure House once again validated my previous thoughts: the means of centralized marketplaces and the high-frequency and zero-fee nature pursued by decentralized exchanges are fundamentally contradictory.

1) As a first-party self-operated platform, the value of all game assets in the Treasure House is supported by the DAU (Daily Active Users) and transaction volume behind it. It can be seen that the first step for a marketplace to have demand is to ensure that the assets have a wide audience and are willing to pay a premium.

2) Customization features do not work well in the hotspots of web3 migration. Customized marketplaces are meant to accumulate user data, such as player preferences, player needs, etc. It requires stable and long-term operation of games to make customization efforts. However, ROI-driven web3 game hotspots may not be able to keep up with the speed of hotspot shifts in customization.

The level of customization in the Treasure House is extremely high. Each game has its own market and special operations, with similar display interface functions, but different lottery/special activities/authentication/special price zones/servers/seasons. In a specific game, there will be a shopping assistant guiding you to choose races-characters-budgets step by step. Only long-term operating projects can truly understand what their players need in order to customize better.

3) The platform’s revenue and user experience come from inconvenience to convenience, and from low turnover to high turnover. 0 transaction fees and high liquidity have no benefits for platform revenue and stable asset prices.

Players familiar with NFTs may understand how the emergence of Sudo swap and Blur in the past year deeply influenced the NFT market. 0 transaction fees and batch transactions undermined the foundation of NFT as a luxury item/belief. Witnessing big players smashing dozens of monkeys with their own hands made some holders doubt the meaning of community belief in such capital operations.

In our previous two decks, we discussed how to increase transaction friction to increase the spread. The Marketplace also has many similar designs, such as the Instant Trade service: it can shorten the original 4-day review time to 0 days, and shorten the secondary transaction time from 8 days to 0 days. This service will charge sellers a 4% commission fee. In the Marketplace, both sellers and buyers need to pay fees, and there are also services that facilitate buyers, such as pre-ordering during the public notice period, which allows buyers to subscribe to game assets in advance, and buyers need to pay a 5% reservation fee.

4) Satisfying human nature through gamified mechanism design is part of the Marketplace delivery.

Many web3 NFT marketplaces focus on transaction forms and matching efficiency, and games are no exception. However, creating a marketplace for game assets with crypto asset thinking obviously ignores the strong demand for gamified selling activities in games themselves.

Some games in the Marketplace have arranged for bidding lottery systems, where the probability of winning increases with the bid, which is also a game that allows users to play with expected values. It is speculated that due to regulations, this mechanism cannot openly exist in the game, but it makes sense to move it to the trading market. It not only increases the frequency of user transactions but also improves the platform’s profitability.

In fact, there have been suggestions for adding various gamified features to NFT trading markets, such as Taobao’s fruit garden or lottery, but so far, no major trading market has adopted them. Only Rollbit has embedded the opening of NFT boxes as a unique gameplay unit of crypto assets in its own casino, which is precisely the opportunity for emerging gamified marketplaces.

5) If there is no demand, artificially increase the demand. The difference between the fifth point and the third point is that the third point can be achieved solely by the platform’s trading rules, but the fifth point emphasizes the human factor. When there is a need, a group of people can be found to support a new trading scenario.

For example, in the Marketplace, there is an appraisal activity, which is when the platform finds a group of authoritative players in the game ecosystem to act as appraisers and pays them to appraise the items listed for sale. This can speed up the selling process for appraised items. These appraisers can be seen as cost calculation experts who help sellers assess asset prices and provide certification. It is expected that the platform will also provide more exposure and display advantages for items listed by appraisers. The fees paid by sellers to the appraisers will definitely be deducted by the platform, and this money is similar to advertising fees for content. By finding a group of people called appraisers to serve as a buffer, the platform makes this fee appear more reasonable and gentle.

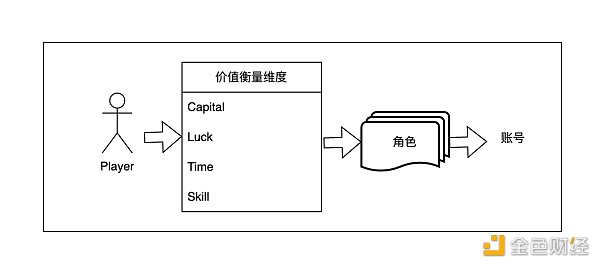

Before understanding “meteconomical interaction,” we need to establish a new “value measurement dimension” for game assets.

Before understanding “meteconomical interaction,” we need to establish a new “value measurement dimension” for game assets.

