Explaining the Maverick protocol mechanism, which entered the top five in DEX after three months of release.

The Maverick protocol mechanism is now in the top five on DEX, just three months after its release.Author: Defi_Mochi, DeFi KOL; Translation: Blockingxiaozou

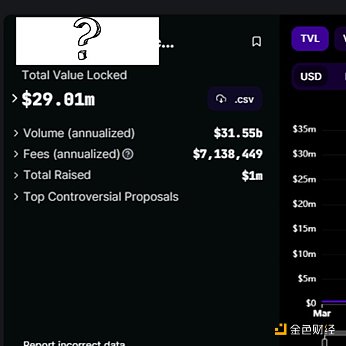

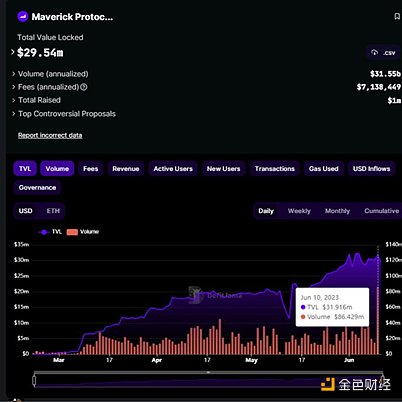

There is a protocol that, within just 3 months of its release, is expected to surpass 31 billion in DEX trading volume and earn $7 million in fees per year, and still has no token. This is the Maverick Protocol.

Let’s take a closer look.

- Binance US hires former chief of the US SEC enforcement division to lead defense

- Sequoia Capital leads investment, testnet goes live, Quick Guide to Taiko’s Layer2 Network Interaction

- Combining “Privacy Pools” and “Innocence Proofs”: How to effectively curb illegal activities while protecting privacy?

Since its upgrade in Shanghai, Maverick Protocol’s trading volume and fees have continued to grow month by month, with the highest trading volume and fees coming from LST (liquidity staking token) pools such as wstETH-ETH and ETH-USDC pools.

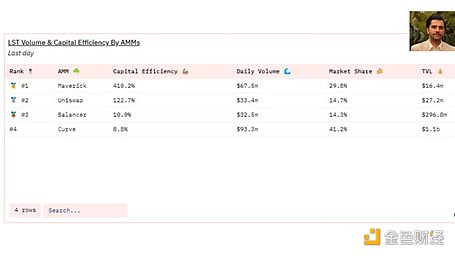

According to Murathan.eth’s LST-related analysis data, Maverick Protocol’s capital efficiency is absolutely impressive, ranking first at 412% (trading volume/total locked value). According to data from DefiLlama.com, its DEX trading volume ranks in the top five, even though Maverick Protocol is only online on Ethereum mainnet and zkSync. How did they achieve such outstanding performance? And how does Maverick Protocol operate?

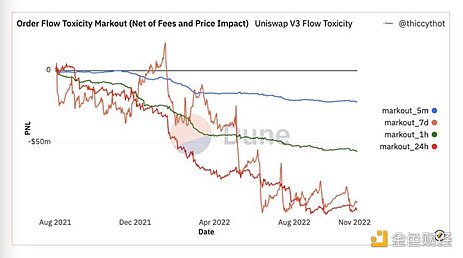

Current automated market makers (AMMs) clearly bet on the horizontal fluctuations of the market, that is, liquidity providers (LPs) will lose money when the market starts to rise and fall. This can be seen from Uniswap’s position-related data.

Maverick Protocol’s four models (tools running on top of Maverick’s native AMM) allow liquidity providers to concentrate liquidity automatically based on price changes, thereby making directional bets on prices to solve impermanent loss. These four models are Mode Right, Mode Left, Mode Both, and Mode static.

(1) Mode Right

Mode right adjusts the price range like this: providing liquidity when the price goes up, and not providing liquidity when the price goes down (bullish). This increases the fees earned by LPs when the price goes up.

(2) Mode Left

Mode left adjusts the price range like this: providing liquidity when the price goes down, but not providing liquidity when the price goes up (bearish). This increases the fees earned when the price goes down.

(3) Mode Both

Mode Both functions like a dynamic range order and provides liquidity close to the price of the fund pool. This mode is very suitable for stable coins and LST semi-stable coin pairs, as it earns more fees by approaching the fund pool price, but increases the risk of impermanent loss (sensitive to bidirectional price changes).

(4) Mode Static

Mode static increases liquidity without involving any liquidity transfer mechanisms and achieves custom liquidity arrangements with lower gas fees.

These 4 liquidity supply models of Maverick Protocol are the reason they can achieve rapid growth in TVL and fee revenue without tokens.

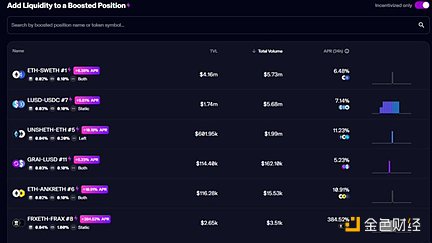

Maverick Protocol also boosts positions: allowing other users to buy the position and allowing the protocol to encourage users to increase liquidity in ETH or stable coins (or any token) by providing token incentives.

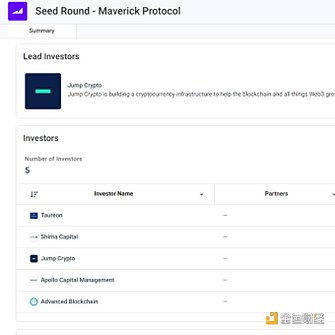

Maverick Protocol has raised $9 million from top investors, including Jump Crypto, which invested in its seed round. Jump Crypto itself is a market maker with a good understanding of liquidity and trading volume, so their investment in Maverick is worth noting.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ArkStream Capital: Nintendo or Steam? Analyzing the Development Path of Decentralized Gaming Platforms

- Rare sats: A system overview of rare sats. What are the types of rare sats and the search tools available?

- Overview of Flood architecture and use cases: How to solve the problems existing in current RPC system testing?

- What is the next step for the whales who have made more than 10x profit in Pendle?

- Detailed explanation of RWA DeFi protocol Ondo Finance, which raised $24 million in funding

- Disappeared “Chinese richest man”

- Experts Interpret What Will Happen Next with Binance and Coinbase