Variant Partner Distinguish DePIN and DeREN as two types of decentralized infrastructure networks.

Variant Partner identifies DePIN and DeREN as two types of decentralized infrastructure networks.Author: Mason Nystrom, Partner at Variant Fund; Translator: LianGuaixiaozou

Decentralized infrastructure networks are rapidly developing, and these cryptographic networks use token incentives to generate liquidity to support the operation of physical infrastructure.

The value of these networks is obvious: they provide better solutions for consumable resources, from computing to energy to data. In turn, these resources are directly consumed by companies or by their own products and services. For example, decentralized networks like Hivemapper directly sell data to transportation companies like Uber, and Uber uses this image data to improve their own products. Similarly, Livepeer allows live streaming applications to enter its video transcoding service market (but also integrated by companies like Bonfire), enabling creators to easily launch their own live streaming businesses.

- DePIN and DeREN Better Classification of Decentralized Infrastructure Networks

- After Unibot went viral, which other mainstream Telegram bots are worth paying attention to?

- RootData 10 Emerging Cryptocurrency Venture Capital Firms Not to Be Ignored in the Bear Market

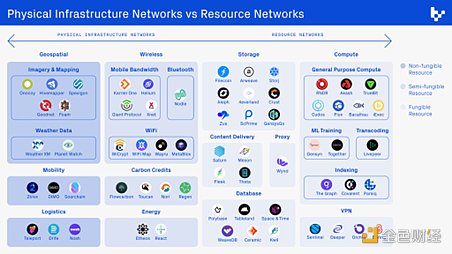

In order to better evaluate the potential of these networks, we need a better way to classify them. The currently popular term for a track is DePIN (a term coined by a Messari research report in 2022), but I suggest a more detailed classification, dividing decentralized infrastructure networks into two categories:

· Decentralized Physical Infrastructure Networks (DePIN): Cryptographic networks with non-fungible consumable resources that deploy location-specific hardware devices using incentive mechanisms.

· Decentralized Resource Networks (DeREN): Cryptographic networks that use incentive mechanisms to build markets and increase the supply of existing or idle fungible consumable resources that do not rely on location-specific hardware.

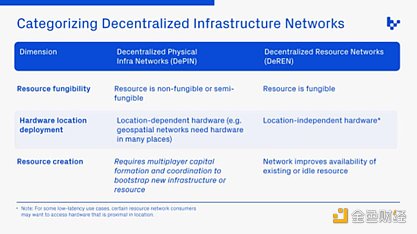

DePIN and DeREN differ in three core aspects:

· Resource fungibility

· Hardware location deployment

· Resource creation

1. Resource Fungibility

Among the above distinctions, the most meaningful is the fungibility of consumable resources.

In a resource network, consumable resources are fungible because the hardware assets of the network are generally interchangeable. For example, computational resources provided by networks like Akash or Render are highly fungible – the processing power of a GPU is the same as any other GPU with the same specifications and capacity. Except for highly specialized activities like high-frequency trading, users generally do not care about the geographical location of their hardware, as long as the network latency is within an acceptable range compared to centralized architecture.

In contrast, DdPIN utilizes non-fungible or semi-fungible resources. In this case, consumable assets are not easily replaceable, and the hardware is typically unique to a specific network. For example, Hivemapper’s dashcam maps specific locations and generates unique data in real time. Additionally, image networks like Spexigon cannot provide their aerial image data to the Hivemapper network; the assets of each network are the image mapping data unique to each network.

Of course, there are also assets in the middle. For example, energy is semi-substitutable, as it can be used for various purposes, but its utility is limited by transmission distance.

2. Hardware Location and Resource Creation

Hardware location is closely related to resource creation; the deployment of application-specific, location-specific hardware typically occurs simultaneously with the construction of proprietary resources.

At this point, DePIN faces more challenges in establishing the supply and demand sides of the market. The supply side requires location-specific hardware settings, while demand generation depends on the supply side having sufficient scale to make the network valuable to consumers.

Resource networks are more prone to guide supply, and idle supply can come from anywhere, often without the need to create new hardware or infrastructure. However, resource networks with substitutable assets also face greater competition, as the cost of switching from one resource network to another becomes lower.

3. Building Moats for DePIN and DeREN

Resource networks based on encryption technology still have to compete with web2 rivals like AWS and Google. Although DePIN and DeREN can use tokens to subsidize initial resource costs, the most successful networks will not only engage in price wars, but will also unleash new demand or expand the market in unique ways.

For example, Arweave did not compete in file storage pricing. It offered new features and conveniences through permanent storage, and ultimately gained attention in storing NFT metadata. In the DePIN category, mobile networks like DIMO aggregate previously isolated data, providing impetus for the next wave of applications, whether they come from the battery intelligence and energy management field or the automotive industry.

Another successful strategy is vertical integration, generating demand by building initial products that utilize infrastructure or resource networks. Render combines its GPU rendering capability with its Octane software, which drives the use of the underlying computational resource network.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of 8 Major Releases at EthCC 2023

- Blue Chip DeFi New Narrative Reviewing Aave and Compound Fundamental Data

- In 71 days, the meme of HarryPotterObamaSonic10Inu increased by 281 times. Where does the meme actually come from?

- Sui 8192 Hot Is a Mini Game the Best Entry Point for Full-Chain Games?

- Layer1 Transformation, Layer2 Discussion – The Business Secrets Behind ‘Ethereum Layer2

- Why is the discount on GBTC narrowing and what are the reasons and impacts?

- Opepen’s Rekindling A Community of Co-creation and Win-win