First, it was the assets traded in the Treasure Trove that got me thinking:

The goods traded in the Treasure Trove are mostly “big-ticket items”, where the transaction is often an account that includes multiple roles and role skins.

It can be seen that the transactions in the Treasure Trove are no longer just a single “asset”, but rather an experience. For games with rich layered experiences, a weapon or an equipment may enhance power, but it cannot fundamentally change the game experience. Why do people always choose different roles and play them multiple times in a game? It’s because the most valuable thing is the role and account that can provide a fundamentally new experience. Buying an account means being able to experience the progress in that account, like a life restart simulator, experiencing what it’s like to be a pro player.

In the deck we released in February, we also mentioned the importance of personal progression. In April this year, we happened to talk about a team that allows players to package the progression of game characters into NFTs for sale, including unlocking skills and skins for the characters. Unfortunately, we haven’t seen such interesting designs for a long time.

How can those who are obsessed with asset units (such as 1155, 6551, and other protocols) understand the tricks? It’s not important how you divide the assets or whether they can be packaged. Whether it’s a wear-and-tear sword or a grain of sand, these are not important; what’s important is identifying the “datasets” that can create a sense of value and recognition for players, and selecting these “datasets” as assets to put on the chain.

Furthermore, why are “big-ticket” assets more important than “fragmented” assets? Because they contain multiple dimensions of value measurement.

Asset trading within the game can indeed be a kind of experience. Many web3 games currently promote the freedom of in-game asset trading, which is similar to popular minerals or military resources on a planet, as mentioned in my previous blog post (Game AMM) design. Let’s not talk about how many DAUs are needed to support the operation of such a trading system. Making transactions in this direction may risk losing the big picture for small gains.

In the subscription era, we used time (or pow) as a measure, focusing on the stability of in-game soft currency. For example, when we argued in the past that the economic system of Fantasy Westward Journey is more stable than that of World of Warcraft, we talked about Fantasy’s use of point cards, while WoW uses monthly cards. As a result, Fantasy can better stabilize the value of every type of asset in the game and control the inflation rate of gold coins (of course, there are many mechanisms worth learning from, I recommend reading Frost’s article, salute).

Nowadays, there aren’t many open-ended economic games, and there aren’t many players who pay close attention to the price of each individual item. Or, it can be said that players who used to care about the stability of item prices are completely different from players who now “splurge on a few 648s with rice”. F2P and Gacha have become mainstream, so the single value dimension of time (pow) can no longer support transactions, but rather it needs proof of capital + proof of luck + proof of work + proof of skill. In plain language, it means: I have money to spend, I can get lucky, and I can create multidimensional value for this account in the correct and efficient way.

In this complex dimension of value measurement, players can roughly calculate the cost of cultivating such an account, but bringing this account back into the game only results in basic resources and a period of gameplay experience. Even if it is to be sold, the price is basically equal to the original price plus the value converted from the amount spent by the new owner, while what the players earn is the saved cultivation time and a completely new experience, not any direct economic return. It is indeed a very good way of commercialization.

Moreover, this is actually a dimension of value measurement that gradually emerged after F2P. When the game becomes “no longer fair” and players can spend money to buy numerical values, these numerical values containing economic value, through randomness and strategy, ultimately have an effect on the account, forming a completely new asset that is more suitable for F2P-oriented player transactions. However, F2P Gocha has earned too much money, and everyone has turned to rolling art and industrial production capacity. No one has thought that the secondary market can be used for secondary commercialization and provide a vent for the accumulated value of characters.

Moreover, this is actually a dimension of value measurement that gradually emerged after F2P. When the game becomes “no longer fair” and players can spend money to buy numerical values, these numerical values containing economic value, through randomness and strategy, ultimately have an effect on the account, forming a completely new asset that is more suitable for F2P-oriented player transactions. However, F2P Gocha has earned too much money, and everyone has turned to rolling art and industrial production capacity. No one has thought that the secondary market can be used for secondary commercialization and provide a vent for the accumulated value of characters.

