Twitter featured | DeFi locks up to 2.5 million Ethereum; Bakkt launches cash delivery contract next month

Cointelegraph reported that the "China's ban on bitcoin" FUD (fear, uncertainty and suspicion) was once again staged, Bitcoin suffered a plunge yesterday, the price returned to $7,500, erasing the October rise, "coin security Shanghai office was The rumor of the investigation may be the reason for the decline.

According to The Block, the office of the company in Shanghai was given by the police, and nearly 100 people were working inside.

- Hash rate changes hidden mystery, BTC bottom-hunting opportunity really came this time?

- Sword refers to the virtual currency borrowing blockchain "returning soul", the national cleanup and rectification curtain has been opened

- Babbitt Column | Yang Wang: A Three-point Economic Discussion on Libra

Afterwards, the CEO of Changan, Changchun Peng, said that this is a rumor. If there is no office in Shanghai, there will be no investigation. Zhao Changpeng later said that it may be that competitors spend money to hire media to post fake news.

Whether there is an office in the currency security has not been determined, The Block said that it will continue to follow up the report, but the people on the Twitter have talked about this matter, and some people voted on Twitter to support the block, or support the currency. Ann."

Sun Yuchen, the CEO of “Where is the hot spot where I am”, responded to Zhao Changpeng’s “Building a fund to combat FUD in the market”, saying that individuals will donate 100 bitcoins to support.

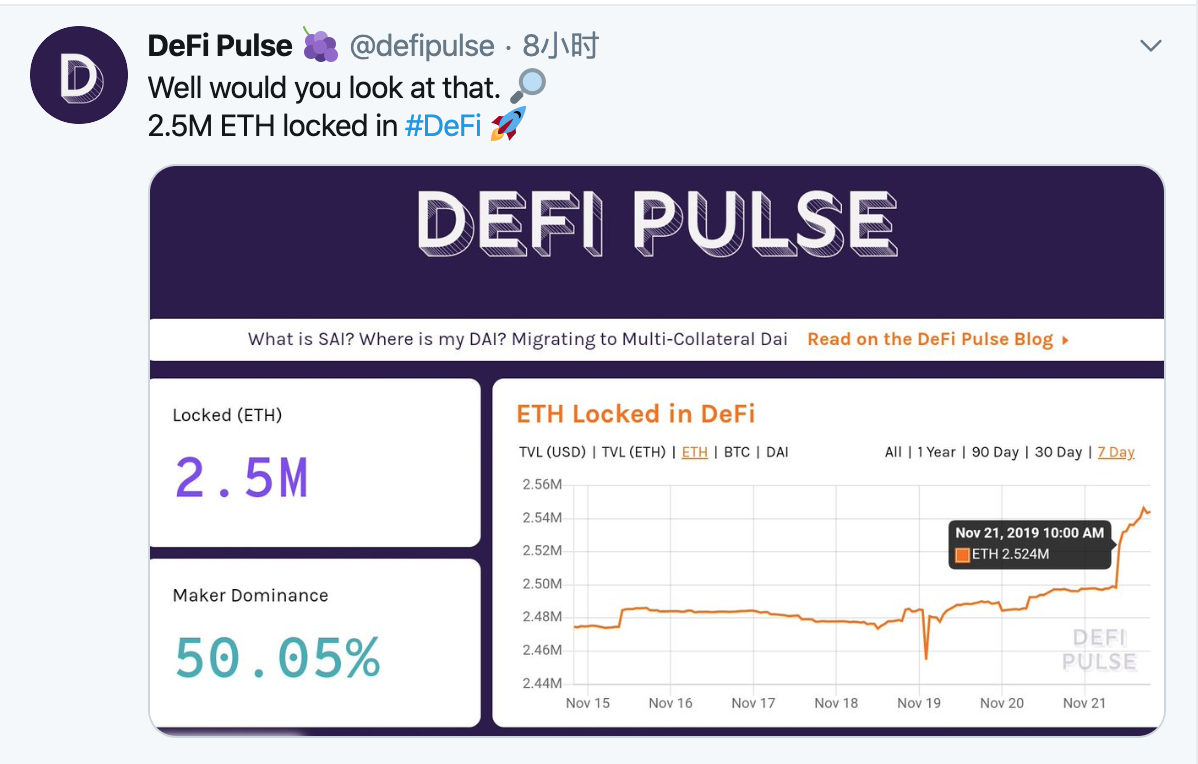

The number of eths in the DeFi Pluse website that has been pushed by DeFi Pluse has been rising, reaching 2.5 million. The DeFiPluse website shows that in all lock applications, MakerDao has the most lock eth, reaching 2 million (80%), absolute NO.1.

