From top mining companies to top crypto funds, Fidelity Mafia is becoming a talent incubator for Crypto.

Fidelity Mafia is a talent incubator for Crypto, attracting top mining companies and crypto funds.Original: “The ‘Fidelity Mafia’ Behind Big Crypto”

Author: Vicky Ge Huang, Wall Street Journal

Translation: Mia, Chaincatcher

Let’s look back at the entire digital asset industry, where some of the most prominent industry leaders have made their mark at Fidelity Investments.

- Reflections on the Game Marketplace, Asset Valuation Dimensions, Metaverse Interactions, and AI Games Triggered by the Treasure Trove

- Are cryptocurrencies, as legal assets, subject to taxation in mainland China?

- Can Bitcoin miners successfully transition to artificial intelligence and perfectly catch the next wave?

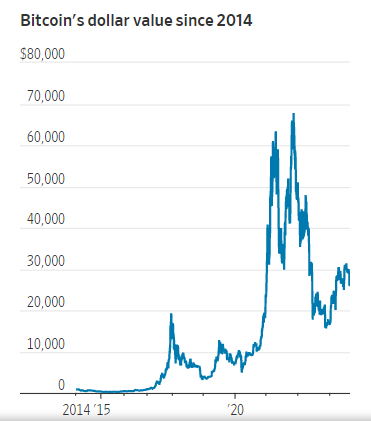

Fidelity, a well-known mutual fund giant, represents the cornerstone of the traditional financial system, while the founders of cryptocurrencies led by Bitcoin are planning to disrupt this system. However, in fact, this traditional financial giant with 77 years of history became a pioneer in the Bitcoin field as early as 2014, when it began mining Bitcoin when the price was around $400 and encouraged its employees to explore blockchain technology, develop new products, and launched its cryptocurrency division four years later.

Along the way, Fidelity has produced many talents for the cryptocurrency industry.

With the rapid expansion of the cryptocurrency industry, Fidelity has become more cautious after previously being open-minded, which has ultimately led to the departure of some early employees in the cryptocurrency industry.

And it turns out that this cautious attitude may also be a wise move. After a series of cryptocurrency company closures and the collapse of the cryptocurrency exchange FTX last year, regulatory authorities have started cracking down on the cryptocurrency industry. The U.S. Securities and Exchange Commission (SEC) recently filed lawsuits against two cryptocurrency exchange giants, Binance and Coinbase Global, for providing unregistered securities trading, among other reasons.

Although the price of Bitcoin rebounded in 2023, it still hovers around $26,000, far below the high point two years ago. Since the beginning of last year, the cryptocurrency industry has shrunk by tens of thousands of jobs. After industry leaders like Sam Bankman-Fried and others who were once considered the “future of crypto” fell, the future role of the cryptocurrency industry in the financial sector has come under question.

Fidelity’s cryptocurrency alumni include venture capitalists, research directors, and founders of startups. Just like PayPal’s “Mafia,” Fidelity’s cryptocurrency alumni jokingly call themselves the “Fidelity Mafia” and have since founded their own tech companies.

The “Fidelity Mafia” includes Alex Thorn, Research Director at Galaxy Digital, Juri Bulovic, Mining Director at Foundry, Matt Walsh, Founding Partner of Castle Island Ventures, and more than a dozen other members.

Alex Thorn, Research Director at Galaxy Digital, once said in a Telegram group he established with former colleagues, “Many of us have been working in the cryptocurrency field for a long time because Fidelity has been exploring the cryptocurrency field much longer than any other traditional financial company.”

Under the advocacy of Fidelity CEO Abby Johnson, Fidelity’s cryptocurrency plans have shifted towards hedge funds and other large investors trading and storing Bitcoin. Over the next few years, Fidelity’s cryptocurrency plans will also make it easier for retail investors to invest in cryptocurrencies, allow businesses to include Bitcoin in Fidelity retirement plans for employees, and provide most of its 43 million customers with the option to trade Bitcoin and Ethereum.

Alex Thorn said, “We did not cautiously engage with this ‘crazy’ cryptocurrency because of our background in traditional finance. On the contrary, we took a big step into the crypto field, which also attracted early crypto talent to Fidelity.”

Alex Thorn began his career as a junior analyst in Fidelity’s legal department in 2009. As an early believer in Bitcoin, he volunteered to help Fidelity with its initial cryptocurrency experiments, earning him the nickname “Bitcoin Viking” from Abby Johnson. He eventually became involved in managing a cryptocurrency venture capital firm under Fidelity.