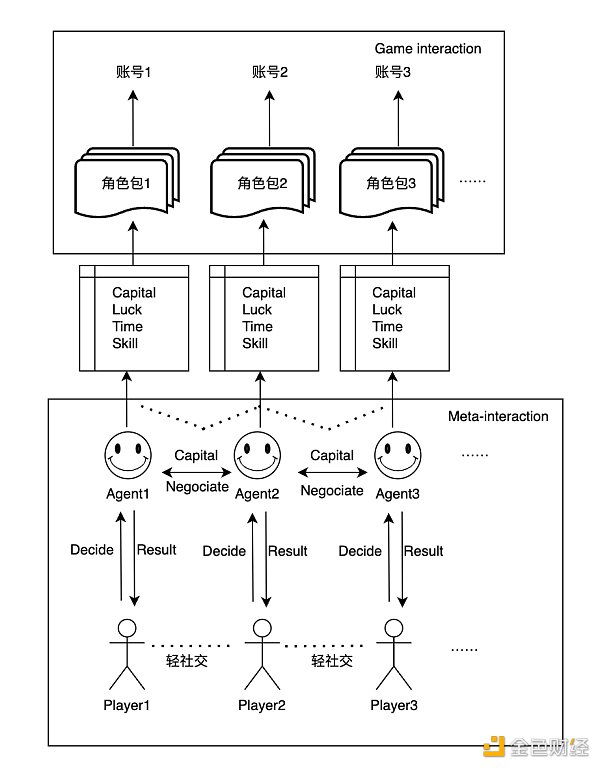

So, what is the interaction of the metaverse economy?

First of all, let’s assume a scenario: which one is more suitable as an experimental field for AI gaming, Rise of Nations or Civilization VI? (Without considering API interfaces and implementation difficulties)

Let’s start with the conclusion: Rise of Nations is better.

In Civilization VI, resources are obtained through player time and technology. In multiplayer mode, due to the limitations of LAN, participants are often friends in real life, and entertainment and polishing time are the main purposes. Therefore, there are many practices of verbal negotiation/threat, such as “Let me borrow it for a while”, “Give this to me” and other practices of exchanging resources for emotions. Secondly, the claimable diplomatic relations are limited and have a sense of distance. Countries can form friendly alliances, but cannot involve more complex and in-depth class relations, such as subordination and payment of taxes.

Rise of Nations, on the other hand, has two major features: 1) Warlord gacha system – In Rise of Nations, a large part of military strength and skills depend on warlords, which are obtained through paid gacha. This also makes the game itself have strong economic interaction. For example, giving red envelopes to regional leaders who submit every month, players will automatically calculate “the cost of initiating a war by drawing a warlord = the cost of paying salaries to 5 counties”. Therefore, there will be more economic interactions, and there are often off-game operations such as giving out red envelopes or paying salaries. 2) Alliance relationship – As a server-based mobile game with thousands of players, Rise of Nations has more subtle social designs compared to games like Civilization that mainly focus on single-player and LAN multiplayer. The seamless large map of Rise of Nations requires continuous land expeditions, and the paving of roads and bridges between allied alliances is particularly important. Alliances have resource allocation buff bonuses, and the siege gameplay also requires cooperation between players with different economic strengths and classes. Therefore, economic and territorial aspects are easily formed into tightly bound subsidiary relationships.

It can be seen that player payments have a significant impact on the dynamics and overall atmosphere of a multiplayer game, regardless of whether it is good or bad, it is a completely different experience.

Paying opens up a channel connecting the game to reality, and the player’s financial resources and luck in the real world greatly influence the game. In addition, apart from the conflicts within the game, there may also be numerous economic transactions and human interactions outside the game, which are difficult to quantify. Because assets are obtained by players through payment, the in-game values can reflect the player’s economic strength in the real world. This economic strength can be input into the game as numerical values, or used as bargaining chips to negotiate with other players and be transferred to their real lives, and then be input into the game as numerical values again via other players.

Speaking of this, we should have a picture in our minds to distinguish between game interaction and meta-economic interaction.

Furthermore, what interesting use cases are there for meta-interaction?

——AI agent meta-interaction

Imagine, based on the value measurement standards we just defined, what can AI participate in?

-

Capital (optimize capital utilization & strategies outside the game)

-

Time (save player time)

-

Skill (in-game strategies)

Now AI already has the ability to bid/negotiate, so in the entire economic interaction system, if AI replaces humans in managing in-game interactions and interactions with other players outside the game; and if each player has an agent that can communicate with other agents and negotiate conditions/bargain together, wouldn’t that be fun?

Imagine the following scenarios:

Imagine the following scenarios:

1) Each player has an initial agent with the same game strategy and negotiation ability;

2) Players need to allocate funds to the agent to carry out operations such as bribery/buying other agents;

3) The agent returns optional strategies to the player every 6 hours, and after the player selects the optimal strategy, the agent executes it;

4) The agent can learn the player’s risk preferences from each strategy selection, and optimize the next strategy (for example, whether to continue bidding to buy other agents, whether to increase troops when there is a certain amount of resources/reserves, etc.);

5) Of course, a player can have more than one agent and independently train multiple agents to cooperate, for example, a diplomatic agent and a tactical agent. It may be possible to have a diplomatic agent who can handle negotiations with other countries without spending any money or troops.