Many stable currency projects this year have referenced MakerDao's philosophy, such as dual currency, governance currency (MKR) and mortgage stability currency (DAI); such as multi-collateral, Tether dollar mortgage to stabilize currency mortgage, or multiple stable Currency mortgage.

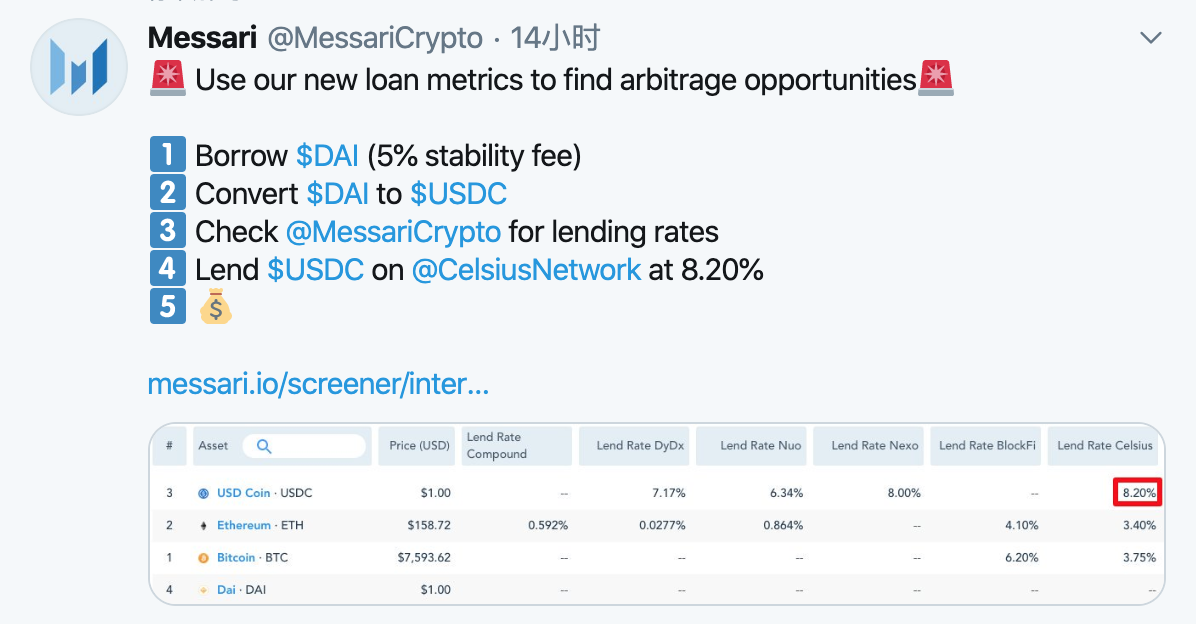

A few days ago, MakerDao completed the upgrade of the multi-mortgage Dai. The data analysis platform Messari said that the stable currency DAI had arbitrage opportunities and detailed the operation methods:

Mortgage generated stable currency DAI in MakerDao (now MakerDao's stable currency rate is 5%);

Then change the stable currency DAI to the stable currency USDC;

Then, the stable currency USDC is lent to obtain 8.2% of the proceeds to achieve arbitrage.

(Note: It is also possible to deposit the stable currency DAI generated by the mortgage into a centralized lending product such as the currency Anbao. As long as the interest income is guaranteed to be greater than 5% of the mortgage rate, there is arbitrage space.)