Members of the “Fidelity Mafia” have expressed that it was Abby Johnson’s early commitment to Bitcoin that attracted them to join Fidelity.

Matt Walsh, co-founder of the cryptocurrency venture capital firm Castle Island Ventures, joined Fidelity after graduating in 2014. He stated that Abby Johnson urged individuals and institutions to have easier access to Bitcoin at a conference in 2017, which gave confidence to the development of Bitcoin. “At that time, Jamie Dimon believed that Bitcoin was a tulip bubble with no use, but Abby Johnson held the opposite view,” he said.

Despite the fact that Abby Johnson’s family owns 49% of Fidelity’s shares, she also faces resistance from both inside and outside the company when it comes to betting too much on cryptocurrency for the company’s future.

In a public speech last year, Abby Johnson revealed that she had proposed a plan in 2014 to spend $200,000 to purchase Bitcoin mining equipment from a Chinese supplier. However, the plan was rejected by Fidelity’s finance department and security department at the time. “I had to go to their offices and say, ‘Look, this is $200,000, we are doing this’,” she said.

Even today, some Fidelity executives still have doubts about whether cryptocurrency can reach mainstream customers. In 2018, Kathleen Murphy, then head of Fidelity’s personal investment business, said in an interview with the Dallas Business Journal that Fidelity’s cryptocurrency products would only be available to experienced investors due to regulatory concerns.

Members of the “Fidelity Mafia” expressed that Murphy’s remarks discouraged employees who focused on retail investors.

Last year, Fidelity also faced criticism for its expansion in the cryptocurrency field. Officials from the U.S. Department of Labor believed that Fidelity’s plan to allow investors to invest Bitcoin in their 401(k) accounts could threaten national retirement security. Fidelity countered and reiterated its commitment to digital assets as the future of finance.

Members of the “Fidelity Mafia” believe that Fidelity could have been more actively involved in the cryptocurrency business, but instead handed over custody business customers to Coinbase (which was established in 2012, two years earlier than Fidelity’s involvement in Bitcoin business). Some also said that Fidelity’s traditional asset management business prevented it from entering high-risk businesses in the absence of clear regulation.

The mining director of Bitcoin mining company Foundry, Juri Bulovic, said: “In hindsight, I believe Fidelity could have become a well-known cryptocurrency trading company like Coinbase today.” Juri Bulovic left Fidelity in 2021 after working for 8 years.

During the pandemic, it would be difficult for Fidelity to retain its cryptocurrency talent as companies focused on cryptocurrencies have a large amount of risk capital and are eager to hire knowledgeable employees.

Alex Thorn left Fidelity in 2021 and established a research department at billionaire Mike Novogratz’s cryptocurrency financial services company, Galaxy Digital. It is reported that Galaxy Digital focuses on trading, investment banking, asset management, and mining, and its asset management department currently manages over $2.4 billion in cryptocurrency assets.

Matt Walsh resigned from Fidelity in 2018 and embarked on his entrepreneurial journey. He founded the cryptocurrency venture capital firm Castle Island with the support of Fidelity, which currently manages approximately $360 million in cryptocurrency assets.

Today, Fidelity still sees cryptocurrencies as long-term growth opportunities and stores billions of dollars of client cryptocurrency assets. The number of employees in its cryptocurrency department has steadily increased from dozens in 2018 to over 600. Recently, Fidelity has also submitted an application for the first spot Bitcoin ETF. If approved by regulatory authorities, it will allow investors to easily trade Bitcoin through brokerage accounts, similar to buying and selling stocks.

The head of Fidelity’s cryptocurrency business, Tom Jessop, said: “We are working closely with various departments at Fidelity to develop a long-term digital asset strategy.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- August Cryptocurrency Market Summary Most indicators further corrected, and the total on-chain transaction volume decreased by 6.3% after adjustment.

- LianGuai Daily | The US SEC has postponed its decision on the Bitcoin spot ETF; UK cryptocurrency travel rules come into effect today.

- Steady profit from rebound? An article lists 4 volatile tokens with the best performance.

- Binance Research Emerging Stablecoins and an Overview of Market Competition

- LianGuai Morning News | SEC decides to postpone the registration of 7 Bitcoin ETFs including BlackRock

- Binance Research Report Emergence of New Types of Stablecoins, Overview of Market Competition Pattern

- Review of the Cryptocurrency Market Summer Trends Mixed Bullish and Bearish News, Doubts about the Sustainability of the Rise.