6) At this point, the agent can become a presence with a “persona”, with appearance, voice, and personality, and the player who trains this agent can receive a share of the agent’s commercialization.

In this way, the gaming experience that used to be similar to a large-scale multiplayer game that heavily relied on off-game social interactions 24/7 can now become a experience of idle play and light social interactions (similar to single-player games). Additionally, agents can also exist as “virtual characters” in similar to 2D games, becoming the player’s main interaction object, and can even be commercialized as new game content.

Finally, why do we find AI games involving meta-economic interactions interesting?

Perhaps it’s because we have been studying incentive mechanisms in the crypto field for too long, or perhaps it’s influenced by zkml, believing that future AI natives can manage users’ assets for financial activities. Maybe it’s because we are not interested in the generative/passive interaction between intelligent agents and humans after playing “Dwarf Fortress”. Maybe it’s because we are obsessed with the idea that games are interactive art. I always feel that the current AI+game interactivity is far from enough.

It is undeniable that almost all AI+games currently only test the extent to which AI can imitate human behavior. Dota trains AI in micro-operations, Minecraft tests AI’s understanding of the physical world, and Stanford Town simulates AI’s understanding of human behavior and emotions. So why hasn’t AI simulated human economic behavior been included in game experiments?

No matter what era it is, games need to cater to human nature. Can watching the daily behavior of AI be considered as satisfying our voyeuristic desires? How long can this satisfaction last and how entertaining is it? Can it compare to the visual and auditory experience brought by graphics cards and VR? Can it compare to the adrenaline and dopamine released when opening a loot box? Can it compare to the satisfaction of vanity when dominating others in the entire server? If not, how can AI be used to create games that better cater to human nature and stimulate human pleasure points? That’s what I find interesting.

In addition, I have been thinking about and researching the role of AI in narrative games. This is some insight I gained after completing “The Wheel of the Universe Sisterhood” this week. I believe that narrative is one of the aspects where AI can greatly enhance the experience/differentiated experience.

Summary

There are actually three purposes for writing this article:

1) Review interesting mechanisms in the treasure trove. If there are teams designing marketplaces, they can learn from it. It also highlights some differences in feasibility and limitations between the treasure trove and web3 game-class trading markets.

2) Explain the new dimensions for measuring the value of game assets. With the development of F2P, players’ entertainment consumption habits have undergone significant changes. Instead of continuing to trade games based on the logic of the subscription era, it is better to change our mindset and explore other forms of asset trading, and identify the main value carriers and trading forms, such as trading a segment of a game experience (including accounts with multiple valuable characters).

3) If you are interested in the “meta-economic interaction” of AI+games mentioned at the end of the article and are also engaged in AI and game-related research, please feel free to contact me. We still have more research to do.

Afterword

It has been 7 months since the publication of the previous article on the fully on-chain game logic engine. The original intention was to encourage everyone to think beyond the framework of “physics engine” and consider factors such as “rules” and “contracts” that are non-physical but can interact with each other. In the past three or four months, 2-3 teams have been exploring this direction. Perhaps it’s just that everyone found that the original direction was not good enough and coincidentally changed direction. It’s not my credit, but it’s still a little joy for me as a researcher to be involved in it. I hope this article has a similar effect.

Nowadays, research always needs to be tied to other people and things. Any ideas need to be tempered, refined, and brewed before being released together at an important time. So not writing an article doesn’t mean I’ve stopped thinking. It’s just that an idea needs to take shape and the right people need to be found for discussion, and all of this takes time. Feel free to collide and contemplate together during the lengthy process of brewing an article, and feel free to chat anytime 😉 DM Twitter @0xAikoDai

This article took 7 hours to complete. The writing was rushed, and there are many subjective judgments that belong to me personally. They do not constitute any investment advice and I do not engage in any nitpicking or detail-oriented arguments.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Daily | The US SEC has postponed its decision on the Bitcoin spot ETF; UK cryptocurrency travel rules come into effect today.

- Steady profit from rebound? An article lists 4 volatile tokens with the best performance.

- Binance Research Emerging Stablecoins and an Overview of Market Competition

- LianGuai Morning News | SEC decides to postpone the registration of 7 Bitcoin ETFs including BlackRock

- Binance Research Report Emergence of New Types of Stablecoins, Overview of Market Competition Pattern

- Review of the Cryptocurrency Market Summer Trends Mixed Bullish and Bearish News, Doubts about the Sustainability of the Rise.

- Bitcoin Spot ETF Application Inventory When will it be approved?