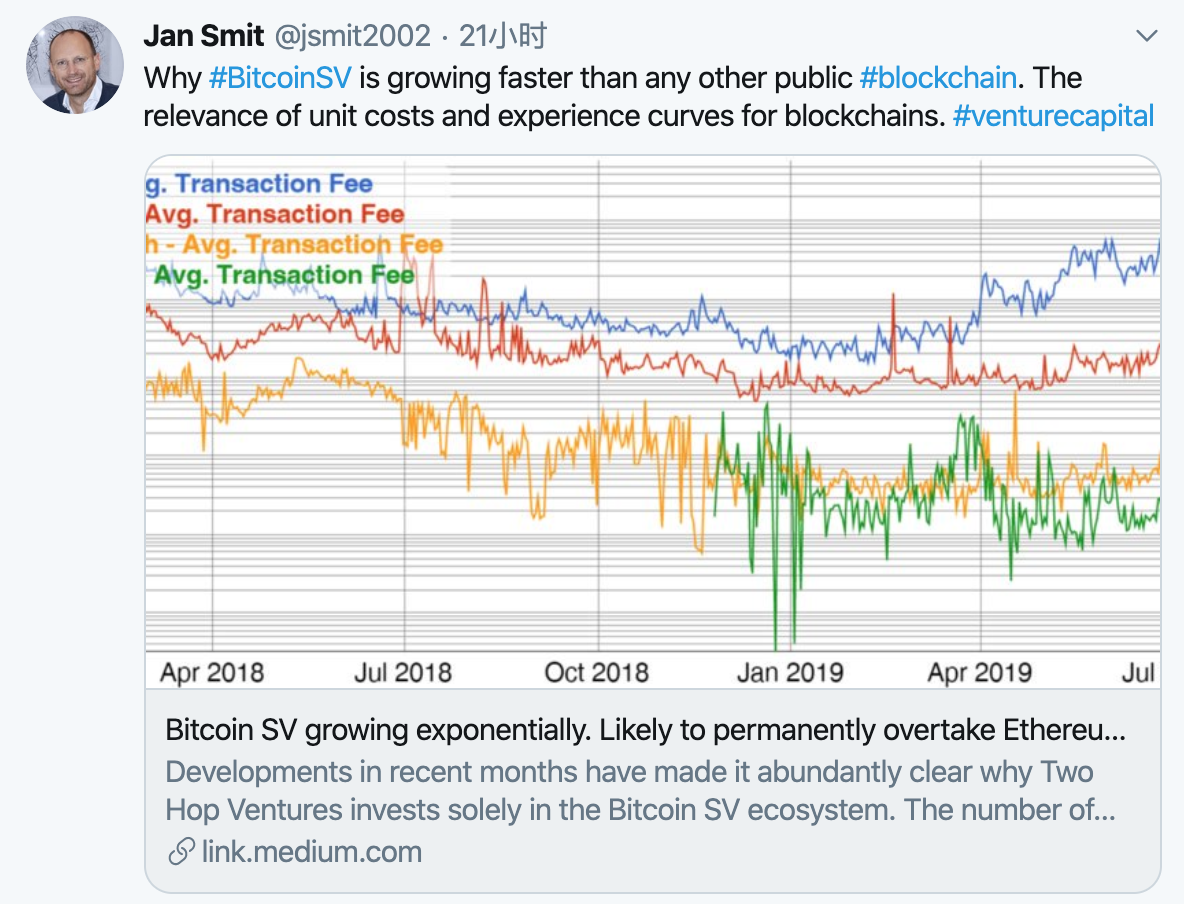

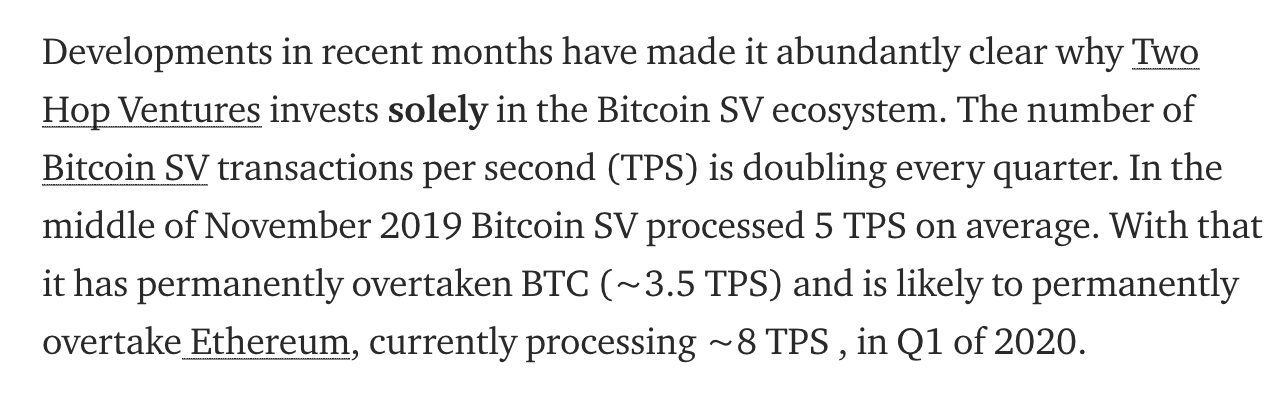

An author named Jas Smit posted an article on the medium saying that BitcoinSV's TPS doubled every quarter. In November, the average BSV transaction processed in November was 5, bitcoin was 3, and Ethereum was 8. The pen is expected to surpass Ethereum in the first quarter of 2020.

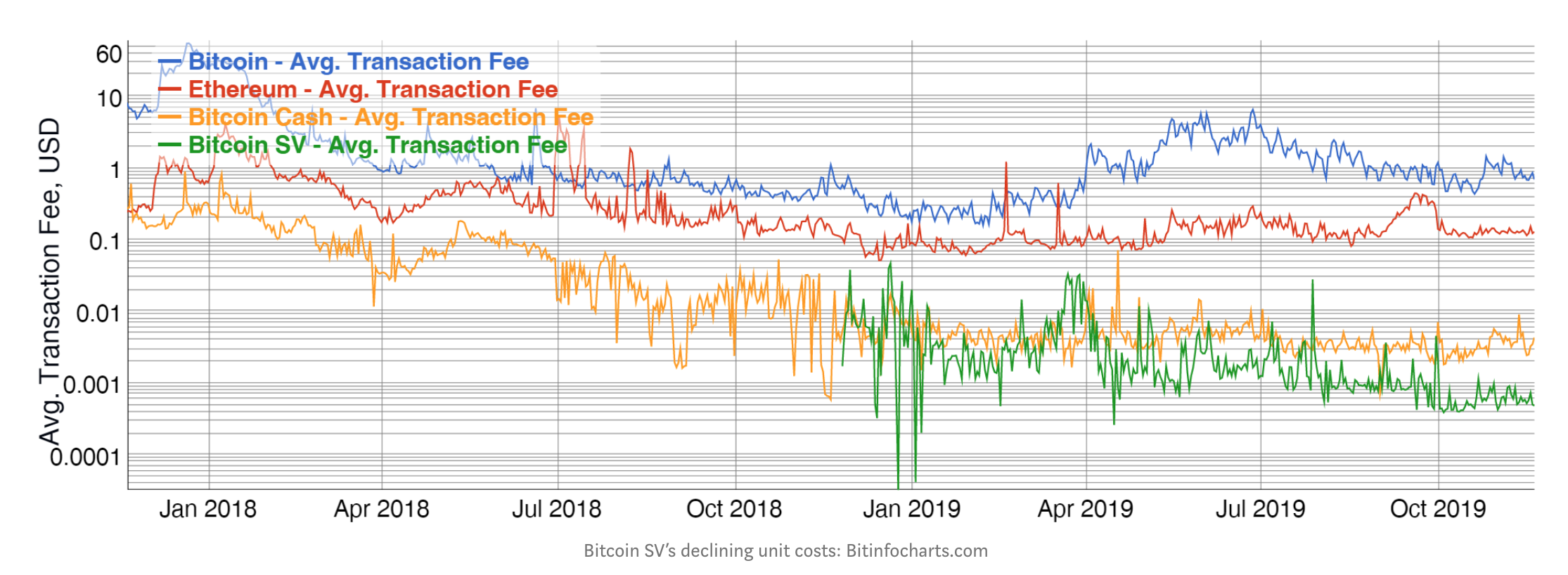

The article said that the low handling fee of BSV will promote innovation and further stabilize the leading position of BSV. The application on BSV is also more diversified, and BSV has become the first choice for data uplink.

The article said that the low handling fee of BSV will promote innovation and further stabilize the leading position of BSV. The application on BSV is also more diversified, and BSV has become the first choice for data uplink.

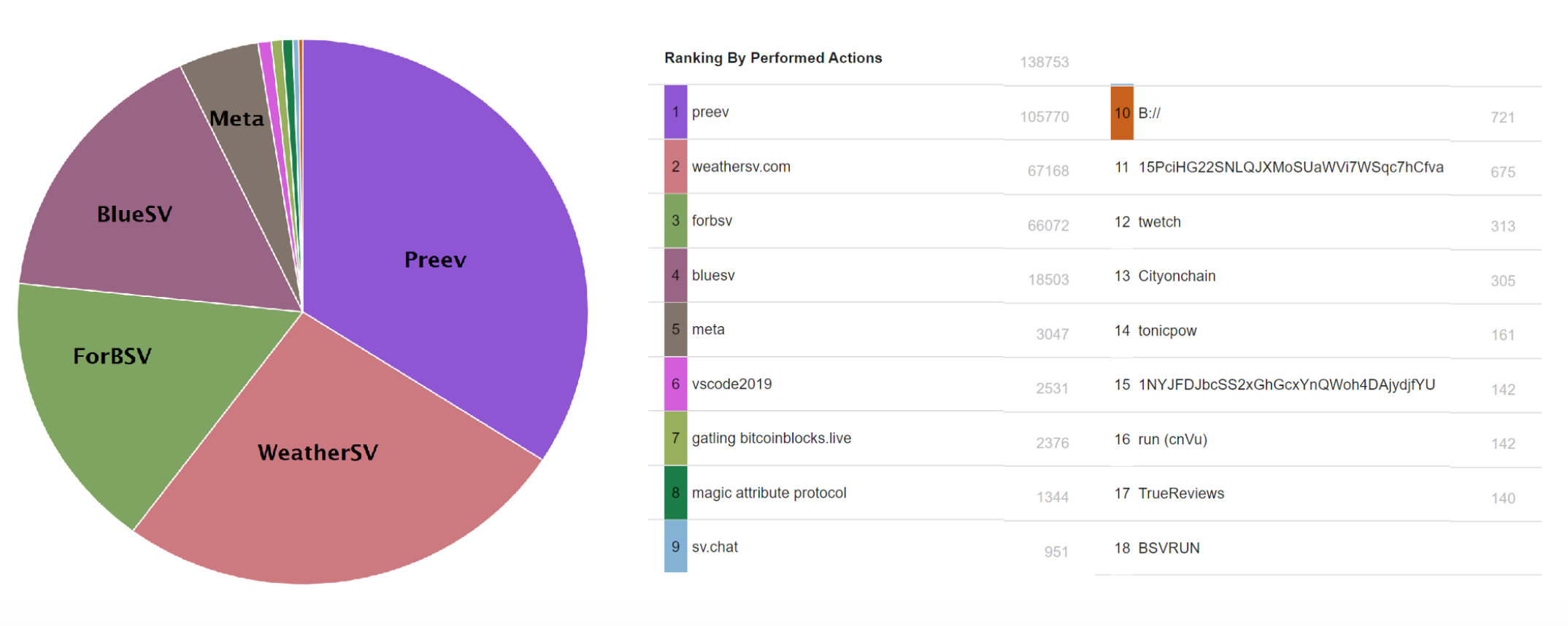

80% of transactions on BSV in October came from WeatherSV (an application for recording weather data), now Preev (recording exchange-traded applications), ForBSV (an economically motivated social application), BlueSV (recording 3,000 in China) Applications such as the application of urban pollution data have emerged.

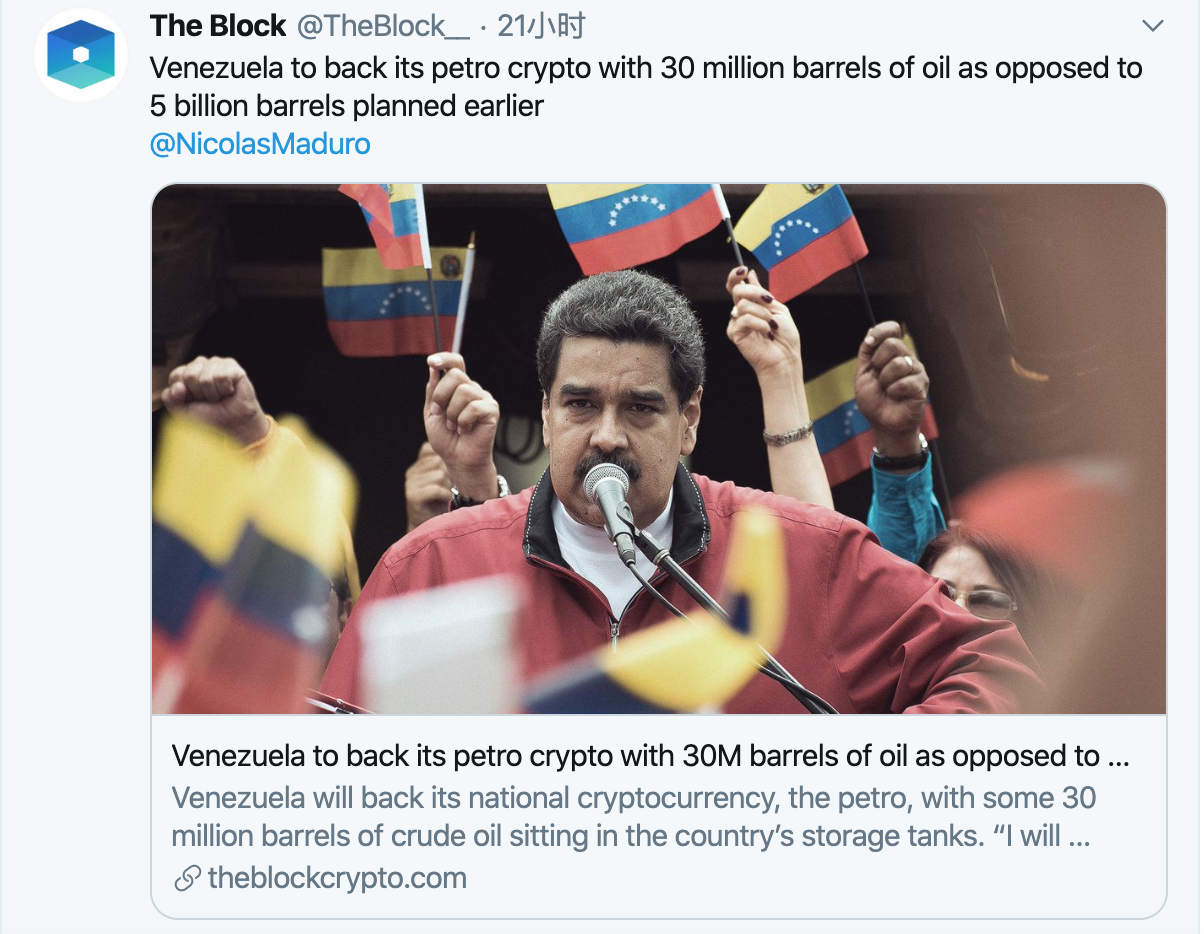

1. The Block reported that Venezuela announced that it will use 30 million barrels of oil to support its national digital currency, the petro, much lower than the 5 billion barrels of oil that was mentioned in February 2018 when it was released.

2. Bakkt announced the launch of a cash-settled Bitcoin futures contract on December 9th, at ICE Futures Singapore.

Yesterday's article mentioned that the exchange is a Singapore-compliant exchange, and the Singapore central bank is considering allowing four compliant exchanges to conduct derivatives trading services for institutional investors.

—— End ——

Turn around every day and see the big coffee point of view, bringing you the freshest and most interesting points. Welcome message, forward!

Author: March only hope Source: wildflowers say

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | What is the government service chain that “runs at most once”?

- Bitcoin fell 11% on two days, a generation of God machine ant mining machine S9 is in jeopardy

- AI, chip, blockchain, China's hardcore technology company Jianan went public in the US

- Still running in the blockchain conference? The chain node calls you to read the book!

- Analysis: Is SMEs suitable for blockchain technology?

- Blockchain + "Made in China": How to improve the financial vitality and effectiveness of supply chain in a block

- Proficient in Filecoin: System Startup